Calculating Annuity Pension 2024: A Guide is a comprehensive resource for understanding how annuity pensions are determined in the current year. Annuity pensions are a vital part of retirement planning, offering a steady stream of income during your golden years.

When considering an annuity, it’s natural to be cautious about the provider’s legitimacy. Is Annuity Gator a legitimate company in 2024 ? It’s important to research and verify the credentials of any financial institution before entrusting them with your savings.

This guide explores the different types of annuity pensions available, the factors that influence their calculation, and the methods used to arrive at your final pension amount.

HDFC is a well-known financial institution that offers various financial products, including annuities. An annuity calculator provided by HDFC in 2024 can help you understand the potential benefits and costs of different annuity options.

Understanding the intricacies of annuity pensions is crucial for individuals seeking financial security in retirement. Whether you’re a seasoned investor or just starting to plan for your future, this guide will provide valuable insights into the world of annuity pensions.

An annuity is a financial product that provides a stream of payments over a specified period. An annuity is essentially a series of payments in 2024 , often designed to provide income during retirement or other life stages.

Contents List

Understanding Annuity Pensions

An annuity pension is a type of retirement income that provides a guaranteed stream of payments for life. It is a popular option for individuals who want to ensure a steady income during their retirement years. Annuities are typically purchased with a lump sum of money, and the insurance company then makes regular payments to the annuitant, usually starting at a specific age.

Estimating future income needs is a crucial aspect of retirement planning. An annuity estimator in 2024 can help you project your potential income based on various factors, such as your age, savings, and investment choices.

Types of Annuity Pensions

Annuity pensions come in various forms, each offering different features and benefits. Here are some common types:

- Fixed Annuities:These provide a fixed amount of payment throughout the annuitant’s lifetime. The payments are not affected by market fluctuations, offering a predictable income stream.

- Variable Annuities:These offer payments that fluctuate based on the performance of underlying investments. The value of the annuity can increase or decrease depending on market conditions. This option provides the potential for higher returns but also carries greater risk.

- Indexed Annuities:These offer payments that are linked to the performance of a specific index, such as the S&P 500. They provide a level of protection against inflation while offering the potential for growth.

Key Features and Benefits of Annuity Pensions

Annuity pensions offer several advantages for retirees, including:

- Guaranteed Income:Annuities provide a guaranteed stream of income for life, ensuring financial security during retirement.

- Protection Against Longevity Risk:Annuities help protect against outliving your savings, as they provide income for as long as you live.

- Tax Advantages:In some cases, annuity payments may be tax-deferred, allowing for tax-efficient growth of your retirement savings.

- Flexibility:Annuities offer various options for customization, allowing you to tailor them to your specific needs and financial goals.

Factors Affecting Annuity Pension Calculations

The amount of an annuity pension is determined by several factors. Understanding these factors is crucial for estimating your potential retirement income.

For those seeking a career in finance, the Jaiib exam is a significant hurdle. Understanding annuity formulas is crucial for success in the Jaiib exam and will help you grasp key concepts in financial planning.

Primary Factors Influencing Annuity Pension Calculations

- Age:The older you are when you purchase an annuity, the lower the monthly payments will be. This is because you are expected to live longer and receive payments for a longer period.

- Salary History:For defined benefit pension plans, your salary history is a key factor in determining your pension amount. Higher salaries generally lead to higher pensions.

- Interest Rates:Interest rates play a significant role in annuity calculations. Higher interest rates generally result in higher annuity payments.

- Mortality Rates:Actuarial tables and mortality rates are used to estimate the life expectancy of annuitants. Higher mortality rates can lead to lower annuity payments.

Impact of Each Factor on Pension Amount

Each factor mentioned above influences the final annuity pension amount in different ways. For example, a higher age at purchase will result in lower monthly payments, while a higher salary history will lead to higher payments. Understanding how these factors interact is essential for accurate pension planning.

If you’re looking to improve your vocabulary, word puzzles can be a fun and engaging way to learn. Unscramble the word “annuity” in 2024 and see if you can decipher the meaning of this financial term.

Annuity Pension Calculation Methods

Different methods are used to calculate annuity pensions, each with its own advantages and disadvantages. Understanding these methods can help you choose the most appropriate option for your retirement planning.

Understanding financial terms across different languages can be helpful for global communication. The Bengali meaning of “annuity” in 2024 might provide valuable insights for those who communicate in this language.

Traditional Method

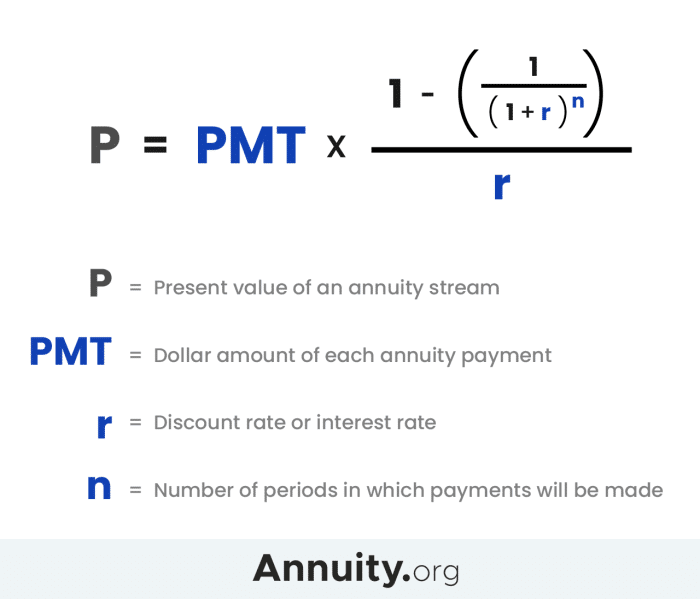

The traditional method involves calculating the present value of future payments based on a specific interest rate and mortality rate. This method is commonly used for fixed annuities.

Retirement planning involves various strategies, and annuities can be a part of the equation. Annuity options within the National Pension System (NPS) in 2024 may offer attractive benefits for those seeking secure retirement income.

Projected Unit Credit Method

The projected unit credit method is often used for defined benefit pension plans. This method calculates the pension based on the number of years of service and the average salary during those years.

Inheritance can bring both joy and financial complexities. If you’ve inherited an annuity, you might wonder about its tax implications. Is an inherited annuity taxable in 2024 ? The answer depends on various factors, so it’s crucial to seek professional advice.

Step-by-Step Guide to Annuity Pension Calculation

Here is a step-by-step guide to calculating an annuity pension using the traditional method:

- Determine the annuity amount:This is the amount of money you will receive each year.

- Determine the interest rate:This is the rate of return used to calculate the present value of future payments.

- Determine the mortality rate:This is the probability of dying at a given age.

- Calculate the present value of the annuity:This is the current value of the future payments, discounted to reflect the time value of money.

Comparison of Calculation Methods

The traditional method is relatively straightforward and provides a predictable income stream. However, it may not be as flexible as other methods. The projected unit credit method offers greater flexibility and can be adjusted to reflect changes in salary or service.

Annuity Pension Calculation Example

Let’s consider a hypothetical scenario to illustrate the calculation of an annuity pension. Suppose a 65-year-old individual purchases a fixed annuity with a lump sum of $100,000. The annuity pays a fixed annual amount of $5,000. Assuming an interest rate of 3% and a mortality rate based on actuarial tables, the present value of the annuity can be calculated using a financial calculator or spreadsheet software.

In a world of fluctuating interest rates, seeking a stable income stream can be challenging. Annuity options offering a 7 percent return in 2024 could be an attractive prospect, but remember to carefully evaluate the terms and conditions before committing.

The present value of the annuity in this scenario would be approximately $110,000.

Implications of Different Input Values, Calculating Annuity Pension 2024

The final annuity pension amount is sensitive to changes in the input values. For example, a higher interest rate would result in a higher present value of the annuity, while a lower interest rate would result in a lower present value.

Annuity Gator is a company that offers annuity products, but it’s crucial to understand the details of their offerings. Annuity Gator’s services in 2024 may be suitable for some individuals, but it’s essential to compare them with other options before making a decision.

Similarly, a higher mortality rate would lead to lower annuity payments.

Annuity insurance can be a valuable tool for retirement planning, but it’s essential to understand the intricacies of this financial product. If you’re wondering if annuity insurance is right for you in 2024 , you’ll want to consider factors like your risk tolerance, investment goals, and tax implications.

Annuity Pension in 2024: Calculating Annuity Pension 2024

Annuity pensions remain a popular option for retirement planning in 2024. However, several factors are shaping the current landscape and future trends.

Staying updated on financial news is essential for informed decision-making. Annuity news in 2024 can provide insights into market trends, regulatory changes, and new product offerings.

Recent Changes and Trends

In recent years, there have been some changes in the annuity market, including:

- Increased Interest in Variable Annuities:With market volatility, individuals are seeking investment options with the potential for growth.

- Rise of Indexed Annuities:Indexed annuities offer a balance between protection against inflation and potential for growth.

- New Products and Features:Insurance companies are constantly innovating and introducing new annuity products with features such as guaranteed lifetime income and withdrawal options.

Potential Future Developments

Looking ahead, several developments could impact annuity pensions in the coming years, including:

- Changes in Interest Rates:Fluctuations in interest rates could affect the value of annuities.

- Increased Longevity:As people live longer, annuity providers may need to adjust their calculations to reflect increased life expectancy.

- Technological Advancements:Technology is playing an increasingly important role in the annuity market, leading to more efficient and personalized products.

Resources for Further Information

For more detailed information about annuity pensions, you can consult the following resources:

- The National Association of Insurance Commissioners (NAIC):The NAIC provides information and resources on insurance regulation, including annuities. https://www.naic.org/

- The Securities and Exchange Commission (SEC):The SEC provides information on investing in annuities, including variable annuities. https://www.sec.gov/

- The American Council of Life Insurers (ACLI):The ACLI is a trade association for the life insurance industry and provides information on annuities. https://www.acli.com/

- Financial Professionals:Consulting with a qualified financial advisor can provide personalized advice on annuity pensions and retirement planning.

End of Discussion

By carefully considering the factors that affect annuity pension calculations and exploring the available methods, you can gain a deeper understanding of your retirement income potential. Remember, the earlier you begin planning, the more time you have to optimize your retirement savings and secure a comfortable future.

This guide serves as a starting point for your journey towards financial well-being.

Tax season can be a stressful time, and understanding the tax implications of your financial products is crucial. If you have an annuity, you’ll want to know how it’s reported on your taxes. Annuity payments are often reported on Form 1099 in 2024 , so it’s important to be familiar with this form.

FAQ Section

What are the tax implications of receiving an annuity pension?

Retirement planning involves careful consideration of various factors, including required minimum distributions (RMDs). If you’re planning to use an annuity for retirement income, you’ll want to know if your annuity is subject to RMDs in 2024.

The tax implications of annuity pensions vary depending on your location and the specific pension plan. It’s crucial to consult with a tax advisor to understand how your pension will be taxed.

How do I choose the right type of annuity pension for my needs?

Choosing the right annuity pension depends on your risk tolerance, investment goals, and financial situation. Consulting with a financial advisor can help you determine the best option for your individual circumstances.

Can I adjust my annuity pension payments after retirement?

The ability to adjust your annuity pension payments after retirement depends on the specific terms of your pension plan. Some plans offer flexibility, while others have fixed payment schedules.