Calculate Annuity With BA II Plus 2024: Unlocking the Power of Annuities with Your Financial Calculator. Annuities, a fundamental financial concept, involve a series of regular payments over a defined period. Whether you’re planning for retirement, managing debt, or investing strategically, understanding annuities is crucial.

Thinking about your retirement plan? Learn about annuities from 2021 to 2024 and how they can fit into your overall strategy.

This guide will empower you to master annuity calculations using the widely-used BA II Plus calculator, providing you with the tools to confidently navigate your financial future.

Wondering if your annuity is subject to required minimum distributions (RMDs)? Our article on annuities and RMDs will provide clarity on this topic.

We’ll delve into the key features of the BA II Plus calculator, focusing on its capabilities for annuity calculations. You’ll learn how to input data for different annuity types, including ordinary annuities and annuities due, and master the step-by-step process of calculating present and future values.

Through practical examples and insightful discussions, we’ll explore the impact of interest rates, payment amounts, and time periods on your annuity outcomes. By the end of this guide, you’ll be equipped to confidently calculate annuities and make informed financial decisions.

Contents List

Introduction to Annuities

Annuities are a type of financial product that provides a series of regular payments over a set period of time. They are commonly used in retirement planning, but they can also be used for other purposes, such as paying off debt or funding a child’s education.

Planning for your retirement? Find out how to calculate your retirement annuity and ensure you have a secure financial future.

Types of Annuities

There are many different types of annuities, but they can be broadly classified into two main categories:

- Fixed Annuities: These annuities provide a guaranteed rate of return, which means that the payments you receive will be predictable. However, the rate of return is typically lower than with variable annuities.

- Variable Annuities: These annuities offer the potential for higher returns, but they also come with more risk. The payments you receive will depend on the performance of the underlying investments.

Present Value and Future Value in Annuities

The present value (PV) of an annuity is the current value of a series of future payments. The future value (FV) of an annuity is the value of those payments at a future point in time.

Understanding the concepts of present value and future value is crucial for making informed financial decisions. For example, when planning for retirement, you need to know how much you need to save today to ensure you have enough income in the future.

Importance of Annuity Calculations

Calculating annuities is essential for financial planning because it helps you:

- Determine how much you need to save for retirement.

- Estimate the amount of income you will receive from an annuity.

- Compare different annuity options and choose the best one for your needs.

- Make informed decisions about loan payments and investments.

The BA II Plus Calculator

The BA II Plus calculator is a powerful tool that can be used to calculate annuities. It features a variety of functions that make it easy to perform complex financial calculations.

Key Features of the BA II Plus Calculator

- Time Value of Money (TVM) Functions: The BA II Plus calculator includes dedicated keys for inputting and calculating the key variables in annuity calculations, such as present value (PV), future value (FV), payment amount (PMT), interest rate (I/Y), and number of periods (N).

- Annuity Modes: The calculator allows you to choose between ordinary annuities (payments made at the end of each period) and annuities due (payments made at the beginning of each period).

- Built-in Formulas: The calculator automatically applies the appropriate formulas for different annuity calculations, making it easier and faster to get accurate results.

Inputting Data for Annuity Calculations

To input data for annuity calculations on the BA II Plus calculator, follow these steps:

- Clear the calculator memory: Press the [2nd] key followed by the [CLR TVM] key.

- Input the known variables: Enter the values for PV, FV, PMT, I/Y, and N using the corresponding keys on the calculator. For example, if you are calculating the present value of an annuity, you will need to input the future value, payment amount, interest rate, and number of periods.

Learn about the potential penalties for withdrawing from an annuity early. Read our article on annuity 10% penalty to understand the implications.

- Set the annuity mode: Press the [2nd] key followed by the [BGN] key to set the calculator to annuity due mode. Press the [2nd] key followed by the [END] key to set the calculator to ordinary annuity mode.

Using the BA II Plus Calculator for Different Annuity Types

The BA II Plus calculator can be used to calculate different types of annuities, including:

- Ordinary Annuity: Payments are made at the end of each period. To calculate the present value (PV) of an ordinary annuity, you would use the following formula:

PV = PMT- [1

Want to estimate your annuity payments based on your age? Check out our annuity calculator by age for a personalized estimate.

– (1 + i)^-n] / i

Unsure about the definition of an annuity? Take a look at our multiple-choice quiz on what an annuity is and test your knowledge!

where:

- PV is the present value

- PMT is the payment amount

- i is the interest rate per period

- n is the number of periods

To calculate the future value (FV) of an ordinary annuity, you would use the following formula:

FV = PMT

Did you win the Powerball? Learn how to calculate your Powerball annuity payments and understand your options.

Not sure how annuities work? We have a guide on how annuities work to help you understand the basics.

Are you thinking about a guaranteed income stream for the next five years? A 5-year annuity guarantee could be a good option for you. You can learn more about this and other annuity options by exploring our website.

- [(1 + i)^n

- 1] / i

where:

- FV is the future value

- PMT is the payment amount

- i is the interest rate per period

- n is the number of periods

PV = PMT

- [1

- (1 + i)^-n] / i

- (1 + i)

where:

- PV is the present value

- PMT is the payment amount

- i is the interest rate per period

- n is the number of periods

To calculate the future value (FV) of an annuity due, you would use the following formula:

FV = PMT

- [(1 + i)^n

- 1] / i

- (1 + i)

where:

- FV is the future value

- PMT is the payment amount

- i is the interest rate per period

- n is the number of periods

Calculating Annuity Present Value (PV)

The present value (PV) of an annuity is the current value of a series of future payments. To calculate the PV of an annuity, you need to know the payment amount, the interest rate, and the number of periods.

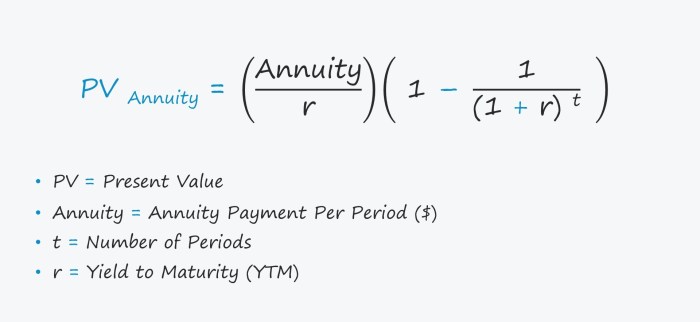

Formula for Calculating PV of an Annuity

The formula for calculating the present value (PV) of an ordinary annuity is:

PV = PMT

- [1

- (1 + i)^-n] / i

where:

- PV is the present value

- PMT is the payment amount

- i is the interest rate per period

- n is the number of periods

Examples of Calculating PV Using the BA II Plus Calculator

Let’s say you want to calculate the present value of an annuity that will pay you $1,000 per year for 10 years, with an interest rate of 5% per year. To do this, you would follow these steps:

- Clear the calculator memory: Press the [2nd] key followed by the [CLR TVM] key.

- Input the known variables: Enter the following values:

- PMT = 1000

- I/Y = 5

- N = 10

- Calculate the present value: Press the [CPT] key followed by the [PV] key. The calculator will display the present value of the annuity, which is approximately $7,721.73.

Impact of Different Variables on PV

The present value of an annuity is affected by the following variables:

- Interest Rate: As the interest rate increases, the present value of the annuity decreases. This is because a higher interest rate means that the future payments are worth less today.

- Payment Amount: As the payment amount increases, the present value of the annuity also increases. This is because you are receiving more money in the future.

- Time Period: As the time period increases, the present value of the annuity decreases. This is because the future payments are further away in time, and their value is discounted more heavily.

Calculating Annuity Future Value (FV)

The future value (FV) of an annuity is the value of a series of payments at a future point in time. To calculate the FV of an annuity, you need to know the payment amount, the interest rate, and the number of periods.

An annuity is a series of payments, but what exactly does that mean? Discover more about what an annuity is and how it works.

Formula for Calculating FV of an Annuity

The formula for calculating the future value (FV) of an ordinary annuity is:

FV = PMT

- [(1 + i)^n

- 1] / i

where:

- FV is the future value

- PMT is the payment amount

- i is the interest rate per period

- n is the number of periods

Examples of Calculating FV Using the BA II Plus Calculator

Let’s say you want to calculate the future value of an annuity that you will contribute to for 20 years, with a payment amount of $2,000 per year and an interest rate of 6% per year. To do this, you would follow these steps:

- Clear the calculator memory: Press the [2nd] key followed by the [CLR TVM] key.

- Input the known variables: Enter the following values:

- PMT = 2000

- I/Y = 6

- N = 20

- Calculate the future value: Press the [CPT] key followed by the [FV] key. The calculator will display the future value of the annuity, which is approximately $78,006.57.

Impact of Different Variables on FV

The future value of an annuity is affected by the following variables:

- Interest Rate: As the interest rate increases, the future value of the annuity also increases. This is because the payments are earning more interest over time.

- Payment Amount: As the payment amount increases, the future value of the annuity also increases. This is because you are contributing more money to the annuity.

- Time Period: As the time period increases, the future value of the annuity also increases. This is because the payments have more time to earn interest.

Practical Applications of Annuity Calculations

Annuity calculations are widely used in various financial planning scenarios, helping individuals make informed decisions about their financial future.

Real-World Examples of Annuity Calculations

Here are some examples of how annuity calculations are used in real-world financial planning:

- Retirement Planning: Annuity calculations help individuals determine how much they need to save for retirement and how much income they can expect to receive from an annuity. This information is crucial for planning a comfortable and secure retirement.

- Loan Payments: Annuity calculations are used to determine the monthly payments for loans, such as mortgages and car loans. This helps borrowers understand the total cost of the loan and make informed decisions about their borrowing capacity.

- Investment Strategies: Annuity calculations can be used to evaluate different investment strategies, such as investing in a mutual fund or buying an annuity. This helps investors make informed decisions about how to allocate their assets.

Case Studies Demonstrating the Use of Annuity Calculations, Calculate Annuity With Ba Ii Plus 2024

Here are some case studies that demonstrate how annuity calculations can help make informed financial decisions:

- Case Study 1: Retirement Planning

- Case Study 2: Loan Payments

- Case Study 3: Investment Strategies

A 45-year-old individual wants to retire at age 65. They want to know how much they need to save each year to have $1 million in retirement savings. Using annuity calculations, they can determine that they need to save approximately $10,000 per year to reach their goal.

Need to calculate an annuity payment? Our article on annuity calculation formulas will help you understand the math behind these financial products.

This information helps them make informed decisions about their savings and investment strategies.

A couple is considering buying a new home. They want to know what their monthly mortgage payments would be. Using annuity calculations, they can determine that their monthly payments would be approximately $2,000. This information helps them make informed decisions about their borrowing capacity and affordability.

An investor is considering investing in a mutual fund or buying an annuity. Using annuity calculations, they can compare the potential returns and risks of each investment option. This information helps them make informed decisions about how to allocate their assets.

Want to know what kind of return you can expect from an annuity? Our article on 7% annuity return provides insights into current market trends and what you can potentially achieve.

Conclusive Thoughts

Mastering annuity calculations with the BA II Plus calculator opens doors to a world of financial possibilities. From retirement planning and loan management to investment strategies, the ability to accurately calculate present and future values of annuities empowers you to make informed decisions about your financial future.

Are you looking for a career in the annuity industry? There are a lot of great opportunities available right now! Find out more about annuity jobs and see if a career in this field is right for you.

This guide has provided you with the knowledge and tools to confidently navigate the world of annuities. Remember, consistent practice and understanding the underlying concepts will solidify your mastery of this essential financial tool.

FAQ Overview: Calculate Annuity With Ba Ii Plus 2024

What is the difference between an ordinary annuity and an annuity due?

An ordinary annuity has payments made at the end of each period, while an annuity due has payments made at the beginning of each period.

How do I reset the BA II Plus calculator for annuity calculations?

Curious about what an annuity with a payout of 3 million dollars looks like? We have information on annuities of 3 million dollars to help you understand the possibilities.

Press the [2nd] key followed by the [CLR TVM] key to reset the calculator’s TVM (Time Value of Money) registers.

Can I use the BA II Plus calculator for other financial calculations besides annuities?

Yes, the BA II Plus calculator is versatile and can handle various financial calculations, including bond pricing, amortization, and cash flow analysis.

What are some common mistakes to avoid when calculating annuities?

Ensure you correctly input the interest rate, payment amount, and number of periods. Double-check the payment frequency (e.g., monthly, quarterly, annually) and whether the annuity is ordinary or due.

Need to calculate annuity payments in your Java program? We’ve got you covered! Check out our article on calculating annuity in Java to find out how to use the right formulas and code for your project.