Calculating An Annuity Rate 2024 is a crucial step for anyone seeking a steady stream of income during retirement. Annuities, essentially financial contracts, provide regular payments for a specific period, offering a sense of financial security. But understanding the factors that influence these rates is essential to making informed decisions about your financial future.

This guide explores the intricacies of annuity rates, covering everything from the basics of annuities to the key factors that determine their value. We’ll delve into the calculation methods, examine real-world examples, and discuss the considerations you need to make before choosing an annuity that aligns with your financial goals.

Contents List

Understanding Annuities

Annuities are financial products that provide a stream of regular payments over a specified period. They are often used for retirement planning, income generation, and protecting against longevity risk. Annuities work by converting a lump sum of money into a series of payments, which can be guaranteed for life or for a specific period.

The relationship between annuities and life insurance can be confusing. While they share some similarities, they are distinct financial products. Understanding these differences is crucial for making informed choices. You can find out more about Is Annuity Life Insurance 2024 to gain clarity on this topic.

Types of Annuities, Calculating An Annuity Rate 2024

There are various types of annuities, each with its own characteristics and benefits:

- Fixed Annuities:These provide a fixed rate of return and guaranteed payments, making them suitable for those seeking predictable income. The payout amount is determined at the outset and remains constant throughout the annuity period.

- Variable Annuities:These offer a potential for higher returns, but they also carry investment risk. The payout amount fluctuates based on the performance of the underlying investment portfolio.

- Immediate Annuities:Payments begin immediately after the purchase of the annuity. This type is ideal for individuals who need income right away, such as retirees.

- Deferred Annuities:Payments are delayed until a future date, allowing the invested funds to grow over time. These are suitable for individuals who are planning for retirement or other future financial needs.

Key Features of Annuities

Annuities have several key features that determine their suitability for different individuals:

- Payment Schedules:Annuities can be structured to provide payments on a monthly, quarterly, or annual basis, depending on the individual’s needs.

- Interest Rates:The interest rate applied to the annuity determines the amount of income generated. Fixed annuities offer a guaranteed interest rate, while variable annuities have a fluctuating rate based on market performance.

- Guarantees:Some annuities provide guarantees, such as a minimum payout amount or a death benefit, offering peace of mind to annuitants.

Factors Affecting Annuity Rates: Calculating An Annuity Rate 2024

Annuity rates are influenced by several factors, including market conditions, interest rates, and individual characteristics.

The interest earned on an annuity can be subject to taxation, just like any other form of investment income. Understanding how taxes apply to annuities is essential for financial planning. Learn more about Is Annuity Interest Taxable 2024 to understand the tax implications.

Current Interest Rates

Interest rates play a crucial role in determining annuity payouts. When interest rates rise, annuity rates tend to increase, as insurers can earn higher returns on their investments. Conversely, when interest rates fall, annuity rates generally decline.

An annuity with an 8.5 percent return can be a tempting prospect, but it’s crucial to understand the factors that influence such rates. Knowing how these rates are determined can help you make informed investment decisions. You can find out more about Annuity 8.5 Percent 2024 to better understand this specific scenario.

Inflation and Market Performance

Inflation erodes the purchasing power of money over time. Annuity rates are adjusted to account for inflation, ensuring that the payments maintain their value. Market performance also impacts annuity rates, as insurers consider the potential returns on their investments when setting rates.

Khan Academy is a great resource for learning about a wide range of subjects, including finance. They offer valuable insights into the world of annuities, helping you understand the basics and more. Check out Annuity Khan Academy 2024 to learn more.

Age, Health, and Other Personal Factors

An individual’s age and health are significant factors in annuity rate calculations. Younger and healthier individuals are expected to live longer, resulting in a higher lifetime payout. Annuities also consider factors like gender, smoking habits, and occupation, which can affect longevity and, consequently, annuity rates.

Annuity Rate Calculation Methods

Annuity rates are calculated using complex formulas that take into account various factors. While the exact calculations are typically performed by financial institutions, understanding the basic principles can be helpful.

Annuities are often considered a retirement planning tool, providing a steady stream of income during those later years. However, it’s essential to understand how annuities work and if they align with your retirement goals. You can find out more about Is Annuity Retirement 2024 to see if it’s the right fit for you.

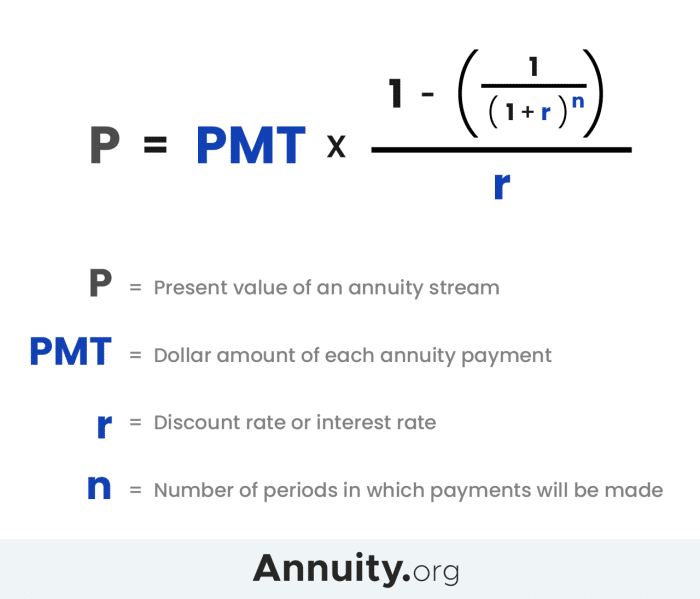

Basic Annuity Rate Formula

The basic formula for calculating an annuity rate involves discounting the future payments back to their present value. This involves using a discount rate that reflects the time value of money and other factors, such as interest rates and risk.

Annuity products have evolved over time, and understanding how they’ve changed can be beneficial. Learning about the history of annuities can provide context for your current financial decisions. You can find out more about Annuity 2021 2024 to gain a better understanding of how they’ve evolved.

Annuity Rate = (Present Value of Payments) / (Annuity Factor)

Manual Calculation

While manual calculation is possible, it is often complex and time-consuming. It requires understanding financial concepts like present value, discount rates, and annuity factors.

Just like any financial product, annuities can come with certain issues or potential drawbacks. It’s important to be aware of these potential downsides before making any investment decisions. You can find out more about Annuity Issues 2024 to make sure you’re making a well-informed choice.

Online Calculators and Financial Software

Online calculators and financial software can simplify annuity rate calculations. These tools allow users to input relevant information, such as the annuity type, payment amount, and interest rate, to obtain an estimated rate.

Comparison of Calculation Methods

Online calculators and financial software provide a convenient and relatively accurate way to estimate annuity rates. However, for complex annuities or personalized calculations, consulting a financial advisor is recommended.

Some annuities may have a 10 percent penalty for early withdrawal, which can impact your investment strategy. Understanding these potential penalties is crucial for making informed decisions. Learn more about Annuity 10 Penalty 2024 to avoid any surprises.

Real-World Examples of Annuity Rates

Annuity rates vary significantly depending on the type of annuity, payment frequency, investment options, and the financial institution offering the product. Here are some examples of current annuity rates:

Fixed Annuities

Fixed annuities typically offer lower interest rates than variable annuities but provide guaranteed payments. For example, a fixed annuity with a guaranteed interest rate of 3% might provide a monthly payout of $1,000 for a 20-year period.

If you’re looking for information about annuities in Tamil, there are resources available to help you understand these financial products. Learning about annuities in your native language can make the process easier and more accessible. You can find out more about Annuity Meaning In Tamil 2024 to gain valuable insights.

Variable Annuities

Variable annuities offer the potential for higher returns but also carry investment risk. For example, a variable annuity with an average annual return of 5% might provide a monthly payout that fluctuates based on the performance of the underlying investment portfolio.

Importance of Comparison

It is essential to compare annuity rates from multiple providers before making a decision. Rates can vary significantly, and it’s crucial to find an annuity that aligns with your financial goals and risk tolerance.

Considerations for Choosing an Annuity

Choosing the right annuity involves considering various factors, including your financial goals, risk tolerance, and investment needs.

Pros and Cons of Annuity Types

Fixed annuities offer guaranteed payments and predictability, while variable annuities provide the potential for higher returns but also carry investment risk. Deferred annuities allow for growth over time, while immediate annuities provide immediate income.

An annuity is not a loan in the traditional sense, but it does involve a series of payments made over time. Understanding how annuities differ from loans is important for making informed financial decisions. Learn more about Annuity Is Loan 2024 to clear up any confusion.

Risks and Potential Downsides

Annuities can have potential downsides, such as limited liquidity, surrender charges, and the risk of outliving your annuity payments. It’s essential to understand these risks before investing in an annuity.

Wondering if an annuity is a lifetime investment? You’re not alone! Many people are curious about the longevity of annuities, and whether they can provide income for the rest of their lives. You can find out more about the details of Is Annuity Lifetime 2024 and how it might fit into your financial plan.

Alignment with Financial Goals

Consider your financial goals and risk tolerance when choosing an annuity. If you seek guaranteed income and stability, a fixed annuity might be suitable. If you are willing to take on more risk for potential higher returns, a variable annuity might be a better option.

While annuities are often associated with retirement planning, they also have elements of insurance. Understanding how these insurance aspects work is essential to make informed decisions. Learn more about Is Annuity Insurance 2024 to understand the nuances of this financial product.

Ending Remarks

In the dynamic world of finance, understanding annuity rates is crucial for anyone looking to secure their financial future. By comprehending the factors that influence these rates, you can make informed decisions that align with your individual circumstances and financial goals.

The owner of an annuity is the individual who has purchased it. This person is entitled to receive the payments generated by the annuity, making them the beneficiary of the investment. You can find out more about Annuity Owner Is 2024 and how it relates to your own financial situation.

Whether you’re seeking a reliable income stream in retirement or simply exploring your investment options, this guide provides a solid foundation for navigating the world of annuities.

An annuity is essentially a series of equal payments made over a set period of time. It’s a common financial tool used for retirement planning, but understanding how annuities work is crucial before making any decisions. You can learn more about Annuity Is A Series Of Equal Payments 2024 to get a better understanding of how they function.

Popular Questions

What is the difference between a fixed and a variable annuity?

The rate of return on an annuity is a key factor to consider when making investment decisions. Understanding how annuity rates work is essential to make informed choices. Learn more about Annuity Rate Is 2024 to help you determine if this type of investment is right for you.

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s rate of return is tied to the performance of the underlying investments.

How often are annuity rates adjusted?

Annuity rates can be adjusted periodically, usually annually, based on factors like interest rates and market performance.

Are there any fees associated with annuities?

Yes, annuities often have fees associated with them, such as administrative fees, surrender charges, and mortality and expense charges.

How can I find the best annuity rate?

Comparing annuity rates from multiple providers is essential. You can use online comparison tools or consult with a financial advisor to find the best option for your needs.