Calculating Growing Annuity 2024 provides a thorough exploration of this financial tool, demystifying its complexities and offering valuable insights for individuals seeking to optimize their financial planning. A growing annuity is a stream of payments that increases over time at a constant rate, making it a powerful instrument for long-term financial goals.

This guide will delve into the fundamental principles of growing annuities, including their calculation, factors influencing their value, and practical applications in retirement planning and investment strategies. Whether you’re a seasoned investor or just starting to explore the world of finance, understanding growing annuities can empower you to make informed decisions about your financial future.

In Bengali, the term “annuity” translates to “বার্ষিকী” (barshiki). To learn more about the Bengali meaning of annuity, you can visit this link: Annuity Is Bengali Meaning 2024. This article provides insights into the cultural understanding of annuities in Bangladesh.

Contents List

- 1 Understanding Growing Annuities

- 2 Calculating the Present Value of a Growing Annuity

- 3 Calculating the Future Value of a Growing Annuity

- 4 Factors Affecting Growing Annuity Calculations

- 5 Applications of Growing Annuities in Financial Planning

- 6 Practical Considerations for Growing Annuities: Calculating Growing Annuity 2024

- 7 Concluding Remarks

- 8 Quick FAQs

Understanding Growing Annuities

A growing annuity is a series of payments that increase over time at a constant rate. It’s like a regular annuity, but with an added twist: each payment is a little bit bigger than the one before it. This makes it a powerful tool for long-term financial planning, especially when you want your investments to grow steadily over time.

Many annuity contracts offer a free-look period, allowing you to review the terms and potentially cancel the contract. If you’re interested in learning more about the 30-day free-look period for annuities, you can find details in this article: Annuity 30 Day Free Look 2024.

This information can be helpful for making informed decisions about annuity contracts.

Key Characteristics of Growing Annuities

Growing annuities have two key features that set them apart from regular annuities:

- Constant Growth Rate:Each payment increases by a fixed percentage, ensuring a consistent growth pattern over time.

- Periodic Payments:Payments are made at regular intervals, such as monthly, quarterly, or annually.

Real-World Examples of Growing Annuities

- Retirement Planning:Many retirement plans offer growing annuity options, where your contributions increase steadily over time, allowing you to accumulate a larger nest egg for your golden years.

- Investment Strategies:Growing annuities are often incorporated into investment strategies, providing a steady stream of income that grows over time, making them ideal for long-term wealth accumulation.

- Business Operations:Companies may use growing annuities to fund future projects or expansion plans, ensuring that their financial resources keep pace with their growth goals.

Calculating the Present Value of a Growing Annuity

The present value (PV) of a growing annuity represents its worth today, taking into account the future growth of payments. It’s essential for understanding the value of an annuity at the time of investment.

To get a better understanding of how annuities work in practice, it’s helpful to look at real-life examples. You can find several annuity examples in this article: Annuity Examples 2024. These examples illustrate how annuities can be used in various financial situations.

Formula for Calculating the Present Value of a Growing Annuity

PV = PMT / (r

Annuity plans can provide financial security for retirement, and understanding how they work is essential. If you want to learn more about annuities in 2021 and 2024, you can find relevant information in this article: Annuity 2021 2024. It explores the current landscape of annuities and their potential benefits.

- g)

- [1

- (1 + g / 1 + r)^-n]

Components of the Formula

- PMT:The initial payment amount.

- r:The discount rate, representing the required rate of return on the investment.

- g:The growth rate of the annuity payments.

- n:The number of periods over which payments are made.

Numerical Example

Let’s say you have a growing annuity that pays $1000 per year, grows at a rate of 3% annually, and has a discount rate of 5%. The annuity will last for 10 years. To calculate the present value, we’d plug these values into the formula:

PV = $1000 / (0.05

Charles Schwab offers an annuity calculator that can help you estimate the potential returns from different annuity options. If you’re interested in using this calculator, you can find it here: Annuity Calculator Charles Schwab 2024. This calculator can be a valuable tool for comparing different annuity options.

- 0.03)

- [1

- (1 + 0.03 / 1 + 0.05)^-10]

Solving this equation, we find that the present value of this growing annuity is approximately $8530.17.

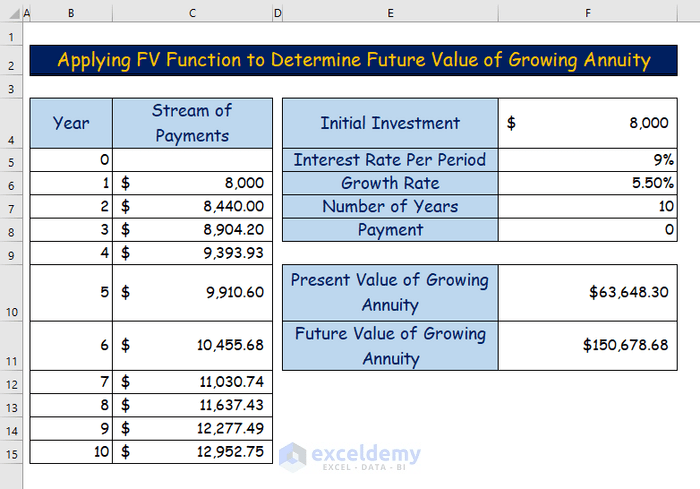

Calculating the Future Value of a Growing Annuity

The future value (FV) of a growing annuity represents its worth at a specific point in the future, taking into account both the growth of payments and the accumulation of interest.

When it comes to annuities from LIC, understanding their tax implications is crucial. If you’re wondering whether annuity income from LIC is taxable, you can find answers here: Is Annuity From Lic Taxable 2024. This article provides clear information on the taxability of LIC annuities.

Formula for Calculating the Future Value of a Growing Annuity, Calculating Growing Annuity 2024

FV = PMT

Chapter 9 of many finance textbooks often covers the topic of annuities. If you’re studying finance and want to learn more about annuities, you can find helpful information in this chapter: Chapter 9 Annuities 2024. This chapter provides a comprehensive overview of annuities and their applications.

- [(1 + r)^n

- (1 + g)^n] / (r

- g)

Relationship Between Future Value and Present Value

The future value of a growing annuity is directly related to its present value. The future value represents the present value compounded over time, taking into account the growth of payments and the accumulation of interest.

The annuity discount factor is a crucial element in calculating the present value of an annuity. If you need to learn how to calculate this factor, you can find helpful information here: Calculate Annuity Discount Factor 2024. This article provides step-by-step guidance on the process.

Numerical Example

Using the same example as before, let’s calculate the future value of the growing annuity after 10 years. We’ll use the same values for PMT, r, g, and n.

FV = $1000

Calculating the future value of an annuity due can be a complex process, but it’s essential for financial planning. If you need guidance on how to calculate this value, you can find helpful resources here: Calculate Annuity Due Future Value 2024.

This article breaks down the process step-by-step.

- [(1 + 0.05)^10

- (1 + 0.03)^10] / (0.05

- 0.03)

Solving this equation, we find that the future value of the growing annuity after 10 years is approximately $12577.89.

An annuity is a financial instrument that provides a series of payments over a set period. To understand the basic definition of an annuity, you can read this article: Annuity Meaning In English 2024. This article explains the concept in clear and simple terms.

Factors Affecting Growing Annuity Calculations

Several factors can influence the present and future values of a growing annuity. Understanding these factors is crucial for making informed financial decisions.

Impact of Growth Rate

- Higher Growth Rate:A higher growth rate results in a larger future value and a smaller present value. This is because the payments increase more quickly, leading to a greater accumulation of wealth over time.

- Lower Growth Rate:A lower growth rate leads to a smaller future value and a larger present value. This is because the payments increase at a slower pace, resulting in a smaller accumulation of wealth over time.

Influence of Discount Rate

- Higher Discount Rate:A higher discount rate results in a smaller present value and a smaller future value. This is because the higher discount rate reflects a higher required rate of return, reducing the present value of future payments.

- Lower Discount Rate:A lower discount rate results in a larger present value and a larger future value. This is because the lower discount rate reflects a lower required rate of return, increasing the present value of future payments.

Number of Periods

- Longer Period:A longer period leads to a larger future value and a smaller present value. This is because the payments have more time to grow and accumulate interest.

- Shorter Period:A shorter period results in a smaller future value and a larger present value. This is because the payments have less time to grow and accumulate interest.

Applications of Growing Annuities in Financial Planning

Growing annuities are versatile financial tools with numerous applications in financial planning. Understanding their potential benefits can help you make informed decisions for your financial future.

If you have questions about annuities, you’re not alone. Many people have questions about this financial product. You can find answers to common annuity questions in this article: Annuity Questions And Answers 2024. This resource can help clarify any doubts you might have.

Retirement Planning

Growing annuities can be a valuable component of a retirement plan. They provide a steady stream of income that increases over time, helping you maintain your standard of living in retirement. By investing in a growing annuity, you can ensure that your retirement income keeps pace with inflation and other living expenses.

Investment Strategies

Growing annuities can also be incorporated into investment strategies to achieve long-term wealth accumulation. By investing in a growing annuity, you can benefit from both the growth of your investment and the regular stream of income it generates.

An annuity is a series of regular payments, often used for retirement income. To learn more about how annuities work and their structure, you can visit this link: Annuity Is A Series Of 2024. This article explains the concept of annuities in detail.

Other Financial Planning Scenarios

- College Savings:Growing annuities can be used to save for your child’s college education, ensuring that you have enough funds to cover tuition and other expenses.

- Estate Planning:Growing annuities can be included in estate planning strategies to provide a steady stream of income for your beneficiaries after your passing.

Practical Considerations for Growing Annuities: Calculating Growing Annuity 2024

While growing annuities offer significant benefits, it’s crucial to consider certain practical aspects before investing.

The annuity formula is a key tool for calculating the present and future values of annuities. If you want to learn more about the formula and how it’s used, you can find information here: Annuity Formula Is 2024. This article explains the formula in detail and provides examples of its application.

Choosing an Appropriate Growth Rate

Selecting an appropriate growth rate is essential. A growth rate that is too high may be unrealistic and unsustainable, while a rate that is too low may not provide sufficient returns. Consider your investment goals, risk tolerance, and the current economic climate when determining an appropriate growth rate.

Risks Associated with Growing Annuities

- Inflation Risk:If inflation outpaces the growth rate of the annuity, your purchasing power may decline over time.

- Interest Rate Risk:If interest rates rise, the value of your annuity may decrease.

- Market Risk:The value of your annuity may fluctuate with the overall market performance.

Tips for Maximizing the Benefits of Growing Annuities

- Start Early:The earlier you begin investing in a growing annuity, the more time your investment has to grow and accumulate interest.

- Choose a Reputable Provider:Select a financial institution with a strong track record and a history of providing reliable financial products.

- Diversify Your Investments:Don’t put all your eggs in one basket. Diversify your investment portfolio to mitigate risk.

Concluding Remarks

As we conclude our journey through the world of growing annuities, it’s clear that this financial tool offers a compelling avenue for individuals seeking to secure their financial well-being. By understanding the key concepts, calculating the present and future values, and considering the various factors influencing their performance, you can leverage the power of growing annuities to achieve your financial goals.

Remember, careful planning and informed decision-making are essential for maximizing the benefits of this valuable financial instrument.

There are many different types of annuities, each with its own features and benefits. To learn more about the various annuity kinds available, you can read this article: Annuity Kinds 2024. Understanding the different types will help you determine which one best suits your needs and financial goals.

Quick FAQs

What are the potential risks associated with investing in growing annuities?

Annuity is a financial product that provides a series of equal payments, often used for retirement planning. If you’re curious about the basics of annuities, check out this article: Annuity Is A Series Of Equal Payments 2024. This will give you a solid understanding of what an annuity is and how it works.

Like any investment, growing annuities carry inherent risks. The most significant risk is that the actual growth rate may not meet your expectations, leading to lower returns than anticipated. Additionally, the value of your annuity may be affected by factors such as interest rate changes and inflation.

It’s crucial to carefully consider these risks before investing in growing annuities.

How can I choose an appropriate growth rate for my growing annuity?

Selecting an appropriate growth rate is essential for maximizing the benefits of your growing annuity. It’s crucial to consider factors such as your investment goals, risk tolerance, and the expected rate of inflation. You can consult with a financial advisor to determine a growth rate that aligns with your individual circumstances.