Calculating Annuity Income 2024: Your Guide to Retirement Planning is a crucial step in ensuring a secure and comfortable retirement. Annuities are financial products that provide a stream of income for a specified period, often throughout your retirement years. Understanding the intricacies of annuities, from their different types to the factors that influence your income, can empower you to make informed decisions about your retirement planning.

Annuity concepts are often tested in multiple-choice questions. Our article on Annuity Is Mcq 2024 explores some common annuity-related MCQs.

This guide delves into the essential aspects of calculating annuity income, including the key factors that determine your payout, the various payment options available, and the tax implications you should consider. We’ll also explore the current market trends and provide tips for maximizing your annuity income in 2024.

By understanding these concepts, you can navigate the complexities of annuity planning and make confident choices for your financial future.

In accounting, annuities play a significant role. You can learn how to calculate annuities within the accounting context by reading our article on Calculating Annuity In Accounting 2024.

Contents List

Understanding Annuities

Annuity is a financial product that provides a stream of payments over a set period of time. It is essentially a contract between you and an insurance company, where you make a lump sum payment or a series of payments in exchange for guaranteed income payments, typically for life.

A PV annuity chart can help visualize the present value of an annuity over time. Our article on Pv Annuity Chart 2024 provides insights into these charts.

Annuities are designed to provide financial security during retirement, offering a predictable income stream that can help you cover essential expenses and maintain your desired lifestyle.

The formula for calculating an annuity depends on various factors. Learn more about how to calculate an annuity in our article on Annuity Is Given By 2024.

Types of Annuities, Calculating Annuity Income 2024

Annuities come in various forms, each with its own features and benefits. Here are some common types:

- Fixed Annuities:These annuities offer a guaranteed interest rate, meaning your payments will be fixed for the duration of the contract. They provide stability and predictability, making them ideal for those seeking guaranteed income.

- Variable Annuities:These annuities invest your money in a range of mutual funds or sub-accounts. The returns you receive are tied to the performance of these investments, making them potentially more lucrative but also riskier than fixed annuities.

- Immediate Annuities:These annuities start making payments immediately after you purchase them. They are suitable for individuals who need income right away, such as retirees who want to supplement their retirement savings.

- Deferred Annuities:These annuities delay payments until a later date, typically after a specific period or upon reaching a certain age. They offer the potential for growth and tax deferral, making them suitable for long-term financial planning.

Advantages and Disadvantages of Annuities

Like any financial product, annuities have their pros and cons. Here’s a breakdown of the key advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

| Guaranteed Income: Annuities provide a steady stream of income, ensuring financial security in retirement. | Limited Growth Potential: Fixed annuities offer limited growth potential, as returns are capped by the guaranteed interest rate. |

| Tax Deferral: Annuity payments are typically tax-deferred, meaning you won’t pay taxes on the earnings until you start receiving payments. | High Fees: Annuities can have high fees, including surrender charges and administrative costs, which can impact your overall returns. |

| Protection Against Inflation: Some annuities offer protection against inflation, ensuring that your payments keep pace with rising costs. | Lack of Flexibility: Annuities can be illiquid, meaning it can be difficult to access your funds before a certain age or without incurring penalties. |

Annuity Income Calculation Factors

The amount of annuity income you receive depends on several key factors. These factors determine the payout structure and ultimately influence the financial benefits you receive from your annuity.

An annuity contract outlines the terms and conditions of your annuity. Learn more about annuity contracts by reading our article on Annuity Contract Is 2024.

Interest Rates

Interest rates play a crucial role in annuity payouts. The higher the interest rate, the greater the potential for growth in your annuity and the higher your income payments. In a low-interest rate environment, your annuity income may be lower, as the interest earned on your investment is less.

If you’re planning to invest 80,000 in an annuity, our article on How Much Annuity For 80000 2024 can help you estimate your potential annuity payments.

However, fixed annuities offer a guaranteed interest rate, providing stability even in fluctuating market conditions.

Looking for information on annuities with a 600,000 deposit? Our article on Annuity 600 000 2024 provides insights into this particular scenario.

Mortality Rates and Life Expectancy

Mortality rates and life expectancy are also significant factors in annuity calculations. Annuities are designed to provide income for a specific period, often for life. Insurance companies use actuarial tables to estimate how long individuals are likely to live, factoring in their age, gender, and health status.

These estimates help determine the amount of income you receive and the duration of your annuity payments.

Annuity options are available for those aged 70 and a half. Check out our article on Annuity 70 1/2 2024 to learn more about these options.

Annuity Payment Options: Calculating Annuity Income 2024

Annuities offer a range of payment options, allowing you to choose the best fit for your financial needs and retirement goals. Understanding these options can help you maximize your income and ensure that you receive payments in a way that suits your lifestyle.

Payment Options

- Lump Sum:You can choose to receive your annuity payments in a single lump sum, providing immediate access to a significant amount of funds. However, this option may not be suitable for everyone, as it requires careful financial planning to ensure the money is managed wisely.

- Monthly Payments:The most common payment option, monthly payments provide a regular and predictable income stream. This option is ideal for those who need a consistent source of funds to cover their living expenses.

- Life-Long Payments:Some annuities offer payments for life, ensuring that you receive income for as long as you live. This option provides peace of mind, knowing that you will have a source of income throughout your retirement years.

Guaranteed and Non-Guaranteed Payments

Annuity payments can be guaranteed or non-guaranteed. Guaranteed payments are typically offered by fixed annuities, ensuring that you receive a specific amount of income regardless of market fluctuations. Non-guaranteed payments, often associated with variable annuities, are subject to investment performance, meaning your income could fluctuate based on market conditions.

Impact of Inflation

Inflation can erode the purchasing power of your annuity income over time. Some annuities offer inflation protection, which adjusts your payments to keep pace with rising costs. However, not all annuities provide this feature, so it’s essential to consider inflation protection when choosing an annuity.

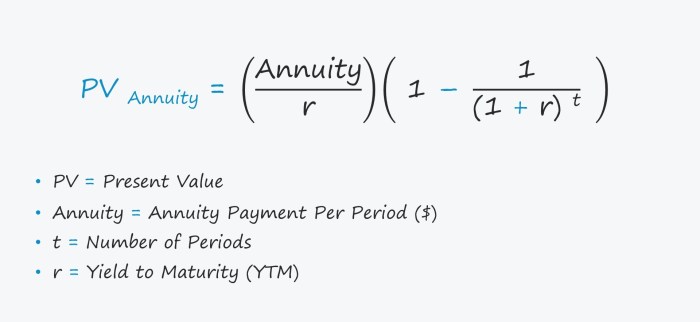

Annuity Income Calculation Methods

Calculating annuity income can be complex, involving several factors and calculations. Here’s a step-by-step guide to help you understand the process:

Step-by-Step Guide

- Determine your annuity type:Identify the type of annuity you are considering, such as fixed, variable, immediate, or deferred. This will influence the calculation method used.

- Choose your payment option:Decide whether you want to receive your payments in a lump sum, monthly, or for life. The payment option will affect the amount of income you receive.

- Estimate your life expectancy:Use actuarial tables or consult with a financial advisor to estimate your life expectancy. This will help determine the duration of your annuity payments.

- Consider interest rates:Factor in the current interest rates or the guaranteed interest rate for your annuity. Higher interest rates generally result in higher annuity income.

- Use an annuity calculator:Online annuity calculators can help you estimate your potential annuity income based on your specific circumstances. These tools simplify the calculation process and provide quick estimates.

Real-World Examples

Let’s look at a real-world example: Suppose you purchase a fixed annuity with a lump sum of $100,000, a guaranteed interest rate of 3%, and you choose to receive monthly payments for life. Using an annuity calculator, you can estimate your monthly income to be around $400.

If you’re wondering what an annuity is, our article on Annuity Kya Hai 2024 provides a comprehensive explanation.

This income stream will be guaranteed for as long as you live, providing a reliable source of income during retirement.

Tax Implications of Annuity Income

Understanding the tax implications of annuity income is crucial for financial planning. Annuity payments are subject to taxation, but the tax treatment can vary depending on the type of annuity and your individual circumstances.

Calculating the right deposit amount for an annuity can be tricky, but we have a guide on Calculate Annuity Deposit 2024 that can help you figure out the optimal amount.

Tax Treatment of Annuity Payments

Generally, annuity payments are taxed as ordinary income. This means that the portion of your payments that represents the return on your investment is taxable. However, the tax treatment can differ depending on whether your annuity is qualified or non-qualified.

Annuity payments are often held in a specific account. Find out more about the type of account an annuity is typically held in by reading our article on Annuity Is Which Account 2024.

Qualified vs. Non-Qualified Annuities

- Qualified Annuities:These annuities are funded with pre-tax contributions, such as from a 401(k) or IRA. When you start receiving payments, a portion of each payment is considered a return of your principal (which is not taxable), while the remaining portion is taxed as ordinary income.

Understanding the annuity factor is crucial for calculating the present value of an annuity. Our guide on Calculating An Annuity Factor 2024 can help you grasp this concept.

- Non-Qualified Annuities:These annuities are funded with after-tax contributions. When you receive payments, the entire amount is typically taxed as ordinary income.

Minimizing Taxes on Annuity Income

Here are some strategies to help minimize taxes on your annuity income:

- Consider a Roth IRA:If you have a Roth IRA, you can withdraw your contributions tax-free and your earnings tax-free in retirement. This can help reduce your overall tax burden.

- Choose a deferred annuity:Deferred annuities allow you to defer taxes on your earnings until you start receiving payments. This can be beneficial if you expect to be in a lower tax bracket in retirement.

- Consult with a tax advisor:A tax advisor can help you understand the specific tax implications of your annuity and develop strategies to minimize your tax liability.

Annuity Income Planning for 2024

As we enter 2024, the annuity market is expected to continue evolving, influenced by factors such as interest rate movements, mortality rate trends, and regulatory changes. Staying informed about these trends can help you make informed decisions about annuity income planning.

Annuity is a financial product that provides regular payments over a specified period. You can find out more about it in our article on 9 Annuity 2024 , which covers various aspects of annuities in 2024.

Current Market Trends

In 2024, the annuity market is likely to see continued competition among insurance companies, leading to innovative product offerings and potentially more favorable rates for consumers. Interest rates are expected to remain at moderate levels, which could impact annuity payouts.

However, the long-term trend of rising life expectancy could lead to adjustments in annuity pricing and payout structures.

Want to explore the specifics of an annuity with a 50,000 deposit? Our article on Annuity 50k 2024 dives into the details of this scenario.

Maximizing Annuity Income in 2024

Here are some tips for maximizing your annuity income in 2024:

- Shop around for the best rates:Compare rates from different insurance companies to find the most competitive offers. Don’t settle for the first annuity you come across.

- Consider a variable annuity:If you are willing to take on some risk, a variable annuity could offer the potential for higher returns. However, it’s essential to understand the risks involved.

- Explore inflation protection:If your annuity does not offer inflation protection, consider purchasing a separate inflation-indexed annuity to safeguard your income against rising costs.

- Seek professional advice:Consult with a financial advisor or insurance broker to discuss your specific needs and goals and get personalized recommendations for annuity planning.

Summary

In conclusion, calculating annuity income is an essential part of retirement planning, requiring careful consideration of various factors. By understanding the different types of annuities, their payment options, and tax implications, you can make informed decisions that align with your financial goals.

The information provided in this guide can serve as a valuable resource as you navigate the world of annuities and strive for a secure and comfortable retirement.

Commonly Asked Questions

What is the difference between a fixed and variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s return fluctuates based on the performance of underlying investments.

How do interest rates affect annuity payouts?

Higher interest rates generally lead to larger annuity payouts, as the insurer can earn more on the invested funds.

Can I withdraw my annuity payments early?

If you’re using Groww, you can use their annuity calculator to determine your potential returns. Check out our article on Annuity Calculator Groww 2024 for more information.

You may be able to withdraw some or all of your annuity payments early, but there may be penalties depending on the terms of your contract.