Capital One settlement payout information for October 2024 is a hot topic, and for good reason! This settlement stems from a significant data breach that affected many individuals. The payout aims to compensate those impacted and provide some relief. This article will delve into the specifics of the settlement, including the payout schedule, eligibility criteria, and common questions.

Understanding the details of the Capital One settlement is crucial for those who were affected by the data breach. This article will guide you through the process of determining your eligibility, filing a claim, and tracking the status of your payout.

It will also address frequently asked questions and provide insights into the broader implications of the settlement.

Contents List

Capital One Settlement Overview: Capital One Settlement Payout Information For October 2024

In 2019, Capital One, a major financial institution, experienced a significant data breach, affecting millions of customers. This incident led to a class-action lawsuit, ultimately resulting in a substantial settlement to compensate affected individuals.

If you’re a freelancer, you’ll need to file a W9 Form by October 2024. The W9 Form October 2024 for freelancers provides your client with your tax identification number, which they need to report your income. You can find more information about how to calculate income tax in October 2024 and the various tax brackets you may fall into.

The Settlement

The Capital One data breach settlement aims to provide financial relief and support to individuals whose personal information was compromised. The settlement was reached between Capital One and a group of plaintiffs representing affected customers.

If you’re under 50, you can contribute up to $22,500 to your 401(k) in 2024. That’s the 401k contribution limit 2024 for people under 50 , and it’s a great way to save for retirement. Just make sure you meet the October 2024 deadline, or you could face tax penalties for missing the October 2024 deadline.

Key Terms of the Settlement

The settlement includes a significant payout to eligible individuals, with the total amount exceeding $190 million. The settlement also covers various forms of relief, including credit monitoring and identity theft protection services.

The 2024 federal tax brackets and personal exemption are important to understand when filing your taxes. The brackets determine how much tax you’ll pay on your income. The personal exemption, on the other hand, is a deduction that can reduce your taxable income.

It’s worth noting that the Roth IRA income limits for 2024 are also important to consider. If your income is too high, you may not be able to contribute to a Roth IRA. You can find more information about the Roth IRA income limits for 2024 online.

Eligibility Criteria

To be eligible for compensation, individuals must have been a Capital One customer during the period of the data breach. This includes individuals whose credit card, bank account, or other financial information was potentially exposed.

It’s important to understand the standard deduction amount for 2024 tax year , which is $13,850 for single filers and $27,700 for married couples filing jointly. This amount can be used to reduce your taxable income, which in turn can lower your tax liability.

There are also a number of tax deductions for the October 2024 deadline , so be sure to research those as well.

Amount of the Payout, Capital One settlement payout information for October 2024

The amount of the payout varies depending on the type of information compromised and the individual’s specific circumstances. For example, individuals whose Social Security numbers were exposed may receive a larger payout than those whose only compromised information was their name and address.

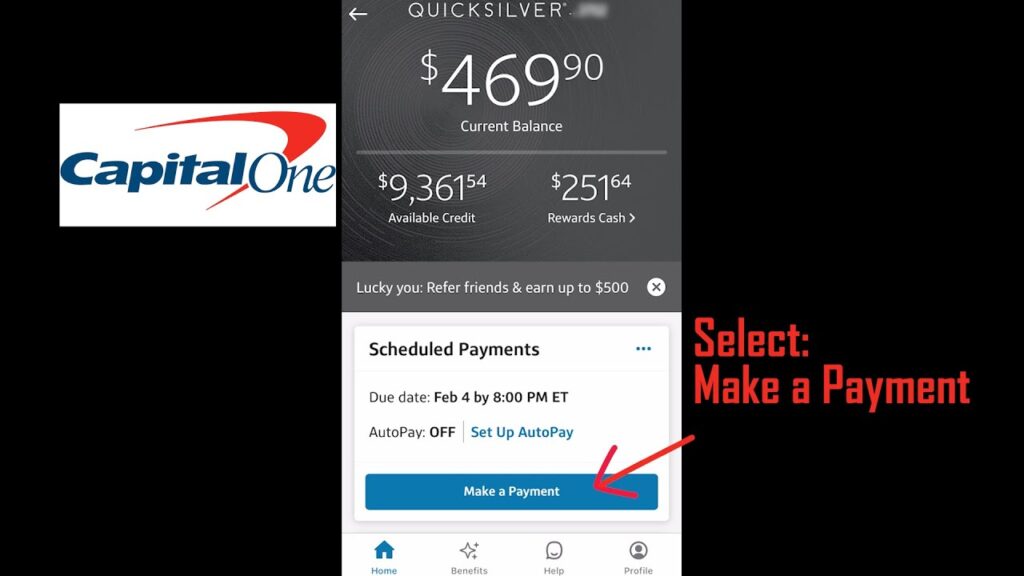

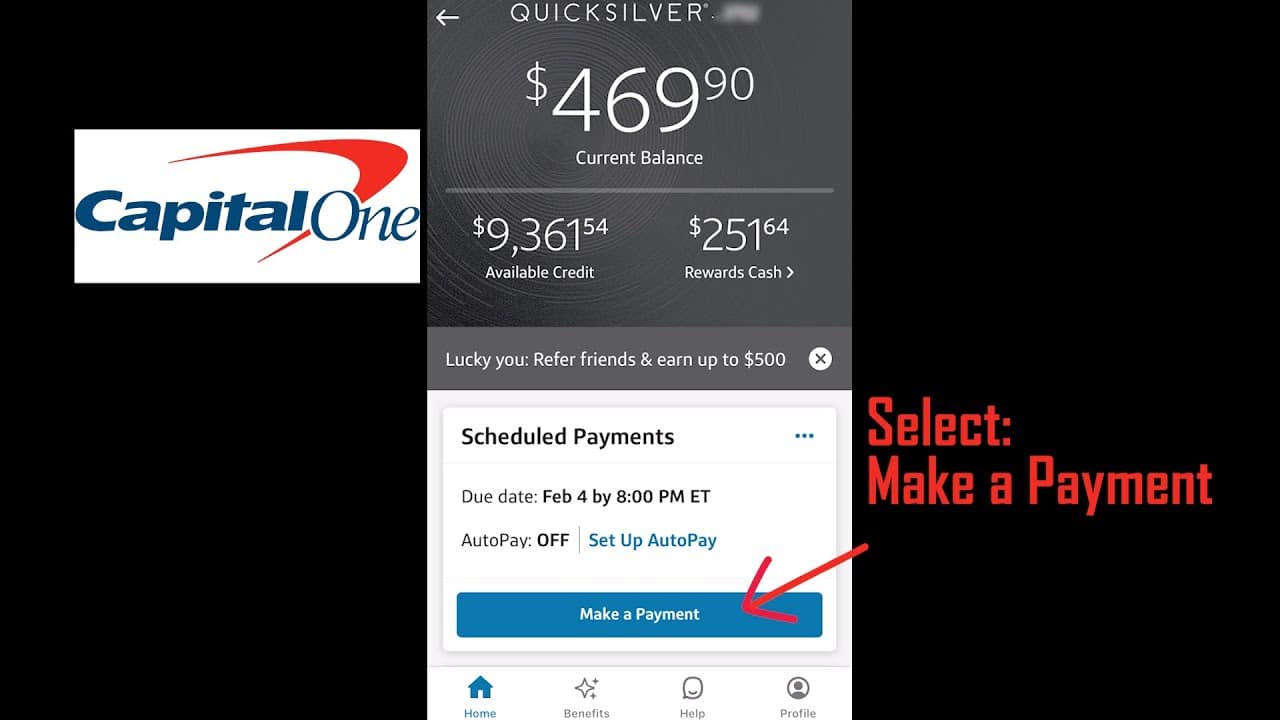

Timeline for the Settlement

The settlement is currently in the process of being finalized and distributed. Individuals who are eligible for compensation will receive a notice from Capital One explaining how to claim their payout. The deadline for filing claims is typically set within a specific timeframe, and individuals should carefully review the information provided by Capital One.

Closing Notes

The Capital One settlement represents a significant step towards addressing the impact of the data breach. It highlights the importance of data security and privacy in the financial industry. While the settlement aims to provide compensation and closure, it also serves as a reminder of the need for ongoing vigilance and proactive measures to protect sensitive information.

By understanding the details of the settlement and taking advantage of the resources available, individuals can navigate this complex process and secure their rightful compensation.

Questions and Answers

What if I don’t remember if I was affected by the data breach?

You can check the Capital One settlement website to see if your information was compromised. They have a tool that allows you to search by your name, address, or other identifying information.

How do I know if I’m eligible for a payout?

The settlement website provides detailed information on eligibility criteria. You can review the information to see if you meet the requirements.

What if I have questions about the claim process?

The settlement website includes a FAQ section and contact information for any questions or concerns you may have.

The 401k contribution limits for 2024 for traditional 401k are the same as for traditional 401(k) plans. You can contribute up to $22,500 if you are under 50. The deadline for filing your taxes is October 2024, but the October 2024 tax deadline for foreign nationals may differ depending on their specific circumstances.

If you’re married, you can contribute up to $15,000 to a Roth IRA in 2024. This is the Roth IRA contribution limits for 2024 for married couples. It’s important to note that the Roth IRA contribution limits and tax implications in 2024 are different than for traditional IRAs.

If you’re planning on attending the Erste Bank Open 2024, you’ll want to check out the Erste Bank Open 2024 accessibility and disabled access information. The event organizers have made sure that the venue is accessible to all guests, including those with disabilities.

You can find information about the what are the 401k contribution limits for 2024 on the IRS website.

The Roth IRA contribution limit 2024 vs 2023 has increased slightly. In 2024, you can contribute up to $6,500 to a Roth IRA, while in 2023, the limit was $6,500. This means you can save even more for retirement this year.