Calculating Annuity 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Annuities are financial products that provide a stream of regular payments over a specified period, often used for retirement planning or income generation.

Understanding how annuities work and how to calculate their payments is crucial for making informed financial decisions, especially in the ever-changing landscape of 2024.

This guide delves into the world of annuities, providing a comprehensive overview of their types, features, and applications. We will explore the nuances of annuity calculations, taking into account factors such as interest rates, time periods, and payment frequencies. We will also examine the impact of current market conditions and regulatory changes on annuity choices in 2024.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a set period of time. It’s essentially a contract between you and an insurance company, where you make a lump sum payment or a series of payments, and in return, you receive guaranteed payments for a specific duration, either for a fixed period or for the rest of your life.

There are many different types of annuities, including those that pay out a fixed amount or those that are tied to the performance of the market. Some people may be interested in annuities that pay out $30,000 per year, Annuity 30k 2024 , or those that are offered by specific companies like Annuity Gator.

Is Annuity Gator Legit 2024. You can also find information about specific types of annuities, like those that are designated as “M”. Annuity M 2024.

Types of Annuities

Annuities come in various forms, each designed to meet different financial needs. Here’s a breakdown of some common types:

- Fixed Annuities:These offer a guaranteed interest rate, providing predictable payments. Your principal is protected, but returns may be limited compared to variable annuities.

- Variable Annuities:These tie your returns to the performance of underlying investments, typically mutual funds. You have the potential for higher returns but also face investment risk.

- Immediate Annuities:Payments begin immediately after you purchase the annuity. This is suitable for those seeking immediate income, such as retirees.

- Deferred Annuities:Payments start at a later date, allowing you to accumulate value over time. This is a good option for long-term savings or retirement planning.

Key Features of Annuity Contracts

Annuity contracts Artikel the terms and conditions of the agreement. Here are some key features to consider:

- Payment Terms:This includes the frequency (monthly, quarterly, annually) and duration of payments.

- Interest Rates:Fixed annuities have guaranteed interest rates, while variable annuities offer potential for higher returns but are subject to market fluctuations.

- Guarantees:Some annuities offer guarantees on principal, minimum interest rates, or death benefits.

Calculating Annuity Payments

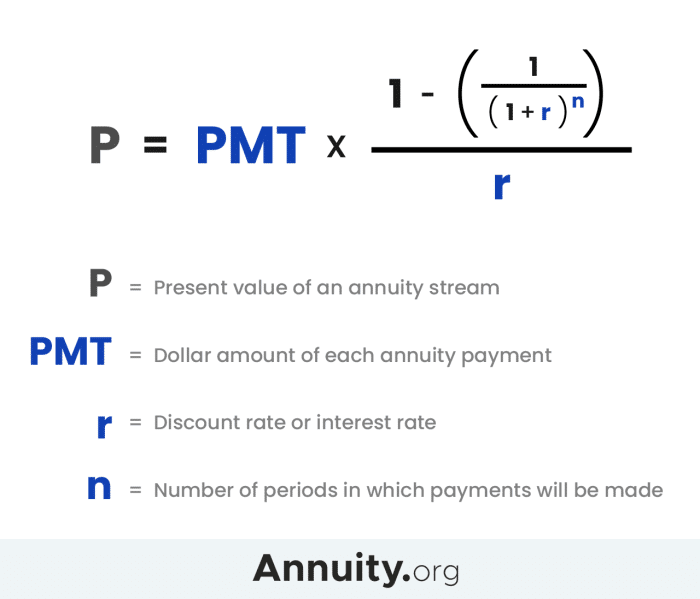

Calculating annuity payments involves using the present value formula, which considers the initial investment, interest rate, and time period.

When researching annuities, you’ll likely come across information about annuity issuers. Annuity Issuer 2024. You might also wonder if an annuity is for life, Is Annuity For Life 2024 , and how to get quotes for annuities. Annuity Quotes 2024.

Some people also question if an annuity is a type of life insurance policy. Is Annuity A Life Insurance Policy 2024.

Step-by-Step Guide to Calculating Annuity Payments

- Determine the present value (PV):This is the initial investment or lump sum you’re putting into the annuity.

- Identify the interest rate (r):This is the annual interest rate offered by the annuity.

- Determine the number of periods (n):This is the total number of payment periods (e.g., monthly, quarterly, annually) over the life of the annuity.

- Calculate the annuity payment (PMT):Using the present value formula, you can solve for the annuity payment amount.

Examples of Calculating Annuity Payments, Calculating Annuity 2024

Let’s illustrate with some scenarios:

- Lump Sum Investment:Suppose you invest $100,000 in a fixed annuity that offers a 4% annual interest rate for 20 years. The annuity payment would be calculated using the present value formula, considering the PV, r, and n. The result would be the regular payment you receive for 20 years.

- Regular Contributions:If you contribute $500 monthly to a deferred annuity that earns 5% annually for 30 years, the annuity payment at the end of the period would be calculated based on the total contributions, interest rate, and time period. The formula would account for the compounding effect of your regular contributions.

Impact of Interest Rates, Time Periods, and Payment Frequencies

Changes in interest rates, time periods, and payment frequencies significantly affect annuity payments. Higher interest rates generally lead to larger payments, while longer time periods result in smaller payments due to the time value of money. The frequency of payments also influences the overall amount received.

Annuity Applications

Annuities have a wide range of applications in financial planning, catering to diverse needs and goals.

Real-World Applications of Annuities

- Retirement Planning:Annuities provide a steady stream of income during retirement, ensuring financial security and helping to cover living expenses.

- Income Generation:Annuities can generate a predictable income stream for individuals who need supplemental income or want to diversify their investment portfolio.

- Estate Planning:Annuities can be used to create a legacy for beneficiaries, providing them with a regular income stream after your passing.

Advantages and Disadvantages of Annuities

| Financial Goal | Advantages | Disadvantages |

|---|---|---|

| Retirement Planning | Guaranteed income stream, principal protection (fixed annuities), tax-deferred growth | Potential for lower returns than other investments, limited flexibility, surrender charges |

| Income Generation | Predictable income, tax advantages (depending on type), diversification | May not keep up with inflation, potential for investment risk (variable annuities) |

| Estate Planning | Provides income for beneficiaries, tax-efficient distribution of assets | May not be the most flexible estate planning tool |

Role of Annuities in Financial Planning Strategies

Annuities can play a significant role in financial planning strategies, particularly for individuals seeking guaranteed income, principal protection, or tax advantages. They can be incorporated into retirement plans, income-generating strategies, or estate planning objectives, depending on individual circumstances and goals.

Annuity Considerations in 2024

Several factors influence annuity choices in 2024, including interest rate trends, inflation, and tax regulations.

Key Factors Influencing Annuity Choices

- Interest Rate Trends:Rising interest rates can impact the returns on fixed annuities, while variable annuities may benefit from higher market returns.

- Inflation:Inflation can erode the purchasing power of annuity payments, making it crucial to consider inflation-adjusted annuities or strategies to mitigate its impact.

- Tax Regulations:Tax laws and regulations surrounding annuities can affect the taxability of payments and the overall attractiveness of different annuity products.

Performance of Different Annuity Products

The performance of different annuity products varies depending on the underlying investments, interest rates, and market conditions. It’s essential to compare the performance of different products and consider factors such as guaranteed returns, potential for growth, and fees.

Potential Risks and Benefits of Investing in Annuities

Investing in annuities comes with both risks and benefits. It’s important to understand these before making a decision. Risks include potential for lower returns, surrender charges, and limitations on flexibility. Benefits include guaranteed income, principal protection, and tax advantages.

Annuity is a financial product that can provide a steady stream of income during retirement. To learn more about how annuities are used in 2024, check out this article: Annuity Is Used In 2024. You can also find information on how annuities are calculated, How Annuity Is Calculated 2024 , and the different types of annuities available.

Resources and Tools

There are numerous resources available to help you learn more about annuities and annuity calculations.

The annuity industry offers a variety of career paths, including those in health and other fields. Annuity Health Careers 2024. If you’re considering a career in the annuity industry, you might want to learn more about the different types of annuities, such as those that pay out a fixed amount or those that are tied to the performance of the market.

Reliable Resources for Learning More About Annuities

- Financial Industry Regulatory Authority (FINRA):FINRA provides investor education materials and resources on various financial products, including annuities.

- National Association of Insurance Commissioners (NAIC):The NAIC offers information on insurance regulations and consumer protection, including resources on annuities.

- The American College of Financial Services:The American College offers educational programs and resources on financial planning, including annuity concepts.

Online Calculators and Software Tools

Online calculators and software tools can assist you with annuity calculations and help you compare different products.

- Bankrate:Bankrate provides a variety of annuity calculators that can help you estimate payments and compare different products.

- NerdWallet:NerdWallet offers a comprehensive guide to annuities, including calculators and tools for comparison.

- Investopedia:Investopedia provides educational resources on annuities, including calculators and articles on different types of annuities.

Reputable Financial Advisors

Seeking advice from a reputable financial advisor can help you understand the intricacies of annuities and determine the best product for your specific needs.

If you’re considering an annuity, it’s important to understand the different types available. There are several types of annuities, including fixed, variable, and indexed. You can also learn about hardship withdrawals, Annuity Hardship Withdrawal 2024 , and how the basis of an annuity is calculated.

Annuity Basis Is 2024. There are also different types of annuity series, Annuity Is Series 2024 , and whether an annuity is considered ordinary. Annuity Is Ordinary 2024.

- Certified Financial Planner (CFP):CFP professionals are required to meet rigorous ethical and educational standards and provide personalized financial advice.

- Chartered Financial Analyst (CFA):CFA charterholders are highly qualified investment professionals with expertise in financial analysis and portfolio management.

Ending Remarks

By understanding the principles of annuity calculations and considering the factors that influence their performance in 2024, individuals can make informed decisions about incorporating annuities into their financial plans. Whether you are seeking a secure stream of income in retirement or looking to create a legacy for future generations, annuities can be a valuable tool.

This guide provides the foundation for navigating the world of annuities, empowering you to make sound financial choices for your future.

Key Questions Answered: Calculating Annuity 2024

What are the tax implications of annuities?

The tax implications of annuities vary depending on the type of annuity and the specific terms of the contract. It is essential to consult with a financial advisor to understand the tax implications for your individual situation.

Are annuities safe investments?

Like any investment, annuities carry risks. However, some types of annuities, such as fixed annuities, offer greater principal protection than others. It is crucial to assess your risk tolerance and understand the potential risks and benefits of each type of annuity before making a decision.

How do I choose the right annuity for me?

Choosing the right annuity depends on your individual financial goals, risk tolerance, and time horizon. Consulting with a financial advisor can help you identify the most suitable annuity product for your needs.