Calculate Annuity Due Present Value 2024: A Guide delves into the world of financial planning, exploring the concept of an annuity due and its present value. This guide provides a comprehensive understanding of how to calculate the present value of an annuity due, taking into account factors like interest rates, payment periods, and the amount of each payment.

Whether an annuity is a good investment for you in 2024 depends on your individual circumstances and financial goals. Consider factors such as your risk tolerance, investment timeline, and potential tax implications. Explore resources on whether annuities are a good investment in 2024.

Understanding annuity due present value is crucial for individuals and businesses making financial decisions. Whether you’re planning for retirement, investing in real estate, or simply managing your savings, knowing how to calculate the present value of future payments can help you make informed choices that maximize your financial well-being.

A reversionary annuity is a type of annuity where the payments continue to a designated beneficiary after the original annuitant’s death. To learn more about this type of annuity, explore resources on reversionary annuities in 2024.

Contents List

Understanding Annuity Due: Calculate Annuity Due Present Value 2024

An annuity due is a series of equal payments made at the beginning of each period. This differs from an ordinary annuity, where payments are made at the end of each period. Annuity due calculations are commonly used in financial planning, especially when dealing with investments or loans that involve regular payments at the start of a period.

If you’re wondering how much annuity income you could receive with a $100,000 investment in 2024, it’s essential to consider the annuity type and interest rate. To get an idea of your potential income, explore resources on annuity income for a $100,000 investment in 2024.

Characteristics of an Annuity Due

- Equal Payments:Each payment in an annuity due is the same amount.

- Regular Intervals:Payments are made at regular intervals, such as monthly, quarterly, or annually.

- Beginning of Period:The key characteristic of an annuity due is that payments are made at the beginning of each period.

Difference Between Annuity Due and Ordinary Annuity

The main difference between an annuity due and an ordinary annuity lies in the timing of payments. In an annuity due, payments are made at the beginning of each period, while in an ordinary annuity, payments are made at the end of each period.

Annuity payments often involve compound interest, meaning that interest is earned not only on the principal but also on accumulated interest. To learn more about how compound interest works in annuities, explore resources on compound interest in annuities in 2024.

This difference in timing has a significant impact on the present value and future value of the annuity. Due to the earlier payment, the present value of an annuity due is always higher than the present value of an ordinary annuity with the same payment amount, interest rate, and number of periods.

If you’re using Microsoft Excel for financial calculations, you can use its built-in functions to calculate annuity due payments. This can be helpful for planning your financial future. To learn more, explore resources on calculating annuity due in Excel in 2024.

Real-World Examples of Annuity Due

- Rent Payments:Most rental agreements require tenants to pay rent at the beginning of each month, making it an example of an annuity due.

- Insurance Premiums:Insurance premiums are typically paid at the beginning of the policy period, making them an annuity due.

- Loan Payments:Some loans, such as mortgages, require payments to be made at the beginning of each month, making them an annuity due.

Present Value Calculation

The present value (PV) of an annuity due is the current value of a series of future payments, taking into account the time value of money. It represents the amount of money you would need to invest today to receive the same stream of future payments.

An annuity is essentially a stream of regular payments that you receive over a specified period. These payments can be fixed or variable, depending on the type of annuity. To learn more about annuities, check out resources on annuities as a stream of payments in 2024.

Importance of Present Value in Financial Planning

Understanding present value is crucial in financial planning because it allows individuals and businesses to compare different investment options and make informed decisions. By calculating the present value of future cash flows, you can determine which investments offer the highest return on investment.

While both annuities and life insurance involve financial planning, they serve different purposes. Annuities provide a stream of income, while life insurance provides a death benefit to beneficiaries. To understand the differences, explore resources on annuities vs. life insurance in 2024.

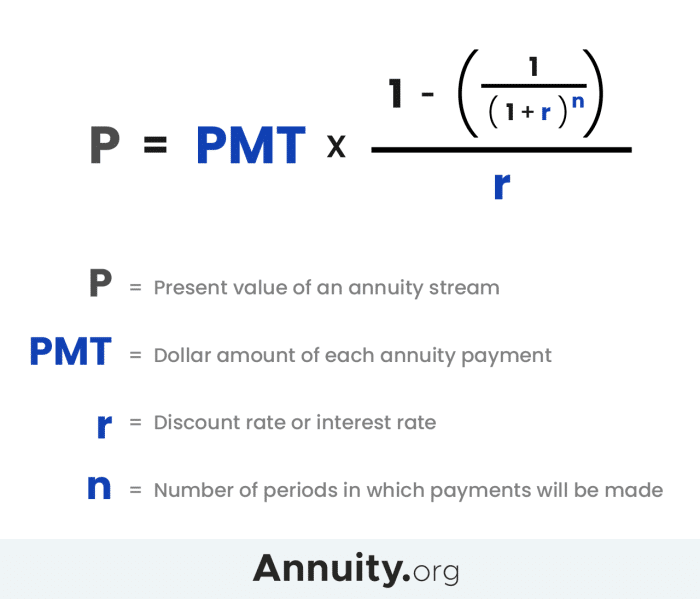

Formula for Calculating Present Value of Annuity Due

PV = PMT

- [(1

- (1 + r)^-n) / r]

- (1 + r)

Where:

- PV = Present Value

- PMT = Payment Amount

- r = Interest Rate per Period

- n = Number of Periods

Step-by-Step Guide to Calculate Present Value of Annuity Due

- Identify the Payment Amount (PMT):Determine the amount of each payment in the annuity due.

- Determine the Interest Rate (r):Find the interest rate per period, usually expressed as an annual percentage rate (APR), which needs to be converted to a periodic rate.

- Calculate the Number of Periods (n):Determine the total number of periods over which payments will be made.

- Apply the Formula:Plug the values of PMT, r, and n into the formula to calculate the present value.

Factors Affecting Annuity Due Present Value

Several factors influence the present value of an annuity due, including the interest rate, the number of periods, and the payment amount.

The current annuity rate in 2024 is influenced by a variety of factors, including the overall economic climate and interest rates. To stay informed, you can check out the latest information on annuity rates in 2024 and compare different options available.

Impact of Interest Rates

The interest rate plays a significant role in determining the present value of an annuity due. As the interest rate increases, the present value decreases. This is because a higher interest rate means that future payments are discounted more heavily, resulting in a lower present value.

Bankrate’s annuity calculator can be a helpful tool for exploring different annuity scenarios. This calculator can help you understand how different factors, such as your investment amount and desired payout period, affect your potential returns. To find out more, check out Bankrate’s annuity calculator in 2024.

Effect of Number of Periods

The number of periods also affects the present value of an annuity due. As the number of periods increases, the present value increases. This is because a longer period allows for more compounding of interest, resulting in a higher present value.

Relationship Between Payment Amount and Present Value

The present value of an annuity due is directly proportional to the payment amount. As the payment amount increases, the present value also increases. This is because a higher payment amount translates to a larger stream of future cash flows, resulting in a higher present value.

To determine the required annuity payment over 12 years in 2024, you’ll need to factor in the desired future value and interest rate. This calculation can help you plan for long-term financial goals. Learn more about annuity payments over 12 years in 2024.

Practical Applications of Annuity Due Present Value

Annuity due present value calculations have numerous applications in financial decision-making, including real estate investments, retirement planning, and other financial planning scenarios.

An annuity calculator that takes age into account can help you tailor your annuity options to your specific needs. This type of calculator can provide insights into how age affects annuity rates and potential returns. Explore annuity calculators that factor in age in 2024.

Financial Decision-Making

- Investment Analysis:Present value calculations can help investors compare different investment options and choose the one that offers the highest return on investment.

- Loan Evaluation:Present value analysis can be used to evaluate the cost of borrowing money, helping borrowers make informed decisions about taking out loans.

- Savings Planning:Present value calculations can help individuals determine how much they need to save today to reach their financial goals in the future.

Real Estate Investments, Calculate Annuity Due Present Value 2024

Annuity due present value calculations are particularly relevant in real estate investments. When evaluating a rental property, investors can use present value analysis to determine the current value of the future rental income stream. This helps them make informed decisions about purchasing or selling properties.

Whether an annuity is guaranteed in 2024 depends on the specific type of annuity you choose. Some annuities offer guaranteed income payments, while others may have variable returns. To learn more about guaranteed annuities, check out resources on guaranteed annuities in 2024.

Retirement Planning

Annuity due present value calculations are essential in retirement planning. Individuals can use these calculations to determine the present value of their future retirement income, allowing them to make informed decisions about saving, investing, and spending during their working years.

A 4% annuity in 2024 could be a good option for those seeking a steady stream of income. However, it’s crucial to compare different annuity options and consider your individual financial needs before making a decision. Learn more about annuities with a 4% return in 2024 to see if it aligns with your goals.

Tools and Resources for Calculating Annuity Due Present Value

Several online calculators and financial software programs are available to calculate the present value of an annuity due. These tools can save time and effort by automating the calculation process.

An annuity contract is a legally binding agreement between you and the annuity provider. It outlines the terms of your annuity, including the payment schedule and any guarantees. For more information on annuity contracts, check out resources on annuity contracts in 2024.

Online Calculators

- Financial Calculators:Many websites offer free online financial calculators that can calculate the present value of an annuity due. These calculators typically require users to input the payment amount, interest rate, and number of periods.

- Spreadsheet Software:Spreadsheet programs like Microsoft Excel and Google Sheets have built-in functions for calculating present value, including the PV function for annuities due.

Financial Software

- Personal Finance Software:Personal finance software programs, such as Quicken and Mint, can also calculate the present value of an annuity due. These programs often provide more comprehensive financial planning tools, including budgeting, investment tracking, and retirement planning.

- Accounting Software:Accounting software programs, such as QuickBooks and Xero, may also include features for calculating present value. These programs are typically used by businesses to manage their finances.

Benefits and Limitations of Using Tools

Using online calculators and financial software can be beneficial for calculating the present value of an annuity due. These tools can save time, reduce errors, and provide quick and easy calculations. However, it’s important to note that these tools may have limitations.

They may not be able to handle complex scenarios or provide detailed financial analysis.

Selecting the Appropriate Tool

When selecting a tool for calculating the present value of an annuity due, consider your specific financial needs and the complexity of the calculation. For simple calculations, online calculators or spreadsheet software may be sufficient. However, for more complex scenarios, financial software programs may be more appropriate.

Closure

In conclusion, calculating the present value of an annuity due is an essential skill for anyone involved in financial planning. By understanding the factors that influence present value and utilizing available tools and resources, individuals and businesses can make informed financial decisions that optimize their returns and achieve their financial goals.

Whether you’re planning for retirement, investing in real estate, or simply managing your savings, understanding annuity due present value can empower you to make the most of your financial resources.

Popular Questions

What is the difference between an annuity due and an ordinary annuity?

If you’re looking to figure out how much interest you might earn on your annuity in 2024, you’ll need to learn how to calculate the annuity interest rate. This involves understanding the factors that influence interest rates, such as current market conditions and the type of annuity you have.

An annuity due is a series of payments made at the beginning of each period, while an ordinary annuity has payments made at the end of each period.

How does interest rate affect the present value of an annuity due?

Higher interest rates generally result in a lower present value, as the future payments are discounted at a higher rate.

What are some online calculators that can be used to calculate annuity due present value?

Several online calculators are available, including those offered by financial websites, banks, and investment firms. These calculators can provide quick and accurate present value calculations based on your specific input.