Calculate Growing Annuity Ba Ii Plus 2024: A Step-by-Step Guide explores the powerful capabilities of the BA II Plus calculator in handling growing annuities, a financial tool crucial for investment planning and retirement analysis. This guide dives into the core concepts of growing annuities, highlighting their differences from traditional annuities and providing practical examples of their real-world applications.

The age of 70 1/2 is a significant milestone for many individuals, especially when it comes to retirement planning. If you’re approaching this age in 2024 and have questions about annuities, you can find helpful information on Annuity 70 1/2 2024.

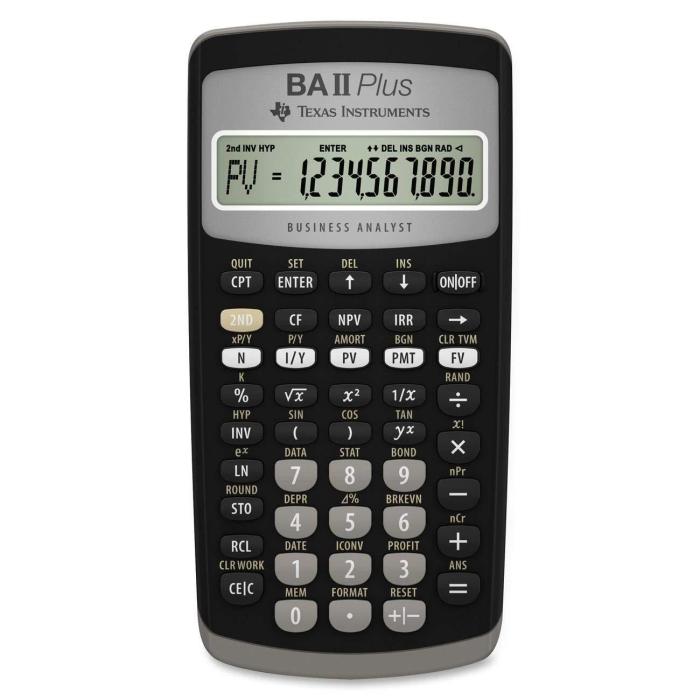

We’ll dissect the essential functions of the BA II Plus calculator, focusing on the specific keys and procedures required for calculating growing annuities. You’ll learn how to input the necessary variables, understand the underlying formula, and confidently execute calculations using the calculator’s intuitive interface.

Financial planning can be complex, and sometimes there’s uncertainty involved. If you’re facing uncertainty about your annuity in 2024, you might find helpful information on Annuity Uncertain 2024.

Contents List

Understanding Growing Annuities

A growing annuity is a series of payments that increase over time at a constant rate. This growth rate can be attributed to factors like inflation, investment returns, or salary increases. Growing annuities are a powerful financial tool that can help individuals plan for their future, especially when it comes to retirement planning and long-term investments.

Understanding the tax implications of your financial decisions is crucial. If you’re wondering if annuity payments are taxable in 2024, you can find out more by visiting Is Annuity Payments Taxable 2024.

Key Characteristics of a Growing Annuity

- Regular Payments:Like a regular annuity, a growing annuity involves a series of payments made at regular intervals. These payments could be monthly, quarterly, or annually.

- Growth Rate:The defining feature of a growing annuity is its growth rate. This rate determines the percentage increase in each subsequent payment.

- Discount Rate:The discount rate is used to calculate the present value of future payments. It represents the opportunity cost of investing money elsewhere.

Difference Between a Growing Annuity and a Regular Annuity

The key difference lies in the payment structure. While a regular annuity involves constant payments, a growing annuity features payments that increase over time. This growth factor adds complexity to the calculation, but also offers potential for greater returns.

Annuity payments can be structured in various ways, including a single sum. If you’re wondering if annuities can be paid out as a single sum in 2024, you can learn more by visiting Annuity Is A Single Sum 2024.

Real-World Scenarios

- Retirement Planning:Growing annuities can be used to model retirement income streams, accounting for expected inflation and investment growth.

- Investment Analysis:Investors can use growing annuities to evaluate the potential returns of investments that are expected to generate increasing cash flows.

- Loan Repayments:Growing annuities can be applied to calculate the repayment schedule for loans with increasing interest rates.

The BA II Plus Calculator

The BA II Plus calculator is a financial calculator widely used by professionals and students for various financial calculations, including growing annuities. Its user-friendly interface and comprehensive functions make it an ideal tool for handling complex financial scenarios.

Annuity bonds can be complex, but understanding their formula is essential for making informed financial decisions. If you’re looking for information about the formula for annuity bonds in 2024, you can find it on Formula Annuity Bond 2024.

Relevant Keys and Functions

- PV (Present Value):This key is used to input the present value of the annuity.

- FV (Future Value):This key is used to input the future value of the annuity, if applicable.

- PMT (Payment):This key is used to input the initial payment amount.

- N (Number of Periods):This key is used to input the total number of payments.

- I/Y (Interest Rate):This key is used to input the discount rate.

- G (Growth Rate):This key is used to input the growth rate of the annuity.

Inputting Variables

To calculate the present value of a growing annuity, you need to input the following variables into the BA II Plus calculator:

- PMT:The initial payment amount.

- N:The total number of payments.

- I/Y:The discount rate.

- G:The growth rate of the annuity.

Calculating Growing Annuities

Formula for Present Value

PV = PMT / (I/Y- G) – [1 – (1 + G / (1 + I/Y))^N]

The term “LIC” often comes up in discussions about annuities. If you’re curious about what it means and how it relates to annuities in 2024, you can find more information on Is Annuity Lic 2024.

Explanation of Variables

- PV:Present value of the growing annuity.

- PMT:Initial payment amount.

- I/Y:Discount rate.

- G:Growth rate of the annuity.

- N:Number of payments.

Step-by-Step Guide Using BA II Plus Calculator

- Clear the calculator:Press the [2nd] key, followed by the [CLR TVM] key.

- Input the variables:Enter the values for PMT, N, I/Y, and G using the corresponding keys.

- Calculate the present value:Press the [CPT] key, followed by the [PV] key. The calculator will display the present value of the growing annuity.

Examples and Applications

Table Illustrating Different Scenarios

| Scenario | Growth Rate (G) | Discount Rate (I/Y) | Number of Payments (N) | Initial Payment (PMT) | Present Value (PV) |

|---|---|---|---|---|---|

| Scenario 1 | 2% | 5% | 10 | $1,000 | $8,110.89 |

| Scenario 2 | 3% | 6% | 15 | $2,000 | $21,888.93 |

| Scenario 3 | 4% | 7% | 20 | $5,000 | $63,782.59 |

Financial Planning

Growing annuities can be used to model future income streams for retirement planning. By incorporating expected inflation and investment growth, individuals can estimate their required savings and plan for a comfortable retirement.

Chapter 9 of the Bankruptcy Code can impact financial products like annuities. If you’re interested in learning more about how Chapter 9 applies to annuities in 2024, you can check out Chapter 9 Annuities 2024.

Investment Analysis, Calculate Growing Annuity Ba Ii Plus 2024

Investors can use growing annuities to evaluate the potential returns of investments that are expected to generate increasing cash flows. By comparing the present value of a growing annuity to the initial investment, investors can determine the potential profitability of an investment.

When planning for the future, it’s important to consider how your assets will be distributed. If you’re considering using a trust as the beneficiary of your annuity in 2024, you can learn more about this option by visiting Annuity Beneficiary Is A Trust 2024.

Retirement Planning

Growing annuities can be a valuable tool for retirement planning. By modeling future income streams that account for inflation and investment growth, individuals can ensure that their retirement savings will provide adequate income for their needs.

The decision to get an annuity is a big one, and it’s natural to want to know if it’s the right choice for you. If you’re considering an annuity in 2024, you might want to read Is Getting An Annuity Worth It 2024 to get a better understanding of the pros and cons.

Advantages and Disadvantages

- Advantages:

- Potential for higher returns due to growth factor.

- Can help with long-term financial planning.

- Can be used to model various financial scenarios.

- Disadvantages:

- Calculations can be complex.

- Growth rate assumptions may not always be accurate.

- Requires careful planning and monitoring.

Advanced Concepts: Calculate Growing Annuity Ba Ii Plus 2024

Perpetuities

A perpetuity is a type of annuity that continues indefinitely. Growing perpetuities are a special case where the payments increase at a constant rate forever. The formula for calculating the present value of a growing perpetuity is:

PV = PMT / (I/Y- G)

Annuity payments can be a valuable source of income for many individuals, but it’s important to understand how they are taxed. If you’re curious about the tax implications of annuity payments in 2024, you can learn more by visiting Is Annuity Income 2024.

Impact of Inflation

Inflation can significantly impact growing annuity calculations. When inflation is high, the real value of future payments decreases, reducing the present value of the annuity. To account for inflation, you can use a real discount rate, which adjusts the nominal discount rate for inflation.

Annuity payments are often a significant source of income for retirees. If you’re wondering if these payments are subject to RMDs in 2024, you’re not alone. To learn more about the specifics of RMDs and annuities, you can visit Is Annuity Subject To Rmd 2024.

Sensitivity Analysis

Sensitivity analysis is a technique used to evaluate the impact of changing variables on the present value of a growing annuity. By varying the growth rate, discount rate, or number of payments, you can assess the sensitivity of the present value to these changes.

This can help you understand the risks and uncertainties associated with growing annuities.

Last Recap

By mastering the art of calculating growing annuities with the BA II Plus calculator, you gain a valuable tool for financial decision-making. This guide has equipped you with the knowledge and practical skills to confidently analyze investment strategies, plan for retirement, and navigate the complexities of growing annuities.

If you’re wondering who the owner of an annuity is in 2024, you’re not alone. It’s a common question, especially when it comes to financial planning. You can find out more about Annuity Owner Is 2024 to get a better understanding of who owns the annuity and their rights.

Remember, the BA II Plus calculator is a powerful ally in your financial journey, empowering you to make informed decisions based on accurate calculations.

FAQ Explained

What are the benefits of using a growing annuity?

Growing annuities offer the potential for higher returns due to the built-in growth factor. They can also help you keep pace with inflation and provide a steady stream of income over time.

How does the growth rate affect the present value of a growing annuity?

A higher growth rate generally leads to a higher present value, as the future cash flows are expected to grow at a faster pace.

Are there any limitations to using a growing annuity?

Growing annuities can be complex to understand and may require professional financial advice. Additionally, the growth rate is not guaranteed and may be affected by market conditions.

Many people want to know if annuities are guaranteed in 2024. This is a valid concern, as financial markets can be unpredictable. If you’re seeking peace of mind, you might want to check out the article on Is Annuity Guaranteed 2024 to learn more about the guarantees associated with annuities.

Annuity options can vary depending on your location. If you’re in New Zealand and have questions about annuities in 2024, you can find information on Annuity Nz 2024.

Sometimes, there are penalties associated with withdrawing funds from an annuity early. If you’re considering withdrawing from an annuity in 2024, you might want to check out Annuity 10 Penalty 2024 to understand any potential penalties.