Can I backdoor Roth IRA contribute in 2024? This question is on the minds of many individuals looking to maximize their retirement savings. A backdoor Roth IRA contribution allows individuals to contribute to a Roth IRA even if their income exceeds the income limitations.

This strategy can be particularly advantageous for those who anticipate being in a lower tax bracket in retirement, as it allows them to withdraw their contributions and earnings tax-free.

This article delves into the intricacies of backdoor Roth IRA contributions, exploring the rules, eligibility requirements, and potential advantages and disadvantages for 2024. We’ll provide a step-by-step guide to making a backdoor Roth IRA contribution, discuss potential tax implications, and examine real-world scenarios to illustrate the practical application of this strategy.

Contents List

Understanding Backdoor Roth IRA Contributions

A backdoor Roth IRA contribution is a strategy that allows individuals who exceed the income limitations for direct Roth IRA contributions to still contribute to a Roth IRA and potentially enjoy tax-free withdrawals in retirement. This strategy involves making a contribution to a traditional IRA and then converting it to a Roth IRA.

The tax landscape is constantly changing. This article outlines the new tax brackets for 2024 , so you can plan your finances accordingly.

Eligibility Requirements for Backdoor Roth IRA Contributions

There are no income limitations for making contributions to a traditional IRA. However, you must meet the general eligibility requirements for traditional IRA contributions, such as having earned income.

Self-employed individuals have unique retirement saving options. This article explains the 401k contribution limits for 2024 for self-employed individuals , so you can take advantage of these benefits.

Income Limitations Associated with Backdoor Roth IRA Contributions, Can I backdoor Roth IRA contribute in 2024

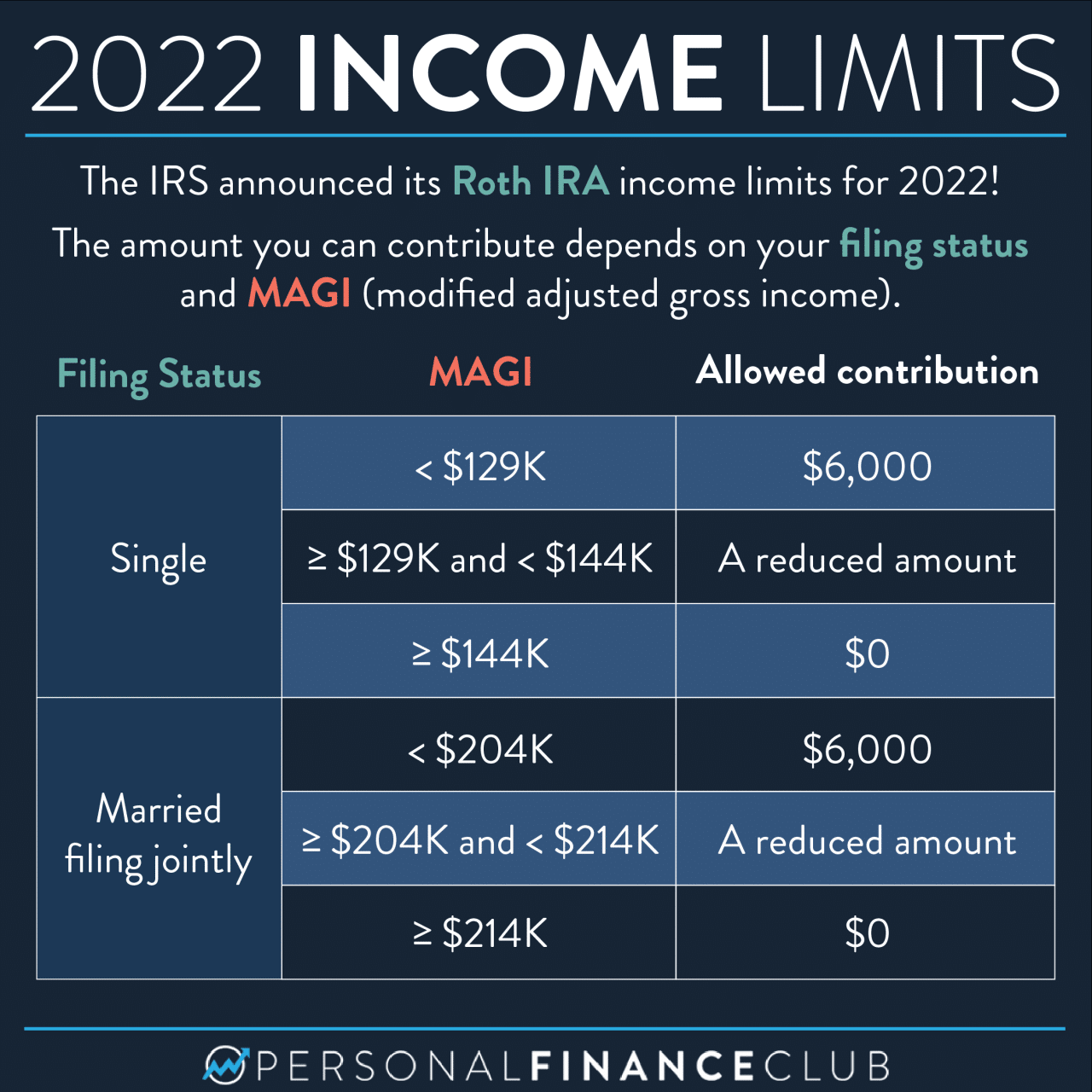

While there are no income limitations for making contributions to a traditional IRA, the income limitations for Roth IRA conversions can impact your ability to utilize the backdoor Roth IRA strategy.

For 2024, if your modified adjusted gross income (MAGI) is $153,000 or higher as a single filer or $228,000 or higher as a married couple filing jointly, you will not be able to convert your traditional IRA contributions to a Roth IRA without incurring a tax penalty.

If you’re over 50, you have the opportunity to contribute a little extra to your retirement savings. Find out about the IRA contribution limits for 2024 for those over 50 and make the most of your catch-up contributions.

The income limitations for Roth IRA conversions can vary depending on your filing status. It’s important to consult with a tax professional to determine your specific situation and whether the backdoor Roth IRA strategy is right for you.

Backdoor Roth IRA Contribution Rules in 2024

The backdoor Roth IRA contribution strategy allows individuals who exceed the income limits for direct Roth IRA contributions to still contribute to a Roth IRA and enjoy the tax-free growth and withdrawals in retirement. This strategy involves making a contribution to a traditional IRA and then converting it to a Roth IRA.

Backdoor Roth IRA Contribution Limits in 2024

The maximum contribution amount for a traditional IRA or a Roth IRA in 2024 is $7,000 for individuals under age 50 and $7,500 for individuals age 50 and older. These contribution limits apply to both direct and backdoor Roth IRA contributions.

Income Limits for Backdoor Roth IRA Contributions in 2024

There are no income limits for contributing to a traditional IRA. However, if your modified adjusted gross income (MAGI) exceeds certain thresholds, you may be subject to a tax penalty on your Roth IRA conversion. The 2024 income thresholds for Roth IRA conversions are:

- Single filers: $153,000 to $228,000

- Married filing jointly: $228,000 to $342,000

- Head of household: $153,000 to $228,000

If your MAGI falls within these ranges, you may be subject to a pro-rata tax penalty on your Roth IRA conversion. This means that only a portion of your conversion will be subject to taxes.

October is a great time to review your tax situation and make any necessary adjustments. These tax planning tips for October 2024 can help you optimize your tax situation for the year ahead.

Tax Implications of Backdoor Roth IRA Contributions in 2024

While the backdoor Roth IRA strategy allows you to avoid taxes on your contributions, you may face tax implications during the conversion process.

- Pro-rata tax penalty: As mentioned above, if your MAGI falls within the specified ranges, you may be subject to a pro-rata tax penalty on your Roth IRA conversion. This penalty applies only to the portion of your conversion that exceeds the income limits.

For example, if your MAGI is $160,000 and you convert $7,000 to a Roth IRA, you may be subject to taxes on a portion of the conversion, depending on the specific pro-rata calculation.

- Taxable income on conversion: While your Roth IRA contributions are tax-free, the conversion from a traditional IRA to a Roth IRA is considered a taxable event. You will need to pay taxes on the amount you convert at your current income tax rate.

This is why it’s important to consider your income and tax bracket when deciding whether to use the backdoor Roth IRA strategy.

- Potential for future tax liability: Although backdoor Roth IRA contributions are generally considered tax-free, there’s a possibility that future legislation could change the tax treatment of Roth IRAs. If the rules change, your future withdrawals may be subject to taxes.

Tax Deduction for Traditional IRA Contributions

You may be eligible for a tax deduction for your traditional IRA contributions, depending on your income and filing status. However, if you are using the backdoor Roth IRA strategy, you will not be able to deduct your traditional IRA contributions.

This is because you are converting the traditional IRA to a Roth IRA, which is a taxable event.

Not all credit cards charge an annual fee. Find out which credit cards offer no annual fee in October 2024 and choose the one that best suits your needs.

Potential Advantages and Disadvantages of Backdoor Roth IRA Contributions

The backdoor Roth IRA contribution strategy can be a valuable tool for individuals who want to take advantage of the tax benefits of a Roth IRA, but who are ineligible for direct contributions due to their income. This strategy allows you to contribute to a traditional IRA and then convert the funds to a Roth IRA, effectively bypassing the income limitations associated with direct Roth IRA contributions.

Don’t forget about your 401k! The contribution limits for employees in 2024 have been updated, so make sure you’re taking advantage of all the benefits your plan offers.

However, there are also potential drawbacks to consider before deciding if a backdoor Roth IRA is right for you.

If you’re filing as single, it’s essential to understand the tax brackets that apply to you. This article provides a breakdown of the tax brackets for single filers in 2024 , so you can plan your finances accordingly.

Potential Advantages of Backdoor Roth IRA Contributions

The potential benefits of making a backdoor Roth IRA contribution include:

- Tax-free withdrawals in retirement: One of the primary advantages of a Roth IRA is that qualified withdrawals in retirement are tax-free. This means you won’t have to pay any taxes on the money you withdraw, which can save you a significant amount of money in the long run.

- Potential for tax-free growth: The money you contribute to a Roth IRA grows tax-free. This means you won’t have to pay any taxes on the investment earnings, which can lead to significant tax savings over time.

- Flexibility in retirement: Roth IRAs offer more flexibility than traditional IRAs, as you can withdraw contributions at any time without penalties. This can be beneficial if you need access to your retirement savings before age 59 1/2.

- No required minimum distributions (RMDs): Unlike traditional IRAs, Roth IRAs do not have required minimum distributions (RMDs). This means you can keep your money invested and growing tax-free for as long as you like.

Potential Disadvantages of Backdoor Roth IRA Contributions

While the backdoor Roth IRA strategy can be beneficial, it also has some potential drawbacks:

- Prohibited Transaction Tax: If you have a traditional IRA with pre-tax contributions, and you convert those funds to a Roth IRA, you may be subject to the Prohibited Transaction Tax. This tax applies to situations where you have a pre-tax balance in a traditional IRA and then convert that balance to a Roth IRA.

Are you maximizing your 401k contributions? This article details the maximum 401k contribution for 2024 , so you can make sure you’re saving as much as possible for your future.

This can lead to a 50% penalty on the taxable amount of the conversion.

- Potential tax liability: Although withdrawals from a Roth IRA are tax-free, the conversion process from a traditional IRA to a Roth IRA can create a taxable event. The amount of taxes you owe will depend on your tax bracket at the time of the conversion.

Even if you work part-time, you can still contribute to your retirement savings. This article explains the IRA contribution limits for 2024 for part-time workers , so you can get started on building your nest egg.

- Administrative complexity: The backdoor Roth IRA strategy can be more complex than making a direct Roth IRA contribution. You’ll need to keep track of your traditional IRA contributions and any conversions, and you may need to file additional forms with the IRS.

A tax calculator can be a valuable tool for understanding your tax obligations. This article explains how to use a tax calculator for October 2024 , so you can get a clear picture of your tax situation.

- Income limitations: While the backdoor Roth IRA strategy allows you to contribute to a Roth IRA even if you exceed the income limits for direct contributions, there are still some income limitations. If your modified adjusted gross income (MAGI) is too high, you may not be able to convert the entire amount of your traditional IRA contribution to a Roth IRA.

If you’re over 50, you can contribute a little extra to your 401k. Find out what the 401k limits are for 2024 for those over 50 and make the most of your catch-up contributions.

Comparison of Backdoor Roth IRA Contributions with Other Retirement Savings Options

The backdoor Roth IRA strategy is just one of many retirement savings options available. Here is a comparison of the backdoor Roth IRA with other common retirement savings plans:

| Retirement Savings Option | Tax Treatment of Contributions | Tax Treatment of Withdrawals | Income Limitations | Other Considerations |

|---|---|---|---|---|

| Traditional IRA | Tax-deductible | Taxable | Yes | Required minimum distributions (RMDs) |

| Roth IRA | Not tax-deductible | Tax-free | Yes | No required minimum distributions (RMDs) |

| 401(k) | Tax-deductible | Taxable | No | Employer matching contributions, potential for loan options |

| Backdoor Roth IRA | Tax-deductible | Tax-free | Yes | Potential for prohibited transaction tax, administrative complexity |

Real-World Examples and Scenarios: Can I Backdoor Roth IRA Contribute In 2024

The backdoor Roth IRA contribution strategy can be beneficial for individuals who are ineligible for direct Roth IRA contributions due to their income. This section provides real-world examples and scenarios to illustrate the application of this strategy.

Income Levels and Eligibility for Backdoor Roth IRA Contributions

Understanding the income limits for direct Roth IRA contributions is crucial to determine if the backdoor strategy is suitable. Here’s a table illustrating various income levels and their potential eligibility for backdoor Roth IRA contributions in 2024:

| Income Level | Direct Roth IRA Contribution Eligibility | Backdoor Roth IRA Contribution Eligibility |

|---|---|---|

| $150,000

The tax deadline for self-employed individuals in October 2024 is approaching. This article outlines the key details for self-employed individuals so you can file your taxes on time.

|

No | Yes |

| $228,000

Are you an international taxpayer? The tax extension deadline for international taxpayers in October 2024 is important to be aware of, so you can plan your filing accordingly.

|

No | Yes |

$10,000

|

Yes | Yes |

$20,000

|

Yes | Yes |

Scenario: Maximizing Retirement Savings with a Backdoor Roth IRA Contribution

Sarah, a single filer with an annual income of $155,000, is ineligible for direct Roth IRA contributions due to her income exceeding the limit. However, she desires to contribute to a Roth IRA to enjoy tax-free withdrawals in retirement.

Sarah can utilize the backdoor Roth IRA strategy to maximize her retirement savings.She can contribute $6,500 to a traditional IRA, and then convert the entire amount to a Roth IRA. Although the conversion will be taxed in the current year, she can withdraw the funds tax-free in retirement.

Traveling soon? Check out this list of the best credit cards for travel rewards in October 2024. You can find the perfect card to help you earn miles and points on your next adventure.

Case Study: Tax Implications of a Backdoor Roth IRA Contribution

John, a married filer with an income of $235,000, decides to contribute $6,500 to a traditional IRA and then convert it to a Roth IRA. However, he has $10,000 in pre-tax traditional IRA contributions from previous years. This creates a situation where the conversion is subject to the “pro-rata” rule, which requires a portion of the conversion to be taxed.

If you’re planning for retirement, you’ll want to know how much you can contribute to your Roth IRA in 2024. This article provides the latest information on contribution limits, so you can make the most of your savings.

In John’s case, the IRS will consider a proportion of the $6,500 conversion to be a taxable distribution based on the ratio of his pre-tax IRA contributions to his total IRA contributions. This means a portion of the conversion will be taxed as ordinary income in the current year.

The “pro-rata” rule applies when you have both pre-tax and after-tax contributions in your traditional IRA. It requires you to calculate the percentage of your traditional IRA contributions that are pre-tax and apply that percentage to your conversion.

Last Word

While the backdoor Roth IRA contribution strategy can be a valuable tool for retirement planning, it’s crucial to carefully consider the associated tax implications and eligibility requirements. Consulting with a qualified financial advisor can help you determine if this strategy is right for your individual circumstances.

Understanding the nuances of backdoor Roth IRA contributions can empower you to make informed decisions about your retirement savings and secure a brighter financial future.

Essential FAQs

What is the income limit for a traditional IRA contribution in 2024?

The income limit for a traditional IRA contribution in 2024 is $153,000 for single filers and $228,000 for married couples filing jointly.

What is the maximum contribution amount for a Roth IRA in 2024?

The maximum contribution amount for a Roth IRA in 2024 is $7,500 for individuals under 50 and $15,000 for individuals 50 and over.

Can I make a backdoor Roth IRA contribution if I have a 401(k)?

Yes, you can make a backdoor Roth IRA contribution even if you have a 401(k). The two are not mutually exclusive.