Calculating Growing Annuity Payment 2024 delves into the intricacies of managing financial growth over time. A growing annuity, unlike a regular annuity, accounts for the impact of inflation and investment returns, ensuring your money keeps pace with rising costs. Imagine building a retirement nest egg that not only maintains its value but also grows alongside the economy.

The Annuity Rate Is 2024 can vary depending on a number of factors, including your age, the type of annuity you choose, and the current market conditions. It’s essential to compare rates from different providers before making a decision.

If you’re looking to receive an annuity from LIC, you’ll want to understand if it’s taxable, which you can find out more about here.

This is the power of a growing annuity, and understanding its calculations is crucial for maximizing financial well-being.

This guide will walk you through the essential concepts, formulas, and factors that influence growing annuity payments. We’ll explore real-world scenarios, practical examples, and the role of inflation, interest rates, and growth rates in determining your financial future.

Contents List

Understanding Growing Annuities

A growing annuity is a series of payments that increase over time at a predetermined rate. It’s a financial tool that helps individuals plan for their future by providing a stream of income that keeps pace with inflation. Growing annuities differ from regular annuities, which offer fixed payments throughout their term.

This article will delve into the nuances of growing annuities, exploring their characteristics, calculations, and real-world applications.

Key Characteristics of Growing Annuities

Growing annuities possess several key characteristics that distinguish them from other types of annuities. These include:

- Regular Payments:Like regular annuities, growing annuities involve a series of periodic payments. These payments can be made monthly, quarterly, annually, or at any other chosen frequency.

- Increasing Payments:The defining feature of a growing annuity is the gradual increase in payment amounts over time. This growth rate is typically fixed and predetermined, ensuring predictable and consistent growth in income.

- Growth Rate:The growth rate of a growing annuity represents the percentage increase in each subsequent payment. This rate can be set to match inflation, a specific investment return target, or any other desired growth rate.

- Term:Growing annuities, like their regular counterparts, have a specific term or duration. This term determines the total number of payments that will be made, and it can be fixed or flexible depending on the agreement.

Difference Between Growing and Regular Annuities

The fundamental difference between growing and regular annuities lies in the nature of their payments. While regular annuities provide fixed payments throughout their term, growing annuities offer payments that increase over time. This growth factor is the key distinction that makes growing annuities suitable for situations where a growing stream of income is desired.

Real-World Examples of Growing Annuities

Growing annuities find application in various real-world scenarios. Here are some examples:

- Retirement Planning:Growing annuities can be used to supplement retirement income. As inflation erodes the purchasing power of money over time, a growing annuity ensures that retirement income keeps pace with rising living expenses.

- Investment Strategies:Investors can use growing annuities as a component of their investment portfolios to generate a steady stream of income that grows over time. This can be particularly beneficial in situations where long-term growth is a priority.

- Estate Planning:Growing annuities can be incorporated into estate planning strategies to provide a continuous source of income for beneficiaries. The growing payments can help ensure that beneficiaries receive a stream of income that increases over time.

Calculating the Payment of a Growing Annuity: Calculating Growing Annuity Payment 2024

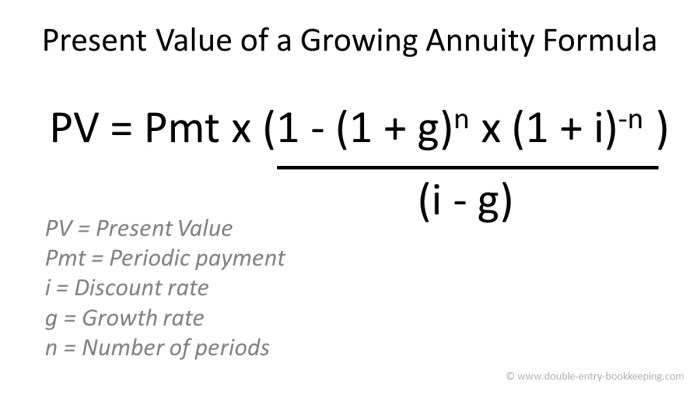

The calculation of the payment of a growing annuity involves a slightly more complex formula than that of a regular annuity. This formula considers the growth rate of the payments, in addition to the interest rate, the number of periods, and the present value.

Formula for Calculating Growing Annuity Payment

PMT = PV- (r – g) / (1 – (1 + g) / (1 + r))^n

Components of the Formula

- PMT:This represents the payment amount of the growing annuity. It is the value that we are solving for.

- PV:This is the present value of the annuity, which is the lump sum amount that is invested initially to generate the growing stream of payments.

- r:This represents the interest rate, which is the rate of return earned on the invested amount. It is typically expressed as an annual percentage rate (APR).

- g:This represents the growth rate of the annuity, which is the percentage increase in each subsequent payment. It is also typically expressed as an annual percentage rate (APR).

- n:This represents the number of periods, which is the total number of payments that will be made over the term of the annuity.

Impact of Variables on Payment Amount, Calculating Growing Annuity Payment 2024

The payment amount of a growing annuity is influenced by the values of each variable in the formula. Understanding the impact of these variables is crucial for determining the appropriate payment amount for a given situation.

- Present Value (PV):A higher present value will result in a higher payment amount, as there is more capital available to generate income. Conversely, a lower present value will lead to a lower payment amount.

- Interest Rate (r):A higher interest rate will generally result in a higher payment amount, as the investment earns a greater return. However, the impact of the interest rate is moderated by the growth rate.

- Growth Rate (g):A higher growth rate will lead to a lower payment amount in the initial periods, but the payments will increase more rapidly over time. Conversely, a lower growth rate will result in higher initial payments, but the growth in payments will be slower.

- Number of Periods (n):A longer term (higher number of periods) will generally result in a lower payment amount, as the income is spread over a greater number of periods. Conversely, a shorter term will lead to a higher payment amount.

Factors Affecting Growing Annuity Payments

Several factors can influence the payment amount of a growing annuity, impacting the overall financial benefits of this type of investment. Understanding these factors is crucial for making informed decisions regarding growing annuities.

Inflation

Inflation is a key factor that impacts the payment amount of a growing annuity. As prices rise due to inflation, the purchasing power of money decreases. To counter this, the growth rate of the annuity should ideally be set to match or exceed the rate of inflation.

This ensures that the growing payments maintain their real value over time, providing a consistent stream of income that keeps pace with rising living expenses.

Growth Rate

The growth rate is a crucial factor that directly influences the payment amount of a growing annuity. A higher growth rate will result in faster-growing payments, but it may also lead to lower initial payments. Conversely, a lower growth rate will result in smaller increases in payments over time, but it may provide higher initial payments.

Many people choose annuities because they offer a guaranteed stream of income for life. If you’re considering this option, you’ll want to understand if Is Annuity For Life 2024 the right choice for you. While annuities can provide lifetime income, there are also some potential drawbacks, such as the fact that you may not be able to access your principal if you need it.

Annuity bonds are another type of annuity, and you can learn more about them here.

The optimal growth rate depends on individual financial goals and risk tolerance. It is essential to consider the desired growth rate in relation to inflation and investment return expectations.

Interest Rates

Interest rates play a significant role in determining the payment amount of a growing annuity. A higher interest rate will generally result in higher payments, as the investment earns a greater return. However, the impact of interest rates is moderated by the growth rate.

When you purchase an annuity, you become the owner. You can learn more about Annuity Owner Is 2024 and what your rights and responsibilities are. If you inherit an annuity, you may be wondering if it’s taxable. You can find out more about I Inherited An Annuity Is It Taxable 2024 and how the tax laws apply.

If the growth rate is higher than the interest rate, the payments may initially be lower but will grow more rapidly over time. Conversely, if the interest rate is higher than the growth rate, the initial payments may be higher, but the growth in payments will be slower.

Annuity rates can vary depending on the length of the term. If you’re looking for a shorter-term annuity, you can learn more about Annuity 3 Year Rates 2024 and how they compare to other options.

It is essential to consider the relationship between interest rates and the growth rate when evaluating a growing annuity.

There are a variety of tools available to help you calculate the potential benefits of an annuity, including spreadsheets. You can learn more about Calculating Annuity Excel 2024 and how to use these tools to your advantage. However, it’s important to remember that there are a number of potential issues with annuities, which you can read more about here.

Applications of Growing Annuities

Growing annuities find applications in various aspects of financial planning, offering flexibility and benefits tailored to specific needs and goals.

Financial Planning

Growing annuities can be a valuable tool for financial planning, providing a predictable stream of income that grows over time. This can help individuals achieve financial goals, such as retirement planning, education funding, or long-term savings.

Retirement Planning

Growing annuities are widely used in retirement planning to provide a steady stream of income that keeps pace with inflation. The increasing payments help ensure that retirees can maintain their living standards throughout their retirement years, even as prices rise.

Additionally, growing annuities can offer protection against longevity risk, ensuring that retirees have a source of income for the duration of their retirement, regardless of how long they live.

If you’re looking to receive annuity payments in the future, you may be considering a deferred annuity. You can find out more about Annuity Is Deferred 2024 and how it works. There are also many people who choose to invest a large sum into an annuity, such as a million dollars.

You can read more about Annuity 1 Million 2024 and its implications.

Investment Strategies

Growing annuities can be incorporated into investment strategies to generate a consistent stream of income that grows over time. This can be particularly beneficial for investors seeking long-term growth and a reliable source of income. Growing annuities can also be used to supplement other investments, providing a diversified portfolio that balances risk and reward.

Estate Planning

Growing annuities can be incorporated into estate planning strategies to provide a continuous source of income for beneficiaries. The growing payments can help ensure that beneficiaries receive a stream of income that increases over time, providing financial security and supporting their long-term financial well-being.

If you have a 401k, you may be considering using it to purchase an annuity. You can find out more about Annuity 401k 2024 and how it works. One of the most important aspects of an annuity is calculating the payments you will receive.

You can find out more about Calculating Annuity Payments 2024 and how to estimate your income.

Example Calculation

Let’s illustrate how to calculate the payment of a growing annuity with a practical example. Suppose an individual invests $100,000 (PV) in a growing annuity with a 5% annual interest rate (r) and a 2% annual growth rate (g) for a term of 20 years (n).

Using the formula above, we can calculate the payment amount (PMT) as follows:

PMT = $100,000 – (0.05 – 0.02) / (1 – (1 + 0.02) / (1 + 0.05))^20

PMT = $100,000 – 0.03 / (1 – 1.02 / 1.05)^20

PMT = $3,000 / (1 – 0.9619)^20

PMT = $3,000 / 0.3171

PMT = $9,460.49

Therefore, the payment amount for this growing annuity would be $9,460.49 per year. This amount will increase by 2% each year, ensuring that the payments keep pace with inflation and provide a growing stream of income for the individual.

End of Discussion

By understanding the principles of calculating growing annuity payments, you gain valuable insights into managing your financial future. From retirement planning to investment strategies, the knowledge acquired here empowers you to make informed decisions and secure a brighter financial horizon.

Whether you’re a seasoned investor or just starting your financial journey, this guide provides the tools and understanding to navigate the world of growing annuities with confidence.

Detailed FAQs

What are the benefits of a growing annuity?

Growing annuities offer the advantage of outpacing inflation and ensuring your savings maintain their purchasing power over time. They also provide a predictable stream of income that increases with growth, making them ideal for long-term financial goals.

How does a growing annuity differ from a regular annuity?

Annuity income can be a great way to supplement your retirement income, but it’s important to understand the tax implications. If you’re wondering Is Immediate Annuity Income Taxable 2024 , you’ll want to check out the latest tax laws.

There are also specific rules about whether or not an annuity is exempt from taxes altogether, which you can read more about here.

A regular annuity provides a fixed payment over time, while a growing annuity’s payments increase at a predetermined rate, typically linked to inflation or investment returns.

What are some common uses for growing annuities?

Growing annuities are commonly used for retirement planning, investment strategies, and estate planning. They provide a reliable source of income for retirement, supplement investment portfolios, and ensure a steady stream of income for beneficiaries.

How do I choose the right growth rate for my growing annuity?

The ideal growth rate depends on your risk tolerance, investment goals, and expected inflation rates. It’s essential to consult with a financial advisor to determine the appropriate growth rate for your specific needs.