Calculating Annuity Due 2024 sets the stage for understanding a powerful financial tool used in various financial scenarios. Annuities due are unique financial instruments that offer regular payments, but with a crucial twist: the payment occurs at the beginning of each period, rather than the end.

This difference can have significant implications for both individuals and businesses when it comes to planning for the future or managing investments.

This guide delves into the intricacies of calculating annuity due, exploring the formula, its variables, and the impact of economic factors like interest rates and inflation. We’ll examine how these calculations can be applied in personal finance, such as retirement planning and loan repayment, as well as in business for investment decisions and project evaluation.

Similar to the 750k option, Annuity 600k 2024 provides a substantial sum for those seeking a significant retirement income.

Contents List

Understanding Annuity Due

An annuity due is a series of equal payments made at the beginning of each period. It is a common financial instrument used in various financial scenarios, including retirement planning, loan repayment, and investment analysis.

Understanding how annuities work in practice is essential, and Annuity Examples In Real Life 2024 can provide valuable insights into their applications.

Key Characteristics of Annuity Due, Calculating Annuity Due 2024

An annuity due differs from a regular annuity, also known as an ordinary annuity, in terms of the timing of payments. In an ordinary annuity, payments are made at the end of each period, while in an annuity due, payments are made at the beginning.

Choosing the right annuity for your needs can be overwhelming, so exploring Annuity Which Is Best 2024 options can help you make an informed decision.

- Payment Timing:The most significant distinction is the timing of payments. Annuity due payments occur at the beginning of each period, while ordinary annuity payments are made at the end.

- Future Value:The future value of an annuity due is generally higher than that of an ordinary annuity because payments earn interest for an additional period.

- Present Value:Conversely, the present value of an annuity due is typically lower than that of an ordinary annuity because the initial payment is discounted for one less period.

Real-World Example of Annuity Due

Imagine you are making monthly rent payments for an apartment. Since you pay your rent at the beginning of each month, this scenario represents an annuity due. The rent payment is the same each month, and it is made at the beginning of the period.

The financial industry offers a range of Annuity Jobs 2024 , providing opportunities for individuals with expertise in financial planning and retirement solutions.

Calculating Annuity Due

Formula for Present Value of Annuity Due

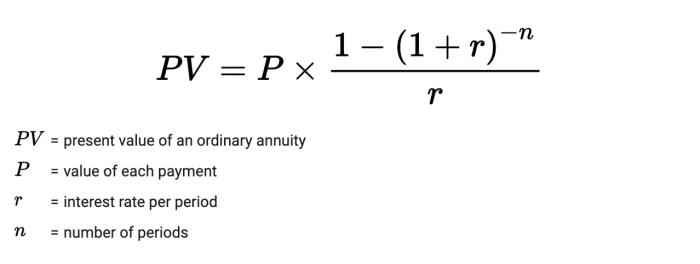

PV = PMT- [(1 – (1 + r)^-n) / r] – (1 + r)

The Annuity 2000 Mortality Table 2024 is a key factor in determining annuity payouts, as it reflects the life expectancy of the population.

Where:

- PV: Present value of the annuity due

- PMT: Payment amount per period

- r: Interest rate per period

- n: Number of periods

Step-by-Step Guide to Calculate Present Value of Annuity Due

To illustrate the calculation process, let’s assume you want to find the present value of an annuity due with the following details:

- PMT = $1,000

- r = 5% per year (0.05/12 = 0.0041667 per month)

- n = 60 months (5 years)

- Calculate the present value of an ordinary annuity:

- Multiply the result by (1 + r):

PV = PMT – [(1 – (1 + r)^-n) / r]

Before committing to an annuity, it’s important to consider whether Is Annuity Right For Me 2024 based on your individual financial situation and goals.

PV = $1,000 – [(1 – (1 + 0.0041667)^-60) / 0.0041667]

To accurately calculate the tax liability on your annuity withdrawals, you can utilize an Annuity Withdrawal Tax Calculator 2024.

PV = $51,503.72

Understanding the Annuity Equation 2024 is crucial for anyone considering an annuity, as it helps determine the amount of regular payments you will receive.

PV (Annuity Due) = PV (Ordinary Annuity) – (1 + r)

PV (Annuity Due) = $51,503.72 – (1 + 0.0041667)

A 5 Year Payout Annuity 2024 provides a fixed income stream for a shorter period, making it suitable for specific financial needs.

PV (Annuity Due) = $51,720.37

Therefore, the present value of this annuity due is $51,720.37.

Understanding the tax implications of annuities is important, so knowing whether Is Annuity Death Benefit Taxable 2024 can help you plan for your future.

Annuity Due in 2024: Calculating Annuity Due 2024

Economic Factors Influencing Annuity Due Calculations

Several economic factors can influence annuity due calculations in 2024, impacting the present value and future value of these financial instruments.

- Interest Rates:Interest rates are a crucial factor in annuity due calculations. Higher interest rates generally lead to a higher future value and a lower present value of an annuity due. Conversely, lower interest rates result in a lower future value and a higher present value.

A Perpetual Annuity 2024 offers continuous payments for an indefinite period, making it a valuable option for those seeking a steady income stream for life.

- Inflation:Inflation erodes the purchasing power of money over time. When inflation is high, the present value of an annuity due might be lower as future payments will have less purchasing power.

- Economic Growth:Economic growth can impact interest rates and inflation, indirectly influencing annuity due calculations. Strong economic growth might lead to higher interest rates, while slow growth could result in lower interest rates.

Potential Changes in Interest Rates and Their Impact

The Federal Reserve’s monetary policy decisions can significantly influence interest rate movements. In 2024, if the Federal Reserve continues to raise interest rates to combat inflation, it could lead to higher interest rates for annuity due calculations. This would result in a higher future value but a lower present value for annuity due contracts.

An annuity is known for providing a consistent income stream, and understanding An Annuity Is Known 2024 can help you make informed financial decisions.

Inflation’s Impact on Present Value

Inflation can erode the real value of future payments. If inflation is high in 2024, the present value of an annuity due might be lower, as the future payments will have less purchasing power than anticipated.

The Annuity Exclusion Ratio 2024 helps determine the portion of your annuity payments that are tax-free, which is crucial for maximizing your returns.

Applications of Annuity Due

Personal Finance Applications

- Retirement Planning:Individuals can use annuity due calculations to estimate the amount of savings needed to generate a desired retirement income stream.

- Loan Repayment:Mortgage payments are often structured as annuity due, where the principal and interest are paid at the beginning of each month. Annuity due calculations can help determine the total amount of interest paid over the loan term.

Business Applications

- Investment Decisions:Businesses can use annuity due calculations to evaluate the profitability of different investment projects, considering the time value of money.

- Project Evaluation:Annuity due calculations can be used to determine the net present value (NPV) of projects, factoring in the timing of cash flows.

Resources for Further Exploration

| Resource Name | Description | Link |

|---|---|---|

| Investopedia | Comprehensive financial education website with articles and explanations on various financial concepts, including annuity due. | https://www.investopedia.com/ |

| Khan Academy | Free online learning platform offering courses and resources on finance and mathematics, including annuity due calculations. | https://www.khanacademy.org/ |

| Corporate Finance Institute | Online resource providing educational materials and training on finance and accounting, including annuity due concepts. | https://corporatefinanceinstitute.com/ |

| “Fundamentals of Financial Management” by Zvi Bodie, Alex Kane, and Alan Marcus | Textbook covering financial management concepts, including annuity due calculations and applications. | [Insert link to the book if available] |

Closure

By understanding the mechanics of calculating annuity due and its potential impact on financial outcomes, individuals and businesses can make more informed decisions. Whether it’s planning for a secure retirement, managing debt effectively, or optimizing investment strategies, mastering the concept of annuity due can be a valuable asset in navigating the complexities of the financial world.

FAQ

What is the difference between an annuity due and a regular annuity?

If you’re considering a substantial investment, learning about Annuity 750k 2024 options might be a good starting point.

An annuity due involves payments made at the beginning of each period, while a regular annuity has payments made at the end of each period. This difference impacts the timing of interest accrual and the overall present value of the annuity.

How does inflation affect annuity due calculations?

For those unfamiliar with the term, Annuity Ka Hindi Meaning 2024 refers to a financial product that provides regular payments over a specific period.

Inflation erodes the purchasing power of money over time. In annuity due calculations, inflation reduces the present value of future payments, making the annuity less valuable in today’s terms.

Are there any online calculators for calculating annuity due?

Yes, several online calculators are available to simplify the process of calculating annuity due. These calculators can help you quickly determine the present value or future value of an annuity due based on your specific parameters.