Calculating Annuity Values 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Annuities, a financial instrument that provides a stream of regular payments, have gained significant popularity in recent years as individuals seek reliable income streams for retirement or other financial goals.

This guide explores the intricacies of annuity calculations, delving into the factors that influence their value, and highlighting the importance of understanding these concepts in today’s dynamic financial landscape.

We’ll delve into the different types of annuities, including fixed, variable, immediate, and deferred annuities, and explore their advantages and disadvantages. You’ll learn how to calculate the present value of an annuity, understanding the impact of interest rates, the length of the annuity period, and other factors that can influence its value.

An annuity can be a complex financial product, so it’s helpful to understand its key features. This article provides a clear definition of an annuity: Annuity Is Defined As Mcq 2024.

This guide will equip you with the knowledge to make informed decisions about incorporating annuities into your financial plan, whether you’re planning for retirement, managing your estate, or seeking a secure source of income.

Contents List

Understanding Annuities

Annuities are financial instruments that provide a stream of regular payments over a specified period. They are often used for retirement planning, but they can also be employed for other financial goals, such as estate planning or income generation. Annuities offer a guaranteed stream of income, which can provide financial security and peace of mind.

Key Characteristics of Annuities

Annuities are characterized by several key features:

- Regular Payments:Annuities provide a series of payments, typically made monthly, quarterly, or annually.

- Guaranteed Income:The payments from an annuity are usually guaranteed for a specific period, ensuring a consistent income stream.

- Longevity Protection:Annuities can provide protection against outliving one’s savings, as they continue to make payments for the duration of the contract.

- Investment Options:Some annuities offer investment options, allowing the annuitant to participate in market growth.

Types of Annuities

Annuities come in various forms, each with its own features and benefits. Here are some common types:

- Fixed Annuities:These annuities guarantee a fixed interest rate, ensuring predictable payments. They are typically suitable for individuals seeking stability and guaranteed income.

- Variable Annuities:Variable annuities offer investment options, allowing the annuitant to participate in market growth. However, the payments are not guaranteed and can fluctuate based on the performance of the underlying investments.

- Immediate Annuities:These annuities begin making payments immediately upon purchase. They are suitable for individuals who need income right away, such as retirees.

- Deferred Annuities:Deferred annuities start making payments at a later date, often during retirement. They are suitable for individuals who are saving for retirement and want to grow their funds before starting to receive payments.

Advantages and Disadvantages of Annuities

Annuities offer both advantages and disadvantages, which should be carefully considered before investing in them.

Advantages

- Guaranteed Income:Fixed annuities provide guaranteed income, offering financial security and peace of mind.

- Longevity Protection:Annuities can help protect against outliving one’s savings, ensuring a consistent income stream throughout retirement.

- Tax-Deferred Growth:In some cases, annuity earnings grow tax-deferred, allowing for potential tax savings.

- Estate Planning Tool:Annuities can be used as a tool for estate planning, providing income for beneficiaries after the annuitant’s death.

Disadvantages

- Limited Liquidity:Annuities are typically illiquid, meaning it can be difficult to access the funds before the annuity starts making payments.

- Fees and Charges:Annuities often come with fees and charges, which can reduce the overall returns.

- Potential for Lower Returns:Fixed annuities may offer lower returns than other investments, especially during periods of high market growth.

- Complexity:Annuities can be complex financial instruments, requiring careful consideration and understanding before investing.

Annuity Payment Calculation Methods

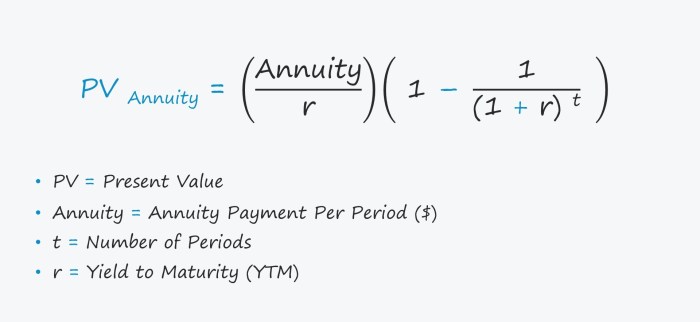

Calculating the present value of an annuity involves determining the current value of a stream of future payments. This calculation is essential for understanding the financial value of an annuity and making informed investment decisions.

Step-by-Step Guide for Calculating Present Value

To calculate the present value of an annuity, follow these steps:

- Determine the annuity payment amount (PMT):This is the regular payment received from the annuity.

- Determine the interest rate (r):This is the rate of return earned on the annuity.

- Determine the number of periods (n):This is the total number of payments to be received from the annuity.

- Use the present value of an annuity formula:The formula for calculating the present value of an annuity is:

PV = PMT

- [(1

- (1 + r)^-n) / r]

Where:

- PV = Present value of the annuity

- PMT = Annuity payment amount

- r = Interest rate per period

- n = Number of periods

Examples of Annuity Payment Calculations

Here are some examples of annuity payment calculations with different payment frequencies and time periods:

Example 1: Monthly Payments

An annuity pays $1,000 per month for 10 years at an annual interest rate of 5%. What is the present value of this annuity?

Microsoft Excel can be a useful tool for calculating annuities. This resource provides guidance on using Excel to perform these calculations: Calculating Annuity Excel 2024.

First, convert the annual interest rate to a monthly rate: r = 5% / 12 = 0.4167%.

Then, calculate the number of periods: n = 10 years – 12 months/year = 120 months.

When planning for retirement, you might wonder if an annuity or drawdown is the better option for you. This article explores the differences between these two approaches: Annuity Or Drawdown 2024.

Now, plug the values into the present value formula:

PV = $1,000

- [(1

- (1 + 0.004167)^-120) / 0.004167] = $95,142.64

Therefore, the present value of this annuity is $95,142.64.

Calculating annuities can be complex, but there are resources available to help you. This article explores the different methods for calculating annuities: Calculating Annuities 2024.

Example 2: Annual Payments

An annuity pays $5,000 per year for 20 years at an annual interest rate of 6%. What is the present value of this annuity?

Annuities can be a valuable tool for retirement planning, but it’s important to consider the different types of annuities available. This article explores the concept of a growing annuity and how to calculate it: Calculating Growing Annuity 2024.

Plug the values into the present value formula:

PV = $5,000

- [(1

- (1 + 0.06)^-20) / 0.06] = $62,092.13

Therefore, the present value of this annuity is $62,092.13.

Understanding the concept of an annuity is essential for making informed financial decisions. This resource provides a clear and concise definition of what an annuity is: An Annuity Is Best Defined As 2024.

Factors Affecting Annuity Values: Calculating Annuity Values 2024

Several factors can influence the value of an annuity, affecting the amount of income received or the present value of the annuity.

If you’re thinking about investing in an annuity, it’s crucial to understand the tax implications. This article discusses the taxability of annuity income in India: Is Annuity Income Taxable In India 2024.

Impact of Interest Rates

Interest rates play a significant role in annuity calculations. As interest rates rise, the present value of an annuity increases, as future payments are discounted at a higher rate. Conversely, as interest rates fall, the present value of an annuity decreases.

The annuity factor is a crucial element in annuity calculations. This article explains how to calculate the annuity factor: Calculating An Annuity Factor 2024.

Length of the Annuity Period

The length of the annuity period also affects its value. Longer annuity periods generally result in higher present values, as the stream of payments extends over a longer duration. However, it’s important to consider the risk associated with longer annuity periods, as interest rates and market conditions can change over time.

Other Factors Influencing Annuity Calculations, Calculating Annuity Values 2024

Other factors that can influence annuity calculations include:

- Inflation:Inflation erodes the purchasing power of money over time. Annuities may offer inflation protection, but it’s important to consider the impact of inflation on the value of future payments.

- Taxes:Annuities may be subject to taxes on earnings and payments. It’s crucial to understand the tax implications of annuities before investing.

- Fees:Annuities often come with fees, such as administrative fees, surrender charges, and mortality charges. These fees can reduce the overall returns from an annuity.

Annuity Applications in Financial Planning

Annuities can be a valuable tool for financial planning, providing a steady stream of income for various financial goals.

Retirement Planning

Annuities are widely used for retirement planning, providing a guaranteed income stream to supplement other retirement savings. They can help retirees meet their living expenses, cover healthcare costs, and maintain their lifestyle during retirement.

Estate Planning

Annuities can also be used for estate planning purposes. For example, an annuity can be structured to provide income for beneficiaries after the annuitant’s death, ensuring financial support for loved ones.

When considering an annuity, it’s important to understand how the discount factor affects its value. This resource provides insights into calculating the annuity discount factor: Calculate Annuity Discount Factor 2024.

Other Financial Scenarios

Annuities can be applicable in other financial scenarios, such as:

- Income Generation:Annuities can provide a steady stream of income for individuals who need regular payments, such as those with disabilities or those who have lost a significant source of income.

- Long-Term Care:Annuities can be used to fund long-term care expenses, providing financial protection against the high costs of assisted living or nursing homes.

- Charitable Giving:Annuities can be used to make charitable donations, providing a stream of income for a designated charity over time.

Annuity Calculations in 2024

In 2024, the interest rate environment and market conditions will continue to influence annuity calculations. It’s important to stay informed about these factors to make informed decisions about annuities.

Annuity calculations can be tricky, but there are tools and resources available to help. For example, you can use a financial calculator like the BA II Plus to make these calculations easier. Find out how to do this on this website: Calculating Annuity Ba Ii Plus 2024.

Current Interest Rate Environment

Interest rates are expected to remain relatively low in 2024, which could impact the value of fixed annuities. As interest rates rise, the present value of an annuity increases, but in a low-interest-rate environment, the present value may be lower.

However, variable annuities may offer opportunities for growth in a rising market.

Potential Changes in Annuity Calculations

The evolving market conditions can lead to changes in annuity calculations. Factors such as inflation, economic growth, and regulatory changes can influence the pricing and features of annuities. It’s crucial to consult with a financial advisor to understand the potential impact of these factors on annuity values.

Resources and Tools for Annuity Calculations

Several resources and tools are available for calculating annuity values in 2024. Online calculators, financial planning software, and financial advisors can provide guidance and assistance with annuity calculations. It’s important to use reputable sources and tools to ensure accurate and reliable results.

Understanding how annuities work is essential for making informed financial decisions. To help you grasp the concept, there are numerous examples available online. This particular example provides a detailed explanation of how to calculate the present value of an annuity: Pv Annuity Example 2024.

Closing Notes

As we navigate the evolving financial landscape of 2024, understanding annuity calculations is more critical than ever. By grasping the fundamental concepts and factors that influence annuity values, individuals can make informed decisions that align with their financial goals. Whether you’re considering an annuity for retirement planning, estate planning, or other financial scenarios, this guide provides a comprehensive framework for understanding this powerful financial tool.

Remember, with careful planning and a solid understanding of annuities, you can create a secure financial future for yourself and your loved ones.

FAQ Resource

What is the difference between a fixed and a variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s returns fluctuate based on the performance of the underlying investments.

Many people wonder whether an annuity is considered insurance. The answer is not straightforward, as annuities can have various features. This article explores the relationship between annuities and insurance: Is Annuity Insurance 2024.

How do taxes affect annuity payments?

The tax treatment of annuity payments depends on the type of annuity and the individual’s tax situation. It’s important to consult with a financial advisor to understand the tax implications of your specific annuity.

Are there any fees associated with annuities?

Yes, annuities typically come with fees, such as administrative fees, mortality and expense charges, and surrender charges. It’s crucial to understand the fee structure before investing in an annuity.

Annuity is a financial product that provides a stream of regular payments for a specific period. If you’re looking to understand the basics of an annuity, including its definition, you can check out this resource: Annuity Is Definition 2024.

How can I find a reliable annuity calculator?

Several online calculators and financial institutions offer annuity calculation tools. It’s essential to choose a reputable source and ensure the calculator considers all relevant factors.