Best Travel Insurance With Covid Coverage 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset. Traveling in a post-pandemic world comes with new uncertainties, and securing the right travel insurance with COVID-19 coverage is crucial.

This guide will help you navigate the complexities of travel insurance, ensuring you have the protection you need to enjoy your trip with peace of mind. It’s more important than ever to understand the nuances of travel insurance, especially with the ongoing impact of COVID-19 on travel.

This guide will provide a comprehensive overview of travel insurance, highlighting the importance of COVID-19 coverage and exploring key features to consider. We’ll delve into the essential coverage components, including medical expenses, trip cancellation, emergency medical evacuation, and quarantine costs.

We’ll also discuss factors to consider when choosing a provider, such as destination, travel duration, age, health conditions, and budget. Ultimately, this guide aims to equip you with the knowledge and insights needed to make informed decisions about travel insurance and ensure a safe and enjoyable trip.

Contents List

- 1 Introduction

- 2 Key Features of Travel Insurance with COVID-19 Coverage

- 3 Top Travel Insurance Providers with COVID-19 Coverage

- 4 6. Tips for Filing a Claim

- 5 8. Travel Insurance for Specific Needs

- 6 The Future of Travel Insurance with COVID-19: Best Travel Insurance With Covid Coverage 2024

- 7 Resources and Further Information

- 8 Final Conclusion

- 9 Top FAQs

Introduction

Travel insurance is a crucial aspect of any travel plan, offering financial protection against unexpected events that may disrupt your trip. It acts as a safety net, providing peace of mind and financial security in case of emergencies or unforeseen circumstances.The global COVID-19 pandemic has significantly impacted the travel industry, highlighting the importance of travel insurance with comprehensive COVID-19 coverage.

This type of insurance can safeguard travelers against various pandemic-related risks, such as travel disruptions, medical expenses, and quarantine costs.

The Current Travel Landscape and Its Impact on Insurance Needs

The travel landscape has undergone significant transformations due to the COVID-19 pandemic. Travel restrictions, quarantine requirements, and evolving health protocols have become common, creating uncertainty and complexity for travelers. This dynamic environment has made it more critical than ever to secure travel insurance that provides adequate coverage for pandemic-related risks.

Key Features of Travel Insurance with COVID-19 Coverage

Travel insurance with COVID-19 coverage offers crucial protection for travelers in the event of unexpected circumstances related to the pandemic. It provides financial assistance and peace of mind by covering various aspects of your trip, including medical expenses, trip cancellations, and emergency medical evacuations.

Essential Coverage Components

This type of insurance typically covers several key components:

- Medical Expenses:This coverage helps pay for medical treatment, including hospitalization, doctor’s visits, and medications, if you contract COVID-19 while traveling. The coverage amount can vary depending on the policy, but it usually includes a maximum limit.

- Trip Cancellation:If you need to cancel your trip due to a positive COVID-19 test, travel restrictions, or other pandemic-related reasons, trip cancellation coverage reimburses you for non-refundable expenses, such as flights, accommodations, and tours.

- Emergency Medical Evacuation:This coverage is essential if you require medical attention that is not available at your travel destination. It covers the costs of transporting you back to your home country for necessary medical care.

- Quarantine Costs:If you are required to quarantine due to COVID-19, this coverage can help pay for accommodation, meals, and other expenses during your quarantine period. It can also cover the costs of additional travel expenses if your quarantine period extends your trip.

Types of COVID-19 Coverage

Travel insurance policies offer different types of COVID-19 coverage, catering to specific needs and situations:

- Medical Expenses due to COVID-19:This coverage pays for medical treatment if you contract COVID-19 while traveling. The coverage amount and specific inclusions may vary depending on the policy.

- Trip Cancellation due to COVID-19:This coverage reimburses you for non-refundable expenses if you need to cancel your trip due to a positive COVID-19 test, travel restrictions, or other pandemic-related reasons. It typically includes a maximum coverage limit and specific criteria for eligibility.

- Travel Disruptions due to COVID-19 Restrictions:This coverage helps with expenses related to travel disruptions caused by COVID-19 restrictions, such as flight cancellations, delays, and changes in itinerary. It can reimburse you for additional accommodation costs, rebooking fees, and other expenses.

Inclusions and Exclusions

It’s crucial to understand the specific inclusions and exclusions related to COVID-19 coverage in your travel insurance policy.

- Inclusions:Most policies cover medical expenses for COVID-19 treatment, trip cancellation due to positive tests or travel restrictions, and emergency medical evacuation. Some policies may also include coverage for quarantine costs and travel disruptions.

- Exclusions:Common exclusions may include pre-existing medical conditions related to COVID-19, travel to high-risk areas, and trips taken against the advice of health authorities. It’s important to carefully review the policy document to understand the specific exclusions.

Top Travel Insurance Providers with COVID-19 Coverage

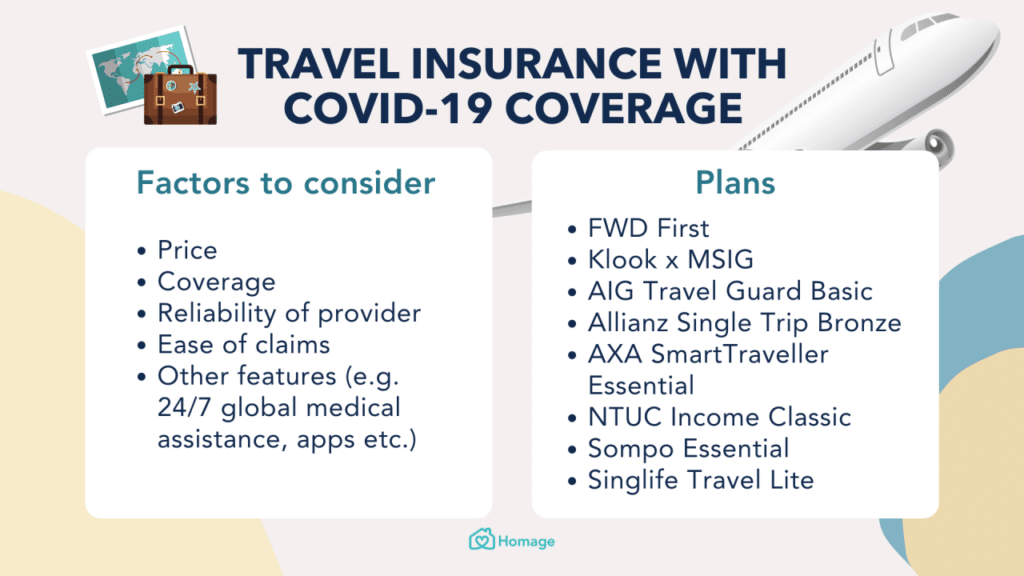

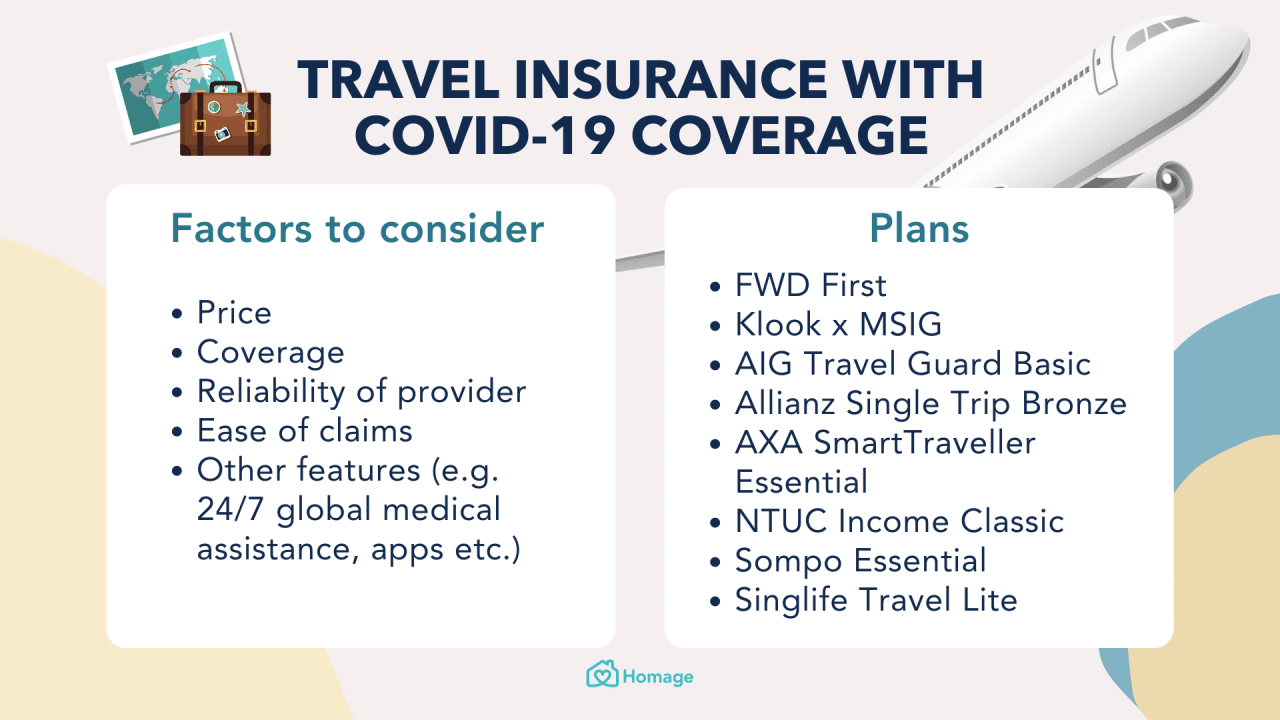

Choosing the right travel insurance with COVID-19 coverage is crucial for peace of mind, especially considering the ongoing uncertainties. This section will compare top providers based on coverage, price, customer reviews, and other important factors.

Comparison of Top Travel Insurance Providers

This table compares four leading travel insurance providers, highlighting their COVID-19 specific coverage, other key coverage aspects, average price range, customer reviews, and additional relevant factors.

| Provider Name | COVID-19 Specific Coverage | Other Key Coverage | Price Range | Customer Reviews | Other Relevant Factors |

|---|---|---|---|---|---|

| World Nomads | Medical expenses, trip cancellation due to COVID-19, emergency medical evacuation, quarantine costs | Medical expenses, baggage loss, trip cancellation due to non-COVID reasons, travel delay, personal liability | $100

|

Generally positive reviews, praising comprehensive coverage and responsive customer service. Some negative reviews mention issues with claim processing speed. | Strong reputation for adventure travel, offers optional COVID-19 add-ons, online claim filing |

| Travel Guard | Medical expenses, trip cancellation due to COVID-19, emergency medical evacuation, quarantine costs | Medical expenses, baggage loss, trip cancellation due to non-COVID reasons, travel delay, personal liability | $100

|

Positive reviews highlighting comprehensive coverage and helpful customer service. Some negative reviews mention high deductibles and limited coverage for certain situations. | Offers various plan options to suit different needs, 24/7 assistance, strong financial backing |

| Allianz Travel Insurance | Medical expenses, trip cancellation due to COVID-19, emergency medical evacuation, quarantine costs | Medical expenses, baggage loss, trip cancellation due to non-COVID reasons, travel delay, personal liability | $100

|

Mixed reviews, with some praising comprehensive coverage and reliable claims processing, while others mention slow response times and confusing policy language. | Wide range of plan options, global network of medical providers, strong financial stability |

| Seven Corners | Medical expenses, trip cancellation due to COVID-19, emergency medical evacuation, quarantine costs | Medical expenses, baggage loss, trip cancellation due to non-COVID reasons, travel delay, personal liability | $100

|

Generally positive reviews, commending comprehensive coverage and competitive pricing. Some negative reviews mention challenges with claim processing and customer service responsiveness. | Offers specialized plans for different travel needs, online policy management, 24/7 emergency assistance |

Provider Information

The following information provides a brief overview of each provider’s COVID-19 coverage:

- World Nomads: Offers comprehensive COVID-19 coverage, including medical expenses, trip cancellation, emergency medical evacuation, and quarantine costs. Their coverage extends to both pre-existing and newly acquired COVID-19 conditions. However, they may have limitations regarding coverage for specific destinations or situations.

- Travel Guard: Provides extensive COVID-19 coverage, covering medical expenses, trip cancellation, emergency medical evacuation, and quarantine costs. Their coverage extends to pre-existing and newly acquired COVID-19 conditions. They may have limitations regarding coverage for specific destinations or situations.

- Allianz Travel Insurance: Offers COVID-19 coverage, including medical expenses, trip cancellation, emergency medical evacuation, and quarantine costs. Their coverage extends to pre-existing and newly acquired COVID-19 conditions. They may have limitations regarding coverage for specific destinations or situations.

- Seven Corners: Provides comprehensive COVID-19 coverage, including medical expenses, trip cancellation, emergency medical evacuation, and quarantine costs. Their coverage extends to pre-existing and newly acquired COVID-19 conditions. They may have limitations regarding coverage for specific destinations or situations.

Key Findings and Considerations

While all four providers offer comprehensive COVID-19 coverage, there are subtle differences in their specific terms and conditions. It is essential to carefully review each provider’s policy documents to understand the scope of their coverage and any limitations. Consider factors such as the destination, duration of the trip, pre-existing conditions, and budget when choosing travel insurance.

It is also crucial to assess customer reviews and consider factors such as claim processing speed, customer service, and policy flexibility.

6. Tips for Filing a Claim

Filing a travel insurance claim, especially one related to COVID-19, can seem daunting. However, understanding the process and gathering the necessary documentation can make the process smoother. This section will guide you through the steps involved in filing a COVID-19 claim and provide tips for successful communication with your insurance company.

A. Detailed Steps for Filing a COVID-19 Claim

Filing a claim online is often the most convenient method. Here’s a step-by-step guide:

1. Locate the Claim Form

Visit your insurance company’s website and navigate to the “Claims” or “Contact Us” section. You should find a link to file a claim online.

Searching for a 3-bedroom apartment that meets your needs and budget can be challenging, but it doesn’t have to be overwhelming. Our guide on 3 Bedroom Apartments For Rent Near Me 2024: Finding Your Perfect Home provides valuable information and resources to help you find the perfect home near you, making the search process easier and more efficient.

2. Fill Out the Claim Form

Finding the perfect apartment can be a journey, but with the right resources and guidance, it can be a smooth process. Our guide on 2 Bedroom Apartments For Rent Brooklyn 2024: Your Guide to Finding the Perfect Home provides valuable insights and tips for navigating the rental market in Brooklyn, helping you find the ideal two-bedroom apartment for your needs.

Complete the necessary information, including your policy details, the nature of your claim, and the dates involved. Ensure you provide accurate and complete information.

3. Upload Supporting Documents

Upload the required documentation, such as medical records, bills, and proof of income, to support your claim.

4. Submit Your Claim

Once you’ve completed the form and uploaded the documents, submit your claim electronically.

5. Receive Confirmation

You should receive an email or notification confirming the receipt of your claim. Here’s a table summarizing the key steps and their estimated timeframes:| Step | Description | Estimated Timeframe ||—|—|—|| Locate the Claim Form | Find the claim form on the insurance company’s website.

| 5-10 minutes || Fill Out the Claim Form | Complete the necessary information and details. | 15-30 minutes || Upload Supporting Documents | Upload the required documentation to support your claim. | 5-15 minutes || Submit Your Claim | Submit your completed claim electronically.

| 1-2 minutes || Receive Confirmation | Receive an email or notification confirming receipt. | Within 24 hours |

B. Required Documentation for a Successful Claim

To ensure a smooth claim process, it’s crucial to gather all necessary documentation before submitting your claim. These documents provide evidence to support your claim and expedite the review process. Here’s a list of essential documents:* Medical Records:This includes any doctor’s notes, test results, and medical bills related to your COVID-19 diagnosis.

These documents demonstrate the medical necessity of your claim.

Bills

Keep all receipts and bills related to your COVID-19 related expenses, such as medical bills, quarantine costs, or flight changes.

Proof of Income

This may be required to support claims for lost wages due to COVID-19 related issues.

Travel Itinerary

This includes your flight confirmations, hotel bookings, and any other travel documents.Here’s a checklist to ensure you have gathered all the necessary documentation:* [ ] Medical Records

- [ ] Bills (Medical, Quarantine, Flight Changes, etc.)

- [ ] Proof of Income (if applicable)

- [ ] Travel Itinerary

C. Effective Communication with the Insurer

Clear and concise communication is crucial when dealing with your insurance company. Here are some tips for effective communication:* Maintain a Professional Tone:Be respectful and polite in all your interactions.

Be Clear and Concise

Clearly state your claim and provide all relevant information.

Keep Detailed Records

Maintain records of all communication with the insurer, including dates, times, and the content of each interaction.Here’s a sample email you can use to initiate a claim with your insurance company:

Subject: Travel Insurance Claim[Your Name]

Policy Number

[Your Policy Number]

Dear [Insurance Company Name],This email is to initiate a travel insurance claim for COVID-19 related expenses. I am writing to request coverage for [briefly describe the nature of your claim, e.g., medical expenses, lost wages, etc.].I have attached the following documents to support my claim:* [List of attached documents, e.g., medical records, bills, proof of income, travel itinerary]Please contact me at [your phone number] or [your email address] if you require any further information.Sincerely,[Your Name]

D. Additional Considerations

Understanding the specific terms and conditions of your insurance policy related to COVID-19 claims is crucial. Here are some important considerations:* Types of COVID-19 Related Claims:Travel insurance policies may cover various COVID-19 related expenses, including:

Medical Expenses

Coverage for medical treatment, hospitalization, and related costs due to COVID-19.

Finding a spacious and comfortable apartment can be a challenge, especially in bustling cities like Brooklyn. Luckily, there are many options available, and finding the perfect home is just a click away. Check out our guide on 3 Bedroom Apartments For Rent Brooklyn 2024: Your Guide to Finding the Perfect Home for insights and tips on navigating the rental market.

Lost Wages

Compensation for lost income if you are unable to work due to COVID-19 related illness or quarantine requirements.

Business Interruption

Coverage for business losses due to COVID-19 related travel disruptions or restrictions.

Policy Terms and Conditions

Thoroughly review your policy’s terms and conditions related to COVID-19 claims. Pay attention to coverage limits, exclusions, and any specific requirements for filing a claim.

8. Travel Insurance for Specific Needs

Travel insurance can be customized to fit your unique travel needs, ensuring you have the right coverage for your specific situation. This section delves into travel insurance options tailored for different types of travelers.

Whether you’re looking for a cozy one-bedroom or a spacious family apartment, finding the right place can be a daunting task. Our guide on Apartments For Rent 33186 2024: Your Guide to Finding the Perfect Place provides valuable information and resources to help you find your ideal home in zip code 33186.

Solo Travelers

Traveling solo offers incredible freedom and independence, but it also comes with unique considerations. Travel insurance specifically designed for solo travelers can provide crucial peace of mind and protection during your journey.

- Medical Emergencies:Solo travelers should prioritize medical coverage, as they may not have immediate support in case of an emergency. Look for plans that offer extensive medical coverage, including emergency medical evacuation and repatriation.

- Lost or Stolen Luggage:When traveling solo, you are responsible for your belongings. Travel insurance can cover the costs of replacing lost or stolen luggage, minimizing the financial burden of such incidents.

- Trip Cancellation or Interruption:Solo travelers often book flights and accommodations independently. Travel insurance can protect you against financial losses due to unexpected trip cancellations or interruptions, such as illness, weather emergencies, or travel advisories.

- Personal Liability:Solo travelers may be more susceptible to personal liability claims. Insurance plans with personal liability coverage can protect you from financial losses due to accidental damage or injury to others.

- Emergency Evacuation:Solo travelers should consider insurance plans that include emergency evacuation coverage, especially when venturing into remote areas. This coverage ensures you can be safely transported to a medical facility in case of a serious medical emergency.

Considerations:

- 24/7 Emergency Support and Travel Assistance:Look for insurance plans that offer 24/7 emergency support and travel assistance, providing you with guidance and assistance in case of unexpected situations.

- Coverage for Solo Activities or Adventure Sports:If you plan to engage in solo activities or adventure sports, ensure your travel insurance covers these activities. Some plans may offer additional coverage for specific activities, such as hiking, skiing, or scuba diving.

- Travel Destination and Budget:Consider the specific needs of your travel destination and your budget when choosing travel insurance. For example, if you are traveling to a remote area with limited medical facilities, you may need a plan with higher medical coverage and emergency evacuation benefits.

Conversely, if you are traveling to a well-developed area with easy access to medical care, you may be able to opt for a more basic plan.

Families

Traveling with family is an exciting experience, but it also requires careful planning and adequate insurance protection. Family travel insurance plans are designed to cater to the specific needs of families, providing comprehensive coverage for everyone in the group.

- Coverage for Children:Children are particularly vulnerable during travel, so it is crucial to have travel insurance that covers their medical emergencies, lost or stolen luggage, and other potential incidents. Look for plans that offer separate coverage for children, with specific benefits tailored to their needs.

- Family-Specific Benefits:Family travel insurance plans often include family-specific benefits, such as child care services, lost luggage coverage for children, and travel assistance for families. These benefits can make a significant difference in managing travel challenges with children.

- Multi-Trip Options:If your family travels frequently, consider multi-trip travel insurance plans that offer coverage for multiple trips within a specific period. This can be a cost-effective option for families who travel often.

Considerations:

- Coverage for Medical Emergencies:Prioritize travel insurance plans that offer extensive medical coverage for children, especially for medical emergencies and hospital stays. This coverage can provide financial protection in case of unexpected medical expenses.

- Family-Friendly Activities and Excursions:Consider travel insurance plans that offer coverage for family-friendly activities and excursions, such as theme parks, water parks, and adventure activities. Some plans may offer specific coverage for these activities, providing peace of mind for families.

- Managing Travel Insurance for Multiple Children:When traveling with multiple children, ensure your travel insurance plan covers all children under the same policy. This simplifies the claims process and ensures that all children are protected.

Adventure Travelers, Best Travel Insurance With Covid Coverage 2024

Adventure travelers often seek experiences that push their limits and explore the world in unique ways. Travel insurance specifically designed for adventure travelers is essential to protect against the inherent risks associated with such activities.

- Coverage for Extreme Sports and Activities:Adventure travel insurance plans should offer coverage for a wide range of extreme sports and activities, including hiking, skiing, scuba diving, rock climbing, and more. Ensure the plan covers the specific activities you plan to participate in.

- Emergency Medical Evacuation for Remote Locations:Adventure travelers often venture into remote locations with limited medical facilities. Travel insurance should include emergency medical evacuation coverage, ensuring you can be transported to a suitable medical facility in case of a serious medical emergency.

- Trip Cancellation Due to Unforeseen Circumstances:Adventure travel plans can be complex and expensive. Travel insurance can protect you against financial losses due to trip cancellation or interruption caused by unforeseen circumstances, such as weather emergencies, natural disasters, or political instability.

- Gear Damage or Loss:Adventure travelers often rely on specialized gear for their activities. Travel insurance should offer coverage for gear damage or loss, protecting you from financial losses in case of accidents or theft.

- Personal Liability:Adventure travelers may be at higher risk of personal liability claims, especially when engaging in activities with inherent risks. Travel insurance with personal liability coverage can protect you from financial losses due to accidental damage or injury to others.

Planning for retirement is crucial, and understanding your financial options is essential. An annuity can be a valuable tool in ensuring a steady stream of income during your golden years. Explore our guide on Annuity Estimator 2024: Planning Your Retirement Income to learn more about how annuities can contribute to your retirement security.

Considerations:

- Specific Activities and Sports Covered:Review the specific activities and sports covered by different insurance plans. Ensure the plan covers the activities you plan to participate in, including any extreme sports or activities.

- Potential Risks Associated with Adventure Travel:Understand the potential risks associated with adventure travel and ensure your insurance plan provides adequate coverage for these risks. Consider factors such as the location, activities, and potential medical emergencies.

- Meeting Specific Needs of Adventure Travelers:Choose insurance plans that meet the specific needs of adventure travelers, offering comprehensive coverage for extreme sports, emergency medical evacuation, trip cancellation, gear damage, and personal liability.

Senior Citizens

Senior citizens often have unique travel needs and considerations. Travel insurance specifically designed for senior citizens can provide essential protection and support during their journeys.

- Pre-Existing Medical Conditions:Senior citizens may have pre-existing medical conditions that require special attention. Travel insurance plans should offer coverage for pre-existing medical conditions, ensuring you are protected in case of medical emergencies related to these conditions.

- Coverage for Medical Emergencies and Hospital Stays:Senior citizens are more susceptible to medical emergencies. Travel insurance should offer comprehensive coverage for medical emergencies, including hospital stays, medical treatments, and emergency medical evacuation.

- Trip Cancellation Due to Health Issues:Senior citizens may need to cancel their trips due to unexpected health issues. Travel insurance should cover trip cancellation due to health reasons, protecting you from financial losses.

- Medical Evacuation and Repatriation:Senior citizens may require medical evacuation or repatriation in case of serious medical emergencies. Travel insurance plans should offer these services, ensuring you can be safely transported to a suitable medical facility or returned to your home country.

- Special Needs Accommodations:Senior citizens may have special needs, such as mobility issues or dietary restrictions. Travel insurance plans should offer coverage for special needs accommodations, ensuring you can access the necessary support and services during your travels.

Considerations:

- Insurance Plans that Cater to Specific Health Needs:Research insurance plans that cater to the specific health needs of senior citizens, offering comprehensive coverage for pre-existing medical conditions, medical emergencies, and medical evacuation.

- Importance of Pre-Existing Condition Coverage and Medical Evacuation Options:Prioritize insurance plans that offer pre-existing condition coverage and robust medical evacuation options, providing crucial protection for senior travelers.

- Additional Support for Senior Travelers:Choose insurance plans that offer additional support for senior travelers, such as assistance with travel arrangements, medical assistance, and emergency contact services.

The Future of Travel Insurance with COVID-19: Best Travel Insurance With Covid Coverage 2024

The COVID-19 pandemic has significantly impacted the travel industry, leading to widespread travel restrictions and uncertainty. As the world navigates the post-pandemic era, travel insurance is evolving to meet the changing needs of travelers. It’s crucial to understand how COVID-19 will continue to shape the future of travel insurance.

Impact of Evolving Health Regulations and Travel Restrictions

The ongoing pandemic has highlighted the importance of flexibility and adaptability in travel insurance. Travel restrictions and health regulations can change rapidly, and travelers need coverage that can adjust to these dynamic situations. Here’s how evolving health regulations and travel restrictions will impact travel insurance:

- Increased Coverage for COVID-19-Related Issues:Travel insurance policies are increasingly including coverage for COVID-19-related expenses, such as medical treatment, quarantine costs, and trip cancellation due to positive test results. This trend is likely to continue as new variants emerge and health concerns persist.

- Dynamic Coverage Options:Travel insurance providers are introducing more flexible policies that allow travelers to adjust their coverage based on the evolving situation. For instance, some policies offer coverage for trip cancellation due to government-imposed travel restrictions, while others provide medical evacuation coverage in case of COVID-19 infection.

- Real-Time Information and Updates:Travel insurance companies are leveraging technology to provide travelers with real-time information about travel restrictions, health regulations, and COVID-19-related risks. This allows travelers to make informed decisions and adjust their plans accordingly.

Resources and Further Information

This section provides links to additional resources that can help you learn more about travel insurance and COVID-19 coverage. You can find information about government resources, travel insurance associations, and consumer protection agencies.

Government Resources

Government agencies provide valuable information and guidance for travelers, including information on travel insurance.

- U.S. Department of State:The U.S. Department of State’s website offers travel advisories, safety tips, and information on consular services.

- Centers for Disease Control and Prevention (CDC):The CDC provides travel recommendations, health advisories, and vaccination information.

- World Health Organization (WHO):The WHO offers global health information, including travel advisories and disease outbreaks.

Travel Insurance Associations

Travel insurance associations can provide information about the industry, best practices, and consumer protection.

- National Association of Insurance Commissioners (NAIC):The NAIC is a non-profit organization that regulates insurance companies in the United States. They provide consumer information and resources on insurance products, including travel insurance.

- Travel Insurance Services Association (TISA):TISA is a trade association for travel insurance companies. They offer information on travel insurance products, consumer rights, and industry best practices.

Consumer Protection Agencies

Consumer protection agencies help consumers with complaints and disputes related to insurance products.

- Better Business Bureau (BBB):The BBB provides information on businesses, including travel insurance companies. They also offer dispute resolution services.

- National Consumer Law Center (NCLC):The NCLC is a non-profit organization that advocates for consumer rights. They provide information on insurance issues and consumer protection laws.

Final Conclusion

In today’s world, travel insurance with COVID-19 coverage is not just a luxury, it’s a necessity. With a well-informed approach and a carefully chosen policy, you can safeguard yourself and your loved ones against unforeseen circumstances. Remember, a little preparation goes a long way in ensuring a smooth and worry-free travel experience.

Don’t let unexpected events derail your travel plans. Invest in the right travel insurance with COVID-19 coverage and embrace the adventure with confidence.

Top FAQs

What are the common exclusions in travel insurance policies related to COVID-19?

Common exclusions may include pre-existing conditions related to COVID-19, travel to high-risk areas designated by government advisories, and claims arising from travel restrictions imposed after the policy purchase date.

What are the key steps involved in filing a COVID-19 claim with travel insurance?

Key steps usually involve contacting your insurer, providing necessary documentation such as medical records and proof of expenses, and completing a claim form. It’s important to follow your insurer’s specific instructions and timelines for filing claims.

How can I choose the right travel insurance plan for my specific needs?

Consider your destination, travel duration, age, health conditions, budget, and any specific activities you plan to engage in. Compare coverage options, read policy terms and conditions carefully, and consider seeking advice from a travel insurance specialist.