Calculating A Deferred Annuity 2024: A Comprehensive Guide delves into the world of deferred annuities, providing a detailed exploration of their mechanics, advantages, and considerations. This guide is designed to equip individuals with the knowledge needed to make informed decisions about deferred annuities, a financial tool that can play a significant role in long-term financial planning.

Deferred annuities are contracts that allow individuals to accumulate funds over time and receive regular payments at a later date. They offer a range of features and options, making them a versatile tool for retirement planning, estate planning, and other financial goals.

This guide will cover the key aspects of deferred annuities, including their types, investment options, tax implications, and how to choose the right annuity for your specific needs.

The Bengali meaning of “annuity” can be helpful to understand if you’re looking for information on this financial product in that language. This article on Annuity Is Bengali Meaning 2024 might be a good place to start.

Contents List

Understanding Deferred Annuities

Deferred annuities are financial instruments that provide a stream of income payments at a future date, typically after a specified period of time. These annuities are designed to help individuals plan for retirement, fund college education, or achieve other long-term financial goals.

An annuity payment is a regular payment you receive from an annuity. You can find more information about annuity payments in this article on Annuity Is Payment 2024.

Defining Deferred Annuities and Their Purpose

A deferred annuity is a contract between an individual and an insurance company, where the individual makes regular payments or a lump sum payment to the insurance company in exchange for a guaranteed stream of income payments at a later date.

This period between making payments and receiving income is known as the “accumulation period.” The purpose of a deferred annuity is to provide a source of income for individuals during their retirement years or other future financial needs.

Comparing Deferred Annuities with Immediate Annuities

Deferred annuities differ from immediate annuities in the timing of income payments. In an immediate annuity, the income payments begin immediately after the purchase, while in a deferred annuity, the income payments are delayed until a future date.

Calculating the present value of an annuity can be helpful for making financial decisions. If you need to learn how to calculate the present value of an annuity, you can check out this article on Calculating Annuity Present Value 2024.

- Immediate Annuity:Payments begin immediately after purchase.

- Deferred Annuity:Payments are delayed until a future date.

Advantages and Disadvantages of Deferred Annuities

Deferred annuities offer several advantages, but also come with some drawbacks.

A 30-day free look period is a common feature of annuities. This allows you to cancel the annuity without penalty if you’re not satisfied. You can find more information about this feature in this article on Annuity 30 Day Free Look 2024.

- Advantages:

- Tax-deferred growth of investment earnings.

- Guaranteed income stream for the future.

- Potential for higher returns compared to traditional savings accounts.

- Flexibility in choosing payment options.

- Disadvantages:

- Limited access to funds during the accumulation period.

- Potential for lower returns than other investment options.

- High surrender charges for early withdrawals.

- Complexity of annuity contracts.

Key Features of Deferred Annuities

Deferred annuities come with various features that impact their performance and suitability for different individuals.

Types of Deferred Annuities

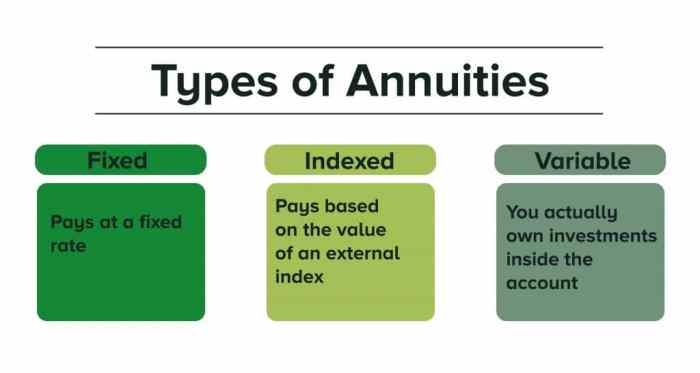

Deferred annuities are available in several variations, each with its own unique characteristics.

An annuity of $250,000 can provide a significant amount of income. If you’re interested in learning more about annuities of this size, you can check out this article on Annuity 250k 2024.

- Fixed Annuities:Offer a guaranteed rate of return, providing predictable income payments.

- Variable Annuities:Offer the potential for higher returns, but also carry investment risk.

- Indexed Annuities:Link their returns to a specific index, such as the S&P 500, offering potential growth with some downside protection.

Accumulation Period and Payout Period

The accumulation period refers to the time when contributions are made to the annuity contract. During this period, the funds grow tax-deferred, allowing for potential compounding of earnings. The payout period is the time when the individual begins receiving income payments from the annuity.

Annuity is primarily used to provide a steady stream of income during retirement. If you’re curious about how annuities can help you plan for your future, take a look at this article on An Annuity Is Primarily Used To Provide 2024.

Investment Options within Deferred Annuities

Deferred annuities often offer various investment options within the contract, allowing individuals to tailor their investment strategy.

Choosing between an annuity and a lump sum can be a difficult decision. To learn more about the advantages and disadvantages of each option, you can check out this article on Annuity Or Lump Sum 2024.

- Fixed-income investments:Bonds, CDs, and other debt instruments.

- Equity investments:Stocks and mutual funds.

- Real estate investments:REITs and other real estate-related investments.

Calculating Deferred Annuity Payments

The amount of deferred annuity payments depends on several factors.

Factors Influencing Deferred Annuity Payments

- Amount of contributions:The larger the contributions, the higher the annuity payments.

- Accumulation period:The longer the accumulation period, the higher the annuity payments.

- Interest rate:Higher interest rates result in higher annuity payments.

- Payment frequency:More frequent payments generally result in lower individual payments.

- Annuity type:Different types of annuities, such as fixed, variable, or indexed, have different payment structures.

Step-by-Step Guide to Calculating Deferred Annuity Payments

Calculating deferred annuity payments requires specific information, including the amount of contributions, the accumulation period, and the interest rate.

Calculating annuity cash flows can help you understand the financial implications of an annuity. If you’re interested in learning how to calculate annuity cash flows, you can check out this article on Calculating Annuity Cash Flows 2024.

- Determine the future value of the contributions:This involves using a compound interest formula to calculate the growth of contributions over the accumulation period.

- Select an annuity payment option:Choose the desired payment frequency and duration.

- Apply the annuity formula:The annuity formula calculates the periodic payment amount based on the future value of contributions, the chosen payment frequency, and the interest rate.

Impact of Interest Rates on Annuity Payouts

Interest rates play a significant role in determining annuity payouts. Higher interest rates generally lead to higher annuity payments, as the funds grow at a faster pace during the accumulation period.

Annuity lotteries are a way to win a guaranteed income stream. If you’re interested in learning more about these types of lotteries, you can check out this article on Annuity Lottery 2024.

Tax Considerations for Deferred Annuities

Deferred annuities have unique tax implications that individuals should consider before purchasing.

Tax Implications During Accumulation and Payout Phases

- Accumulation Phase:Earnings on contributions grow tax-deferred, meaning taxes are not paid until the funds are withdrawn during the payout phase.

- Payout Phase:Income payments received from the annuity are generally taxed as ordinary income. However, the portion of the payment that represents the original contributions is not taxed.

Potential Tax Advantages of Deferred Annuities, Calculating A Deferred Annuity 2024

- Tax-deferred growth:Allows for potential compounding of earnings without immediate tax liability.

- Tax-efficient income:Payments are taxed as ordinary income, but the original contributions are not taxed.

Deferred Annuity Contract Components

Deferred annuity contracts contain essential terms and conditions that individuals should carefully review before purchasing.

Key Components of a Deferred Annuity Contract

The contract Artikels the rights and responsibilities of both the individual and the insurance company.

Deciding whether an annuity is a good idea for you depends on your individual circumstances. You can find more information about the pros and cons of annuities in this article on Annuity Is It A Good Idea 2024.

| Component | Description |

|---|---|

| Annuitization Option | The option to receive income payments for life or for a specified period of time. |

| Death Benefit | The amount payable to the beneficiary upon the annuitant’s death. |

| Surrender Charges | Fees charged for withdrawing funds from the annuity before a specified period. |

| Interest Rate Guarantee | The guaranteed minimum rate of return on the annuity. |

| Investment Options | The range of investment options available within the annuity contract. |

Importance of Reviewing the Contract

It is crucial to carefully review the deferred annuity contract before purchasing to understand the terms and conditions, including fees, charges, and limitations. Consulting with a financial advisor can help individuals understand the contract and make an informed decision.

Annuity is a financial product that provides regular payments over a period of time. You can find out more about how annuities work by checking out this article on Annuity Is A Mcq 2024.

Choosing the Right Deferred Annuity

Selecting the right deferred annuity requires careful consideration of individual needs, financial goals, and risk tolerance.

Joint ownership of an annuity means that two or more people can share in the benefits. To learn more about joint ownership of annuities, you can check out this article on Annuity Joint Ownership 2024.

Factors to Consider When Selecting a Deferred Annuity

- Financial goals:What are the intended uses of the annuity, such as retirement income or college savings?

- Risk tolerance:How much risk are you willing to take with your investment?

- Time horizon:How long do you plan to invest in the annuity?

- Investment options:What investment options are available within the annuity contract?

- Fees and charges:What fees and charges are associated with the annuity?

Comparing Annuity Providers and Offerings

It is essential to compare different annuity providers and their offerings before making a decision. Factors to consider include:

- Financial strength:The financial stability of the insurance company.

- Customer service:The quality of customer support and responsiveness.

- Contract terms:The specific terms and conditions of the annuity contract.

- Investment options:The range of investment options available.

- Fees and charges:The fees and charges associated with the annuity.

Recommendations for Choosing an Annuity

Choosing a deferred annuity that aligns with individual needs and goals is essential. Consulting with a financial advisor can help individuals make an informed decision and select an annuity that meets their specific requirements.

Quizlet is a popular learning platform that can help you understand different financial concepts, including annuities. You can find resources on annuities on Quizlet by checking out this article on An Annuity Is Quizlet 2024.

End of Discussion: Calculating A Deferred Annuity 2024

In conclusion, understanding the intricacies of deferred annuities is crucial for anyone seeking to maximize their long-term financial well-being. This guide has provided a comprehensive overview of the key elements involved in calculating and managing deferred annuities. By carefully considering the factors discussed, individuals can make informed decisions about how to utilize this financial tool to achieve their financial objectives.

A perpetual annuity is a type of annuity that pays out indefinitely. To learn more about this type of annuity, you can check out this article on Annuity Is Perpetual 2024.

Question Bank

What is the difference between a deferred annuity and an immediate annuity?

A deferred annuity provides payments at a future date, while an immediate annuity starts paying out immediately after purchase.

How do I choose the right deferred annuity?

Consider your financial goals, risk tolerance, and time horizon. Compare annuity providers and their offerings to find the best fit.

What are the tax advantages of deferred annuities?

Deferred annuities offer tax-deferred growth, meaning earnings are not taxed until withdrawal.

Annuity rates in the UK can vary depending on factors like your age and health. To see what rates are currently available, you can check out this resource on Annuity Rates Uk 2024.

Can I withdraw funds from a deferred annuity before the payout period?

Yes, but early withdrawals may be subject to penalties and taxes.

How often are annuity payments made?

Payments can be made monthly, quarterly, annually, or in a lump sum.