Calculate Annuity With Different Payments 2024: A Guide delves into the world of annuities, exploring how different payment schedules can impact your financial future. Annuities, often used for retirement planning and income generation, can provide a steady stream of income, but understanding how various payment frequencies affect your returns is crucial.

The distinction between an annuity and a life insurance policy can be confusing. To clarify this, Is Annuity A Life Insurance Policy 2024 provides an insightful breakdown.

This guide will walk you through the fundamentals of annuities, covering their types, benefits, and drawbacks. We’ll then dive into the intricacies of calculating annuity payments, exploring the variables involved and how different payment schedules can influence your overall financial outcome.

Annuity contracts often have specific features and terms. An Annuity Is Sometimes Called The Flip Side Of 2024 delves into the concept of an annuity being the opposite of a lump-sum payment.

From understanding the impact of inflation and interest rate fluctuations to analyzing real-world scenarios, this guide equips you with the knowledge to make informed decisions about your annuity investments.

Annuity payments are typically calculated using specific methods. Annuity Method 2024 provides an overview of the different annuity methods used.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a specified period of time. Annuities are often used for retirement planning, income generation, or estate planning. They can be purchased from insurance companies, banks, or other financial institutions.

Some annuities offer guaranteed periods of payments. Annuity 6 Guaranteed 2024 examines the implications of a six-year guaranteed annuity.

Key Characteristics of Annuities

Annuities have several key characteristics that distinguish them from other financial products:

- Regular Payments:Annuities provide a steady stream of payments, making them a reliable source of income.

- Guaranteed Payments:The payments from an annuity are typically guaranteed for a certain period of time, providing financial security.

- Longevity Protection:Annuities can provide protection against outliving your savings, ensuring that you have a consistent income stream even in your later years.

Types of Annuities

There are various types of annuities, each with its own features and benefits:

- Fixed Annuities:These annuities offer a guaranteed interest rate, providing predictable income payments.

- Variable Annuities:The interest rate on variable annuities is linked to the performance of a specific investment portfolio, offering the potential for higher returns but also greater risk.

- Immediate Annuities:Payments from an immediate annuity begin immediately after the purchase.

- Deferred Annuities:Payments from a deferred annuity start at a future date, allowing the investment to grow over time.

Benefits and Drawbacks of Annuities

Annuities can offer several benefits, but they also come with certain drawbacks:

- Benefits:

- Guaranteed income stream

- Longevity protection

- Tax-deferred growth (for some annuities)

- Drawbacks:

- Potential for lower returns compared to other investments

- Limited access to funds (in some cases)

- Fees and surrender charges

Calculating Annuity Payments

Calculating annuity payments involves determining the amount of each payment that will be received over a specified period. The calculation depends on several factors, including the principal amount, interest rate, and payment frequency.

Understanding the cash flows associated with an annuity is crucial for financial planning. Calculating Annuity Cash Flows 2024 provides guidance on how to determine these cash flows.

Formula for Annuity Payments

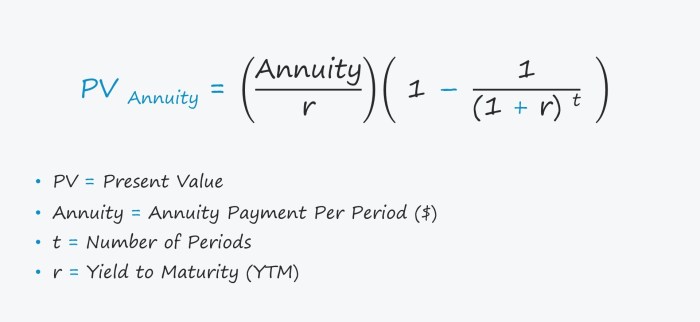

The formula for calculating annuity payments is:

PMT = PV

- (r / (1

- (1 + r)^-n))

Where:

- PMT = Payment amount

- PV = Present value (principal amount)

- r = Interest rate per period

- n = Total number of payment periods

Example of Annuity Calculation

Let’s say you have a principal amount of $100,000, an annual interest rate of 5%, and you want to receive monthly payments for 20 years. The calculation would be:

- PV = $100,000

- r = 5% / 12 = 0.4167% (monthly interest rate)

- n = 20 years – 12 months/year = 240 months

Using the formula, the monthly payment would be:

PMT = $100,000

Annuity contracts are complex, and understanding their intricacies can be challenging. If you’re wondering about the specifics of a contingent annuity in 2024, Annuity Contingent Is 2024 provides a helpful starting point.

- (0.004167 / (1

- (1 + 0.004167)^-240)) = $607.78

Varying Payment Frequencies

The frequency of payments can significantly impact the total amount received over the life of the annuity. More frequent payments, such as monthly payments, generally result in a higher total return due to the compounding effect of interest.

Calculating annuity payments can be complex, and tools like calculators can be helpful. Annuity Calculator Hmrc 2024 provides information on using HMRC’s annuity calculator.

Here’s a table comparing the total return for different payment frequencies, assuming a principal amount of $100,000, an annual interest rate of 5%, and a 20-year period:

| Payment Frequency | Total Payments Received | Total Interest Earned |

|---|---|---|

| Annually | $200,000 | $100,000 |

| Semi-annually | $205,000 | $105,000 |

| Quarterly | $207,500 | $107,500 |

| Monthly | $209,500 | $109,500 |

Impact of Different Payment Schedules: Calculate Annuity With Different Payments 2024

The frequency of payments has a significant impact on the growth of an annuity. More frequent payments generally lead to higher total returns due to the compounding effect of interest.

Annuity contracts are offered in various countries. Annuity Nz 2024 explores the specifics of annuities in New Zealand.

Monthly vs. Annually

Consider the example of two annuities with the same principal amount, interest rate, and time period, but different payment frequencies:

- Annuity A:Monthly payments

- Annuity B:Annual payments

Annuity A, with monthly payments, will experience more frequent compounding of interest. This means that interest is earned on the previous month’s interest, leading to faster growth. As a result, Annuity A will generally have a higher total return than Annuity B, despite having the same initial investment and interest rate.

Calculating annuity due payments involves specific formulas and considerations. Calculating Annuity Due Payment 2024 offers a guide to help you navigate this process.

Advantages and Disadvantages of Payment Frequencies

Different payment frequencies have their own advantages and disadvantages, depending on individual financial goals and circumstances:

- More Frequent Payments:

- Advantages:Higher total return due to compounding, greater cash flow flexibility.

- Disadvantages:May result in lower individual payments, potentially leading to higher taxes.

- Less Frequent Payments:

- Advantages:Higher individual payments, potentially lower taxes.

- Disadvantages:Lower total return due to less frequent compounding, less cash flow flexibility.

Factors Influencing Annuity Calculations

Several factors can affect annuity calculations and the overall value of an annuity over time. These factors include inflation, interest rate fluctuations, and fees.

Annuity contracts can have various payout periods. Annuity 5 Year Payout 2024 explores the specifics of a five-year payout annuity.

Inflation

Inflation erodes the purchasing power of money over time. If inflation is higher than the interest rate earned on an annuity, the real value of the payments received may decline. For example, if an annuity pays a 3% annual interest rate, but inflation is 4%, the purchasing power of the payments will decrease by 1% each year.

Interest Rate Fluctuations

Interest rates can fluctuate over time, affecting the value of an annuity. If interest rates rise, the value of an annuity may increase, but if interest rates fall, the value may decrease. This is particularly true for variable annuities, where the interest rate is linked to the performance of a specific investment portfolio.

Annuity payments are typically made from a dedicated account. If you’re curious about which account these payments come from in 2024, Annuity Is Which Account 2024 delves into this question.

Fees

Annuities typically come with various fees, such as administrative fees, surrender charges, and mortality and expense charges. These fees can reduce the overall return on an annuity. It’s important to carefully consider the fees associated with any annuity before making a purchase.

Annuity payments can be structured in various ways. Annuity Is Series 2024 explores the concept of an annuity series and its implications.

Strategies for Mitigating Impact

To mitigate the impact of these factors on annuity growth, consider the following strategies:

- Choose an annuity with a higher interest rate:This can help offset the effects of inflation.

- Consider a fixed annuity:Fixed annuities offer a guaranteed interest rate, providing protection against interest rate fluctuations.

- Negotiate lower fees:Shop around for annuities with lower fees to maximize your return.

Annuity Examples and Applications

Annuities can be used for various financial purposes, including retirement planning, income generation, and estate planning.

There are various types of annuities, each with its own characteristics. 7 Annuities 2024 highlights seven different annuity options to consider.

Retirement Planning

Annuities can provide a reliable stream of income during retirement, ensuring that you have financial security in your later years. They can help supplement other retirement savings, such as 401(k)s and IRAs.

Income Generation

Annuities can be used to generate a steady stream of income, which can be used for various purposes, such as paying bills, covering living expenses, or supplementing other income sources.

Estate Planning

Annuities can be used as part of an estate plan to provide for beneficiaries after your death. They can help ensure that your loved ones receive a consistent income stream, even after you are gone.

When considering annuities, you have a range of options to choose from. Annuity Options 2024 provides a detailed overview of the different types of annuities available.

Annuity Scenarios, Calculate Annuity With Different Payments 2024

Here’s a table showcasing different annuity scenarios with varying payment amounts and timeframes:

| Scenario | Principal Amount | Interest Rate | Payment Frequency | Payment Period | Monthly Payment |

|---|---|---|---|---|---|

| Scenario 1 | $100,000 | 5% | Monthly | 20 years | $607.78 |

| Scenario 2 | $250,000 | 4% | Quarterly | 15 years | $2,028.37 |

| Scenario 3 | $500,000 | 3% | Annually | 10 years | $60,187.39 |

Closure

By understanding the nuances of annuities and the impact of different payment schedules, you can make informed decisions that align with your financial goals. Whether you’re seeking a secure retirement income, a reliable stream of cash flow, or a way to protect your assets, annuities offer a range of possibilities.

Annuity investments can offer potential returns, and understanding interest rates is crucial. Annuity 8 Percent 2024 provides insights into the implications of an 8% return in 2024.

This guide provides a comprehensive overview of annuities, empowering you to navigate this complex financial landscape with confidence.

FAQ Summary

How do annuities work?

Annuities are financial products that provide a stream of regular payments over a specific period. You typically invest a lump sum or make regular contributions, and the insurer guarantees a stream of income in return.

What are the different types of annuities?

Annuities come in various types, including fixed annuities, variable annuities, immediate annuities, and deferred annuities. Each type has its own features, risks, and potential returns.

Are annuities a good investment?

Whether annuities are a good investment depends on your individual circumstances and financial goals. They can provide guaranteed income and protect against longevity risk, but they may have limitations and fees.

How do I choose the right annuity?

Choosing the right annuity involves considering your risk tolerance, investment goals, and time horizon. It’s essential to consult with a financial advisor to determine the most suitable annuity for your needs.