Calculate Growing Annuity In Excel 2024 takes center stage, offering a practical guide to understanding and calculating growing annuities using the powerful tools available in Microsoft Excel. Growing annuities, a financial concept where periodic payments increase over time, are commonly used in financial planning, investment analysis, and retirement planning.

An annuity is not a loan in the traditional sense. However, it can be structured to provide a stream of payments similar to a loan. You can learn more about how an annuity can be like a loan in 2024 to understand the different aspects of this financial product.

This guide will demystify the complexities of growing annuities by providing a clear and concise explanation of the underlying concepts, along with step-by-step instructions on how to use Excel functions to calculate their present value. Whether you are a financial professional or an individual seeking to understand the intricacies of long-term financial planning, this guide will equip you with the knowledge and skills to effectively utilize growing annuities in your financial decision-making.

We will begin by defining growing annuities and exploring their key characteristics. This will be followed by a detailed explanation of the formula used to calculate the present value of a growing annuity, along with a breakdown of each variable and its significance.

Next, we will delve into the world of Excel functions specifically designed for growing annuities, demonstrating their application with real-world examples. Building upon this foundation, we will construct an Excel spreadsheet model to calculate the present value of a growing annuity, incorporating clear labels and formulas for ease of understanding and use.

Rolling over your 401(k) into an annuity can be a strategic move for your retirement savings. If you’re considering this option, it’s helpful to understand the process and potential benefits. You can learn more about annuity 401(k) rollovers in 2024 to make an informed decision.

Finally, we will explore the impact of various growth rates and other variables on the present value of a growing annuity, providing insights into the sensitivity of this financial instrument to changes in key parameters. By the end of this guide, you will have a comprehensive understanding of growing annuities and the ability to confidently calculate their present value using Excel.

Contents List

- 1 Understanding Growing Annuities

- 2 Formula for Calculating a Growing Annuity

- 3 Excel Functions for Growing Annuities

- 4 Building a Growing Annuity Model in Excel

- 5 Analyzing Growing Annuities in Excel

- 6 Applications of Growing Annuities in Finance

- 7 Final Review: Calculate Growing Annuity In Excel 2024

- 8 Key Questions Answered

Understanding Growing Annuities

A growing annuity is a series of payments that increase over time at a constant rate. This type of annuity is often used in financial planning, investment analysis, and retirement planning, as it allows for the growth of payments to keep pace with inflation or other economic factors.

Defining a Growing Annuity

A growing annuity is characterized by the following features:

- A series of regular payments

- Payments that increase at a constant rate over time

- A fixed time period over which the payments are made

Growing Annuity vs. Regular Annuity

The key difference between a growing annuity and a regular annuity is that the payments in a growing annuity increase over time, while the payments in a regular annuity remain constant. This difference can have a significant impact on the present value and future value of the annuity.

An annuity is a financial product that provides a series of equal payments over time. To understand the basics, you can learn more about an annuity being a series of equal payments in 2024. This can be a useful tool for retirement planning, income generation, or other financial needs.

Examples of Growing Annuities

Here are some examples of real-world applications of growing annuities:

- Retirement planning:Many retirement plans offer growing annuities, where the payments increase each year to keep pace with inflation. This ensures that retirees can maintain their standard of living in retirement.

- Investment analysis:Growing annuities can be used to model the cash flows from investments that are expected to generate increasing returns over time.

- Loan payments:Some loans, such as mortgages, have growing payments, where the principal and interest payments increase over time.

Formula for Calculating a Growing Annuity

The present value (PV) of a growing annuity can be calculated using the following formula:

PV = PMT / (r

Receiving a monthly annuity payment of $10,000 could provide a significant source of income for retirement or other financial needs. If you’re interested in exploring this option, you can learn more about an annuity that pays $10,000 per month in 2024 to see if it’s a good fit for your situation.

- g)

- [1

- (1 + g / (1 + r))^n]

Where:

- PMT = The first payment amount

- r = The discount rate or interest rate

- g = The growth rate of the payments

- n = The number of periods

Step-by-Step Calculation

To calculate the present value of a growing annuity, follow these steps:

- Determine the first payment amount (PMT).

- Determine the discount rate or interest rate (r).

- Determine the growth rate of the payments (g).

- Determine the number of periods (n).

- Plug the values into the formula and solve for PV.

Excel Functions for Growing Annuities

Excel provides several functions that can be used to calculate the present value and future value of a growing annuity.

If you’re considering setting up a trust as the beneficiary of your annuity, there are some key things to understand. You can learn more about an annuity beneficiary being a trust in 2024 to ensure that your wishes are carried out.

PV Function

The PV function calculates the present value of a series of payments. To use the PV function for a growing annuity, you need to specify the growth rate in the “rate” argument. For example, to calculate the present value of a growing annuity with a payment of $100, a discount rate of 5%, a growth rate of 2%, and a term of 10 years, you would use the following formula:

=PV(5%-2%,10,100)

An annuity can be a good investment for some people, but it’s not right for everyone. To determine if an annuity is a good investment for you, it’s important to consider your financial goals, risk tolerance, and other factors.

You can find out more about whether an annuity is a good investment in 2024 to make an informed decision.

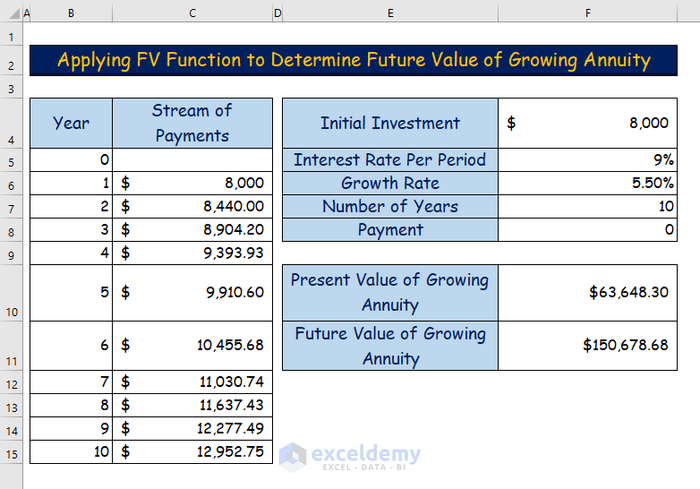

FV Function

The FV function calculates the future value of a series of payments. To use the FV function for a growing annuity, you need to specify the growth rate in the “rate” argument. For example, to calculate the future value of a growing annuity with a payment of $100, a discount rate of 5%, a growth rate of 2%, and a term of 10 years, you would use the following formula:

=FV(5%-2%,10,100)

When you inherit an annuity, it can become a valuable asset. However, there are some important things to consider. You can find out more about what happens when you inherit an annuity in 2024 , including the potential tax implications.

Comparison of Functions

The PV and FV functions can be used to calculate the present value and future value of a growing annuity, respectively. The choice of function depends on the specific scenario and the information available.

Building a Growing Annuity Model in Excel

To create an Excel spreadsheet to calculate the present value of a growing annuity, you can organize the spreadsheet with clear labels and formulas.

The “59 1/2 rule” applies to many retirement accounts, including annuities. It’s important to understand how this rule applies to your situation. You can find out more about the annuity 59 1/2 rule in 2024 to avoid potential penalties.

Spreadsheet Structure

The spreadsheet can be organized as follows:

| Cell | Label | Formula |

|---|---|---|

| A1 | First Payment (PMT) | $100 |

| A2 | Discount Rate (r) | 5% |

| A3 | Growth Rate (g) | 2% |

| A4 | Number of Periods (n) | 10 |

| A5 | Present Value (PV) | =PV(A2-A3,A4,A1) |

Inputting Data and Interpreting Results

You can input the values for the first payment, discount rate, growth rate, and number of periods into the spreadsheet. The spreadsheet will then calculate the present value of the growing annuity. You can use the spreadsheet to analyze the impact of different growth rates and discount rates on the present value of the annuity.

Analyzing Growing Annuities in Excel

By using an Excel spreadsheet, you can analyze the impact of different growth rates, discount rates, and time periods on the present value of a growing annuity.

Whether an annuity is good or bad for you depends on your individual financial goals and circumstances. It’s important to weigh the pros and cons before making a decision. You can learn more about whether an annuity is good or bad in 2024 to determine if it’s right for you.

Impact of Growth Rate

The growth rate has a significant impact on the present value of a growing annuity. As the growth rate increases, the present value also increases. This is because the payments are growing at a faster rate, making them more valuable in today’s dollars.

Sensitivity to Changes

The present value of a growing annuity is also sensitive to changes in the discount rate and the time period. As the discount rate increases, the present value decreases. This is because the future payments are being discounted at a higher rate, making them less valuable in today’s dollars.

As the time period increases, the present value also increases, as there are more payments in the annuity.

Scenario Analysis

You can use the spreadsheet to analyze different scenarios with different growth rates, discount rates, and time periods. This can help you to understand the impact of different assumptions on the present value of a growing annuity.

An annuity joint life option can be a good choice for couples who want to ensure that their income stream continues even after one spouse passes away. You can read more about annuity joint life options in 2024 to see if it might be right for you.

This type of annuity typically pays out until the last surviving spouse passes away.

Applications of Growing Annuities in Finance

Growing annuities have numerous applications in finance, including financial planning, investment analysis, and retirement planning.

When comparing annuities to 401(k)s, there are advantages and disadvantages to each. To determine which option is better for you, it’s important to consider your individual circumstances and goals. You can learn more about whether an annuity is better than a 401(k) in 2024 to make a well-informed decision.

Financial Planning

Growing annuities can be used to model the future cash flows from financial plans, such as retirement plans and college savings plans. By assuming a growth rate for the payments, financial planners can estimate the future value of these plans and ensure that they are on track to meet their financial goals.

Required Minimum Distributions (RMDs) are a factor to consider when it comes to annuities. You can learn more about whether an annuity is subject to RMDs in 2024 to understand how they might affect your retirement planning.

Investment Analysis

Growing annuities can be used to analyze the cash flows from investments that are expected to generate increasing returns over time. By using a growing annuity model, investors can estimate the present value of these investments and make informed investment decisions.

Annuities can provide a consistent stream of income, making them a good option for those seeking fixed income. You can learn more about whether an annuity is fixed income in 2024 to see if it aligns with your financial needs.

Retirement Planning, Calculate Growing Annuity In Excel 2024

Growing annuities are commonly used in retirement planning to model the future cash flows from retirement plans, such as pensions and 401(k)s. By assuming a growth rate for the payments, retirees can estimate their future income and plan for their retirement expenses.

Benefits and Limitations

Growing annuities offer several benefits, such as the ability to model the growth of payments and the flexibility to adjust the growth rate. However, there are also limitations, such as the difficulty in predicting future growth rates and the sensitivity of the present value to changes in the growth rate and discount rate.

An annuity is a financial product that provides a series of regular payments, often for a set period of time. To understand how this works, you can learn more about an annuity being a series of equal periodic payments in 2024.

These payments can be used for retirement income, to cover expenses, or even to provide financial security for loved ones.

Final Review: Calculate Growing Annuity In Excel 2024

By understanding the intricacies of growing annuities and mastering the techniques presented in this guide, you will be equipped to effectively analyze and manage your long-term financial goals. The ability to calculate the present value of a growing annuity, using Excel’s powerful tools, will empower you to make informed financial decisions that align with your individual needs and aspirations.

The tax treatment of an inherited annuity can vary depending on the type of annuity and your individual circumstances. It’s helpful to understand how an inherited annuity is taxed in 2024 to plan accordingly.

Whether you are planning for retirement, investing in a growing business, or simply seeking to understand the dynamics of long-term financial growth, the knowledge gained from this guide will serve as a valuable asset in your financial journey.

Key Questions Answered

What are the main differences between a regular annuity and a growing annuity?

A regular annuity has fixed payments over time, while a growing annuity has payments that increase at a constant rate. This growth rate can be due to inflation, investment returns, or other factors.

What is the significance of the growth rate in a growing annuity?

The growth rate plays a crucial role in determining the present value of a growing annuity. A higher growth rate generally results in a higher present value, reflecting the future appreciation of the payments.

How does the interest rate affect the present value of a growing annuity?

The interest rate has an inverse relationship with the present value of a growing annuity. A higher interest rate typically leads to a lower present value, as the future payments are discounted at a higher rate.