Calculate Annuity Payments Ba Ii Plus 2024 – Calculate Annuity Payments with the BA II Plus 2024, this guide provides a comprehensive understanding of annuities, their types, and how to calculate them using the powerful BA II Plus financial calculator. We’ll delve into the key concepts, explore practical applications, and equip you with the knowledge to confidently navigate your financial planning needs.

Bankrate provides a useful annuity calculator that can help you compare different annuity options and their potential returns. You can access this calculator by visiting Annuity Calculator Bankrate 2024. This tool allows you to customize your calculations based on factors such as your age, investment amount, and desired payout period.

Annuities are a powerful financial tool used for a variety of purposes, including retirement planning, loan payments, and investment returns. They involve a series of regular payments over a specific period, making them ideal for managing long-term financial goals.

Whether an annuity qualifies as a plan under specific tax laws is an important consideration. To learn about the tax implications of annuities in 2024, visit Is Annuity A Qualified Plan 2024. This article provides insights into the tax treatment of annuities and their potential benefits for retirement planning.

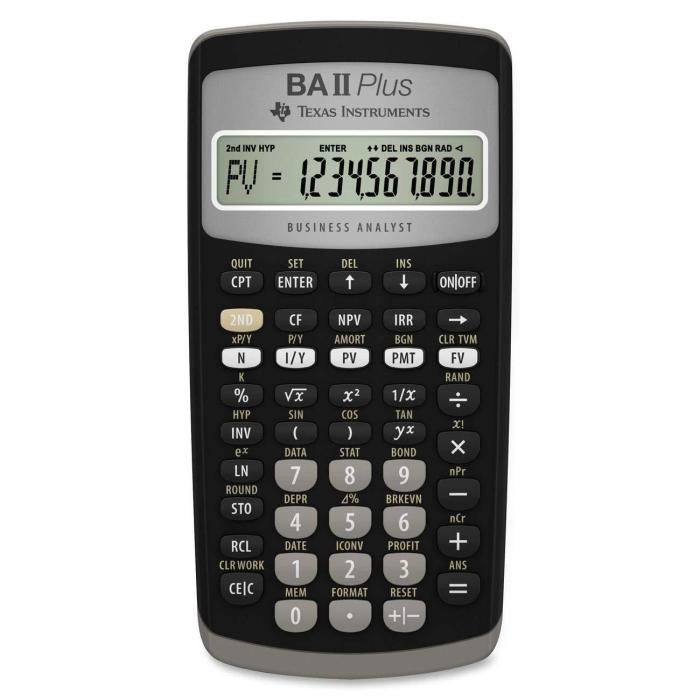

The BA II Plus calculator, with its dedicated functions for annuity calculations, simplifies the process, enabling you to accurately determine annuity payments and analyze different scenarios.

While annuities and life insurance share some similarities, they are distinct financial products. To understand the key differences between these two, you can visit Is Annuity The Same As Life Insurance 2024. This article clarifies the unique features and purposes of annuities and life insurance, helping you make informed financial decisions.

Contents List

Understanding Annuities

Annuities are financial products that provide a series of regular payments over a specific period of time. They are commonly used for retirement planning, income generation, and managing financial obligations. There are various types of annuities, each with its unique features and characteristics.

The government offers a tool to help you calculate the potential benefits of an annuity. To access this tool, visit Annuity Calculator Gov 2024. This calculator can help you estimate the amount of income you could receive from an annuity based on your specific circumstances.

Types of Annuities

- Ordinary Annuity:Payments are made at the end of each period.

- Annuity Due:Payments are made at the beginning of each period.

- Deferred Annuity:Payments start after a specified period of time.

- Fixed Annuity:Payments are guaranteed at a fixed rate of interest.

- Variable Annuity:Payments are linked to the performance of an underlying investment portfolio.

Present Value and Future Value

The concept of present value (PV) and future value (FV) is crucial in annuity calculations. PV represents the current value of a future stream of payments, while FV represents the future value of a present sum of money.

Annuities are often considered a voluntary retirement vehicle, providing a steady stream of income during your golden years. To learn more about how annuities can be used for retirement planning in 2024, visit Annuity Is A Voluntary Retirement Vehicle 2024.

This article explains the advantages and disadvantages of annuities as a retirement strategy.

Factors Influencing Annuity Payments

- Interest Rate:A higher interest rate generally leads to higher annuity payments.

- Time Period:The longer the time period, the higher the annuity payments.

- Payment Frequency:More frequent payments result in higher annuity payments.

The BA II Plus Calculator

The BA II Plus calculator is a popular financial calculator widely used by professionals and students for various financial calculations, including annuities. It features a user-friendly interface and a comprehensive set of functions designed to simplify complex financial computations.

If you’re interested in understanding the formula for calculating annuity payments on a half-yearly basis, you can find a comprehensive explanation by visiting Annuity Formula Half Yearly 2024. This article outlines the steps involved in calculating half-yearly annuity payments, including the relevant formulas and variables.

Functions for Annuity Calculations

- PV (Present Value):Calculates the present value of a future stream of payments.

- FV (Future Value):Calculates the future value of a present sum of money.

- PMT (Payment):Calculates the periodic payment amount.

- N (Number of Periods):Represents the total number of payment periods.

- I/Y (Interest Rate per Year):Represents the annual interest rate.

Inputting Annuity Parameters

- Clear the Calculator:Press the “2nd” key followed by the “CLR TVM” key to clear all previous calculations.

- Input the Known Values:Enter the values for PV, FV, N, and I/Y based on the specific annuity scenario.

- Select the Payment Mode:Press the “2nd” key followed by the “PMT” key to toggle between “END” (payments at the end of the period) and “BGN” (payments at the beginning of the period).

- Calculate the Unknown Value:Press the “CPT” key followed by the desired value (e.g., PMT for payment amount) to calculate the unknown variable.

Calculating Annuity Payments

The formula for calculating annuity payments is based on the concept of present value and future value. It considers the interest rate, time period, and payment frequency to determine the periodic payment amount.

If you’re considering an annuity with a starting value of $300,000, you can find information about this type of annuity by visiting Annuity 300k 2024. This resource can help you understand the potential returns and features associated with a $300,000 annuity in 2024.

Using the BA II Plus Calculator, Calculate Annuity Payments Ba Ii Plus 2024

The BA II Plus calculator simplifies annuity calculations by providing dedicated functions for each variable. To calculate annuity payments, follow these steps:

- Input the Known Values:Enter the values for PV, FV, N, and I/Y based on the specific annuity scenario.

- Select the Payment Mode:Press the “2nd” key followed by the “PMT” key to toggle between “END” (payments at the end of the period) and “BGN” (payments at the beginning of the period).

- Calculate the Payment Amount:Press the “CPT” key followed by the “PMT” key to calculate the periodic payment amount.

Real-World Applications

- Retirement Planning:Annuities can provide a steady stream of income during retirement.

- Loan Payments:Mortgages and car loans are examples of annuities where regular payments are made over a fixed period.

- Investment Returns:Annuities can be used to generate regular income from investments.

Advanced Annuity Concepts

Amortization

Amortization refers to the process of gradually paying off a loan or debt over time. Annuities play a key role in amortization calculations, as they provide a framework for determining the regular payments required to repay the principal and interest.

If you’re looking to determine the amount of annuity required to provide income over a 12-year period, you can find helpful information by visiting What Annuity Is Required Over 12 Years 2024. This article explains how to calculate the necessary annuity amount based on your desired income and the duration of the payout.

Fixed vs. Variable Annuities

- Fixed Annuity:Payments are guaranteed at a fixed rate of interest, providing predictable income.

- Variable Annuity:Payments are linked to the performance of an underlying investment portfolio, offering potential for higher returns but also higher risk.

Inflation and Taxes

Inflation can erode the purchasing power of annuity payments over time. Taxes may also be applicable on annuity income, depending on the specific type of annuity and tax laws in the jurisdiction.

A common characteristic of annuities is that they involve a series of equal payments made over a specific period. For a detailed explanation of this concept, visit An Annuity Is A Series Of Equal Periodic Payments 2024. This article provides a clear definition of annuities and their role in financial planning.

Practical Applications of Annuity Calculations

Annuity Scenarios

| Scenario | PV | FV | N | I/Y | PMT |

|---|---|---|---|---|---|

| Retirement Savings | $1,000,000 | $0 | 20 | 5% | -$79,504 |

| Mortgage Payment | $200,000 | $0 | 360 | 4% | -$954 |

| Loan Amortization | $50,000 | $0 | 60 | 7% | -$1,029 |

Financial Planning Contexts

- Retirement Planning:Annuities can be used to project retirement income needs and plan for a comfortable retirement.

- Mortgage Payments:Annuity calculations can help determine the monthly mortgage payments based on the loan amount, interest rate, and loan term.

- Loan Amortization:Annuities can be used to calculate the regular payments required to amortize a loan over a specific period.

Maximizing Annuity Payments

- Invest Early:The earlier you start investing, the more time your money has to grow through compounding.

- Maximize Contributions:Contribute as much as possible to your annuity accounts to increase your future payments.

- Seek Professional Advice:Consult with a financial advisor to develop a personalized annuity strategy that meets your financial goals.

Ultimate Conclusion: Calculate Annuity Payments Ba Ii Plus 2024

By understanding the fundamentals of annuities and leveraging the capabilities of the BA II Plus calculator, you can gain valuable insights into your financial options. From retirement planning to loan amortization, annuity calculations empower you to make informed decisions and effectively manage your financial future.

A common question about annuities is whether they are a form of life insurance. You can find an answer to this question by checking out Is Annuity Life Insurance 2024. This article explains the differences between annuities and life insurance, clarifying their distinct roles in financial planning.

Embrace the power of annuities and the BA II Plus calculator, and unlock the potential for a more secure and prosperous tomorrow.

While annuities can offer some advantages, they also have potential drawbacks. You can explore the arguments against annuities in 2024 by visiting Why An Annuity Is Bad 2024. This article discusses key concerns, such as potential fees and limited flexibility, to help you make an informed decision.

Commonly Asked Questions

What are the different types of annuities?

There are several types of annuities, including ordinary annuities, annuities due, deferred annuities, and variable annuities. Each type has unique characteristics and applications.

How does the BA II Plus calculator handle different payment frequencies?

The BA II Plus calculator allows you to input various payment frequencies, such as monthly, quarterly, or annually. It automatically adjusts the calculations based on the chosen frequency.

Can I use the BA II Plus calculator for amortization schedules?

Yes, the BA II Plus calculator can generate amortization schedules, providing a detailed breakdown of loan payments and principal and interest balances over time.

If you’re looking to calculate the potential returns on an annuity bond in 2024, you can find a helpful tool by checking out Calculate Annuity Bond 2024. This resource can help you understand the different factors that influence annuity bond returns, including interest rates and market conditions.

The concept of equal payments is fundamental to annuities. To understand this aspect further, you can visit Annuity Is A Series Of Equal Payments 2024. This article explains how annuities provide a consistent stream of income through regular payments.

When considering an annuity, it’s important to understand who owns the annuity contract. To learn more about annuity ownership in 2024, visit Annuity Owner Is 2024. This article explains the different types of annuity ownership and their implications for beneficiaries and tax treatment.

If you’re looking for a tool to estimate the potential returns on an annuity, you can find a helpful resource by checking out Annuity Estimator 2024. This tool can help you understand the potential income you could receive from an annuity based on your investment amount, payout period, and other factors.