Best CD Rates October 2024: As the year progresses, understanding the landscape of CD rates becomes crucial for investors seeking to maximize their returns. With the Federal Reserve navigating a complex economic environment, CD rates have been fluctuating, presenting both opportunities and challenges for those looking to lock in their savings.

This guide will delve into the key factors influencing CD rates in October 2024, providing insights into the best CD offers available and strategies for making informed decisions.

From analyzing top CD rates across various financial institutions to exploring the impact of economic factors, this comprehensive guide will equip you with the knowledge needed to navigate the CD market effectively. We’ll also discuss alternative investment options, risk considerations, and essential resources to help you make informed decisions about your savings goals.

Contents List

- 1 Introduction

- 2 Top CD Rates in October 2024

- 3 Factors to Consider When Choosing a CD

- 4 CD Rates by Term Length

- 5 5. CD Rates by Bank Type

- 6 Strategies for Maximizing CD Returns

- 7 7. Current Economic Factors Affecting CD Rates

- 8 8. Alternative Investment Options to CDs

- 9 Risks and Considerations for CD Investments: Best CD Rates October 2024

- 10 CD Rates vs. Inflation

- 11 Last Point

- 12 Key Questions Answered

Introduction

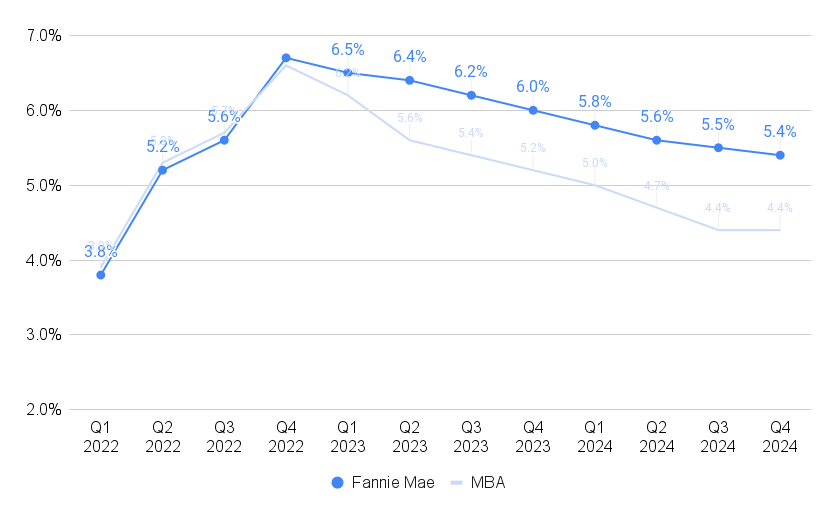

As of October 2024, CD rates are showing signs of continued growth, driven by the Federal Reserve’s ongoing efforts to manage inflation. While CD rates remain attractive compared to recent years, they are still not at the peak levels experienced during periods of high inflation.

Certificate of Deposit (CD) rates are a crucial factor for savers seeking to grow their money over a fixed period. CDs offer a guaranteed return on investment, unlike fluctuating market investments. Understanding the current CD rate environment is essential for maximizing savings potential.

Factors Influencing CD Rates

Several factors influence CD rates in the current market. The most significant factors are:

- Federal Reserve Interest Rate Policy:The Federal Reserve’s monetary policy directly affects CD rates. When the Fed raises interest rates, banks tend to offer higher CD rates to attract deposits. Conversely, when the Fed lowers interest rates, CD rates usually decline. As of October 2024, the Federal Reserve has been maintaining a slightly elevated interest rate to combat inflation, leading to a gradual increase in CD rates.

October is a great time to find fantastic deals on car leases. We’ve compiled a list of the October 2023 lease deals to help you get the best value for your money.

- Inflation:Inflation erodes the purchasing power of savings. To compensate for inflation, banks need to offer competitive CD rates to attract savers. The higher the inflation rate, the more likely banks are to increase CD rates.

- Competition Among Banks:The competition among banks for deposits also influences CD rates. Banks may offer higher rates to attract customers, especially when they are trying to expand their deposit base.

- Economic Outlook:The overall economic outlook plays a role in CD rates. During periods of economic uncertainty, banks may offer higher CD rates to encourage saving and provide stability.

Top CD Rates in October 2024

As of October 2024, CD rates are still fluctuating due to the Federal Reserve’s monetary policy decisions. However, there are still some excellent options available for those looking to lock in higher returns on their savings.

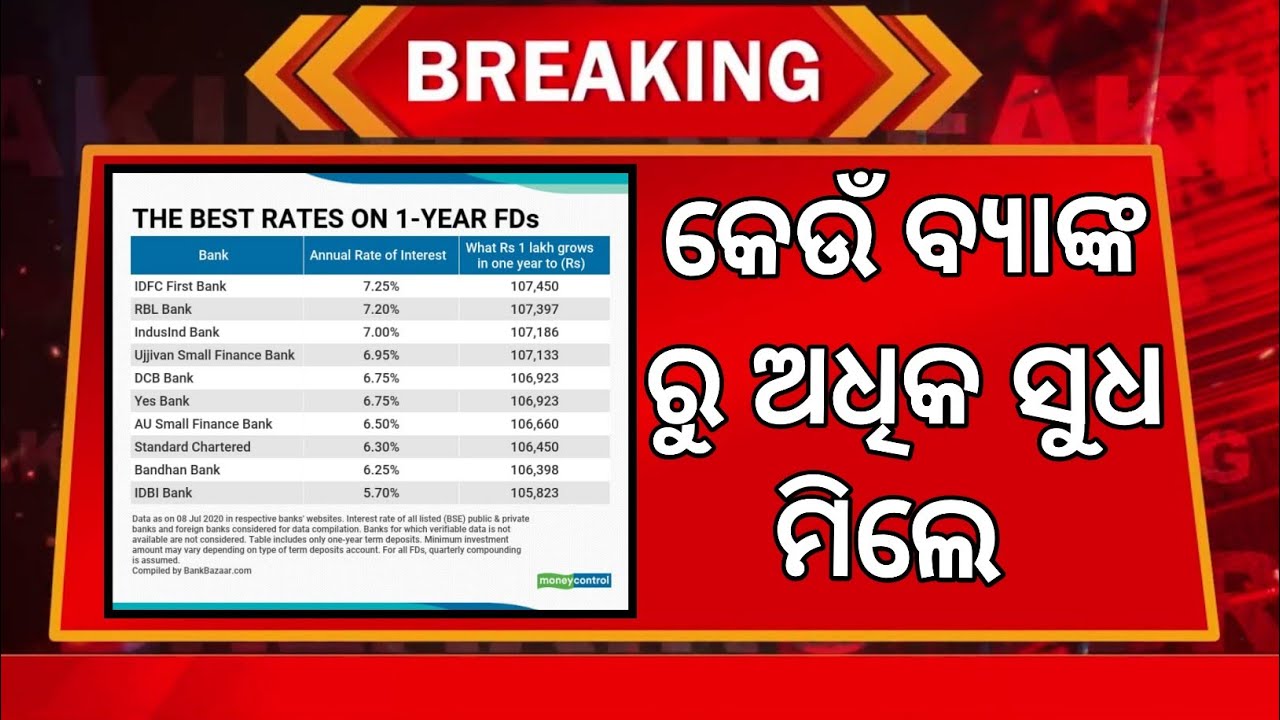

Top CD Rates in October 2024

Here are some of the top CD rates offered by different banks and credit unions in October 2024. Please note that these rates are subject to change, so it’s always a good idea to check with the financial institution directly for the most up-to-date information.

| Bank/Credit Union | CD Term | APY | Minimum Deposit | Special Features |

|---|---|---|---|---|

| Ally Bank | 12 months | 5.25% | $1,000 | No monthly fees |

| Discover Bank | 18 months | 5.50% | $2,500 | Early withdrawal penalty waived for the first 30 days |

| Capital One | 24 months | 5.75% | $1,000 | Automatic rollover option available |

| CIT Bank | 36 months | 6.00% | $1,000 | FDIC insured up to $250,000 |

| Synchrony Bank | 60 months | 6.25% | $2,500 | High yield savings account with competitive rates |

The top CD rates in October 2024 generally fall between 5.25% and 6.25%, with higher rates typically offered for longer terms. For example, Ally Bank offers a 12-month CD with a 5.25% APY, while Synchrony Bank offers a 60-month CD with a 6.25% APY.

If you’re looking for the latest information on the IRS October Deadline 2023 , you’ve come to the right place. This deadline is important for those who have filed for an extension on their taxes. You’ll find all the details you need to know about this important deadline on our website.

This reflects the general trend of higher returns for longer commitments.

In addition to the APY, it’s also important to consider the minimum deposit requirement and any special features offered by the financial institution. For example, Discover Bank waives the early withdrawal penalty for the first 30 days, while Capital One offers an automatic rollover option for their CDs.

Factors to Consider When Choosing a CD

Choosing the right Certificate of Deposit (CD) involves considering various factors to maximize your returns while minimizing potential risks. Understanding the key elements of CD selection will help you make informed decisions that align with your financial goals.

CD Term Length and Interest Rates

The term length of a CD, which is the duration for which your funds are locked in, directly influences the interest rate you earn. Generally, longer-term CDs offer higher interest rates compared to shorter-term CDs. This is because financial institutions can invest your funds for a longer period, allowing them to potentially earn higher returns and offer you a more attractive rate.For example, a 1-year CD might offer an annual percentage yield (APY) of 4%, while a 5-year CD could offer an APY of 5%.

The higher APY on the longer-term CD reflects the increased potential for the financial institution to generate returns over a longer period.However, locking your funds in a longer-term CD also carries a risk. If interest rates rise significantly after you’ve committed to a longer term, you could miss out on potentially higher returns.

If you need to access your funds before the CD matures, you may face early withdrawal penalties, which could erode your earnings.

Minimum Deposit Requirements

CD minimum deposit requirements vary depending on the financial institution and the specific CD product. These requirements can range from a few hundred dollars to tens of thousands of dollars. Understanding these requirements is crucial when deciding which CD to choose, as it directly affects the amount of capital you need to invest.For instance, let’s say you have $5,000 to invest.

One CD option requires a minimum deposit of $10,000, while another accepts a minimum of $1,000. You would be ineligible for the first CD option, as your available funds don’t meet the minimum requirement. However, you could invest your $5,000 in the second CD option.

Minimum deposit requirements can pose a challenge for individuals with limited funds. If you have a smaller amount to invest, you might need to explore CDs with lower minimum deposit requirements or consider alternative investment options.

Evaluating the Overall Value of a CD

Evaluating the overall value of a CD goes beyond just looking at the interest rate. It’s important to consider several key features and benefits to make an informed decision. Here are some important factors to consider:

Interest Rates

The APY offered by the CD is a crucial factor, as it directly determines your potential earnings.

Term Lengths

Choose a term length that aligns with your financial goals and risk tolerance.

Minimum Deposits

Ensure your investment capital meets the minimum deposit requirement for the chosen CD.

Special Features

Some CDs may offer additional features, such as the ability to make early withdrawals without penalty, or the option to renew the CD at maturity with a higher interest rate.

Stay informed about the IRS October Deadline 2023 and ensure you meet all your tax obligations. We’ve got the latest information to help you.

| CD Option | Interest Rate (APY) | Term Length | Minimum Deposit | Special Features ||—|—|—|—|—|| Option A | 4.5% | 1 year | $1,000 | None || Option B | 5.0% | 3 years | $5,000 | Early withdrawal without penalty || Option C | 5.5% | 5 years | $10,000 | Renew at maturity with higher APY |By comparing different CD options based on these features, you can identify the CD that best suits your needs and financial goals.To evaluate the overall value of a CD, consider both financial and non-financial factors.

Financial factors include interest rates, term lengths, and minimum deposits. Non-financial factors include the reputation of the financial institution, customer service, and the convenience of accessing your funds.

CD Rates by Term Length

Understanding how CD rates vary based on the term length is crucial for maximizing your returns. Longer terms generally offer higher APYs, but they also come with the risk of being locked into a rate for a longer period.

Need to know when are taxes due in October 2023 ? Our website provides a clear and concise overview of the tax deadlines and extension information you need.

Let’s explore the relationship between term length and APY.

CD Rates by Term Length

This data is based on the average CD rates from Bankrate.com for the past year.| Term Length | Average APY ||—|—|| 3 Months | 4.50% || 6 Months | 4.75% || 1 Year | 5.00% || 2 Years | 5.25% || 5 Years | 5.50% |> As you can see from the table, CD rates generally increase with term length.

This is because banks are willing to pay a higher rate to lock in your money for a longer period.

Visualizing the Relationship

To illustrate the trend between term length and APY, we can create a line graph. The x-axis would represent the term length (in months), and the y-axis would represent the average APY. The graph would show an upward trend, indicating that longer term CDs generally have higher APYs.

Risks and Rewards of Different Term Lengths

Choosing a shorter CD term offers more flexibility, as you can access your funds sooner. However, shorter terms typically have lower APYs compared to longer terms.> Shorter Term:>

Risk

Recent news about PNC Bank layoffs in October 2023 has been a topic of conversation. Our website provides the latest updates on this situation.

Lower APY, potential for missing out on higher rates if interest rates rise.>

Reward

More flexibility, ability to access funds sooner.> Longer Term:>

Risk

Locked in at a specific rate for a longer period, potential for missing out on higher rates if interest rates rise.>

Reward

Higher APY, potential for greater returns over time.

Impact of Economic Conditions

Current economic conditions can significantly influence CD rates. When interest rates rise, banks typically offer higher CD rates to attract deposits. Conversely, when interest rates fall, CD rates tend to decrease. It’s important to consider the current economic climate and the potential direction of interest rates when choosing a CD term.

5. CD Rates by Bank Type

Understanding the differences in CD rates offered by various types of financial institutions can help you make an informed decision about where to invest your money. This section examines CD rates offered by national banks, regional banks, credit unions, and online banks, highlighting the key factors that influence these rates.

CD Rates by Bank Type

| Bank Type | Minimum Deposit | Term Options | APY |

|---|---|---|---|

| National Banks (e.g., Bank of America, Chase, Wells Fargo) | $1,000

|

3 months, 6 months, 1 year, 5 years | 4.00%

Did you file for a tax extension? Don’t forget about the IRS tax deadline in October 2023. Find out when you need to file your taxes to avoid penalties.

|

| Regional Banks (e.g., PNC Bank, Regions Bank, US Bank) | $500

|

3 months, 6 months, 1 year, 5 years | 4.25%

|

| Credit Unions (e.g., Navy Federal Credit Union, State Employees’ Credit Union) | $500

|

3 months, 6 months, 1 year, 5 years | 4.50%

|

| Online Banks (e.g., Ally Bank, Marcus by Goldman Sachs, Discover Bank) | $100

|

3 months, 6 months, 1 year, 5 years | 4.75%

|

Bank Size and CD Rates, Best CD Rates October 2024

The relationship between bank size and CD rates is complex and can vary depending on market conditions. Generally, smaller banks and credit unions tend to offer higher CD rates than larger national banks. This is because smaller institutions often have lower overhead costs and may be more competitive in attracting deposits.

Advantages and Disadvantages of Bank Types

-

National Banks

- Advantages:Wide branch network, established reputation, robust online and mobile banking features.

- Disadvantages:Potentially lower CD rates, higher fees, may have stricter lending requirements.

-

Regional Banks

- Advantages:May offer higher CD rates than national banks, personalized customer service, strong local presence.

- Disadvantages:Limited branch network, fewer online banking features compared to national banks.

-

Credit Unions

- Advantages:Often offer the highest CD rates, member-owned, not-for-profit structure, community focus.

- Disadvantages:Membership requirements, limited branch networks, potentially less robust online banking features.

-

Online Banks

- Advantages:Generally offer the highest CD rates, convenient online access, competitive fees.

- Disadvantages:Lack of physical branches, limited customer service options, potential security concerns.

Strategies for Maximizing CD Returns

While finding the highest CD rate is a good start, there are additional strategies to maximize your returns. Understanding how CD rates work and employing smart tactics can help you get the most out of your savings.

Research and Comparison

Before choosing a CD, it’s essential to research and compare rates from different banks and credit unions. Online tools and websites dedicated to CD rate comparisons can simplify this process. Consider factors like minimum deposit requirements, term lengths, and any penalties for early withdrawal.

Planning your month? Take a look at the October 2023 calendar to keep track of important dates, holidays, and events. It’s a handy tool for staying organized.

CD Laddering

CD laddering involves diversifying your CD investments by spreading them across different maturity dates. This strategy helps manage interest rate risk. For example, you might invest in CDs with terms of 6 months, 12 months, 18 months, and so on.

The October extension tax deadline is approaching. Make sure you know when to file your taxes to avoid penalties. Our website provides all the information you need.

As each CD matures, you can reinvest the principal at the prevailing market rate, potentially locking in higher rates if interest rates have risen.

Considering CD Rates with Other Savings Goals

CD rates should be considered in conjunction with your overall financial goals. If you need access to your funds within a shorter timeframe, a CD might not be the best option. Consider your emergency fund needs, retirement savings goals, and any other financial commitments before committing to a CD.

7. Current Economic Factors Affecting CD Rates

CD rates, like other investment yields, are influenced by a variety of economic factors. Understanding these factors can help investors make informed decisions about their CD investments.

Want to find the best deals on a new car lease? We’ve got you covered. Check out our list of the best lease deals for October 2023.

Inflation

Inflation, the rate at which prices for goods and services increase over time, has a direct impact on CD rates. When inflation rises, lenders need to offer higher returns on CDs to compensate investors for the declining purchasing power of their money.

- For example, if inflation is at 5%, a CD with a 3% annual percentage yield (APY) will actually lose 2% of its purchasing power each year. To attract investors, lenders may offer higher CD rates to offset the effects of inflation.

Currently, inflation remains elevated, which has contributed to the recent increase in CD rates. However, the pace of inflation is expected to moderate in the coming months, potentially leading to a slowdown in CD rate increases.

Interest Rates

The Federal Reserve’s monetary policy, particularly its target for the federal funds rate, plays a significant role in shaping CD rates. The federal funds rate is the interest rate at which banks lend reserves to each other overnight. When the Fed raises interest rates, it becomes more expensive for banks to borrow money, incentivizing them to offer higher rates on deposits, including CDs, to attract funds.

Conversely, when the Fed lowers interest rates, CD rates tend to decline.

- The Fed has been aggressively raising interest rates in recent months to combat inflation. This has resulted in higher CD rates, as banks compete for deposits in a higher interest rate environment.

The Fed’s future interest rate decisions will have a direct impact on CD rates. If the Fed continues to raise rates, CD rates are likely to rise further. However, if the Fed pauses or reverses its rate hikes, CD rates could stabilize or even decline.

Want to find the best way to grow your savings? Explore the best CD rates for October 2023 and find a great deal on your next CD.

Economic Growth

Economic growth, measured by the rate of increase in a country’s gross domestic product (GDP), can also influence CD rates. Strong economic growth typically leads to higher CD rates, as lenders are more confident about the future health of the economy and are willing to offer higher returns to attract investors.

Conversely, if economic growth slows, lenders may become more cautious about lending, potentially leading to lower CD rates.

News of PNC Bank layoffs in October 2023 has been circulating, impacting employees and the banking industry. Stay updated with the latest news and developments on our website.

- The US economy has been experiencing moderate growth in recent quarters. This has contributed to the recent rise in CD rates, as lenders are more willing to offer higher returns in a favorable economic environment.

The outlook for economic growth in the coming months will be a key factor influencing CD rates. If the economy continues to grow at a moderate pace, CD rates are likely to remain elevated. However, if economic growth slows or enters a recession, CD rates could decline.

8. Alternative Investment Options to CDs

Certificates of Deposit (CDs) are a popular choice for savers seeking fixed interest rates and guaranteed returns. However, they are not the only option available. Exploring other investment avenues can potentially offer higher returns, greater flexibility, or a different risk profile.

This section delves into alternative investment options to CDs, comparing their features, benefits, and drawbacks.

Comparison of Investment Options

This table compares CDs with other popular savings and investment options, highlighting key features to aid in decision-making:

| Investment Type | Minimum Deposit | Interest Rate | Term Length | Liquidity | FDIC Insurance | Risk Level |

|---|---|---|---|---|---|---|

| Certificate of Deposit (CD) | Varies by bank | Fixed for the term | Fixed (e.g., 3 months, 6 months, 1 year, etc.) | Limited (early withdrawal penalties) | Yes (up to $250,000 per depositor, per insured bank) | Low |

| High-Yield Savings Account (HYSA) | Varies by bank | Variable (subject to change) | No fixed term | High (easy access to funds) | Yes (up to $250,000 per depositor, per insured bank) | Low |

| Money Market Account (MMA) | Varies by bank | Variable (subject to change) | No fixed term | High (limited check-writing privileges) | Yes (up to $250,000 per depositor, per insured bank) | Low |

| Bonds | Varies by issuer | Fixed (for the term) or variable (for some bonds) | Fixed (maturity date) | Limited (can be traded on the secondary market) | Not all bonds are FDIC insured | Moderate to High (depending on the bond type and issuer) |

Pros and Cons of Investment Options

Understanding the advantages and disadvantages of each investment option can help you make an informed decision:

Certificates of Deposit (CDs)

- Pros:

- Guaranteed fixed interest rate

- Predictable returns

- FDIC insured (up to $250,000)

- Low risk

- Cons:

- Limited liquidity (early withdrawal penalties)

- Interest rates may be lower than other options

- Inflation can erode purchasing power

High-Yield Savings Accounts (HYSAs)

- Pros:

- Higher interest rates than traditional savings accounts

- Easy access to funds

- FDIC insured (up to $250,000)

- Low risk

- Cons:

- Interest rates can fluctuate

- May not offer the same level of return as CDs

Money Market Accounts (MMAs)

- Pros:

- Variable interest rates that can be higher than savings accounts

- Limited check-writing privileges

- FDIC insured (up to $250,000)

- Low risk

- Cons:

- Interest rates can fluctuate

- May have higher minimum balance requirements

Bonds

- Pros:

- Potential for higher returns than CDs or savings accounts

- Can be traded on the secondary market (providing some liquidity)

- Diversification benefits

- Cons:

- Higher risk than CDs or savings accounts

- Interest rate risk (bond prices fall when interest rates rise)

- Not all bonds are FDIC insured

Suitability of Investment Options

The best investment option for you depends on your individual circumstances, including your financial goals, risk tolerance, and time horizon.

Financial Goals

- Short-term savings:HYSAs or MMAs may be suitable due to their high liquidity and potential for higher returns than traditional savings accounts.

- Long-term growth:Bonds can offer potential for higher returns, but they also carry more risk.

- Retirement planning:A diversified portfolio of investments, including stocks, bonds, and real estate, may be appropriate for long-term growth and income generation.

Risk Tolerance

- Low risk:CDs, HYSAs, and MMAs are generally considered low-risk investments.

- Moderate risk:Bonds can offer a moderate level of risk, depending on the type of bond and the issuer.

- High risk:Stocks, real estate, and other alternative investments can offer higher potential returns, but they also carry a higher risk of loss.

Yield Curve and Its Impact on Investments

The yield curve is a graphical representation of interest rates for bonds of different maturities. It can be used to assess the overall health of the economy and the attractiveness of fixed-income investments.

Definition of Yield Curve

The yield curve typically slopes upward, meaning that longer-term bonds have higher interest rates than shorter-term bonds. This is because investors demand higher returns for holding bonds for longer periods.

Impact on Investments

The shape of the yield curve can influence the interest rates offered on CDs, bonds, and other fixed-income investments.

- Normal Yield Curve:When the yield curve slopes upward, it generally indicates a healthy economy with expectations of future growth. This can lead to higher interest rates on CDs and bonds.

- Inverted Yield Curve:When the yield curve slopes downward, it can signal an economic slowdown or recession. This can lead to lower interest rates on CDs and bonds.

- Flat Yield Curve:When the yield curve is flat, it suggests that investors are uncertain about the future economic outlook. This can lead to a range of interest rates on CDs and bonds, depending on the specific issuer and maturity date.

Example of Yield Curve Impact

Imagine an inverted yield curve where short-term bonds have higher interest rates than long-term bonds. This might make CDs less attractive than short-term bonds, as investors could earn higher returns on shorter-term investments.

Inflation and Its Impact on Investments

Inflation is a gradual increase in the prices of goods and services over time. It can erode the purchasing power of savings and investments.

Inflation’s Impact on Purchasing Power

Inflation reduces the real value of your savings and investments. For example, if inflation is 3% per year, a $100 investment will only be worth $97 in real terms after one year.

Real Return

Real return is the return on an investment adjusted for inflation. It reflects the actual increase in your purchasing power.

Real Return = Nominal Return

Inflation Rate

For example, if a CD earns a nominal return of 5% and inflation is 3%, the real return is 2%.

If you’re looking to invest your money, check out the PNC Bank CD rates for October 2023. We’ll help you find the best rates for your savings.

Investment Strategies to Mitigate Inflation

Investors can adjust their investment strategies to mitigate the effects of inflation.

Investors looking for dividend income might be interested in the Jepi Dividend for October 2023. Find out how this dividend can impact your portfolio.

- Invest in assets that are likely to appreciate faster than inflation:This could include stocks, real estate, or commodities.

- Consider inflation-indexed bonds:These bonds adjust their principal value to keep pace with inflation, providing some protection against rising prices.

- Diversify your portfolio:Holding a mix of assets with different risk profiles can help to reduce the overall impact of inflation.

Choosing the Best Alternative Investment Option

The best alternative investment option for you depends on your unique circumstances and goals.

Scenario

Let’s consider Sarah, a 35-year-old professional with a moderate risk tolerance and a long-term investment horizon. She is saving for retirement and wants to grow her wealth over time.

Recommendation

For Sarah, a diversified portfolio of stocks and bonds might be the most suitable alternative investment option to CDs.

Considerations

- Financial goals:Sarah’s goal is to save for retirement, which is a long-term goal. Stocks and bonds have the potential for higher returns over the long term.

- Risk tolerance:Sarah has a moderate risk tolerance, which makes stocks and bonds appropriate investments.

- Time horizon:Sarah’s long-term investment horizon allows her to ride out market fluctuations and benefit from the potential for long-term growth.

- Liquidity needs:Sarah does not need immediate access to her savings, so the illiquidity of stocks and bonds is not a major concern.

- Tax implications:Sarah should consult with a tax advisor to understand the tax implications of different investment options.

Risks and Considerations for CD Investments: Best CD Rates October 2024

While CDs offer a relatively safe and predictable way to earn interest on your savings, it’s crucial to understand the potential risks associated with these investments before committing your funds. This section delves into key considerations, helping you make informed decisions and potentially maximize your returns.

Early Withdrawal Penalties

Early withdrawal penalties are a common feature of CDs, designed to discourage investors from withdrawing funds before maturity. These penalties can significantly reduce your overall return on investment. Here’s a table comparing different types of early withdrawal penalties:| Penalty Type | Penalty Amount | Time Period | Circumstances ||—|—|—|—|| Fixed Penalty | A specific dollar amount or percentage of the principal | Typically within the first few months of the CD term | Withdrawal before the maturity date || Interest Forfeiture | Loss of accrued interest | Varies depending on the CD terms | Withdrawal before the maturity date || Full Principal Forfeiture | Loss of the entire principal amount | May apply in extreme circumstances, such as CD closure due to bank failure | Withdrawal before the maturity date |For example, if you withdraw $10,000 from a CD with a $500 fixed early withdrawal penalty within the first six months, you’ll receive $9,500, losing $500 in the process.

Interest Rate Risk

Interest rate risk refers to the possibility of losing money due to changes in interest rates. When interest rates rise, the value of your existing CD may decline, as new CDs are issued with higher interest rates. For instance, if you invest $10,000 in a one-year CD with a 2% interest rate, and interest rates rise to 3% the following year, your CD will be worth less than a new CD issued at the higher rate.

It’s a good time to consider upgrading your credit card. Check out our list of the best credit cards for October 2023, featuring cards with great rewards, low interest rates, and other perks.

You’ll earn a lower return compared to investing in a new CD at the higher rate.

Understanding CD Terms and Conditions

Before investing in a CD, it’s essential to carefully review the terms and conditions. These documents Artikel the specifics of the investment, including:* Maturity Date:The date on which the CD matures and your principal and accrued interest become payable.

Interest Rate

The annual percentage yield (APY) you’ll earn on your investment.

Minimum Deposit Amount

The minimum amount required to open the CD.These terms can significantly impact your overall return on investment. For example, a higher interest rate will lead to greater returns, while a longer maturity date may offer a higher rate but tie up your funds for a longer period.

Tips for Mitigating Risks and Maximizing Returns

Several strategies can help you mitigate potential risks and maximize returns on CD investments:* Choose CDs with Shorter Maturities:CDs with shorter maturities expose you to less interest rate risk. If interest rates rise, you can reinvest your funds at the higher rate sooner.

Ladder Your Investments

Spread your investments across CDs with different maturity dates. This diversification strategy helps reduce interest rate risk and ensures a steady stream of income.

Compare Interest Rates

Shop around and compare interest rates from different banks and credit unions. Consider factors like current market conditions and the institution’s reputation for financial stability.

Diversify Across Institutions

Spread your investments across multiple institutions to reduce the risk of losing your entire investment in case of a bank failure.

CD Rates vs. Inflation

Inflation is a key factor to consider when evaluating the returns on a certificate of deposit (CD). While CDs offer a fixed interest rate, inflation can erode the purchasing power of your earnings over time. Understanding the relationship between CD rates and inflation is crucial for making informed investment decisions.

Inflation’s Impact on CD Returns

Inflation is a general increase in the prices of goods and services over time. As inflation rises, the purchasing power of your money decreases. For example, if the inflation rate is 3%, you’ll need $103 today to buy the same amount of goods and services that cost $100 a year ago.

If your CD rate is lower than the inflation rate, your investment is effectively losing value in real terms. This is because the interest earned on your CD may not be enough to offset the decline in purchasing power due to inflation.

Strategies for Protecting Savings from Inflation

Several strategies can help you protect your savings from inflation.

Investing in Higher-Yielding Investments

One strategy is to invest in investments that offer higher returns than CDs. While these investments may come with greater risk, they can potentially outpace inflation. Some examples include:* High-yield savings accounts:These accounts typically offer higher interest rates than traditional savings accounts, although they may not keep pace with high inflation.

Stocks

Stocks represent ownership in companies and can offer significant growth potential over time.

Bonds

Looking for a new car? October is a great time to check out the best car lease deals. With many manufacturers offering incentives, you can find a great deal on the car of your dreams.

Bonds are debt securities issued by corporations or governments. They typically offer lower returns than stocks but are generally considered less risky.

Real estate

Real estate can be a good hedge against inflation, as property values tend to rise with inflation.

Commodities

Commodities, such as gold and oil, are raw materials that can also be used as a hedge against inflation.

Adjusting Spending Habits

Another strategy is to adjust your spending habits to minimize the impact of inflation. This may involve:* Cutting unnecessary expenses:Identify areas where you can cut back on spending, such as dining out, entertainment, or subscriptions.

Negotiating lower prices

Try to negotiate lower prices on goods and services, such as utilities, insurance, or cable bills.

Shopping around for better deals

Compare prices and shop around for the best deals on everything from groceries to gas.

Consider Alternative Investments

While CDs are a safe and secure investment option, they may not be the best choice for protecting your savings from inflation. Consider exploring alternative investment options that have the potential to provide higher returns, such as:* Index funds:These funds track a specific market index, such as the S&P 500, and offer diversification and low fees.

Exchange-traded funds (ETFs)

ETFs are similar to index funds but are traded on stock exchanges, making them more liquid.

Mutual funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets.It’s important to note that all investments carry some degree of risk. Before making any investment decisions, it’s crucial to carefully research and understand the risks involved.

You should also consult with a financial advisor to determine the best investment strategies for your individual needs and goals.

Last Point

In conclusion, navigating the world of CD rates requires a thoughtful approach, taking into account both current market conditions and your individual financial objectives. By understanding the factors influencing CD rates, researching available options, and considering alternative investments, you can make informed decisions that align with your savings goals.

Whether you’re seeking to maximize your returns, manage risk, or simply find a safe haven for your savings, this guide provides a valuable roadmap for success in the ever-evolving CD market.

Key Questions Answered

What are the best CD rates currently available in October 2024?

The best CD rates in October 2024 vary depending on the CD term length, the financial institution offering the CD, and the minimum deposit requirement. To find the best rates, it’s recommended to use a CD rate comparison website or contact several banks and credit unions directly.

How do I choose the right CD term length for my needs?

The optimal CD term length depends on your individual financial goals and risk tolerance. If you need access to your funds sooner, a shorter term CD may be more suitable. However, longer term CDs typically offer higher interest rates. Consider your time horizon and liquidity needs when choosing a CD term.

Are CDs FDIC insured?

Yes, CDs offered by banks and credit unions are FDIC insured up to $250,000 per depositor, per insured bank. This means that your CD deposits are protected in the event of a bank failure.

What are the risks associated with investing in CDs?

CDs carry some risks, including interest rate risk and early withdrawal penalties. Interest rate risk occurs when interest rates rise after you’ve locked in a CD at a lower rate. Early withdrawal penalties are fees charged if you withdraw funds from a CD before its maturity date.