Best Mortgage Interest Rates 2024 are a hot topic for anyone looking to buy a home. Understanding the factors influencing these rates is crucial to securing the best deal. The Federal Reserve’s monetary policy plays a significant role, as does the overall health of the economy.

U.S. Bank is a major financial institution that provides mortgage services. You can explore their mortgage offerings, including rates and loan options, by visiting U.S. Bank Mortgage 2024.

By analyzing historical trends and current market conditions, you can make informed decisions about your mortgage.

Understanding the current housing interest rates is essential when making mortgage decisions. These rates can fluctuate, so staying informed is key.

This guide will provide you with a comprehensive overview of the current mortgage interest rate landscape, including average rates for various loan types, comparisons between lenders, and strategies for finding the best rates. We’ll also discuss the impact of interest rates on affordability and homeownership costs, as well as resources for staying up-to-date on mortgage rate information.

Contents List

Understanding Mortgage Interest Rates

Mortgage interest rates are a crucial factor in determining the cost of homeownership. They represent the annual percentage rate (APR) that a borrower pays on their mortgage loan. Understanding how these rates work and what influences them is essential for making informed financial decisions.

Factors Influencing Mortgage Interest Rates, Best Mortgage Interest Rates 2024

Several factors influence mortgage interest rates, including:

- Federal Reserve Monetary Policy:The Federal Reserve (Fed) sets the federal funds rate, which influences the cost of borrowing for banks and other financial institutions. When the Fed raises rates, it typically leads to higher mortgage rates, and vice versa.

- Inflation:High inflation erodes the purchasing power of money, prompting the Fed to raise interest rates to curb inflation. This, in turn, can lead to higher mortgage rates.

- Economic Growth:A strong economy often leads to higher demand for loans, which can push interest rates up. Conversely, a weak economy may lead to lower interest rates as lenders compete for borrowers.

- Creditworthiness:Borrowers with good credit scores typically qualify for lower interest rates than those with poor credit. Lenders consider credit history, debt-to-income ratio, and other factors to assess creditworthiness.

- Loan Type:Different types of mortgage loans, such as fixed-rate or adjustable-rate mortgages, have varying interest rates. The terms and conditions of the loan, such as the loan term and down payment, can also affect rates.

- Market Demand:The supply and demand for mortgages can also influence interest rates. High demand can lead to higher rates, while low demand can lead to lower rates.

Relationship Between the Federal Reserve and Mortgage Rates

The Federal Reserve’s monetary policy plays a significant role in shaping mortgage interest rates. When the Fed raises interest rates, it becomes more expensive for banks to borrow money, which, in turn, leads to higher mortgage rates. This is because banks pass on the cost of borrowing to their customers, including mortgage borrowers.

If you need additional funds for home improvements or other expenses, a second mortgage loan might be a good option. Be sure to carefully consider the terms and interest rates before committing.

Conversely, when the Fed lowers interest rates, it becomes cheaper for banks to borrow money, which can lead to lower mortgage rates.

Reverse mortgages are a unique financial product, and it’s important to understand their terms and conditions before making a decision. You can find more information about reverse mortgage rates for 2024 online.

Historical Overview of Mortgage Interest Rate Trends

Mortgage interest rates have fluctuated significantly over time. In the 1970s and 1980s, rates soared to double digits, making homeownership expensive. However, rates declined steadily throughout the 1990s and early 2000s, reaching historic lows in recent years. The housing crisis of 2008 led to a temporary spike in rates, but they have since fallen back to more manageable levels.

Historical data suggests that mortgage interest rates tend to follow broader economic trends, with periods of growth often accompanied by rising rates and periods of recession or stagnation often accompanied by falling rates.

Current Mortgage Interest Rate Landscape

Mortgage interest rates are constantly evolving, influenced by a complex interplay of economic factors. It’s essential to stay updated on current trends to make informed decisions about homeownership.

Average Mortgage Interest Rates

As of [current date], average mortgage interest rates for various loan types are:

| Loan Type | Average Interest Rate |

|---|---|

| 30-Year Fixed-Rate Mortgage | [Insert current average interest rate] |

| 15-Year Fixed-Rate Mortgage | [Insert current average interest rate] |

| Adjustable-Rate Mortgage (ARM) | [Insert current average interest rate] |

Comparison of Interest Rates from Different Lenders

Mortgage interest rates can vary significantly among different lenders. It’s crucial to shop around and compare rates from multiple sources. Factors that can influence rates include the lender’s creditworthiness, loan terms, and fees. Online mortgage lenders often offer competitive rates, while traditional banks and credit unions may have higher rates but offer personalized service.

Current Market Conditions Affecting Mortgage Rates

The current market conditions play a significant role in determining mortgage interest rates. Factors such as inflation, economic growth, and the Federal Reserve’s monetary policy influence rates. For example, high inflation can lead to higher mortgage rates as the Fed raises interest rates to combat inflation.

Similarly, strong economic growth can lead to higher demand for loans, which can push rates up.

Navy Federal Credit Union offers mortgage services to its members. You can find out more about Navy Federal mortgage rates for 2024 by visiting their website.

Finding the Best Mortgage Interest Rate: Best Mortgage Interest Rates 2024

Securing the best mortgage interest rate can save you thousands of dollars over the life of your loan. Here’s a step-by-step guide to help you find the most favorable rates:

Comparing Mortgage Interest Rates from Top Lenders

Start by comparing rates from multiple lenders to identify the most competitive offers. You can use online mortgage calculators and comparison tools to streamline this process. Consider factors such as loan terms, fees, and lender reputation when comparing rates.

| Lender | 30-Year Fixed-Rate Mortgage | 15-Year Fixed-Rate Mortgage | ARM |

|---|---|---|---|

| [Lender 1] | [Interest rate] | [Interest rate] | [Interest rate] |

| [Lender 2] | [Interest rate] | [Interest rate] | [Interest rate] |

| [Lender 3] | [Interest rate] | [Interest rate] | [Interest rate] |

Step-by-Step Guide to Obtaining the Best Mortgage Interest Rate

- Check your credit score:Your credit score is a crucial factor in determining your interest rate. Aim for a score of 740 or higher to qualify for the most favorable rates.

- Shop around:Compare rates from multiple lenders, including online lenders, banks, and credit unions. Use mortgage calculators and comparison tools to streamline the process.

- Negotiate:Once you’ve found a lender with a competitive rate, don’t be afraid to negotiate. You may be able to secure a lower rate by offering a larger down payment or opting for a shorter loan term.

- Consider loan terms:Different loan types, such as fixed-rate or adjustable-rate mortgages, have varying interest rates. Choose the loan type that best suits your financial situation and risk tolerance.

- Read the fine print:Before signing any loan documents, carefully review the terms and conditions, including fees and closing costs.

Strategies for Negotiating Lower Interest Rates

- Offer a larger down payment:Lenders typically offer lower rates to borrowers who make larger down payments.

- Opt for a shorter loan term:A shorter loan term, such as a 15-year mortgage, typically comes with a lower interest rate.

- Shop around for a lower APR:Compare APRs from different lenders, as they include the interest rate and other fees.

- Negotiate closing costs:You may be able to negotiate lower closing costs, which can reduce the overall cost of your loan.

Impact of Mortgage Interest Rates on Homeownership

Mortgage interest rates have a significant impact on the affordability and cost of homeownership. Understanding how rates affect housing costs is crucial for making informed decisions about buying a home.

PNC Bank offers home equity lines of credit (HELOCs), which can be a useful financial tool for homeowners. You can find information about PNC Bank HELOC options for 2024 online.

Effect of Interest Rates on Affordability and Homeownership Costs

Higher mortgage interest rates make homeownership more expensive. This is because a higher interest rate increases the total amount of interest paid over the life of the loan. For example, a 1% increase in the interest rate on a $300,000 mortgage could add thousands of dollars to the total cost of the loan.

Conversely, lower interest rates make homeownership more affordable, as borrowers pay less interest over the life of the loan.

If you’re looking for a stable and predictable payment plan for your mortgage, you might want to consider a fixed-rate home loan. These loans offer consistent monthly payments, making budgeting easier and giving you peace of mind about your finances.

Potential Impact of Interest Rate Fluctuations on the Housing Market

Fluctuations in mortgage interest rates can significantly impact the housing market. Rising interest rates can slow down home sales as buyers become less willing to purchase homes at higher prices. This can lead to a decrease in demand, which can, in turn, lead to lower home prices.

A 30-year mortgage is a common choice for homebuyers, offering a longer repayment period and potentially lower monthly payments. You can learn more about 30-year mortgage rates for 2024 online.

Conversely, falling interest rates can stimulate the housing market, as buyers become more eager to purchase homes at lower prices. This can lead to increased demand, which can drive up home prices.

Securing a mortgage with the best mortgage rates can significantly impact your monthly payments and overall financial well-being. It’s worth comparing rates and lenders to find the best deal.

Insights into How Rising Interest Rates Might Affect Homebuyers

Rising interest rates can make it more challenging for homebuyers to qualify for a mortgage. This is because lenders typically use a debt-to-income ratio (DTI) to assess a borrower’s ability to repay a loan. A higher interest rate can increase the monthly mortgage payment, which can affect a borrower’s DTI and make it harder to qualify for a loan.

Everyone wants the best deal, and finding the cheapest home loan rates can save you a significant amount of money over the life of your mortgage. It’s worth comparing rates from different lenders.

Rising interest rates can also lead to higher monthly payments, which can strain a borrower’s budget. As a result, homebuyers may need to adjust their expectations, such as considering smaller homes or making a larger down payment, to manage the impact of higher interest rates.

Everyone wants the lowest possible interest rate on their mortgage. You can find information about the lowest mortgage rates available in 2024 online.

Resources for Mortgage Interest Rate Information

Staying informed about current mortgage interest rates is essential for making sound financial decisions. There are numerous resources available to help you access reliable and up-to-date information.

Reputable Websites and Organizations Offering Mortgage Rate Data

- Bankrate.com:Provides comprehensive mortgage rate data and analysis, including average rates, lender comparisons, and mortgage calculators.

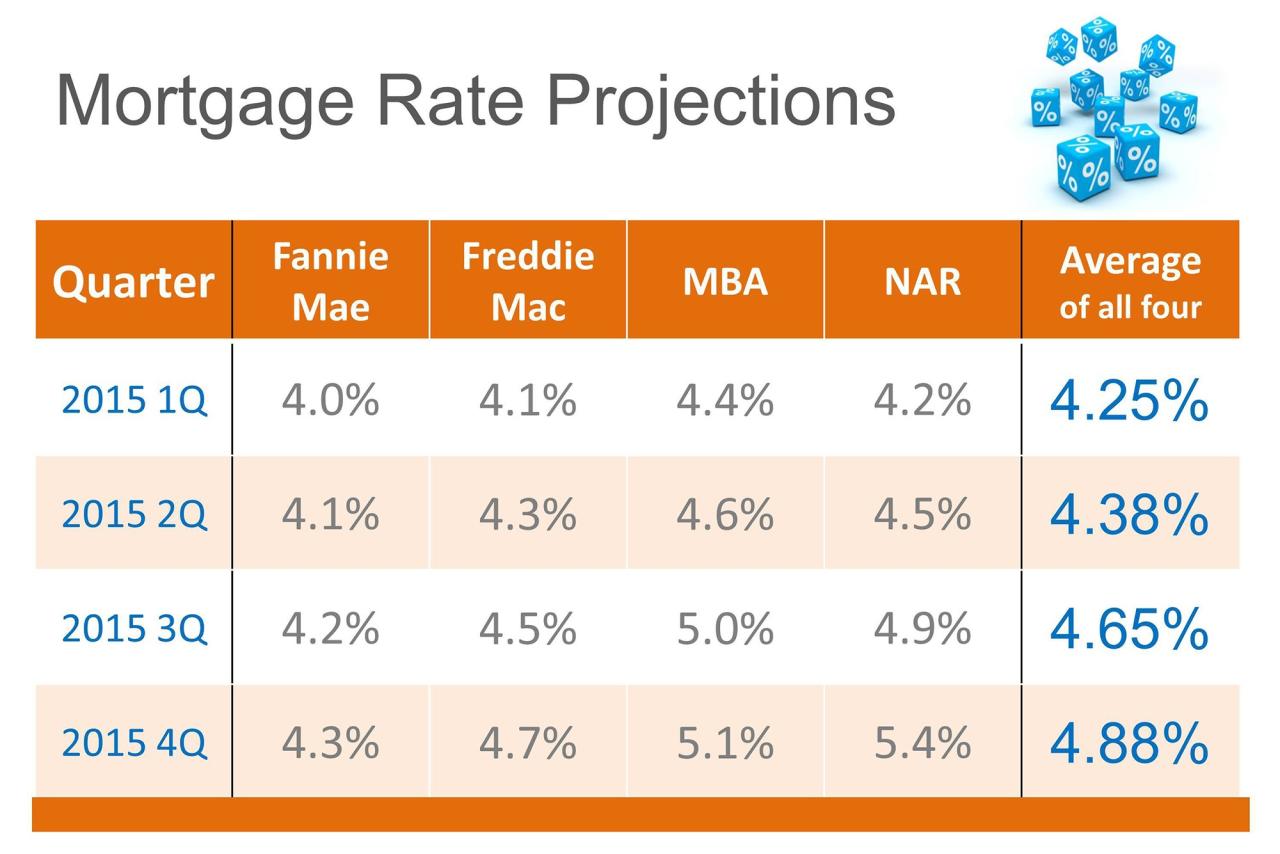

- Freddie Mac:A government-sponsored enterprise that provides mortgage financing, publishes weekly mortgage rate data, and offers resources for homebuyers.

- Mortgage Bankers Association (MBA):A trade association representing mortgage lenders, provides industry data and analysis, including mortgage rate trends.

- The Federal Reserve:The central bank of the United States, publishes data on interest rates and other economic indicators that influence mortgage rates.

Mortgage Calculators and Tools for Estimating Payments

| Calculator/Tool | Description | Website |

|---|---|---|

| Bankrate Mortgage Calculator | Estimates monthly mortgage payments based on loan amount, interest rate, and loan term. | www.bankrate.com |

| Freddie Mac Loan Simulator | Allows users to explore different loan scenarios and see how interest rates and other factors affect payments. | www.freddiemac.com |

| NerdWallet Mortgage Calculator | Provides detailed calculations of mortgage payments, including principal, interest, taxes, and insurance. | www.nerdwallet.com |

Financial Advisors Specializing in Mortgage Financing

If you need personalized advice and guidance on mortgage financing, consider consulting a financial advisor specializing in this area. They can help you understand your options, explore different loan scenarios, and negotiate the best possible terms.

When choosing a mortgage lender, it’s essential to consider their reputation and track record. You can research and compare the top mortgage lenders for 2024 to find the best fit for your needs.

Final Thoughts

Securing the best mortgage interest rate requires careful planning and research. By understanding the factors influencing rates, comparing lenders, and utilizing available resources, you can increase your chances of obtaining a favorable loan. Remember, navigating the mortgage market can be complex, so don’t hesitate to consult with a financial advisor for personalized guidance.

FAQ Compilation

What is the current average mortgage interest rate?

For first-time homebuyers, the idea of a zero-down mortgage might seem appealing. However, it’s crucial to understand the potential drawbacks and ensure you’re financially prepared for the responsibilities of homeownership.

The average mortgage interest rate fluctuates daily. For the most up-to-date information, refer to reputable sources like Bankrate or Freddie Mac.

How can I improve my chances of getting a lower interest rate?

Mr. Cooper is a well-known mortgage lender, and you might be interested in their current offerings. You can learn more about their rates and services by checking out Mr. Cooper Mortgage 2024.

Boost your credit score, increase your down payment, consider a shorter loan term, and shop around for competitive rates from different lenders.

Navigating the mortgage landscape can be overwhelming, but tools like Mortgage Finder 2024 can help you find the best options based on your specific needs and circumstances.

What are the risks associated with fixed-rate mortgages?

Fixed-rate mortgages offer predictable payments but may not be as advantageous if interest rates drop significantly after you lock in your rate.

What are the benefits of an adjustable-rate mortgage (ARM)?

ARMs typically have lower initial interest rates than fixed-rate mortgages, but the rates can adjust over time, potentially leading to higher payments.

What should I look for in a mortgage lender?

Choose a lender with a good reputation, competitive rates, transparent fees, and excellent customer service.