Average Variable Annuity Returns 2024: The world of investing is constantly evolving, and variable annuities, with their potential for growth and income, remain a popular choice for many. This year, however, presents a unique set of circumstances, requiring investors to carefully consider the factors that will influence their returns.

Class B variable annuities are a specific type of annuity with certain characteristics. To learn more about Class B variable annuities in 2024, you can visit this informative article: Class B Variable Annuity 2024. Understanding the differences between various annuity types is essential for making informed investment decisions.

Variable annuities, unlike their fixed counterparts, offer the potential for higher returns tied to the performance of underlying investment options. However, this potential comes with inherent risks, as the value of your investment can fluctuate with market conditions. Understanding these risks and rewards is crucial for making informed decisions about whether variable annuities are right for you.

Annuity investments can be a complex topic, and some argue that they’re not always the best option. To explore the potential downsides of annuities, visit this article: Annuity Is Bad 2024. It’s essential to thoroughly research and understand the risks and potential drawbacks of any investment before making a decision.

Contents List

Variable Annuity Basics

Variable annuities are investment products that offer the potential for growth while providing some protection against market downturns. They are a type of annuity that allows you to invest your premiums in a variety of sub-accounts, which are similar to mutual funds.

For those considering variable annuities, understanding how they work within a Roth IRA is crucial. You can find information on variable annuities and Roth IRAs in 2024 here: Variable Annuity Roth Ira 2024. Knowing the rules and regulations associated with different retirement accounts can help you make the most of your savings.

The value of your variable annuity will fluctuate based on the performance of the sub-accounts you choose.

Variable annuities can be a complex topic, and a helpful resource for learning about them is Quizlet. To access Quizlet resources on variable annuities in 2024, visit this link: Variable Annuity Quizlet 2024. Quizlet can be a valuable tool for understanding the fundamentals of variable annuities.

Key Features of Variable Annuities

Variable annuities have several key features that distinguish them from other investment products. These include:

- Growth Potential:Variable annuities offer the potential for growth through investment in a variety of sub-accounts.

- Death Benefit:Most variable annuities provide a death benefit that guarantees a minimum payout to your beneficiaries, even if the value of your annuity has declined.

- Living Benefits:Some variable annuities offer living benefits, such as guaranteed minimum income or guaranteed minimum withdrawal benefits, which can provide additional protection against market volatility.

- Tax Deferred Growth:The earnings on your variable annuity investment are tax deferred, meaning you will not have to pay taxes on them until you withdraw them.

Variable Annuities vs. Fixed Annuities

Variable annuities differ from fixed annuities in several key ways:

- Investment Growth:Fixed annuities provide a guaranteed rate of return, while variable annuities offer the potential for higher returns but also carry the risk of losing money.

- Investment Options:Fixed annuities offer a limited number of investment options, typically a single fixed interest rate. Variable annuities offer a wide range of investment options, allowing you to customize your portfolio based on your risk tolerance and investment goals.

- Risk:Fixed annuities are considered low-risk investments, as the principal and interest are guaranteed. Variable annuities are considered higher-risk investments, as the value of your investment can fluctuate based on market performance.

Risk Factors Associated with Variable Annuities

Variable annuities come with several risks that investors should be aware of:

- Market Risk:The value of your variable annuity can fluctuate based on the performance of the sub-accounts you choose. If the market declines, the value of your annuity could decrease.

- Interest Rate Risk:Changes in interest rates can impact the value of your variable annuity. If interest rates rise, the value of your annuity could decline.

- Fees and Expenses:Variable annuities typically come with higher fees and expenses than other investment products, which can eat into your returns.

- Surrender Charges:Some variable annuities impose surrender charges if you withdraw your money before a certain period of time.

Potential Benefits of Variable Annuities

Despite the risks, variable annuities offer several potential benefits:

- Growth Potential:Variable annuities offer the potential for higher returns than fixed annuities, which can be beneficial for long-term investors.

- Tax Deferred Growth:The earnings on your variable annuity investment are tax deferred, which can help you grow your wealth faster.

- Death Benefit:Most variable annuities provide a death benefit that guarantees a minimum payout to your beneficiaries.

- Living Benefits:Some variable annuities offer living benefits, which can provide additional protection against market volatility.

Factors Influencing Variable Annuity Returns

The returns on variable annuities are influenced by a variety of factors, including market performance, fees and expenses, and interest rate changes. Understanding these factors can help investors make informed decisions about their variable annuity investments.

Market Performance

The performance of the sub-accounts you choose will have a significant impact on the returns of your variable annuity. If the market performs well, the value of your annuity will likely increase. However, if the market declines, the value of your annuity could decrease.

Variable annuities, like any investment, come with both potential advantages and disadvantages. To learn more about the pros and cons of variable annuities in 2024, you can visit this article: Variable Annuity Pros And Cons 2024. Weighing the potential benefits and risks is essential for making informed investment decisions.

Investors should carefully consider the risk tolerance of the sub-accounts they choose and make sure they are aligned with their investment goals.

Annuity payments can be a significant part of your retirement income, and understanding the tax implications is crucial. To learn more about whether living annuities are taxable in 2024, visit this informative article: Is A Living Annuity Taxable 2024.

It’s essential to factor in taxes when planning for your retirement years.

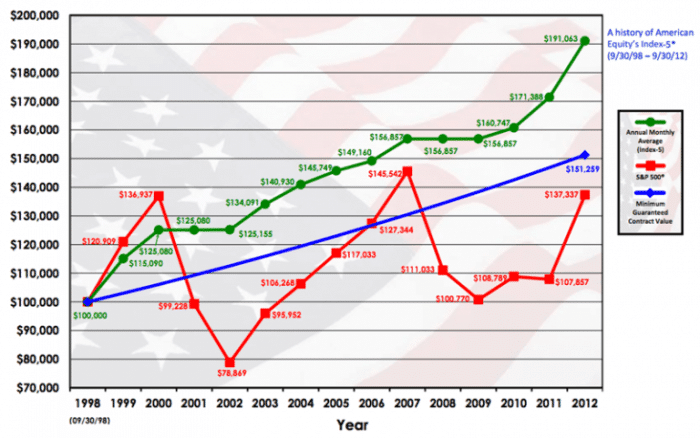

Historical Performance of Variable Annuity Sub-Accounts

It is important to research the historical performance of different variable annuity sub-accounts before making an investment decision. This can provide valuable insights into the potential risks and rewards associated with different investment strategies. Historical performance is not a guarantee of future results, but it can be a helpful indicator of past performance.

Fees and Expenses, Average Variable Annuity Returns 2024

Variable annuities typically come with higher fees and expenses than other investment products. These fees can include annual maintenance fees, mortality and expense charges, and administrative fees. It is important to carefully consider the fees and expenses associated with a variable annuity before making an investment decision.

High fees can significantly reduce your returns over time.

Looking to understand how annuities work and how to calculate their value? You can learn more about how to calculate an annuity due in 2024 by visiting this helpful resource: How To Calculate An Annuity Due 2024. Understanding the intricacies of annuities can help you make informed decisions about your financial future.

Interest Rate Changes

Interest rate changes can also impact the returns on variable annuities. If interest rates rise, the value of your annuity could decline. This is because higher interest rates can make it more expensive for insurance companies to guarantee the death benefit on variable annuities.

Investors should consider the potential impact of interest rate changes on their variable annuity investments.

Average Variable Annuity Returns in 2024: Average Variable Annuity Returns 2024

Predicting the average variable annuity returns for 2024 is challenging, as it depends on a variety of factors, including market performance, interest rate changes, and economic conditions. However, based on current market conditions and historical trends, a realistic estimate of average variable annuity returns for 2024 could be in the range of 4% to 7%.

Historical Performance of Variable Annuities

Over the past few years, variable annuities have generally performed in line with the overall stock market. In 2023, for example, the average variable annuity returned around 6%, while the S&P 500 index returned around 7%. However, it’s important to note that past performance is not a guarantee of future results.

Market conditions can change rapidly, and returns can fluctuate significantly from year to year.

Annuity investments can be a complex topic, and it’s essential to weigh the pros and cons carefully. To learn more about the arguments for and against annuities in 2024, you can check out this article: Annuity Is Good Or Bad 2024.

Understanding the potential benefits and drawbacks can help you make an informed decision about whether annuities are right for you.

Current Market Conditions

Current market conditions are characterized by high inflation, rising interest rates, and geopolitical uncertainty. These factors could potentially impact variable annuity returns in 2024. However, the stock market has been relatively resilient in recent months, and many analysts believe that the economy is poised for continued growth.

If you’re considering an annuity with a payout of $200,000, you might find this article helpful: Annuity 200k 2024. This article can provide valuable insights into the specifics of annuities with a $200,000 payout in 2024.

Factors Influencing Variable Annuity Returns in 2024

Several factors could influence variable annuity returns in 2024, including:

- Market Performance:The overall performance of the stock market will have a significant impact on variable annuity returns.

- Interest Rate Changes:Changes in interest rates can impact the value of variable annuities.

- Inflation:High inflation can erode the purchasing power of returns on variable annuities.

- Economic Growth:Strong economic growth can support higher returns on variable annuities.

- Geopolitical Uncertainty:Geopolitical events can create market volatility and impact returns on variable annuities.

Variable Annuity Strategies for 2024

Developing a sound investment strategy for variable annuities in 2024 requires a careful consideration of your risk tolerance, investment goals, and the current market environment. Here are some key strategies to consider:

Portfolio Allocation Strategy

A well-diversified portfolio allocation strategy is crucial for managing risk and maximizing returns. Consider allocating your variable annuity investments across different asset classes, such as stocks, bonds, and real estate. This diversification can help to mitigate the impact of market fluctuations on your overall portfolio.

Comparison of Variable Annuity Sub-Accounts

It is important to compare different variable annuity sub-accounts based on their risk and return profiles. Here is a table comparing different sub-accounts based on their typical risk and return characteristics:

| Sub-Account Type | Risk | Return Potential |

|---|---|---|

| Large-Cap Stock Funds | High | High |

| Small-Cap Stock Funds | Very High | Very High |

| Bond Funds | Low | Low |

| Real Estate Funds | Medium | Medium |

Risk and Return Relationship

A visual illustration depicting the relationship between risk and return in variable annuities can be helpful. Generally, higher risk investments have the potential for higher returns, but they also carry a greater risk of loss. Lower risk investments tend to have lower returns but are less likely to experience significant losses.

The illustration would show a curve that slopes upwards from left to right, indicating that as risk increases, the potential for return also increases. However, it is important to note that this relationship is not always linear and can be influenced by a variety of factors.

There are various types of annuities available, and understanding the differences is crucial for making informed choices. To learn more about 7 different types of annuities in 2024, you can visit this article: 7 Annuities 2024. Exploring the different options can help you find the annuity that best suits your needs.

Adjusting Your Portfolio Based on Market Conditions

Market conditions can change rapidly, and it is important to adjust your variable annuity portfolio accordingly. For example, if interest rates are rising, you may want to consider shifting your portfolio towards more conservative investments, such as bonds. Conversely, if the stock market is performing well, you may want to consider increasing your allocation to stocks.

Regular portfolio reviews and adjustments can help you stay on track to achieve your financial goals.

Calculator.net offers a helpful tool for calculating annuity values. To access Calculator.net’s annuity calculator in 2024, you can visit this link: Calculator.Net Annuity 2024. This calculator can be a useful resource for estimating potential annuity payments and understanding the financial implications of your investment choices.

Important Considerations for Variable Annuity Investors

Variable annuities can be complex investment products, and it is important to understand the risks and rewards before making an investment decision. Here are some important considerations for variable annuity investors:

Understanding Risks and Rewards

Variable annuities offer the potential for growth, but they also come with significant risks. Investors should carefully consider their risk tolerance and investment goals before investing in a variable annuity. It is also important to understand the fees and expenses associated with variable annuities, as these can significantly impact your returns.

Fixed and variable annuities offer different features and benefits. To learn more about the distinctions between fixed and variable annuities in 2024, check out this informative article: Fixed Variable Annuity 2024. Understanding the differences between these annuity types can help you choose the option that aligns with your investment goals.

Diversification

Diversification is a key principle of investing, and it is particularly important for variable annuity investors. Diversifying your portfolio across different asset classes can help to reduce your overall risk and increase your potential for returns. Consider allocating your investments across stocks, bonds, real estate, and other asset classes.

Annuity payments can be a significant source of income during retirement. To explore whether annuities are a viable retirement option in 2024, check out this article: Is Annuity Retirement 2024. Learning about the different types of annuities can help you determine if they’re right for your retirement planning.

Tax Implications

The earnings on your variable annuity investment are tax deferred, meaning you will not have to pay taxes on them until you withdraw them. However, when you withdraw your money, it will be taxed as ordinary income. It is important to consider the tax implications of variable annuities before making an investment decision.

Benefits and Drawbacks for Different Investor Profiles

Variable annuities can be a suitable investment for a variety of investor profiles, but they are not appropriate for everyone. For example, variable annuities may be a good option for investors who are seeking growth potential and tax deferral, but they may not be suitable for investors who are risk-averse or who need guaranteed income.

It is important to consult with a financial advisor to determine if a variable annuity is right for you.

Variable annuities offer a variety of potential benefits, including the potential for growth. To learn more about the advantages of variable annuities in 2024, check out this article: Variable Annuity Advantages 2024. Weighing the pros and cons of different investment options is crucial for making sound financial decisions.

Final Thoughts

In conclusion, while predicting the future of variable annuity returns in 2024 is impossible, a well-informed approach is key. By understanding the market dynamics, carefully considering your risk tolerance, and seeking professional advice, you can navigate this landscape and make choices that align with your financial goals.

FAQ Compilation

What are the risks associated with variable annuities?

Variable annuities carry market risk, meaning the value of your investment can fluctuate based on the performance of the underlying investments. You could lose money if the market declines. Additionally, variable annuities typically involve fees and expenses, which can impact your returns.

Are variable annuities suitable for all investors?

If you’re looking for information on beneficiary payouts for variable annuities, you might be interested in this article: Aig Beneficiary Payout P Variable Annuity 2024. Understanding how beneficiary payouts work can help you ensure your loved ones are financially protected in the event of your passing.

Variable annuities are not suitable for all investors. They are generally recommended for those with a long-term investment horizon, a higher risk tolerance, and a desire for potential growth. If you are seeking guaranteed returns or a low-risk investment, fixed annuities might be a better option.

How do I choose the right variable annuity for me?

Selecting the right variable annuity depends on your individual circumstances, financial goals, and risk tolerance. Consider factors such as the investment options available, the fees and expenses, and the features and guarantees offered. It’s advisable to consult with a financial advisor who can provide personalized guidance.