Can I claim the standard deduction in 2024? This question is on the minds of many taxpayers as they prepare to file their federal income taxes. The standard deduction is a valuable tool that can reduce your taxable income, potentially leading to a smaller tax bill.

Understanding how the standard deduction works and whether you qualify can make a significant difference in your tax outcome.

The standard deduction is a fixed amount that you can subtract from your adjusted gross income (AGI) to determine your taxable income. It’s a simplified way to account for certain common expenses, such as medical costs, charitable contributions, and state and local taxes.

In contrast, itemized deductions allow you to deduct specific expenses that exceed certain thresholds. The standard deduction is often a more straightforward option, especially for taxpayers who don’t have significant deductible expenses.

Contents List

Understanding the Standard Deduction

The standard deduction is a set amount that you can subtract from your adjusted gross income (AGI) when calculating your federal income tax liability. It’s a way to reduce your taxable income, leading to a lower tax bill. You can choose to take the standard deduction or itemize your deductions, whichever results in a lower tax liability.

Small businesses have their own 401k contribution limits. Find out the specifics of the 401k contribution limits for 2024 for small businesses.

The Standard Deduction’s Purpose

The standard deduction is designed to simplify the tax filing process for many taxpayers. It’s a fixed amount that reflects the average deductions claimed by taxpayers in a particular filing status. By using the standard deduction, taxpayers avoid the need to gather and document detailed information about their individual expenses, such as medical expenses, charitable contributions, and state and local taxes.

Missing the October 2024 tax deadline can lead to penalties. It’s important to be aware of the tax penalties for missing the October 2024 deadline to avoid any unexpected costs.

Differences Between the Standard Deduction and Itemized Deductions

The standard deduction is a simplified approach to deducting certain expenses, while itemized deductions allow taxpayers to claim specific expenses that exceed the standard deduction. The key differences between the two are:

Standard Deduction

- A fixed amount determined by your filing status.

- Simple to claim, requiring no additional documentation.

- Suitable for most taxpayers with relatively few deductible expenses.

Itemized Deductions

- Specific expenses, such as medical expenses, charitable contributions, and mortgage interest.

- Requires detailed documentation and calculations.

- Beneficial for taxpayers with significant deductible expenses exceeding the standard deduction.

Eligibility for the Standard Deduction

In 2024, most taxpayers can claim the standard deduction, a set amount that reduces their taxable income. This deduction is designed to simplify the tax filing process and provide a basic level of tax relief for many individuals and families.

Need to calculate your mileage for business or medical expenses? Check the mileage rate for October 2024 to get the correct amount.

To be eligible for the standard deduction, you must meet certain criteria, and your filing status plays a key role in determining the amount you can deduct.

Determining Eligibility for the Standard Deduction

Several factors determine whether you can claim the standard deduction.

Wondering how much you can contribute to your IRA this year? Check out the IRA contribution limits for 2024 to stay within the allowed range.

The most important factor is your filing status.

Don’t forget to factor in the mileage rate for October 2024 when calculating your expenses.

- Single:If you are unmarried and do not qualify for another filing status, you are considered single. The standard deduction for single filers in 2024 is $13,850.

- Married Filing Jointly:If you are married and file a joint return with your spouse, you can claim the standard deduction for married couples filing jointly. The standard deduction for married filing jointly in 2024 is $27,700.

- Married Filing Separately:If you are married but choose to file separately from your spouse, you can claim the standard deduction for married filing separately. The standard deduction for married filing separately in 2024 is $13,850.

- Head of Household:If you are unmarried and pay more than half the costs of keeping up a home for a qualifying child or dependent, you can claim the standard deduction for head of household. The standard deduction for head of household in 2024 is $20,800.

- Qualifying Widow(er) with Dependent Child:If your spouse died in the previous year, and you have a qualifying child living with you, you can claim the standard deduction for qualifying widow(er) with dependent child. The standard deduction for qualifying widow(er) with dependent child in 2024 is $27,700.

If you’re over 50, you can contribute more to your 401k. Find out the exact amount with the 401k limits for 2024 for over 50.

When Claiming the Standard Deduction is Beneficial

Claiming the standard deduction can be beneficial in several situations.

Looking to understand how much you’ll be paying in taxes next year? Check out the tax brackets for 2024 in the United States to get a clearer picture of your potential tax liability.

The standard deduction is often the best option for taxpayers who don’t have significant itemized deductions.

Thinking about contributing to an IRA even though you have a 401k? You can! Learn more about the specifics of contributing to an IRA if you have a 401k.

- Low to Moderate Income:If your income is relatively low, you may not have enough itemized deductions to exceed the standard deduction. Claiming the standard deduction simplifies your tax return and reduces your taxable income.

- No Significant Itemized Deductions:Itemized deductions include expenses like medical expenses, charitable contributions, and mortgage interest. If you don’t have substantial expenses in these categories, the standard deduction will likely be more advantageous.

- First-Time Homebuyers:If you’ve recently purchased a home, you may have mortgage interest and property taxes you can deduct. However, if these deductions are relatively small, the standard deduction might still be more beneficial.

Factors Affecting Standard Deduction

The standard deduction is a fixed amount that you can subtract from your adjusted gross income (AGI) to reduce your taxable income. This amount is determined by your filing status, age, and whether you are blind. The standard deduction can also be affected by certain circumstances, such as if you are claimed as a dependent on someone else’s return or if you are a student.

Standard Deduction Amounts for 2024

The standard deduction amounts for 2024 are as follows:

| Filing Status | Standard Deduction |

|---|---|

| Single | $13,850 |

| Married Filing Separately | $13,850 |

| Married Filing Jointly | $27,700 |

| Qualifying Widow(er) | $27,700 |

| Head of Household | $20,800 |

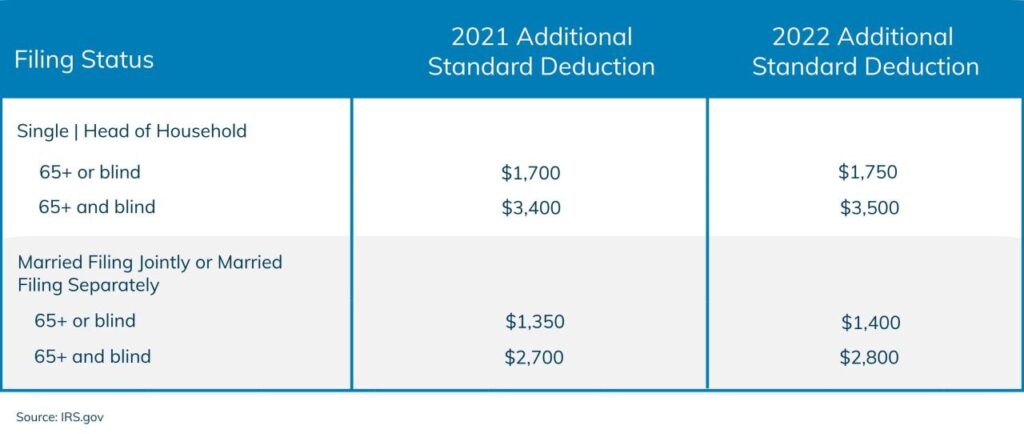

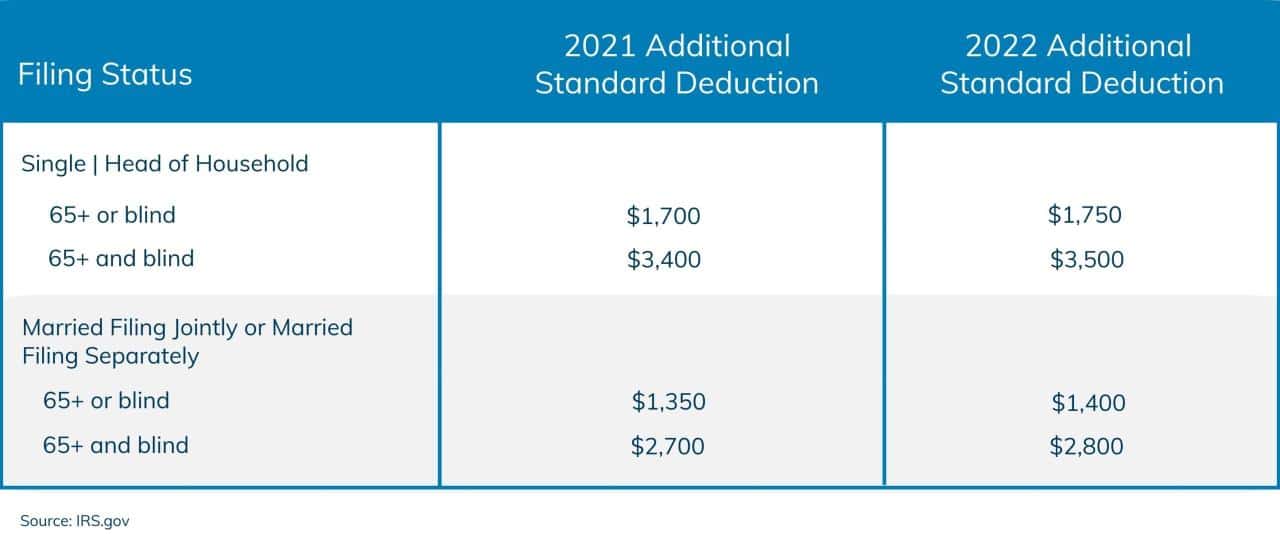

Age and Blindness

You can claim an additional standard deduction if you are 65 years of age or older or if you are blind. For 2024, the additional standard deduction is $1,800 for each qualifying condition. For example, if you are single and 65 years of age or older, your standard deduction would be $15,650 ($13,850 + $1,800).

There have been some changes to the W9 form, so be sure to review the W9 Form October 2024 changes and updates before you file.

If you are single and blind, your standard deduction would also be $15,650. If you are single, 65 years of age or older, and blind, your standard deduction would be $17,450 ($13,850 + $1,800 + $1,800).

There are various tax credits available to help reduce your tax burden. See what credits you might qualify for with the tax credits for the October 2024 deadline.

Dependency Status

If you are claimed as a dependent on someone else’s return, you may not be able to claim the standard deduction. The IRS has specific rules regarding dependency status. If you are claimed as a dependent, you may be able to claim a different deduction, such as the personal exemption, depending on your situation.

If you’re considering a Roth IRA, be sure to check the IRA contribution limits for Roth IRA in 2024 to ensure you’re not exceeding the maximum.

Other Factors

Other factors that can affect your standard deduction include:

- Whether you are a student

- Whether you are a member of the military

- Whether you are a victim of a disaster

- Whether you are a victim of identity theft

- Whether you have certain medical expenses

- Whether you have certain charitable contributions

You should consult with a tax professional to determine your specific standard deduction amount.

The standard deduction is a key factor in your tax liability. Find out the standard deduction amount for the 2024 tax year to see how it affects your tax bill.

Choosing Between Standard Deduction and Itemized Deductions

When preparing your tax return, you have the option of claiming the standard deduction or itemizing your deductions. Choosing the right method can significantly impact your tax liability. This section delves into the factors you should consider when making this decision, outlining the potential benefits and drawbacks of each approach, and providing a checklist of situations where itemizing might be advantageous.

The mileage rate for business and medical expenses can change throughout the year. Make sure you’re using the most up-to-date rate by checking the October 2024 mileage rate changes.

Comparing Standard Deduction and Itemized Deductions

To make an informed decision, it’s crucial to understand the advantages and disadvantages of each approach. The standard deduction is a fixed amount that you can claim on your tax return, while itemized deductions allow you to deduct specific expenses.

- Standard Deduction:This is a set amount that you can claim on your tax return without having to itemize your expenses. The standard deduction is based on your filing status and age. The IRS updates the standard deduction amount annually, and it is often a simple and straightforward way to reduce your tax liability.

- Itemized Deductions:These allow you to deduct specific expenses that exceed a certain threshold. Common itemized deductions include medical expenses, state and local taxes, mortgage interest, and charitable contributions. Itemizing can be more beneficial if you have significant deductible expenses.

Factors to Consider When Choosing

The decision of whether to claim the standard deduction or itemize your deductions depends on several factors, including:

- The amount of your deductible expenses:If your deductible expenses exceed the standard deduction amount, you may benefit from itemizing.

- Your filing status:The standard deduction amount varies based on your filing status. If you’re single or married filing separately, you might be more likely to benefit from itemizing.

- Your age:The standard deduction amount increases for taxpayers over a certain age.

- Your tax bracket:The benefits of itemizing are more significant for taxpayers in higher tax brackets.

Situations Where Itemizing Might Be Advantageous, Can I claim the standard deduction in 2024

Itemizing deductions can be advantageous in certain situations, including:

- High medical expenses:If you have significant medical expenses that exceed a certain percentage of your adjusted gross income, you can deduct the excess.

- High state and local taxes:If you live in a state with high state and local taxes, you may be able to deduct a portion of these taxes.

- Large mortgage interest payments:If you have a mortgage, you can deduct the interest paid on the mortgage.

- Significant charitable contributions:If you make substantial charitable contributions, you can deduct a portion of these contributions.

- Homeownership expenses:If you own a home, you may be able to deduct property taxes, mortgage interest, and certain home improvement expenses.

Standard Deduction and Other Tax Credits

The standard deduction is a valuable tax benefit that can reduce your tax liability. However, it’s important to understand how it interacts with other tax credits and deductions to maximize your tax savings. The standard deduction is a fixed amount that you can subtract from your adjusted gross income (AGI) before calculating your taxable income.

It can be claimed by individuals, married couples, and heads of households. It is important to note that you can only claim either the standard deduction or itemized deductions, not both.

Impact of Standard Deduction on Other Tax Benefits

The standard deduction can affect the amount of other tax benefits you can claim. For instance, certain tax credits, like the Earned Income Tax Credit (EITC) or the Child Tax Credit, are calculated based on your AGI. Choosing the standard deduction may reduce your AGI, potentially increasing the amount of these credits you can claim.

If you’re self-employed, you might be interested in learning about the IRA contribution limits for solo 401k in 2024 to maximize your retirement savings.

However, claiming the standard deduction can also affect itemized deductions, such as deductions for mortgage interest, charitable contributions, and medical expenses. If you choose the standard deduction, you cannot claim these itemized deductions.

If you’re planning on deducting medical expenses, be sure to check the October 2024 mileage rate for medical expenses to ensure you’re using the correct rate.

Examples of Tax Credits Claimed with the Standard Deduction

There are various tax credits that can be claimed in conjunction with the standard deduction. Here are a few examples:

- Earned Income Tax Credit (EITC):This credit is available to low- and moderate-income working individuals and families. The amount of the credit depends on your income, marital status, and the number of qualifying children you have.

- Child Tax Credit:This credit is available for each qualifying child under 17 years old. The amount of the credit is $2,000 per qualifying child.

- American Opportunity Tax Credit:This credit is available for the first four years of post-secondary education. The amount of the credit is up to $2,500 per eligible student.

- Premium Tax Credit:This credit helps individuals and families afford health insurance through the Affordable Care Act marketplaces. The amount of the credit depends on your income and the cost of your health insurance plan.

It’s important to note that the eligibility requirements and amount of these tax credits may vary depending on your individual circumstances. Consult with a tax professional to determine which tax credits you qualify for and how to maximize your tax savings.

Last Word

Navigating the world of taxes can feel overwhelming, but understanding the standard deduction is a crucial step in maximizing your tax benefits. By carefully considering your eligibility and comparing the standard deduction to itemized deductions, you can make informed decisions that optimize your tax strategy.

Remember, seeking professional guidance from a tax advisor can provide valuable insights and ensure you’re taking advantage of all available deductions and credits.

FAQ Summary: Can I Claim The Standard Deduction In 2024

How do I know if I should claim the standard deduction or itemize?

You should compare the total amount of your itemized deductions to the standard deduction amount for your filing status. If your itemized deductions exceed the standard deduction, you should itemize. Otherwise, you should claim the standard deduction.

What if I am unsure about my filing status?

It’s essential to determine your correct filing status as it directly impacts your standard deduction amount. The IRS provides guidance on filing statuses, including single, married filing jointly, married filing separately, head of household, and qualifying widow(er). Consult IRS publications or seek advice from a tax professional for accurate determination.

Can I claim the standard deduction if I am self-employed?

Yes, self-employed individuals can claim the standard deduction. However, they may also be eligible for additional deductions related to their business expenses. It’s recommended to consult a tax professional for guidance on specific deductions applicable to your situation.