Calculate Annuity Loan Excel 2024 empowers you to take control of your finances. Annuity loans are a popular choice for borrowers, offering a predictable payment structure. By understanding the key factors influencing these loans, you can make informed financial decisions.

The amount of interest you can earn on an annuity can vary depending on the type of annuity and the current market conditions. 6 Percent Annuity 2024 provides information on a specific type of annuity. While annuities can offer a guaranteed rate of return, they are not always the best investment option, especially if you’re looking for a high rate of return.

It’s important to consider your investment goals and risk tolerance before investing in an annuity.

This guide delves into the intricacies of annuity loans, providing a step-by-step guide to calculating payments and analyzing amortization schedules in Excel 2024.

The taxability of annuity payments can vary depending on the type of annuity and the terms of your contract. Is Annuity For Life Insurance Taxable 2024 provides insights into the tax implications of annuity payments. For example, if you’re receiving payments from a traditional annuity, the payments will be taxed as ordinary income.

However, if you’re receiving payments from a Roth annuity, the payments will be tax-free. It’s important to consult with a tax professional to understand the tax implications of your specific annuity.

From the fundamentals of annuity loans to advanced calculations, this guide equips you with the knowledge and tools to effectively manage your loan obligations. Explore the PMT function, create amortization schedules, and gain valuable insights into the impact of interest rates and loan terms on your monthly payments.

Annuities are often considered a type of fixed income investment Is Annuity Fixed Income 2024. This means that they provide a predictable stream of income, which can be helpful for planning your finances. However, it’s important to understand that annuities can be complex and have different features and benefits depending on the type you choose.

Annuity Is Used In 2024 explores the various ways annuities can be used, but it’s always a good idea to consult with a financial advisor to determine if an annuity is the right investment for you.

Contents List

Understanding Annuity Loans

Annuity loans are a type of loan where the borrower makes regular, equal payments over a set period of time. These payments cover both the principal amount borrowed and the accrued interest. Annuity loans are often used for long-term financing, such as mortgages, car loans, and personal loans.

Key Characteristics of Annuity Loans

- Equal Payments:Borrowers make consistent, fixed payments throughout the loan term, simplifying budgeting and financial planning.

- Amortization:Each payment gradually reduces the principal amount owed while also covering interest charges.

- Loan Term:The loan term defines the duration of the loan, influencing the total interest paid and the size of monthly payments.

Annuity Loans vs. Other Loan Types, Calculate Annuity Loan Excel 2024

Annuity loans differ from other loan types in several ways. For example, fixed-rate mortgages also involve regular payments but may not be fully amortized, leading to a balloon payment at the end of the loan term. Annuity loans, in contrast, are fully amortized, ensuring the entire principal is repaid by the final payment.

Annuities are often used as a way to provide a steady stream of income during retirement. What Annuity Is The Best For Retirement 2024 explores the different types of annuities available and which might be best suited for your individual needs.

You can also use a government calculator to get a better idea of how taxes will affect your annuity withdrawals Annuity Withdrawal Tax Calculator 2024. It’s important to remember that annuities are a long-term investment and should be considered as part of a comprehensive retirement plan.

Real-World Examples of Annuity Loans

- Mortgages:A common example of an annuity loan, where homeowners make monthly payments to repay their home loans over a specified period, often 15 or 30 years.

- Car Loans:Auto loans are typically structured as annuity loans, with monthly payments made over several years until the car is fully paid off.

- Personal Loans:These loans can be used for various purposes, such as debt consolidation or home improvements, and often involve regular annuity payments.

Calculating Annuity Loan Payments in Excel 2024

Excel’s PMT function is a powerful tool for calculating annuity loan payments. This function takes into account the loan amount, interest rate, and loan term to determine the required monthly payment.

Understanding the PMT Function

The PMT function follows the syntax: PMT(rate, nper, pv, [fv], [type])

Annuities can be a valuable tool for retirement planning, but it’s important to understand the different types available and how they work. Annuity Hk 2024 offers information on a specific type of annuity, while Annuity Fund Is 2024 provides an overview of the concept of annuity funds.

It’s important to consult with a financial advisor to determine if an annuity is the right investment for you.

- rate:The interest rate per period (usually monthly).

- nper:The total number of payment periods (loan term in months).

- pv:The present value of the loan (the amount borrowed).

- fv:The future value of the loan (optional, usually 0 for annuity loans).

- type:Specifies when payments are made (0 for end of period, 1 for beginning of period, optional, usually 0).

Example Calculation

Let’s assume you’re taking out a $100,000 loan with a 5% annual interest rate (0.4167% monthly) for 30 years (360 months). Using the PMT function, the monthly payment would be calculated as follows: =PMT(0.004167, 360, 100000). The result will show the monthly payment amount.

Creating an Excel Spreadsheet

- Set up the Spreadsheet:Create columns for Loan Amount, Interest Rate, Loan Term (in months), and Monthly Payment.

- Enter Values:Input the loan details into the respective columns.

- Apply the PMT Function:In the Monthly Payment column, use the PMT function with the correct cell references for the loan amount, interest rate, and loan term.

- Format Cells:Format the Monthly Payment cell to display currency.

Factors Affecting Annuity Loan Payments

Several factors influence the size of annuity loan payments. Understanding these factors allows borrowers to make informed decisions about their loan options.

Key Factors

- Interest Rate:Higher interest rates result in larger monthly payments. Lower interest rates lead to smaller payments.

- Loan Term:Longer loan terms generally result in smaller monthly payments but lead to higher total interest paid over the life of the loan. Shorter terms mean larger payments but less overall interest.

- Loan Amount:Larger loan amounts require larger monthly payments to cover the principal and interest.

Impact of Changes

| Factor | Change | Impact on Monthly Payment |

|---|---|---|

| Interest Rate | Increase | Increases |

| Loan Term | Increase | Decreases |

| Loan Amount | Increase | Increases |

Compounded Interest

Interest on annuity loans is often compounded, meaning interest is calculated on both the principal and previously accrued interest. Compounding can lead to a significant increase in the total interest paid over the life of the loan.

Analyzing Annuity Loan Amortization Schedules: Calculate Annuity Loan Excel 2024

An amortization schedule is a detailed breakdown of each loan payment, showing how much goes towards principal repayment and how much covers interest. This schedule provides valuable insights into the loan’s progress and helps borrowers understand the impact of their payments over time.

Creating an Amortization Schedule

- Set up the Spreadsheet:Create columns for Payment Number, Payment Amount, Principal Payment, Interest Payment, and Remaining Balance.

- Enter Loan Details:Input the loan amount, interest rate, and loan term into the appropriate cells.

- Calculate Payment Amount:Use the PMT function to determine the monthly payment.

- Calculate Interest Payment:In the first row, multiply the remaining balance by the monthly interest rate.

- Calculate Principal Payment:Subtract the interest payment from the total payment amount.

- Calculate Remaining Balance:Subtract the principal payment from the previous remaining balance.

- Repeat for Subsequent Payments:Copy the formulas down for the remaining payment periods, ensuring that the remaining balance and interest calculations reference the previous row’s values.

Analyzing the Amortization Schedule

The amortization schedule clearly illustrates how each payment is allocated between principal and interest. In the early stages of the loan, a larger portion of each payment goes towards interest, while the principal repayment increases over time. This gradual shift reflects the decreasing remaining balance and the decreasing interest charges.

Advanced Annuity Loan Calculations

Excel provides tools for more complex annuity loan calculations, including present value and future value calculations. These calculations are useful for understanding the time value of money and making informed financial decisions.

Annuity payments can be calculated using various methods, including the HP12c calculator Calculate Annuity Hp12c 2024. However, it’s important to remember that annuities are not the same as life insurance Is Annuity A Life Insurance Policy 2024.

While annuities can provide a guaranteed income stream, they don’t offer the same level of death benefit protection as a life insurance policy. If you’re looking for a product that combines both income and death benefit, you might want to consider a variable annuity.

Calculating Present Value

The present value of an annuity loan represents the current value of a series of future payments. Excel’s PV function calculates the present value based on the interest rate, payment amount, and loan term.

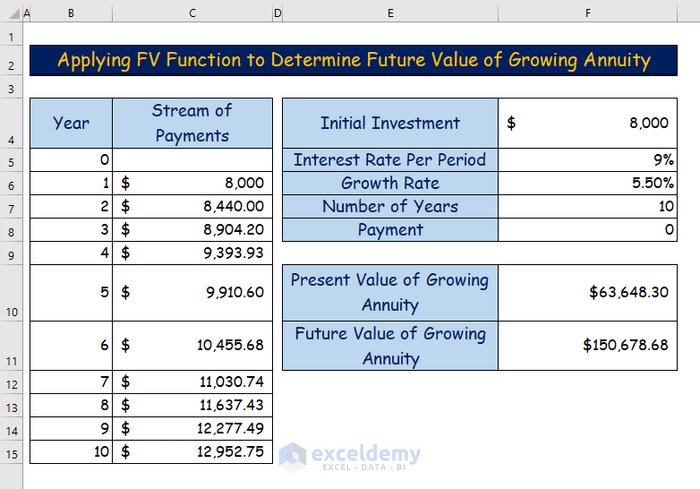

Calculating Future Value

The future value of an annuity loan represents the total amount that will be accumulated at the end of the loan term. Excel’s FV function calculates the future value based on the interest rate, payment amount, and loan term.

An annuity is a financial product that provides a series of payments over a set period of time. An Annuity Is Known 2024 explains that these payments can be fixed or variable, and can be used for a variety of purposes, such as retirement income, college savings, or even to cover long-term care expenses.

It’s important to note that there are often penalties associated with withdrawing money from an annuity early Annuity 10 Penalty 2024 , so it’s essential to understand the terms of your contract before investing.

Advanced Scenarios

- Balloon Payments:Some annuity loans include a large final payment, known as a balloon payment. This payment is used to cover the remaining principal balance at the end of the loan term. Excel’s PMT function can be modified to accommodate balloon payments by adjusting the future value (fv) argument.

- Variable Interest Rates:Annuity loans with variable interest rates involve fluctuating interest rates over the loan term. Excel’s PMT function can be adjusted to account for variable interest rates by referencing a cell containing the changing interest rate for each payment period.

Last Word

Mastering the art of annuity loan calculations in Excel 2024 unlocks a world of financial clarity. With the ability to accurately assess loan payments and analyze amortization schedules, you can make informed decisions about your borrowing needs. Whether you’re a seasoned investor or a first-time borrower, this guide provides a comprehensive framework for navigating the intricacies of annuity loans and maximizing your financial well-being.

If you’re looking to calculate the value of an annuity, there are a few different tools available to you. For example, you can learn how to calculate annuities on a TI-84 calculator How To Calculate Annuities On Ti 84 2024 , or you can use an online calculator like the one provided by BMO Annuity Calculator Bmo 2024.

It’s important to understand that annuities can be a complex financial instrument, so it’s always a good idea to consult with a financial advisor before making any decisions.

FAQ

Can I use Excel 2019 to calculate annuity loans?

Yes, the PMT function and other relevant formulas are available in Excel 2019 and earlier versions. The process and steps Artikeld in this guide will generally apply.

What is the difference between an annuity loan and a fixed-rate mortgage?

An annuity loan typically has a fixed interest rate and equal monthly payments, while a fixed-rate mortgage may have a fixed interest rate but allows for different payment amounts over the loan term.

How does compounding interest affect my annuity loan payments?

Compounding interest means that interest is calculated on both the principal amount and accrued interest. This can lead to higher overall interest costs over the loan term.