Calculate Annuity Hp12c 2024: A Guide for Financial Professionals, this guide dives into the world of annuities, providing a comprehensive overview of their intricacies and practical applications. We will explore the different types of annuities, their key features, and how to calculate their values using the powerful HP-12C calculator.

This guide is designed for financial professionals, students, and anyone seeking to master the art of annuity calculations.

From understanding the fundamentals of annuities to mastering advanced calculations, this guide covers everything you need to know. We will delve into real-world applications of annuity calculations, including retirement planning, loan amortization, and investment analysis. Whether you are a seasoned financial expert or just starting your journey, this guide will equip you with the knowledge and skills to confidently navigate the complex world of annuities.

Contents List

Understanding Annuities

An annuity is a series of equal payments made over a specified period of time. They are often used for retirement planning, loan amortization, and savings goals. Annuities can be categorized into different types based on the timing and frequency of payments.

Types of Annuities

- Ordinary Annuity:Payments are made at the end of each period. This is the most common type of annuity.

- Annuity Due:Payments are made at the beginning of each period. This type of annuity is often used for rent or lease payments.

- Deferred Annuity:Payments are delayed for a specific period of time before they begin. This type of annuity is often used for retirement planning.

Key Features of Annuities

- Payment Frequency:The frequency of payments can be monthly, quarterly, annually, or any other specified period.

- Interest Rate:The interest rate determines the amount of interest earned or paid on the annuity.

- Term:The term of an annuity is the length of time over which payments are made.

Examples of Annuities

- Retirement Annuities:These annuities provide a steady stream of income during retirement.

- Loan Amortization:Loan payments are often structured as annuities, with equal payments made over a specified period.

- Savings Goals:Annuities can be used to save for specific goals, such as a down payment on a house or a child’s education.

The HP-12C Calculator

The HP-12C calculator is a popular financial calculator that is widely used by professionals and students. It is designed to perform a variety of financial calculations, including annuity calculations.

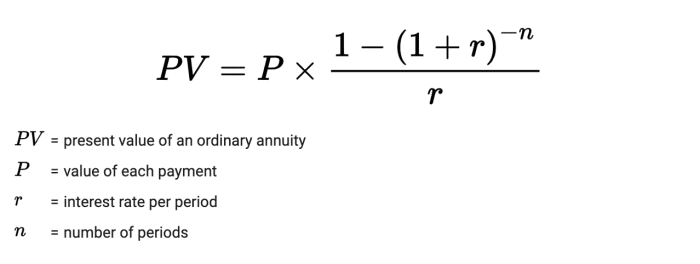

Understanding how to calculate the present value of an annuity is essential for making informed financial decisions. You can find examples of how to calculate PV annuity to better understand this concept.

Basic Functions and Keys

- PV (Present Value):This key is used to enter the present value of an annuity.

- FV (Future Value):This key is used to enter the future value of an annuity.

- PMT (Payment):This key is used to enter the amount of each payment.

- I (Interest Rate):This key is used to enter the interest rate per period.

- N (Number of Periods):This key is used to enter the total number of periods.

Inputting Data and Performing Calculations

To perform annuity calculations on the HP-12C, you need to input the relevant data into the calculator. For example, to calculate the present value of an annuity, you would need to enter the payment amount (PMT), the interest rate (I), and the number of periods (N).

Annuity interest rates can vary, and you might be interested in a 4 percent annuity. To figure out how much you need to invest to receive a specific monthly income, you can use a calculator to determine how much annuity for 100,000 dollars.

Then, you would press the PV key to display the present value.

Annuity payments are typically structured to provide a regular stream of income, and it’s important to understand that an annuity is a payment that you receive. While annuities are not life insurance policies, it’s good to know that an annuity is not a life insurance policy.

Calculating Annuity Values on the HP-12C: Calculate Annuity Hp12c 2024

The HP-12C calculator can be used to calculate the present value (PV), future value (FV), and payment amount (PMT) of an annuity.

If you’re planning to use Excel for your financial calculations, you can learn how to calculate annuity payments in Excel. You can also find helpful tools like the Bankrate annuity calculator to compare different options.

Calculating Present Value (PV)

To calculate the present value of an annuity, you need to input the payment amount (PMT), the interest rate (I), and the number of periods (N). Then, press the PV key to display the present value.

Calculating Future Value (FV)

To calculate the future value of an annuity, you need to input the payment amount (PMT), the interest rate (I), and the number of periods (N). Then, press the FV key to display the future value.

Calculating Annuity Payments (PMT)

To calculate the payment amount of an annuity, you need to input the present value (PV), the interest rate (I), and the number of periods (N). Then, press the PMT key to display the payment amount.

Annuity contracts can offer a variety of benefits, and they can be particularly relevant to those in the healthcare field. You might be interested in exploring annuity health careers if you’re looking for a career that offers financial security.

Advanced Annuity Calculations

The HP-12C calculator can also be used to perform more advanced annuity calculations, such as annuities with varying payment frequencies, different interest rate periods, and varying payment amounts.

If you’re looking to withdraw from your retirement savings, you might consider a 72t annuity. This type of annuity allows you to withdraw funds from your retirement account without incurring a penalty.

Varying Payment Frequencies

To calculate an annuity with a different payment frequency, you need to adjust the interest rate and the number of periods accordingly. For example, if you are calculating a monthly annuity, you would need to use the monthly interest rate and the number of months in the term.

Different Interest Rate Periods

To calculate an annuity with different interest rate periods, you need to adjust the interest rate and the number of periods accordingly. For example, if you are calculating an annuity with an annual interest rate but monthly payments, you would need to use the monthly interest rate and the number of months in the term.

The legal aspects of annuities can be complex, particularly when dealing with bankruptcy. Chapter 9 annuities are an example of this complexity. It’s important to understand how annuities work, including the role of compound interest , to make informed financial decisions.

Varying Payment Amounts

The HP-12C calculator can handle annuities with varying payment amounts, but it requires a more complex approach. You would need to calculate the present value of each individual payment and then sum those present values to obtain the total present value of the annuity.

Annuity contracts can offer a guaranteed stream of income for a specific period, like a 20-year certain annuity , or for your lifetime. Understanding the different types of annuities, like term annuities , can help you choose the right one for your needs.

Real-World Applications of Annuity Calculations

Annuity calculations are used in a variety of real-world applications, including personal finance, business finance, and insurance.

When considering an annuity, it’s natural to wonder how much income you could receive. You might be interested in a 2 million dollar annuity , or maybe you want to calculate the potential payments from a smaller lump sum.

There are resources available to help you with this, like the annuity payment calculator.

Personal Finance

- Retirement Planning:Annuities are commonly used to estimate future retirement income and plan for financial security during retirement.

- Loan Amortization:Annuity calculations are used to determine the monthly payments on loans, such as mortgages, car loans, and student loans.

- Savings Goals:Annuities can be used to calculate how much needs to be saved each month to reach a specific savings goal.

Business Finance

- Loan Repayment Schedules:Annuities are used to calculate loan repayment schedules, ensuring that payments are made on time and the loan is repaid within the agreed-upon timeframe.

- Investment Analysis:Annuities are used to evaluate the profitability of investments, such as bonds and other fixed-income securities.

Insurance

- Insurance Premiums:Annuities are used to calculate insurance premiums, ensuring that the premiums are sufficient to cover the expected claims.

- Insurance Benefits:Annuities are used to calculate insurance benefits, such as life insurance payouts and annuity payments.

Common Mistakes and Tips

While the HP-12C calculator is a powerful tool for annuity calculations, there are some common mistakes that users may make. Here are some tips and best practices to ensure accurate results.

Common Mistakes

- Incorrect Inputting of Data:Make sure you are entering the correct data, including the payment amount, interest rate, number of periods, and other relevant information.

- Incorrectly Setting the Payment Frequency:Ensure that the payment frequency is set correctly, whether it’s monthly, quarterly, or annually.

- Incorrectly Setting the Interest Rate Period:Make sure that the interest rate period matches the payment frequency.

Tips and Best Practices, Calculate Annuity Hp12c 2024

- Double-Check Your Input:Always double-check the data you have entered to ensure accuracy.

- Use a Spreadsheet:You can use a spreadsheet to organize your data and calculations, making it easier to identify and correct any errors.

- Seek Professional Advice:If you are unsure about how to perform annuity calculations or have complex financial needs, it’s always a good idea to seek professional financial advice.

Last Recap

By understanding the intricacies of annuities and mastering the HP-12C calculator, you will be well-equipped to make informed financial decisions. Whether you are managing your own finances, advising clients, or conducting business analysis, this guide will serve as a valuable resource for your financial endeavors.

So, let’s embark on this journey to unravel the world of annuities and harness the power of the HP-12C to make sound financial choices.

FAQ Summary

What is the difference between an ordinary annuity and an annuity due?

An ordinary annuity has payments made at the end of each period, while an annuity due has payments made at the beginning of each period.

How do I change the payment frequency on the HP-12C?

The HP-12C assumes annual payments by default. To change the payment frequency, you need to adjust the number of periods (N) and the interest rate (I) accordingly. For example, for monthly payments, you would divide N by 12 and I by 12.

What are some common mistakes made when using the HP-12C for annuity calculations?

Common mistakes include entering the wrong payment frequency, using the wrong interest rate, and forgetting to clear the calculator memory before starting a new calculation.