Calculate Annuity LIC 2024 offers a comprehensive guide to understanding and utilizing annuities from Life Insurance Corporation of India (LIC) for your financial planning. Annuities are a valuable tool for securing a steady income stream during retirement, protecting against financial uncertainties, and ensuring a legacy for your loved ones.

Annuity payments are often considered a reliable source of income. Is Annuity Fixed Income 2024 examines whether annuities are classified as fixed income investments and the implications for retirement planning.

This guide delves into the intricacies of LIC annuity products, exploring their features, benefits, and how to calculate your potential annuity payments.

For those who speak Hindi, understanding the nuances of annuity in their native language can be beneficial. Annuity Meaning In Hindi 2024 provides a clear definition of annuity in Hindi, making it easier for Hindi speakers to grasp this financial concept.

Whether you’re seeking to supplement your retirement income, protect your loved ones from financial hardship, or simply invest wisely, LIC annuities can provide the financial security and peace of mind you desire. This guide will equip you with the knowledge and tools necessary to make informed decisions about incorporating annuities into your financial plan.

Contents List

Understanding Annuities

Annuities are financial products that provide a stream of regular payments for a specified period of time. They are often used as part of retirement planning, but can also be utilized for other purposes such as income protection or estate planning.

Annuity bonds are a type of investment that involves a series of payments over time. Formula Annuity Bond 2024 explains the formula used to calculate the value of these bonds, providing insights into their financial structure.

Annuities work by converting a lump sum of money into a series of guaranteed payments, providing a steady income stream for the annuitant.

Annuity certain is a type of annuity where payments are guaranteed for a specific period. Formula Annuity Certain 2024 explains the formula used to calculate the present value of an annuity certain, which can be helpful for evaluating its financial value.

Types of Annuities

There are various types of annuities available, each with its own characteristics and benefits. Some common types include:

- Fixed Annuities:These offer a guaranteed interest rate for a set period, providing predictable income payments. The interest rate is typically fixed at the time of purchase and remains unchanged throughout the term.

- Variable Annuities:These link the annuity payments to the performance of underlying investments, such as mutual funds or stocks. While they offer the potential for higher returns, they also carry greater investment risk.

- Indexed Annuities:These offer a minimum guaranteed return based on the performance of a specific index, such as the S&P 500. They aim to provide growth potential while mitigating some of the downside risk associated with variable annuities.

Examples of Annuity Applications

Annuities can be used in a variety of financial planning scenarios. Here are some examples:

- Retirement Income:Annuities can provide a reliable source of income during retirement, supplementing other retirement savings.

- Income Protection:Annuities can help protect against income loss due to disability or unemployment, providing a safety net in challenging times.

- Estate Planning:Annuities can be used to create a stream of income for beneficiaries after death, ensuring their financial security.

LIC Annuity Products

LIC (Life Insurance Corporation of India) offers a range of annuity products designed to cater to diverse financial needs. These products provide guaranteed income streams, offering financial security and peace of mind. Here are some of the key LIC annuity products available in 2024:

LIC Annuity Products Overview

- LIC Jeevan Akshay VI:This is a single premium immediate annuity plan that offers a guaranteed income stream for life. It allows for flexible payout options, including monthly, quarterly, half-yearly, or yearly payments. The plan provides a minimum guaranteed return, ensuring a steady income stream for the annuitant.

Before investing in an annuity, it’s essential to consider its safety and reliability. Is Annuity Safe 2024 addresses the safety of annuities, exploring the risks and factors that contribute to their stability.

- LIC Jeevan Akshay VII:This is another immediate annuity plan that offers a guaranteed income stream for life, with the option to choose between a single premium or regular premium payment. It provides a guaranteed return on the premium paid, ensuring a stable income stream.

There are rules governing when you can access your annuity funds without penalty. Annuity 59 1/2 Rule 2024 explains the 59 1/2 rule, which allows early withdrawals under certain circumstances.

- LIC Jeevan Shanti:This is a deferred annuity plan that allows individuals to accumulate funds over time and receive a guaranteed income stream during retirement. The plan offers flexible premium payment options and various payout options to suit individual needs.

- LIC New Jeevan Dhara:This is a single premium deferred annuity plan that provides a guaranteed income stream for life, starting at a specified future date. The plan offers a minimum guaranteed return and allows for flexible payout options, ensuring a steady income stream during retirement.

Federal employees have access to a special type of annuity called the Federal Employees Retirement System (FERS). Calculating A Federal Annuity – Fers 2024 provides insights into how to calculate FERS annuity payments, helping federal employees understand their retirement benefits.

Features and Benefits of LIC Annuity Products

LIC annuity products are designed to provide a variety of features and benefits, including:

- Guaranteed Income:All LIC annuity products offer a guaranteed income stream, providing financial security and peace of mind.

- Flexible Payout Options:Annuitants can choose from various payout options, such as monthly, quarterly, half-yearly, or yearly payments, to suit their needs.

- Tax Benefits:Annuity payments received are generally tax-free in India, providing tax savings for annuitants.

- Guaranteed Returns:Most LIC annuity products offer a guaranteed return on the premium paid, ensuring a stable income stream.

Calculating Annuity Payments

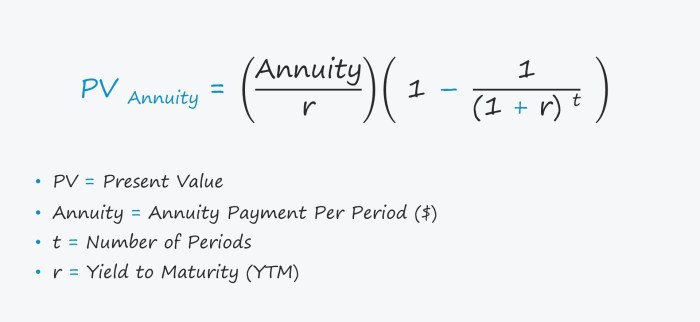

The amount of annuity payments received depends on various factors, including the initial investment amount, interest rate, and payout period. The formula for calculating annuity payments is:

Annuity Payment Calculation

Annuity Payment = (Initial Investment Amount

If you’re considering an annuity with a large initial investment, you might be curious about how the payments will work. Annuity 600 000 2024 discusses the potential income stream from an annuity with a starting amount of $600,000, giving you a better understanding of the potential returns.

- Interest Rate) / (1

- (1 + Interest Rate)^-Payout Period)

For example, if you invest ₹10 lakh in an annuity with a 5% interest rate and a 10-year payout period, your monthly annuity payment would be:

Annuity Payment = (₹10,00,000

- 0.05) / (1

- (1 + 0.05)^-120) = ₹10,607.92

This formula can be used to calculate annuity payments for different LIC products. However, it is important to note that LIC annuity products may have specific formulas or calculators available for calculating payments.

There are different types of annuities available, each with its own features and benefits. 4 Annuity 2024 provides an overview of the four main types of annuities, helping you understand the options and choose the one that best suits your needs.

Calculating Annuity Payments for LIC Products

To calculate annuity payments for specific LIC products, you can follow these steps:

- Identify the LIC annuity product you are interested in.

- Determine the initial investment amount and payout period.

- Use the LIC product-specific formula or calculator to calculate the annuity payment.

LIC provides detailed information on its website and through its agents about the calculation methods for its annuity products.

Not all annuities are created equal. Some qualify for favorable tax treatment, while others don’t. Annuity Is Qualified 2024 discusses the characteristics of a qualified annuity and the potential tax benefits it offers.

Factors to Consider Before Purchasing an Annuity

Before purchasing an annuity, it is crucial to carefully consider various factors to ensure it aligns with your financial goals and risk tolerance. Here are some key considerations:

Pros and Cons of Purchasing an Annuity

Purchasing an annuity has both potential benefits and risks. Here is a comparison of the pros and cons:

| Pros | Cons |

|---|---|

| Guaranteed Income Stream | Limited Growth Potential |

| Protection Against Longevity Risk | Potential for Low Returns |

| Tax Benefits | Loss of Liquidity |

| Flexibility in Payout Options | Early Withdrawal Penalties |

Key Factors to Consider

Here are some key factors to consider before purchasing an LIC annuity:

- Age:Annuities are typically purchased closer to retirement, but they can be purchased at any age.

- Financial Goals:Annuities can help achieve various financial goals, such as retirement income, income protection, or estate planning.

- Risk Tolerance:Annuities offer varying levels of risk, with fixed annuities being less risky than variable annuities.

- Tax Implications:Annuity payments received are generally tax-free in India, but it is important to understand the tax implications of purchasing an annuity.

Comparison of LIC Annuity Products

Here is a table comparing the key features and benefits of different LIC annuity products:

| Product | Premium Payment | Payout Options | Guaranteed Return | Risk Tolerance |

|---|---|---|---|---|

| LIC Jeevan Akshay VI | Single Premium | Monthly, Quarterly, Half-Yearly, Yearly | Yes | Low |

| LIC Jeevan Akshay VII | Single or Regular Premium | Monthly, Quarterly, Half-Yearly, Yearly | Yes | Low |

| LIC Jeevan Shanti | Regular Premium | Monthly, Quarterly, Half-Yearly, Yearly | Yes | Low |

| LIC New Jeevan Dhara | Single Premium | Monthly, Quarterly, Half-Yearly, Yearly | Yes | Low |

Annuity Regulations and Tax Implications

Annuities in India are regulated by the Insurance Regulatory and Development Authority of India (IRDAI). The IRDAI sets guidelines for annuity products, including product features, premium payments, and payout options. Here are some key regulations and tax implications to consider:

Annuity Regulations in India, Calculate Annuity Lic 2024

- IRDAI Regulations:LIC annuity products must comply with IRDAI regulations, ensuring consumer protection and financial stability.

- Product Features:IRDAI sets guidelines for product features, including premium payment options, payout options, and guaranteed returns.

- Transparency:LIC is required to provide clear and transparent information about its annuity products to potential buyers.

Tax Implications of Annuities

Annuities in India have specific tax implications. Here are some key points to consider:

- Tax-Free Annuity Payments:Annuity payments received are generally tax-free in India.

- Tax on Premium Paid:Premiums paid for annuities are generally not tax-deductible.

- Tax on Lump Sum Withdrawal:If you withdraw the entire annuity corpus before the maturity date, the withdrawal amount may be subject to tax.

Tax Calculation Examples

Here are some examples of how taxes are calculated on annuity payments:

- Example 1:If you receive an annuity payment of ₹10,000 per month, you will not be taxed on this income.

- Example 2:If you withdraw the entire annuity corpus of ₹10 lakh before maturity, the withdrawal amount may be subject to tax based on your income tax slab.

Case Studies and Real-World Examples

Annuities can be a valuable tool for financial planning, and many individuals have successfully used LIC annuities to achieve their financial goals. Here are some real-world examples and case studies illustrating the impact of LIC annuities:

Real-World Examples of LIC Annuity Usage

Here are some examples of how individuals have used LIC annuities for their financial planning:

- Retirement Income:A retired teacher, Mr. Sharma, purchased an LIC Jeevan Akshay VI annuity to supplement his pension income, providing him with a guaranteed income stream for life.

- Income Protection:A young professional, Ms. Patel, purchased an LIC Jeevan Shanti annuity to provide financial protection for her family in case of an unexpected event.

- Estate Planning:A successful businessman, Mr. Kapoor, purchased an LIC New Jeevan Dhara annuity to create a stream of income for his children after his death.

Case Studies of LIC Annuity Outcomes

Here are some case studies analyzing the financial outcomes of investing in LIC annuities based on different scenarios and market conditions:

- Case Study 1:A 60-year-old individual invested ₹10 lakh in an LIC Jeevan Akshay VI annuity. Assuming a 5% guaranteed return, the individual would receive a monthly annuity payment of ₹5,303.64 for life. This provides a steady income stream during retirement, mitigating longevity risk.

- Case Study 2:A 40-year-old individual invested ₹5 lakh in an LIC Jeevan Shanti annuity. Assuming a 6% guaranteed return, the individual would receive a monthly annuity payment of ₹3,929.13 starting at age 60. This provides a reliable income stream during retirement, ensuring financial security.

Outcome Summary

By understanding the intricacies of LIC annuities and carefully considering your individual financial circumstances, you can harness the power of these financial instruments to secure your future and achieve your financial goals. Whether you’re seeking a reliable income stream, a safety net for your loved ones, or a means to build a legacy, LIC annuities can play a pivotal role in your financial journey.

You might be considering an annuity as part of your 401(k) retirement plan. Annuity 401k 2024 examines the use of annuities within 401(k) plans, helping you understand the advantages and disadvantages.

Essential Questionnaire: Calculate Annuity Lic 2024

What are the minimum and maximum investment amounts for LIC annuities?

Annuity is a complex financial instrument. Annuity Is 2024 provides a comprehensive explanation of what an annuity is, its key features, and its role in retirement planning.

The minimum and maximum investment amounts vary depending on the specific LIC annuity product you choose. It’s best to consult the LIC website or an LIC agent for detailed information on the investment limits for each product.

Are there any penalties for withdrawing from an LIC annuity before maturity?

Yes, most LIC annuities have surrender charges or penalties if you withdraw your investment before the maturity date. The specific penalty amount depends on the product and the duration of your investment. It’s crucial to understand the terms and conditions before committing to an annuity.

How do LIC annuities compare to other investment options like mutual funds or fixed deposits?

Figuring out how much annuity income you’ll receive can be a bit tricky. Calculate Annuity Amount 2024 provides a breakdown of the factors that affect annuity payouts, giving you a better idea of what you can expect to receive.

LIC annuities offer a guaranteed income stream and potential for growth, making them suitable for risk-averse investors seeking stable returns. However, they may not offer the same potential for high returns as mutual funds. Fixed deposits, on the other hand, provide fixed returns but may not keep pace with inflation.

Annuity payments are often treated differently for tax purposes than other types of income. Is Annuity Income Capital Gains 2024 explains whether annuity income is considered capital gains and how it’s taxed. This information is crucial for understanding the potential tax implications of choosing an annuity.

The best choice depends on your individual risk tolerance, investment goals, and financial circumstances.

Annuity is a popular financial product that provides a steady stream of income in retirement. But how does it compare to an IRA? Is Annuity The Same As Ira 2024 explores the key differences between these two retirement savings options, helping you make an informed decision for your financial future.