Calculating Mortgage Payment 2024: A Guide to Understanding Your Costs can be a daunting task, but it’s essential for anyone looking to buy a home. Understanding the different components of a mortgage payment, such as principal, interest, property taxes, and homeowners insurance, is crucial for making informed financial decisions.

Citibank is another major financial institution that provides home loans. See their current home loan rates to compare options.

This guide will walk you through the process of calculating your mortgage payment, taking into account factors like interest rates, loan terms, and property value. We’ll also explore different scenarios and provide tips for managing your mortgage payments effectively.

A 10-year fixed-rate mortgage can provide stability. 10-year fixed-rate mortgages offer predictable monthly payments.

Contents List

Understanding Mortgage Payment Components

A mortgage payment is a monthly obligation that homeowners make to repay their home loan. This payment comprises several key components, each contributing to the overall cost of owning a home.

Principal

The principal is the initial amount borrowed from the lender to purchase the property. It represents the actual cost of the house, excluding any additional fees or closing costs. Each mortgage payment includes a portion of the principal, gradually reducing the outstanding loan balance over time.

Interest

Interest is the cost of borrowing money. Lenders charge interest on the principal amount, representing the cost of providing the loan. The interest rate, typically expressed as an annual percentage rate (APR), determines the amount of interest accrued on the loan.

Interest payments form a significant part of the monthly mortgage payment, especially in the early years of the loan term.

Stay up-to-date on the latest house loan interest rates in 2024 to make informed financial decisions.

Property Taxes

Property taxes are levied by local governments to fund public services such as schools, roads, and fire departments. These taxes are calculated based on the assessed value of the property and are typically paid annually. In many cases, mortgage lenders collect property taxes on behalf of homeowners as part of the monthly mortgage payment, ensuring timely payment to the local government.

Homeowners Insurance

Homeowners insurance protects homeowners against financial losses due to unforeseen events such as fire, theft, or natural disasters. Mortgage lenders typically require homeowners to maintain homeowners insurance as a condition of the loan. The monthly mortgage payment often includes a portion of the homeowners insurance premium, ensuring that the policy remains active and provides adequate coverage.

Finding the right lender is important. Mortgage lenders near you can offer personalized guidance and competitive rates.

Factors Affecting Components

The specific amount of each mortgage payment component can vary significantly depending on several factors:

- Loan Terms:Longer loan terms generally result in lower monthly payments but higher total interest paid over the life of the loan. Conversely, shorter loan terms lead to higher monthly payments but lower overall interest costs.

- Interest Rates:Higher interest rates result in larger interest payments, increasing the total monthly mortgage payment. Conversely, lower interest rates lead to lower interest payments and smaller monthly outlays.

- Property Location:Property taxes can vary significantly based on the location of the property. Properties in areas with higher property values or higher tax rates will generally have higher property tax payments.

Factors Influencing Mortgage Payment: Calculating Mortgage Payment 2024

Several factors play a crucial role in determining the overall mortgage payment, influencing the financial burden associated with homeownership.

Looking to purchase a home in 2024? Understanding ARM mortgage rates is a key factor in your decision. These rates can fluctuate, so staying informed is crucial.

Interest Rates

Interest rates are a primary driver of mortgage payment amounts. As interest rates rise, the cost of borrowing money increases, leading to higher monthly payments. Conversely, declining interest rates reduce the cost of borrowing, resulting in lower monthly outlays. The relationship between interest rates and mortgage payments is directly proportional, meaning that a higher interest rate corresponds to a larger monthly payment.

Navy Federal Credit Union offers mortgage services to eligible members. See their current mortgage rates to explore your options.

Loan Terms

The loan term, or the duration of the loan, also significantly affects mortgage payments. Longer loan terms, such as 30 years, generally result in lower monthly payments but higher total interest paid over the life of the loan. This is because the principal is amortized over a longer period, leading to smaller principal payments and larger interest payments.

Conversely, shorter loan terms, such as 15 years, lead to higher monthly payments but lower overall interest costs, as the principal is paid down more quickly.

Refinancing your mortgage can be a smart move. Best refinance companies can help you secure a lower interest rate and potentially save money.

Property Taxes and Homeowners Insurance

Property taxes and homeowners insurance, while not directly part of the loan principal or interest, contribute significantly to the overall monthly mortgage payment. These costs can vary depending on factors such as property location, assessed value, and insurance coverage. Lenders often collect these payments on behalf of homeowners as part of the monthly mortgage payment, ensuring timely payment to the respective authorities or insurance providers.

Calculating Mortgage Payment

Calculating a mortgage payment involves understanding the fundamental formula and applying it to the specific loan terms and property value. Several methods exist for determining the monthly payment, including manual calculation and utilizing online mortgage calculators.

Iccu is a credit union known for its competitive rates. Check out their current mortgage rates for potential savings.

Formula

The most common formula for calculating a mortgage payment is the following:

M = P [ i(1 + i)^n ] / [ (1 + i)^n

For the most up-to-date information, check out the home loan interest rates today. Rates can fluctuate daily.

1 ]

Where:

- M = Monthly mortgage payment

- P = Principal loan amount

- i = Monthly interest rate (annual interest rate divided by 12)

- n = Total number of monthly payments (loan term in years multiplied by 12)

Manual Calculation

To manually calculate a mortgage payment, you can follow these steps:

- Convert the annual interest rate to a monthly interest rate by dividing it by 12.

- Calculate the total number of monthly payments by multiplying the loan term in years by 12.

- Plug the values of P, i, and n into the formula and solve for M.

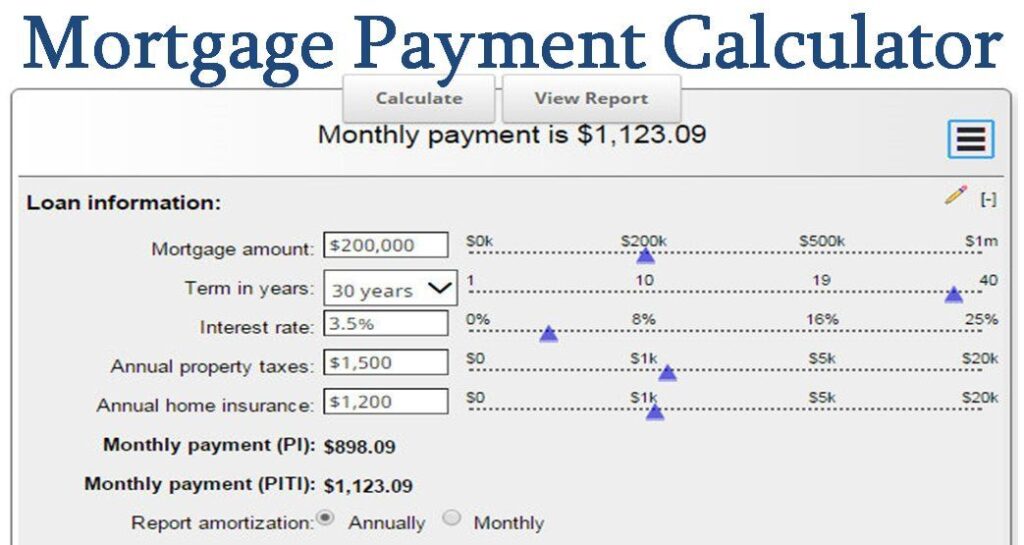

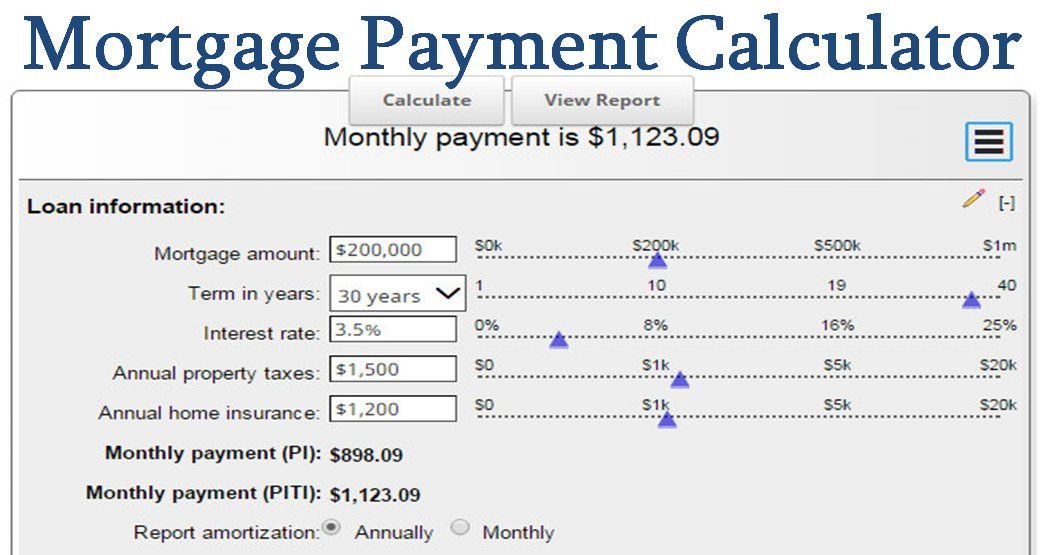

Online Mortgage Calculators

Numerous online mortgage calculators are available to simplify the calculation process. These calculators typically require users to input the principal amount, interest rate, loan term, and other relevant factors. The calculators then automatically generate the estimated monthly mortgage payment, providing a convenient and quick way to determine affordability and compare different loan options.

Mortgage Payment Scenarios

Different mortgage payment scenarios arise based on varying interest rates, loan terms, and property values. Understanding these scenarios can provide valuable insights into the financial implications of homeownership and aid in making informed decisions.

Scenario Table

| Scenario | Interest Rate | Loan Term | Property Value | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|---|

| Scenario 1 | 4.00% | 30 years | $300,000 | $1,432 | $255,120 |

| Scenario 2 | 5.00% | 30 years | $300,000 | $1,610 | $327,600 |

| Scenario 3 | 4.00% | 15 years | $300,000 | $2,202 | $96,720 |

| Scenario 4 | 5.00% | 15 years | $300,000 | $2,536 | $154,560 |

Financial Implications

The scenarios demonstrate the significant impact of interest rates and loan terms on monthly payments and total interest paid. Scenario 1, with a lower interest rate and longer loan term, results in a lower monthly payment but higher total interest paid.

Bank of America is a major player in the mortgage market. See their current refinance rates to see if they’re right for you.

Scenario 3, with a shorter loan term, leads to a higher monthly payment but significantly lower total interest costs. The choice between different scenarios depends on individual financial circumstances and priorities, balancing affordability with long-term financial goals.

Affordability and Financial Planning, Calculating Mortgage Payment 2024

Understanding different mortgage payment scenarios is crucial for assessing affordability and planning for homeownership. It allows individuals to evaluate their financial capacity to handle the monthly mortgage payments and make informed decisions about loan terms and interest rates. By carefully analyzing these scenarios, homeowners can ensure that their mortgage payments align with their financial goals and long-term financial stability.

Tips for Managing Mortgage Payments

Effective management of mortgage payments is essential for maintaining financial stability and avoiding potential financial strain. Implementing sound strategies can help homeowners minimize interest costs, ensure timely payments, and optimize their mortgage experience.

Getting pre-approved for a mortgage can give you a significant advantage. Pre-approval demonstrates your financial readiness to lenders.

Budgeting and Managing Payments

Creating a comprehensive budget that includes the mortgage payment is crucial for managing finances effectively. Allocate a specific portion of monthly income towards the mortgage payment, ensuring timely payment and avoiding late fees. Monitor bank accounts and credit card statements regularly to track expenses and ensure that the mortgage payment remains a top priority.

Getting your mortgage application approved can be a stressful process. Mortgage approval requires careful preparation and documentation.

Minimizing Interest Costs

Several strategies can help minimize interest costs associated with a mortgage. Making extra payments on the principal amount can significantly reduce the overall interest paid over the life of the loan. Refinancing the mortgage to a lower interest rate when rates decline can also result in substantial savings.

A home equity line of credit (HELOC) can be a useful financial tool. Explore the best home equity line of credit options available in 2024.

Explore these options to optimize your mortgage and reduce your overall financial burden.

Automatic Payments and Monitoring

Setting up automatic payments can ensure timely payments and avoid potential late fees. This eliminates the risk of forgetting or missing payments, simplifying the payment process and reducing the potential for financial penalties. Regularly monitor mortgage accounts, reviewing statements for accuracy and identifying any discrepancies or errors.

Navigating the home buying process in 2024 can be a challenge. Home buyers should prepare by researching the market and understanding their budget.

Proactive monitoring can help prevent issues and ensure that payments are applied correctly.

Last Recap

By understanding the factors that influence your mortgage payment, you can make informed choices that align with your financial goals. Whether you’re a first-time homebuyer or looking to refinance your existing mortgage, this guide provides valuable insights into the intricacies of mortgage payments.

Chase Bank is a popular choice for home loans. Check out their current mortgage rates to see if they align with your financial goals.

Remember to carefully consider your financial situation and consult with a financial advisor to make the best decisions for your individual circumstances.

Commonly Asked Questions

What is the difference between a fixed-rate and a variable-rate mortgage?

A fixed-rate mortgage has a set interest rate that remains the same for the entire loan term, providing predictable monthly payments. A variable-rate mortgage has an interest rate that can fluctuate based on market conditions, resulting in varying monthly payments.

How can I make extra payments on my mortgage?

You can make extra payments by sending a lump sum payment to your lender or by increasing your monthly payment amount. Extra payments can help you pay off your mortgage faster and save on interest costs.

What is mortgage insurance?

Mortgage insurance is a type of insurance that protects your lender in case you default on your mortgage loan. It is typically required if your down payment is less than 20% of the purchase price.

How can I refinance my mortgage?

Refinancing involves getting a new mortgage to replace your existing one. This can be beneficial if interest rates have fallen or if you want to change the terms of your loan.