Calculating An Annuity In Excel 2024 empowers you to manage your financial future with confidence. Annuities, a series of regular payments, play a crucial role in various financial strategies, from retirement planning to loan amortization. This guide delves into the fundamentals of annuities, explores their applications, and equips you with the Excel skills needed to calculate and visualize their impact.

Before committing to an annuity, it’s essential to understand its present value. Learn how to calculate an annuity’s present value to make informed financial decisions.

Understanding the time value of money is key when working with annuities. Excel provides powerful tools to analyze the present and future value of these payments, allowing you to make informed financial decisions. Whether you’re seeking to project your retirement income or understand the true cost of a loan, mastering annuity calculations in Excel is an invaluable skill.

Contents List

Understanding Annuities

An annuity is a series of equal payments made over a specified period of time. Annuities are commonly used in financial planning, especially for retirement savings and loan amortization. Understanding the concept of annuities is crucial for making informed financial decisions.

Key Components of an Annuity

An annuity has several key components:

- Payment Amount:The fixed amount of money paid out at regular intervals.

- Payment Frequency:The time interval between payments (e.g., monthly, quarterly, annually).

- Number of Payments:The total number of payments made over the annuity’s term.

- Interest Rate:The rate of return earned on the annuity’s principal.

Types of Annuities

Annuities can be categorized into different types based on the timing of payments:

- Ordinary Annuity:Payments are made at the end of each period.

- Annuity Due:Payments are made at the beginning of each period.

Time Value of Money and Annuities

The time value of money concept is fundamental to understanding annuities. It states that money received today is worth more than the same amount of money received in the future due to the potential for earning interest. Annuities take this concept into account by considering the present value and future value of the payments.

Annuity Formulas in Excel

Excel provides powerful functions for calculating the present value (PV) and future value (FV) of an annuity. These formulas help us determine the current value of a stream of future payments or the total amount accumulated at a future point in time.

Present Value of an Annuity

The present value (PV) of an annuity is the current worth of a series of future payments. The Excel formula for calculating PV is:

=PV(rate, nper, pmt, [fv], [type])

The tax implications of an annuity can be complex. Explore how annuities are taxed to understand their financial impact.

Where:

- rate:The interest rate per period.

- nper:The total number of payment periods.

- pmt:The payment amount per period.

- fv:The future value (optional). This is the value of the annuity at the end of the payment period.

- type:(optional) Specifies whether payments are made at the beginning (1) or end (0) of each period.

Future Value of an Annuity

The future value (FV) of an annuity is the total amount accumulated at the end of the annuity’s term. The Excel formula for calculating FV is:

=FV(rate, nper, pmt, [pv], [type])

Where:

- rate:The interest rate per period.

- nper:The total number of payment periods.

- pmt:The payment amount per period.

- pv:The present value (optional). This is the value of the annuity at the beginning of the payment period.

- type:(optional) Specifies whether payments are made at the beginning (1) or end (0) of each period.

Annuity Formulas in a Table

| Formula | Description | Parameters |

|---|---|---|

| =PV(rate, nper, pmt, [fv], [type]) | Present Value of an Annuity | rate, nper, pmt, [fv], [type] |

| =FV(rate, nper, pmt, [pv], [type]) | Future Value of an Annuity | rate, nper, pmt, [pv], [type] |

Practical Applications of Annuities in Excel: Calculating An Annuity In Excel 2024

Annuities have a wide range of practical applications in finance. They are used for retirement planning, loan amortization, and various other financial calculations.

Annuity options are available for 401(k) plans. Discover more about annuities within 401(k) plans and their benefits.

Retirement Planning

Annuities are often used in retirement planning to calculate the amount of savings needed to generate a desired income stream during retirement. By using Excel’s annuity functions, individuals can estimate the future value of their retirement savings or determine the amount of regular payments they can expect to receive from an annuity.

The annuity rate is a crucial factor to consider. Explore information on annuity rates to make informed decisions.

Loan Amortization

Annuities are also used to calculate loan amortization schedules. By applying the annuity formulas, we can determine the monthly payments, the total interest paid over the loan’s term, and the remaining principal balance at any point in time.

Example: Calculating a Retirement Annuity

Let’s say you want to retire in 20 years and have a goal of receiving $5,000 per month in retirement income for 25 years. Assuming an average annual return of 6%, we can use Excel to calculate the amount you need to save today.

1. Open a new Excel spreadsheet.

2. In cell A1, enter “Rate”.

To understand the financial implications of an annuity, it’s important to calculate its cash flows. Learn how to calculate annuity cash flows and make informed decisions.

3. In cell B1, enter “Nper”.

If you need to roll over an annuity within a specific timeframe, a 60-day rollover might be necessary. Learn more about 60-day annuity rollovers and their rules.

4. In cell C1, enter “Pmt”.

For guaranteed income for a specific period, a 20-year certain annuity might be suitable. You can find information about 20-year certain annuities and their features.

5. In cell A2, enter “0.06/12” (this represents the monthly interest rate).

Annuity rates can vary depending on the term. Get insights into 3-year annuity rates and how they compare to other options.

6. In cell B2, enter “25*12” (this represents the total number of months in retirement).

7. In cell C2, enter “-5000” (this represents the monthly payment, negative because it’s an outflow).

A contingent annuity provides income based on a specific event. Learn more about contingent annuities and how they can be used in financial planning.

8. In cell D2, enter “=PV(A2, B2, C2)”.

A $75,000 annuity can provide a steady stream of income. Explore information about $75,000 annuities and their potential benefits.

The result in cell D2 will be the present value of the annuity, which is the amount you need to save today to achieve your retirement goal.

Annuity Calculation Table

| Year | Beginning Balance | Payment | Interest | Ending Balance |

|---|---|---|---|---|

| 1 | $1,000,000 | -$50,000 | $60,000 | $1,010,000 |

| 2 | $1,010,000 | -$50,000 | $60,600 | $1,020,600 |

| 3 | $1,020,600 | -$50,000 | $61,236 | $1,031,836 |

Advanced Annuity Calculations in Excel

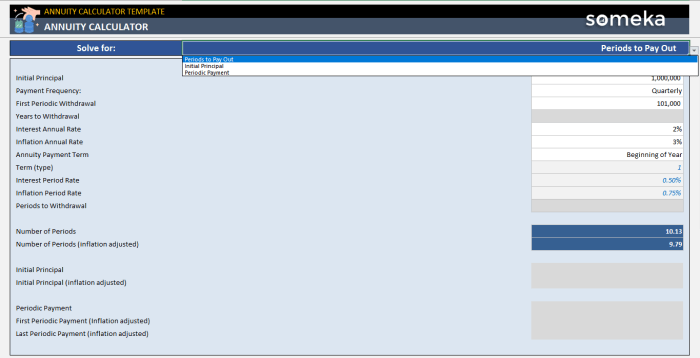

Excel provides a range of functions for performing more complex annuity calculations. These functions allow us to incorporate factors such as inflation, taxes, and variable interest rates.

Using Excel Functions

- PV:Calculates the present value of an annuity.

- FV:Calculates the future value of an annuity.

- PMT:Calculates the payment amount for an annuity.

- RATE:Calculates the interest rate for an annuity.

Incorporating Inflation and Taxes

Inflation can significantly impact the purchasing power of future payments. By adjusting the interest rate for inflation, we can obtain a more accurate estimate of the real return on an annuity. Similarly, taxes can reduce the actual amount of income received from an annuity.

By factoring in taxes, we can account for their impact on the overall value of the annuity.

Understanding the concept of an annuity in Hindi can be helpful. Explore the meaning of annuity in Hindi for a better grasp of this financial product.

Comparing Annuity Calculations with Varying Assumptions

To understand the impact of different assumptions on annuity calculations, we can create a table that compares the results for various interest rates, inflation rates, and tax scenarios. This allows us to see how changes in these factors affect the present value, future value, and payment amounts.

If you’re looking for an annuity with a substantial payout, you might consider a $600,000 annuity. Learn more about annuities with a $600,000 payout and their features.

Annuity Calculation Table with Varying Assumptions, Calculating An Annuity In Excel 2024

| Scenario | Interest Rate | Inflation Rate | Tax Rate | Present Value | Future Value | Payment |

|---|---|---|---|---|---|---|

| 1 | 5% | 2% | 15% | $1,000,000 | $2,653,297 | $45,000 |

| 2 | 6% | 2% | 15% | $1,000,000 | $3,207,135 | $50,000 |

| 3 | 7% | 2% | 15% | $1,000,000 | $3,814,697 | $55,000 |

Visualizing Annuity Results in Excel

Visualizing annuity calculations can provide valuable insights into trends and patterns. Charts and graphs can help us understand the growth of an annuity over time, the impact of different assumptions, and the relationship between key variables.

If you need access to your annuity funds before retirement, a hardship withdrawal might be an option. Learn more about hardship withdrawals from annuities and their requirements.

Creating Charts and Graphs

Excel offers a wide range of chart types that can be used to visualize annuity data. Some common chart types include:

- Line Chart:Shows the growth of an annuity over time.

- Bar Chart:Compares the present value, future value, and payment amounts for different scenarios.

- Pie Chart:Illustrates the breakdown of an annuity’s value into different components (e.g., principal, interest, taxes).

Importance of Visual Aids

Visual aids can help us:

- Identify trends and patterns in annuity calculations.

- Compare different scenarios and assumptions.

- Communicate complex financial information in a clear and concise manner.

Examples of Annuity Charts

A line chart can show the growth of an annuity over time, highlighting the impact of interest and compounding. A bar chart can compare the present value, future value, and payment amounts for different scenarios, demonstrating the effects of varying interest rates or inflation.

Annuity drawdown is a popular strategy, but it’s important to understand how it works. Check out this guide on annuity drawdown to see if it’s right for you.

A pie chart can illustrate the breakdown of an annuity’s value into different components, such as principal, interest, and taxes.

Epilogue

From basic calculations to advanced scenarios incorporating inflation and taxes, Excel provides a comprehensive platform for exploring the nuances of annuities. By leveraging its functions and visualization tools, you can gain a deeper understanding of your financial goals and make informed choices to achieve them.

So, embrace the power of Excel and unlock the potential of annuities in your financial journey.

FAQ Summary

What are the limitations of using Excel for annuity calculations?

While Excel is powerful, it might not handle extremely complex annuity scenarios involving multiple streams of income or intricate tax structures. In such cases, specialized financial software or consulting might be necessary.

Can I use Excel to calculate annuities for different countries?

Yes, Excel can be used to calculate annuities for different countries, but you’ll need to adjust the formulas to reflect the specific interest rates, tax regulations, and other financial factors relevant to that country.

How often should I update my annuity calculations in Excel?

If you’re 85 years old and looking for income options, you might want to consider an annuity. You can learn more about annuities for those over 85 and how they can provide financial security in your later years.

It’s advisable to update your annuity calculations at least annually to account for changes in interest rates, inflation, and your financial goals. Regular updates ensure your projections remain accurate and relevant.