Calculate Annuity Loan 2024: A Comprehensive Guide – Annuity loans, also known as installment loans, are a common financial tool used for various purposes, from purchasing homes to funding business ventures. These loans involve regular fixed payments over a predetermined period, offering a structured approach to repaying debt.

Annuity payments can provide a steady stream of income for retirement, but it’s important to understand what they are. An Annuity Is What 2024 resource can help you grasp the basics.

This guide will delve into the intricacies of annuity loans, providing a comprehensive understanding of their features, calculation methods, and factors that influence their cost.

Calculating annuities on a calculator can be straightforward, but it’s important to know the right steps. A How To Calculate Annuity On Calculator 2024 guide can provide step-by-step instructions.

We will explore the essential elements of annuity loans, including their core concept, key features, and comparison with other loan types. Understanding how to calculate annuity loan payments is crucial for making informed financial decisions. We will provide a step-by-step guide, covering manual calculation methods and exploring the impact of interest rates and loan terms on monthly payments.

Many financial calculators, like the BA II Plus, have functions for calculating annuities. A Calculating Annuities On Ba Ii Plus 2024 guide can help you learn how to use these functions effectively.

We will also introduce online tools and calculators that streamline the calculation process, simplifying the task for individuals.

Contents List

Understanding Annuity Loans

An annuity loan, also known as a fixed-payment loan, is a type of loan where you make equal payments over a set period. These payments cover both the principal amount borrowed and the interest accrued. This structure makes it a popular choice for borrowers seeking predictable and manageable repayment plans.

Your age is a significant factor when calculating annuity payments. An Annuity Calculator By Age 2024 can show you how your age impacts potential payouts.

Key Features of Annuity Loans

- Fixed Payments:The most notable feature of annuity loans is that you make consistent, equal payments throughout the loan term. This predictability allows for better budgeting and financial planning.

- Interest Rates:Annuity loans typically come with fixed interest rates, meaning the cost of borrowing remains constant throughout the loan term. This offers stability and protects you from fluctuations in interest rates.

- Loan Terms:Annuity loans have predetermined terms, ranging from a few years to several decades. The loan term impacts the total amount of interest you pay and the monthly payment amount.

Comparing Annuity Loans with Other Loan Types

Annuity loans share similarities with other loan types, but they also have distinct advantages and disadvantages. Let’s compare them with mortgages and personal loans:

| Feature | Annuity Loan | Mortgage | Personal Loan |

|---|---|---|---|

| Purpose | Versatile, suitable for various purposes | Real estate purchase | Personal expenses, debt consolidation |

| Loan Term | Flexible, ranging from short to long terms | Typically longer terms (15-30 years) | Shorter terms (1-7 years) |

| Interest Rates | Fixed or variable, depending on the lender | Usually fixed, but adjustable-rate mortgages (ARMs) exist | Fixed or variable, depending on the lender |

| Payment Structure | Equal, fixed payments over the loan term | Equal, fixed payments over the loan term | Equal, fixed payments over the loan term |

| Advantages | Predictable payments, fixed interest rates, flexibility | Tax deductions on interest payments, long-term financing | Quick approval, flexible uses |

| Disadvantages | Potentially higher interest rates than mortgages | High upfront costs, long-term commitment | Higher interest rates than mortgages, shorter terms |

Calculating Annuity Loan Payments

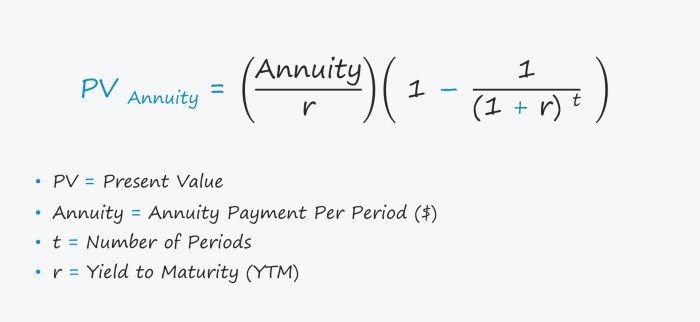

Calculating annuity loan payments manually involves using a formula that considers the principal amount, interest rate, and loan term. This formula helps you understand the financial implications of your loan and make informed decisions.

Manual Calculation

The formula for calculating annuity loan payments is:

Monthly Payment = (P

When dealing with LIC annuities, you’ll often need a unique annuity number for identification. A Annuity Number Lic 2024 resource can help you find this information.

- r) / (1

- (1 + r)^-n)

Where:

- P= Principal amount borrowed

- r= Monthly interest rate (annual interest rate divided by 12)

- n= Total number of payments (loan term in months)

Impact of Interest Rates and Loan Terms

The interest rate and loan term significantly influence the monthly payment amount. Higher interest rates lead to larger payments, while longer loan terms result in lower monthly payments but higher overall interest costs. Let’s illustrate this with an example:

- Scenario 1:A $10,000 loan at 5% annual interest for 5 years (60 months) results in a monthly payment of approximately $188.71.

- Scenario 2:The same $10,000 loan at 7% annual interest for 5 years (60 months) results in a monthly payment of approximately $202.76.

- Scenario 3:A $10,000 loan at 5% annual interest for 10 years (120 months) results in a monthly payment of approximately $106.07.

Online Tools and Calculators

Numerous online calculators and tools simplify the process of calculating annuity loan payments. These resources often allow you to input the loan details, such as principal amount, interest rate, and loan term, and instantly generate the monthly payment amount. Some calculators even provide breakdowns of principal and interest payments over the loan term, offering valuable insights into the repayment process.

Different methods are used to calculate annuities, and understanding these can be beneficial. An Annuity Method 2024 resource can explain the various approaches used.

Factors Influencing Annuity Loan Costs

The total cost of an annuity loan is influenced by various factors, including interest rates, loan duration, and fees. Understanding these factors helps you make informed decisions and choose a loan that aligns with your financial goals.

Most annuities come with a 30-day free look period, allowing you to cancel the policy without penalty. An Annuity 30 Day Free Look 2024 guide can explain this important provision.

Interest Rates

Interest rates are a primary driver of loan costs. Higher interest rates result in larger interest payments over the loan term, increasing the overall cost. Interest rates are influenced by market conditions, the lender’s risk assessment, and your creditworthiness.

When calculating the present value of an annuity due, you’re essentially determining the current worth of future payments. Using a Calculate Annuity Due Present Value 2024 tool can make this process easier.

Loan Duration, Calculate Annuity Loan 2024

The length of the loan term significantly impacts the total interest paid. Longer loan terms, while resulting in lower monthly payments, lead to higher overall interest costs. Conversely, shorter loan terms lead to higher monthly payments but lower total interest costs.

HDFC offers various annuity products, and their calculator can help you estimate potential payments. An Annuity Calculator Hdfc 2024 can provide a helpful overview.

Fees

Lenders may charge various fees associated with annuity loans, such as origination fees, processing fees, and early repayment penalties. These fees add to the overall cost of the loan, so it’s crucial to inquire about them upfront and factor them into your financial planning.

If your annuity is out of surrender, it means you can no longer withdraw your principal. This can be a concern, so it’s wise to understand the implications. Check out My Annuity Is Out Of Surrender 2024 for more information.

Amortization

Amortization refers to the gradual repayment of the loan principal over the loan term. In annuity loans, each payment consists of both principal and interest. The early payments are primarily interest-heavy, with a smaller portion going towards the principal. As you progress through the loan term, the principal portion of each payment increases, while the interest portion decreases.

Understanding amortization helps you visualize how your payments are distributed over time and how your loan balance decreases.

An annuity isn’t a bond, but it can be a fixed-income investment. An Is Annuity Bond 2024 resource can clarify the difference between these financial instruments.

Early Repayment and Loan Default

Early repayment of an annuity loan can potentially save you on interest costs. However, some lenders may charge early repayment penalties, which can offset the savings. Loan default, on the other hand, can lead to severe consequences, including damage to your credit score, legal action, and potential repossession of assets used as collateral.

Wondering how a 50k annuity might look? An Annuity 50k 2024 calculator can help you see potential payment amounts and how they might impact your retirement planning.

Annuity Loan Examples and Applications

Annuity loans find applications in various scenarios, offering flexibility and predictability in managing financial obligations. Let’s explore some common examples and applications of annuity loans:

Loan Scenarios

| Loan Amount | Interest Rate | Loan Term | Monthly Payment |

|---|---|---|---|

| $20,000 | 6% | 5 years | $386.66 |

| $50,000 | 4.5% | 10 years | $533.36 |

| $100,000 | 3.75% | 20 years | $591.55 |

Applications

- Real Estate Purchases:Annuity loans can finance real estate purchases, providing predictable payments over the loan term. This structure is beneficial for homeowners seeking financial stability and consistent budgeting.

- Business Investments:Businesses often utilize annuity loans for equipment purchases, expansion projects, or working capital needs. The fixed payments allow for predictable cash flow management and financial planning.

- Personal Financing:Annuity loans can be used for various personal expenses, such as debt consolidation, home renovations, or medical bills. They offer a structured repayment plan, making it easier to manage debt and achieve financial goals.

Real-World Examples

Imagine a young couple purchasing their first home. An annuity loan with a fixed interest rate and a 30-year term provides them with predictable monthly payments, allowing them to budget effectively and build equity over time. Similarly, a small business owner seeking to expand their operations can utilize an annuity loan to finance new equipment, knowing that the fixed payments will not disrupt their cash flow.

If you’re considering a joint life annuity for you and your partner, it’s important to understand how these work. An Annuity Calculator Joint Life 2024 can help you estimate your potential payments based on your age and other factors.

Considerations Before Taking an Annuity Loan

Before taking out an annuity loan, it’s essential to carefully consider your financial situation and explore all available options. Here are some key factors to consider:

Credit Score, Income, and Debt-to-Income Ratio

Your credit score, income, and debt-to-income ratio play a crucial role in determining your eligibility for an annuity loan and the interest rate you qualify for. A higher credit score generally leads to lower interest rates, while a stable income and a manageable debt-to-income ratio improve your chances of loan approval.

Finding the Best Rates and Terms

Shop around with multiple lenders to compare interest rates, fees, and loan terms. Consider factors such as prepayment penalties, origination fees, and loan duration when evaluating different loan options.

Potential Risks and Drawbacks

While annuity loans offer benefits like predictability and fixed interest rates, they also have potential drawbacks. High interest rates can significantly increase the overall cost of the loan, and early repayment penalties may limit your flexibility. It’s crucial to understand the terms and conditions of the loan agreement before signing, ensuring that the loan aligns with your financial goals and risk tolerance.

Final Thoughts: Calculate Annuity Loan 2024

By grasping the factors that influence annuity loan costs, including interest rates, loan duration, and fees, borrowers can make informed decisions about their financing options. We will examine the concept of amortization and its impact on payment distribution over the loan term.

Furthermore, we will analyze the consequences of early repayment or loan default on the overall cost. Annuity loans offer a flexible and structured approach to financing, finding applications in various scenarios. We will explore real-world examples, highlighting the benefits and potential drawbacks of annuity loans, providing valuable insights for potential borrowers.

Ultimately, this guide aims to empower individuals with the knowledge and tools necessary to make informed decisions regarding annuity loans, ensuring a clear understanding of their benefits, risks, and financial implications.

FAQ Explained

What are the advantages of annuity loans?

Before committing to an annuity, it’s crucial to weigh the pros and cons. A Annuity Is It A Good Idea 2024 guide can help you make an informed decision.

Annuity loans offer predictable monthly payments, making budgeting easier. They also provide a structured approach to repaying debt, helping borrowers stay on track. Additionally, annuity loans can be used for various purposes, including home purchases, business investments, and personal financing.

What are the disadvantages of annuity loans?

Annuity loans can have higher interest rates compared to other loan types, leading to a higher overall cost. Borrowers should carefully consider their financial situation before taking on an annuity loan, ensuring they can comfortably afford the monthly payments.

How can I find the best annuity loan rates?

The Jaiib (Junior Associate of the Indian Institute of Bankers) exam often covers topics related to annuities. You can find relevant information on Annuity Jaiib 2024 to prepare for your exams.

To find the best annuity loan rates, it’s essential to compare offers from multiple lenders. Consider factors like your credit score, income, and debt-to-income ratio, as these influence the interest rates you qualify for. Online loan comparison websites can help streamline the process.

What happens if I default on an annuity loan?

Defaulting on an annuity loan can have serious consequences. Lenders may take legal action to recover the outstanding debt, potentially leading to damage to your credit score, wage garnishment, or even foreclosure on your property.