B Share Variable Annuity 2024 presents a unique investment opportunity for individuals seeking to grow their wealth while managing potential market risks. This type of annuity combines the stability of traditional annuities with the growth potential of the stock market, offering a balance between security and returns.

Annuity can play a significant role in your retirement plan. The Annuity Is A Voluntary Retirement Vehicle 2024 article discusses how annuities can be a voluntary option to secure your financial future.

B Share variable annuities, also known as “B-shares,” are a type of annuity contract that allows investors to allocate their funds into a variety of sub-accounts, each representing a different investment strategy. These sub-accounts typically invest in mutual funds or exchange-traded funds (ETFs) that track specific market indices or sectors.

Winning a lottery can be life-changing, and often involves receiving payments over time. To learn more about annuities in lottery winnings, you can check out the Annuity Lottery 2024 article. It explains the role of annuities in managing lottery winnings.

The value of your B Share variable annuity will fluctuate based on the performance of the underlying investments.

Annuity is a valuable financial tool, particularly in retirement planning. To learn more about how it can work for you, you can read the article on Annuity Is 2024. It covers key aspects of annuities and their role in securing your future.

Contents List

- 1 B Share Variable Annuity: Overview

- 2 B Share Variable Annuity: Components

- 3 B Share Variable Annuity: Fees and Expenses

- 4 B Share Variable Annuity: Risks and Considerations

- 5 B Share Variable Annuity: Suitability

- 6 B Share Variable Annuity: Market Outlook 2024

- 7 B Share Variable Annuity: Alternatives: B Share Variable Annuity 2024

- 8 Summary

- 9 Question & Answer Hub

A B Share variable annuity is a type of retirement savings product that allows investors to allocate their funds to a variety of sub-accounts that track the performance of different investment options, such as stocks, bonds, or mutual funds. These annuities are known for their potential to grow tax-deferred, meaning that taxes on investment gains are not paid until the funds are withdrawn in retirement.

Variable annuities offer potential growth tied to market performance. The Variable Annuity 2024 article provides information on how these annuities work and the factors that influence their returns.

Definition

A B Share variable annuity is a type of annuity contract that allows investors to allocate their funds to a variety of sub-accounts that track the performance of different investment options, with the potential for growth and income. The primary characteristic of a B Share variable annuity is that it typically has a surrender charge period, which means that investors may face penalties if they withdraw their funds before a certain period of time.

If you’re receiving annuity payments, it’s important to understand the process. The K Is An Annuitant Currently Receiving Payments 2024 article provides information on what it means to be an annuitant and how payments are structured.

Key Features and Characteristics

- Growth Potential:B Share variable annuities offer the potential for growth based on the performance of the underlying investment options.

- Tax-Deferred Growth:Investment gains within a B Share variable annuity are not taxed until the funds are withdrawn, allowing for tax-deferred growth.

- Surrender Charges:B Share variable annuities typically have surrender charges, which are fees imposed if the investor withdraws their funds before a specified period of time.

- Guaranteed Minimum Death Benefit:Some B Share variable annuities may offer a guaranteed minimum death benefit, which ensures that a certain amount will be paid to the beneficiary upon the death of the annuitant.

- Living Benefits:Some B Share variable annuities may offer living benefits, such as guaranteed income or protection against market downturns.

B Share variable annuities are comprised of several key components that work together to provide investors with a comprehensive retirement savings solution.

Understanding the accumulation phase of a variable annuity is essential for maximizing returns. The Variable Annuity Accumulation Phase 2024 article explains how investments grow during this phase and the factors that influence its performance.

Underlying Investment Options

B Share variable annuities allow investors to allocate their funds to a variety of sub-accounts that track the performance of different investment options, such as:

- Stocks:Sub-accounts that track the performance of various stock indexes, such as the S&P 500 or the Nasdaq Composite.

- Bonds:Sub-accounts that track the performance of various bond indexes, such as the Barclays Aggregate Bond Index.

- Mutual Funds:Sub-accounts that invest in a diversified portfolio of stocks, bonds, or other assets managed by professional fund managers.

Sub-Accounts

B Share variable annuities offer a variety of sub-accounts, each with its own investment strategy and risk profile. Some common sub-account types include:

- Equity Sub-Accounts:These sub-accounts primarily invest in stocks and offer the potential for higher returns but also carry a higher level of risk.

- Fixed Income Sub-Accounts:These sub-accounts primarily invest in bonds and offer a lower level of risk but also a lower potential for returns.

- Balanced Sub-Accounts:These sub-accounts invest in a mix of stocks and bonds, aiming to provide a balance between growth potential and risk management.

Role of the Insurance Company

The insurance company that issues the B Share variable annuity plays a critical role in managing the product. They are responsible for:

- Providing the Annuity Contract:The insurance company provides the legal framework for the annuity contract, outlining the terms and conditions of the investment.

- Managing the Sub-Accounts:The insurance company manages the sub-accounts and ensures that the investment options are aligned with the investor’s goals and risk tolerance.

- Providing Customer Service:The insurance company provides customer service to assist investors with questions and concerns related to their B Share variable annuity.

B Share variable annuities come with various fees and expenses that investors should be aware of.

T-C annuities are a type of fixed annuity that offers guaranteed income. The T-C Annuity 2024 article provides details on how these annuities work and their benefits.

- Surrender Charges:These are fees imposed if the investor withdraws their funds before a specified period of time.

- Mortality and Expense Charges:These fees cover the insurance company’s costs of providing the annuity contract, including mortality risk and administrative expenses.

- Investment Management Fees:These fees cover the costs of managing the underlying investment options within the sub-accounts.

- Administrative Fees:These fees cover the administrative costs of managing the annuity contract, such as record-keeping and customer service.

Comparison to Other Annuity Types

B Share variable annuities typically have higher fees than other annuity types, such as fixed annuities or immediate annuities. This is because they offer the potential for growth based on the performance of the underlying investment options, which requires more complex management and higher administrative costs.

Variable annuities require disclosures to provide transparency to investors. The A Variable Annuity Disclosure Is Required To Contain 2024 article highlights the key information that should be included in these disclosures.

Impact of Fees on Overall Return

Fees can significantly impact the overall return of a B Share variable annuity. It’s crucial to carefully consider the fee structure of any B Share variable annuity before investing, as high fees can eat into potential returns.

If you’re looking to understand the factors influencing annuity rates in 2024, you might want to check out the 3 Year Annuity Factor 2024 article. It provides insights into how these factors affect your potential returns.

Investing in a B Share variable annuity comes with certain risks and considerations that investors should carefully evaluate.

Planning for retirement involves understanding how your pension can be used to generate income. The Calculate Annuity From Pension 2024 article offers valuable information on converting your pension into a steady stream of income.

Potential Risks

- Market Risk:The value of the underlying investment options within a B Share variable annuity can fluctuate with market conditions, potentially resulting in losses.

- Surrender Charge Risk:Investors may face surrender charges if they withdraw their funds before a specified period of time, which can reduce their overall return.

- Mortality and Expense Charge Risk:These charges can reduce the overall return of the annuity, especially over the long term.

- Inflation Risk:The purchasing power of the annuity payments can be eroded by inflation, especially during periods of high inflation.

Key Factors to Consider

- Investment Goals:Determine whether a B Share variable annuity aligns with your long-term investment goals and risk tolerance.

- Time Horizon:Consider your time horizon for investing, as B Share variable annuities are generally intended for long-term retirement savings.

- Fee Structure:Carefully evaluate the fee structure of any B Share variable annuity to ensure that the fees are reasonable and won’t significantly impact your potential returns.

- Surrender Charges:Understand the surrender charge period and the potential penalties associated with withdrawing funds early.

Risks and Rewards Comparison

| Investment Option | Risk | Reward |

|---|---|---|

| B Share Variable Annuity | High | High |

| Fixed Annuity | Low | Low |

| Stocks | High | High |

| Bonds | Low | Low |

B Share variable annuities may be suitable for certain types of investors, depending on their individual circumstances and investment goals.

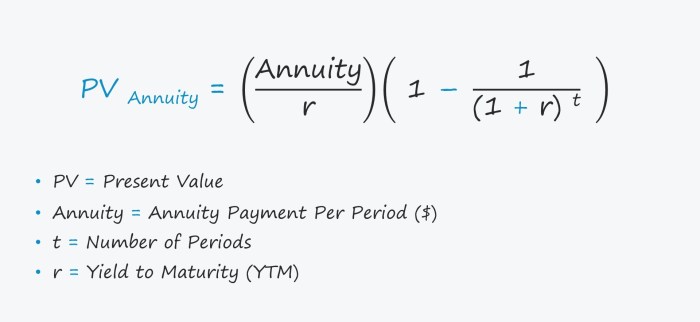

Calculating the present value of an annuity is a crucial step in financial planning. The Pv Annuity Sheet 2024 article explains how to use a spreadsheet to calculate the present value of an annuity.

Types of Investors

- Long-Term Investors:B Share variable annuities are generally suitable for investors with a long-term time horizon, such as those saving for retirement.

- Risk-Tolerant Investors:B Share variable annuities carry a higher level of risk, so they are more suitable for investors with a higher risk tolerance.

- Tax-Conscious Investors:The tax-deferred growth feature of B Share variable annuities can be beneficial for tax-conscious investors.

Scenario Example

A 45-year-old investor with a long-term investment horizon and a high risk tolerance may find a B Share variable annuity suitable for their retirement savings. They can allocate their funds to sub-accounts that track the performance of various investment options, such as stocks, bonds, and mutual funds, with the potential for tax-deferred growth and a higher return over time.

Variable annuities offer potential growth but come with certain charges. To gain insight into these charges, you can read the article on A Variable Annuity Charges 2024. It breaks down the various fees associated with this type of annuity.

| Investor Objective | Pros | Cons |

|---|---|---|

| Retirement Savings | Tax-deferred growth, potential for higher returns | Surrender charges, market risk, higher fees |

| Income Generation | Potential for income from investment gains | May not provide guaranteed income, market risk |

| Estate Planning | Guaranteed minimum death benefit, potential for estate growth | May not be the most efficient estate planning tool |

The market outlook for B Share variable annuities in 2024 is influenced by several factors, including economic conditions, interest rates, and the performance of the underlying investment options.

There are various types of annuities, each with its own characteristics. To explore the different types of annuities available, you can read the article on Annuity Kinds 2024. It provides an overview of the common annuity options.

Current Market Conditions

In 2024, the market is expected to face ongoing challenges from inflation, rising interest rates, and geopolitical uncertainty. These factors can impact the performance of the underlying investment options within B Share variable annuities.

If you’re using a financial calculator like the BA II Plus, you’ll find the article on Calculate Growing Annuity Ba Ii Plus 2024 helpful. It provides step-by-step instructions for calculating a growing annuity using this calculator.

Expected Performance of Underlying Investment Options

The performance of the underlying investment options in 2024 is expected to be influenced by a combination of factors, including economic growth, inflation, and interest rates. Stocks are likely to face volatility, while bonds may offer some stability but with lower potential returns.

Potential for Growth and Risk

B Share variable annuities offer the potential for growth, but they also carry a higher level of risk. The overall performance of B Share variable annuities in 2024 will depend on the performance of the underlying investment options and the ability of investors to navigate market volatility.

B Share variable annuities are not the only investment option available for retirement savings. Investors may consider other alternatives with similar risk profiles.

Alternative Investment Options

- Mutual Funds:Mutual funds offer a diversified portfolio of stocks, bonds, or other assets, providing exposure to different markets and investment strategies.

- Exchange-Traded Funds (ETFs):ETFs are similar to mutual funds but trade on stock exchanges, offering more flexibility and lower costs.

- Individual Retirement Accounts (IRAs):IRAs are tax-advantaged retirement savings accounts that allow investors to choose their own investment options.

- 401(k) Plans:401(k) plans are employer-sponsored retirement savings plans that offer tax-deferred growth and potential employer matching contributions.

Advantages and Disadvantages

| Investment Option | Advantages | Disadvantages |

|---|---|---|

| B Share Variable Annuity | Tax-deferred growth, potential for higher returns, guaranteed minimum death benefit | Surrender charges, market risk, higher fees |

| Mutual Funds | Diversification, professional management | Higher fees, market risk |

| ETFs | Diversification, lower costs, flexibility | Market risk |

| IRAs | Tax-advantaged growth, investment flexibility | Market risk, limited investment options |

| 401(k) Plans | Tax-deferred growth, potential for employer matching contributions | Limited investment options, employer restrictions |

Summary

B Share variable annuities offer a potential path to long-term wealth accumulation, providing investors with a diversified portfolio that can weather market fluctuations. However, it is crucial to carefully consider the associated risks and fees before making an investment decision.

Understanding the complexities of B Share variable annuities and consulting with a financial advisor can help you make informed choices aligned with your individual financial goals.

Question & Answer Hub

What is the difference between B Share variable annuities and other annuity types?

B Share variable annuities differ from traditional fixed annuities, which guarantee a fixed rate of return. B Share variable annuities offer the potential for higher returns but also carry the risk of losing principal value. They also differ from C Share variable annuities, which typically have lower fees but may have surrender charges.

Calculating an annuity can seem complex, but it doesn’t have to be. The Calculating Simple Annuity 2024 article provides a clear explanation and steps to help you understand the process.

How do I choose the right B Share variable annuity for me?

Selecting the right B Share variable annuity depends on your investment goals, risk tolerance, and time horizon. It’s essential to consider the underlying investment options, fees, and potential risks. Consult with a financial advisor to determine the best fit for your specific needs.

What are the tax implications of B Share variable annuities?

The tax implications of B Share variable annuities can be complex. Withdrawals before age 59 1/2 are generally subject to ordinary income tax and a 10% penalty. Withdrawals after age 59 1/2 are taxed as ordinary income. It’s advisable to seek professional tax advice to understand the specific tax implications for your situation.