Calculating Annuity Future Values 2024 is a powerful tool for individuals seeking to understand and maximize the potential growth of their savings over time. Annuities, a series of regular payments, offer a structured approach to financial planning, allowing individuals to project and accumulate wealth for various financial goals, such as retirement, education, or even a dream vacation.

Annuity contracts can be complex, and it’s common to have questions. You can find a wealth of information about Annuity Questions And Answers 2024 online, covering various aspects of these financial products.

This guide delves into the intricacies of annuity calculations, empowering you to make informed financial decisions.

Understanding the concept of annuities is essential before delving into future value calculations. An annuity is a stream of equal payments made over a specified period, with each payment earning interest. This interest accumulation plays a crucial role in determining the future value of an annuity.

One of the key questions people ask about annuities is whether they provide lifetime income. The answer to the question, Is Annuity Lifetime 2024 , depends on the specific type of annuity you choose.

Annuities can be classified into various types, including ordinary annuities, annuity dues, fixed annuities, and variable annuities, each with unique characteristics and applications.

Contents List

Understanding Annuities

An annuity is a series of equal payments made over a specified period of time. It’s a financial product that provides a steady stream of income, often used for retirement planning, education savings, or other long-term financial goals. Annuities involve several key components:

Components of an Annuity

- Principal:The initial amount of money invested in the annuity.

- Interest Rate:The rate at which the principal earns interest over time.

- Payment Period:The frequency of payments (e.g., monthly, quarterly, annually).

- Payment Amount:The fixed amount paid out during each payment period.

- Term:The duration of the annuity, or the total number of payments.

Types of Annuities

Annuities can be categorized based on their payment structure and investment features:

- Ordinary Annuity:Payments are made at the end of each period.

- Annuity Due:Payments are made at the beginning of each period.

- Fixed Annuity:Guarantees a fixed interest rate and payment amount, providing predictable income.

- Variable Annuity:Investment returns are tied to the performance of underlying investments, offering potential for higher growth but also greater risk.

Real-World Scenarios

Annuities are widely used in various financial situations:

- Retirement Planning:Annuities can provide a steady income stream during retirement, ensuring financial security.

- Education Savings:Annuities can help accumulate funds for college tuition and other educational expenses.

- Income Replacement:Annuities can provide income for individuals who have experienced a loss of income due to disability or other unforeseen circumstances.

Calculating Future Value of an Annuity

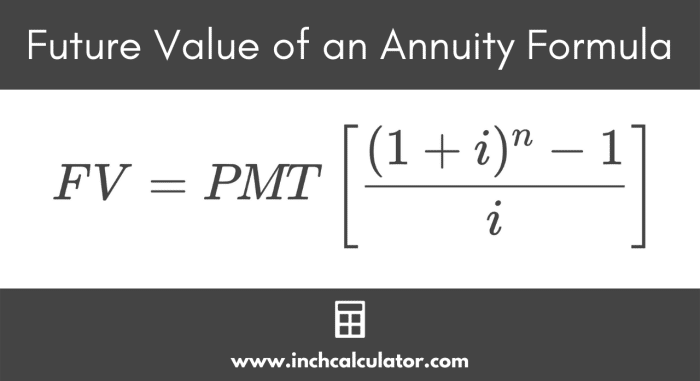

The future value (FV) of an annuity represents the total amount of money accumulated at the end of the annuity term, including both principal and interest earned. The formula for calculating the future value of an ordinary annuity is:

FV = P

If you’re in Canada and considering an annuity, it’s helpful to compare quotes from different providers. You can find Annuity Quotes Canada 2024 online, allowing you to make an informed decision.

- [((1 + r)^n

- 1) / r]

Where:

- FV = Future value of the annuity

- P = Payment amount

- r = Interest rate per period

- n = Number of payment periods

Example

Let’s say you invest $1,000 per year in an annuity that earns 5% annual interest for 10 years. Using the formula above:

- FV = $1,000 – [((1 + 0.05)^10 – 1) / 0.05]

- FV = $1,000 – [1.62889 – 1) / 0.05]

- FV = $1,000 – 12.5778

- FV = $12,577.80

Therefore, the future value of the annuity after 10 years would be approximately $12,577.80.

Key Variables and Their Impact

| Variable | Impact on Future Value |

|---|---|

| Payment Amount (P) | Directly proportional: Higher payment amount leads to higher future value. |

| Interest Rate (r) | Exponentially proportional: Higher interest rate results in significantly higher future value, especially over longer periods. |

| Number of Periods (n) | Exponentially proportional: Longer annuity term leads to greater future value, as interest compounds over time. |

Factors Affecting Annuity Future Values

Several factors can influence the future value of an annuity, impacting the overall growth of your investment:

Interest Rate

The interest rate plays a crucial role in determining the future value of an annuity. A higher interest rate leads to greater interest earned, resulting in a significantly higher future value. This relationship is exponential, meaning that even small increases in the interest rate can have a substantial impact on the final amount accumulated.

Index annuities are a type of annuity that links returns to the performance of a specific market index. If you’re looking for an explanation of, Index Annuity Is What 2024 , you can find detailed information online.

Payment Frequency

The frequency of payments also affects the future value. More frequent payments, such as monthly payments, generally lead to a higher future value compared to less frequent payments, such as annual payments. This is because interest is compounded more often with more frequent payments, resulting in greater growth over time.

Inheriting an annuity can be a complex situation, especially when it comes to taxes. If you’re wondering, I Inherited An Annuity Is It Taxable 2024 , you should consult with a financial advisor or tax professional for guidance.

Duration of the Annuity

The duration of the annuity, or the number of payment periods, has a significant impact on the future value. A longer annuity term allows for more compounding periods, leading to a greater accumulation of interest and a higher future value.

If you’re curious about the Bengali meaning of the word “annuity,” you can find the answer on the web. The term Annuity Is Bengali Meaning 2024 will likely lead you to a definition and perhaps even some examples of how the concept is used in Bengali language and culture.

The longer you invest, the more time interest has to work its magic.

Annuity contracts can be categorized as either qualified or nonqualified. If you’re unsure about whether a particular annuity is Is An Annuity Qualified Or Nonqualified 2024 , it’s best to consult with a financial professional.

Compounding Frequency

The frequency at which interest is compounded also affects the future value. More frequent compounding, such as daily or monthly compounding, generally leads to a higher future value than less frequent compounding, such as annual compounding. This is because interest is calculated and added to the principal more often, resulting in greater growth over time.

The term “annuity due” refers to a type of annuity where payments are made at the beginning of each period. If you’re curious about the specifics of Annuity Due Is 2024 , you can find explanations online.

Tools and Resources for Annuity Calculations: Calculating Annuity Future Values 2024

Numerous online calculators and financial software programs can be used to calculate annuity future values, simplifying the process and providing valuable insights.

Online Calculators

Many websites offer free annuity calculators that allow you to input the necessary variables (payment amount, interest rate, number of periods) and instantly calculate the future value. These calculators are user-friendly and provide a quick estimate of the potential growth of your annuity.

Financial Software

Financial software programs, such as Microsoft Excel or personal finance software, often include features for calculating annuity future values. These programs offer more advanced functionality, allowing you to create detailed financial models and perform more complex calculations.

For many people, receiving a large sum of money like Annuity $400 000 2024 can be a life-changing event. It’s important to consider your financial goals and how you plan to use this income to make informed decisions.

Methods for Calculating Annuity Future Values, Calculating Annuity Future Values 2024

- Formula:The traditional formula for calculating the future value of an annuity, as discussed earlier, provides a precise calculation.

- Financial Calculators:Financial calculators, both physical and online, are designed specifically for financial calculations, including annuities. They provide a quick and efficient way to calculate future values.

- Spreadsheets:Spreadsheets, such as Microsoft Excel, can be used to create a table or formula to calculate future values. This method allows for more flexibility and customization.

Real-World Applications of Annuity Future Value Calculations

Calculating the future value of an annuity has numerous practical applications in personal finance and investment planning.

Tax laws vary from country to country, and it’s important to understand how they apply to annuities. If you’re wondering, Is Annuity Taxable In India 2024 , you can find information about Indian tax laws and regulations related to annuities.

Retirement Planning

Annuity future value calculations can be used to estimate the amount of money you will have accumulated in your retirement account by a certain age. By inputting your expected contributions, investment growth rate, and retirement timeline, you can determine how much your annuity will grow over time.

This information can help you make informed decisions about your retirement savings strategy and ensure you have enough funds to meet your financial goals.

Investment Scenarios

| Scenario | Interest Rate | Payment Amount | Time Period | Future Value |

|---|---|---|---|---|

| Conservative | 3% | $5,000 | 20 years | $135,794.77 |

| Moderate | 5% | $5,000 | 20 years | $163,861.65 |

| Aggressive | 7% | $5,000 | 20 years | $200,124.92 |

The table above shows the future value of an annuity for different investment scenarios, varying the interest rate, payment amount, and time period. This illustrates how changes in these variables can significantly impact the potential growth of your savings. By analyzing these scenarios, you can understand the trade-offs involved in different investment strategies and make informed decisions based on your risk tolerance and financial goals.

Assessing Savings Growth

Annuity future value calculations can be used to assess the potential growth of your savings over time. By comparing the future value of different annuity options, you can identify the most effective strategies for maximizing your returns. This information can help you make informed decisions about where to invest your money and how to achieve your financial objectives.

Annuity payments can be structured in many different ways. If you’re considering a 6 Annuity 2024 , it’s important to understand the terms and conditions before making a commitment.

Ultimate Conclusion

By understanding the factors that influence annuity future values, individuals can make informed financial decisions and optimize their investment strategies. Utilizing online calculators and financial software can further simplify the calculation process, providing valuable insights into the potential growth of their savings.

Armed with this knowledge, you can confidently plan for a secure financial future, leveraging the power of annuities to achieve your financial aspirations.

Annuity payments can be substantial, and a Annuity 400k 2024 could significantly impact your financial situation. It’s wise to plan carefully for how you’ll manage this income.

FAQs

What are the benefits of investing in an annuity?

Annuity payments can vary greatly, and the specific amount you receive will depend on several factors. If you’re looking for information about a particular type of annuity, such as Annuity 712 2024 , you can often find detailed explanations online.

Annuities offer several benefits, including guaranteed income streams, tax advantages, and protection from market volatility. They provide a structured approach to savings and can help individuals achieve their financial goals.

How do I choose the right type of annuity?

There are various rules and regulations surrounding annuities. The Annuity 59 1/2 Rule 2024 is one such example, and it can impact when you can access your funds.

The choice of annuity depends on individual needs and financial goals. Fixed annuities offer guaranteed interest rates, while variable annuities provide potential for higher returns but carry some risk. Consider your risk tolerance, time horizon, and financial goals when making your decision.

Are there any fees associated with annuities?

Yes, annuities typically involve fees, including administrative fees, surrender charges, and mortality and expense charges. Carefully review the fee structure before investing in an annuity.

How often should I review my annuity investment?

It’s recommended to review your annuity investment at least annually, or more frequently if your financial circumstances change. This ensures that your investment strategy remains aligned with your goals and risk tolerance.

Understanding how annuities work can be a bit complex, but there are resources available to help you navigate the process. If you’re interested in learning more about the Annuity 2000 Mortality Table 2024 , you can find helpful information online.

This table is used to calculate life expectancies, which can be a key factor in determining annuity payments.