Capital One’s Payout Distribution: What to Expect sets the stage for an exploration of the company’s dividend history, financial performance, and future payout prospects. Understanding these factors can help investors make informed decisions about their investments in Capital One.

This analysis will delve into Capital One’s dividend history, examining trends, key influences, and potential implications for future payouts. We’ll also assess the company’s financial health, including profitability, revenue growth, and capital adequacy, which are crucial indicators of its ability to sustain dividend payments.

Furthermore, we’ll examine Capital One’s dividend policy, exploring its approach to payouts and the factors that may influence its decisions.

Remember to click How Do I Know If I Will Get a Payout? to understand more comprehensive aspects of the How Do I Know If I Will Get a Payout? topic.

Contents List

Capital One’s Dividend History: Capital One’s Payout Distribution: What To Expect

Capital One, a prominent financial institution, has a history of dividend payouts that reflects its financial performance and strategic priorities. Understanding the company’s dividend history is crucial for investors seeking insights into its past performance and potential future distributions.

Dividend Payout History

Capital One has a consistent track record of paying dividends to its shareholders. The company began paying dividends in 2003, and since then, it has distributed a substantial amount of capital to its investors. The frequency of dividend payments has been quarterly, providing investors with regular income streams.

Obtain access to When Will I Receive My Capital One Settlement Payout? to private resources that are additional.

- Dividend Amount:Capital One’s dividend payments have fluctuated over time, reflecting changes in its profitability and financial condition. In recent years, the company has increased its dividend payouts steadily, demonstrating its commitment to shareholder returns.

- Notable Changes:In 2009, during the global financial crisis, Capital One temporarily suspended its dividend payments to conserve capital and strengthen its financial position. However, the company resumed dividend payouts in 2010, showcasing its resilience and commitment to shareholder value.

Factors Influencing Dividend Decisions

Several factors have historically influenced Capital One’s dividend decisions, including:

- Profitability:Capital One’s dividend payouts are closely linked to its profitability. When the company generates strong earnings, it is more likely to increase its dividend payments to reward shareholders.

- Capital Adequacy:Regulatory requirements and capital adequacy ratios play a significant role in dividend decisions. Capital One must maintain sufficient capital reserves to support its operations and manage potential risks. Therefore, dividend payouts are often adjusted to ensure adequate capital levels.

- Growth Opportunities:Capital One’s investment plans and growth opportunities also influence dividend payouts. When the company identifies attractive investment opportunities, it may prioritize reinvesting earnings for growth rather than distributing them as dividends.

Trends in Dividend Payouts

Over the past few years, Capital One’s dividend payouts have exhibited a positive trend, indicating a commitment to shareholder returns and a belief in the company’s long-term growth prospects. The company has consistently increased its dividend payments, demonstrating its ability to generate sustainable profits and distribute a portion of its earnings to shareholders.

This trend suggests that Capital One may continue to increase its dividend payouts in the future, assuming favorable financial performance and market conditions. However, investors should be aware that future dividend decisions are subject to various factors and uncertainties.

Capital One’s Financial Performance

Capital One’s financial performance is a key driver of its dividend payouts. By analyzing its recent financial results, investors can gain insights into the company’s profitability, growth prospects, and ability to sustain dividend payments.

Explore the different advantages of What Happens If You Missed the Claim Deadline? that can change the way you view this issue.

Recent Financial Performance

Capital One has consistently delivered strong financial performance in recent years, driven by its diversified business model and focus on growth. The company’s key financial metrics, such as profitability, revenue growth, and capital adequacy, have demonstrated its financial strength and resilience.

- Profitability:Capital One’s profitability has been consistently high, driven by its efficient operations and strong loan growth. The company has demonstrated its ability to generate sustainable profits, which are essential for supporting dividend payouts.

- Revenue Growth:Capital One’s revenue has been growing steadily, reflecting its expanding customer base and product offerings. The company’s focus on innovation and digital transformation has contributed to its revenue growth, further strengthening its financial position.

- Capital Adequacy:Capital One maintains strong capital adequacy ratios, exceeding regulatory requirements. This demonstrates its ability to manage risks effectively and support its lending activities, ensuring financial stability and the sustainability of dividend payouts.

Key Financial Metrics

Several financial metrics are particularly relevant to dividend payouts, including:

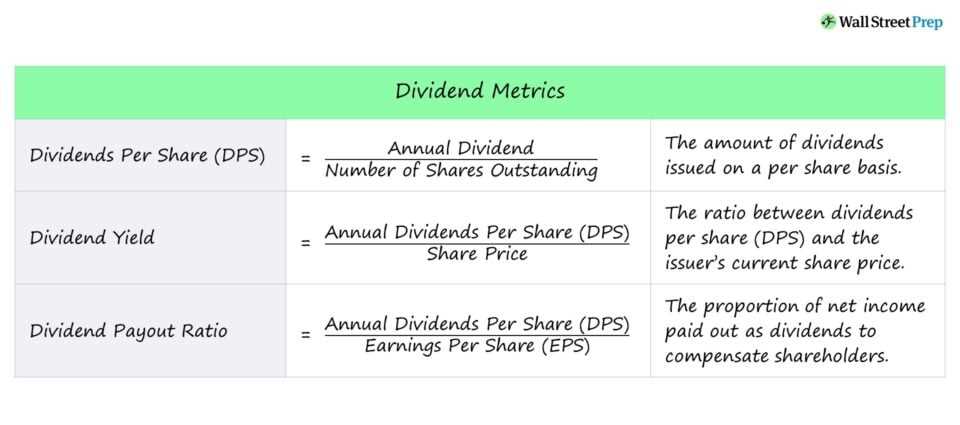

- Earnings per Share (EPS):EPS measures a company’s profitability on a per-share basis. A strong EPS indicates a company’s ability to generate profits and potentially increase dividend payouts.

- Return on Equity (ROE):ROE measures a company’s profitability relative to its shareholder equity. A high ROE indicates efficient use of shareholder capital and potentially supports dividend payouts.

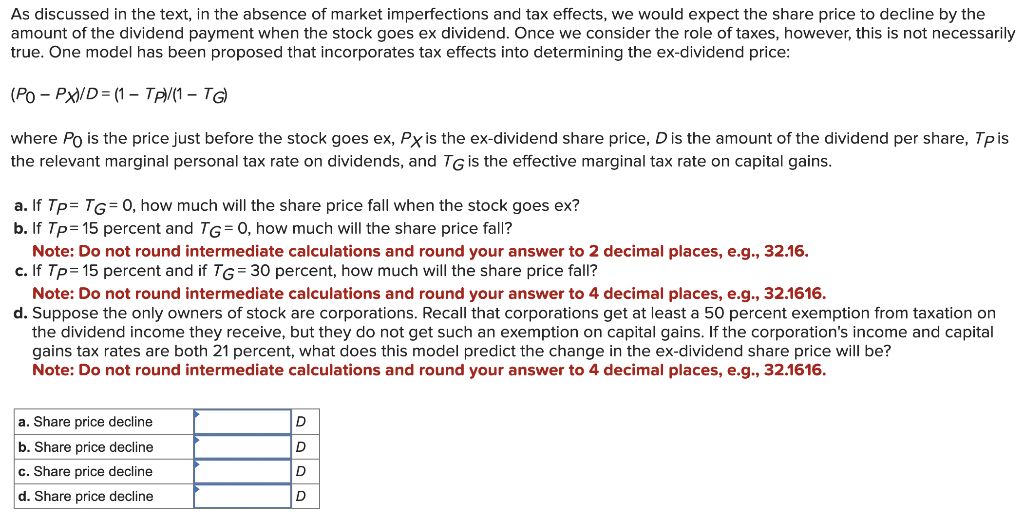

- Dividend Payout Ratio:The dividend payout ratio measures the proportion of earnings that a company distributes as dividends. A higher payout ratio suggests a more generous dividend policy, while a lower ratio may indicate a focus on reinvesting earnings for growth.

Comparison to Competitors

Capital One’s financial performance compares favorably to its competitors in the banking and financial services industry. The company has consistently ranked among the top performers in terms of profitability, revenue growth, and capital adequacy. This strong performance suggests that Capital One is well-positioned to maintain its dividend payouts and continue to reward shareholders.

Capital One’s Dividend Policy

Capital One’s dividend policy Artikels the company’s approach to dividend payments and its objectives for shareholder returns. Understanding the company’s dividend policy provides investors with insights into its commitment to dividends and potential future payouts.

Explore the different advantages of How Long Does It Take to Process a Capital One Claim? that can change the way you view this issue.

Official Dividend Policy

Capital One’s official dividend policy emphasizes its commitment to returning value to shareholders through dividends. The company aims to maintain a consistent and sustainable dividend policy, while also balancing dividend payments with its growth and investment priorities. Capital One’s dividend policy typically includes the following elements:

- Dividend Frequency:Capital One typically pays dividends quarterly, providing investors with regular income streams.

- Dividend Amount:The company’s dividend payments are determined based on its financial performance, capital adequacy, and growth prospects. Capital One aims to pay a reasonable and sustainable dividend that reflects its profitability and commitment to shareholder returns.

- Dividend Growth:Capital One typically seeks to increase its dividend payments over time, subject to its financial performance and strategic priorities. This growth in dividends reflects the company’s confidence in its long-term growth prospects and its commitment to shareholder value.

Factors Influencing Dividend Policy

Capital One’s dividend policy is influenced by various factors, including:

- Regulatory Requirements:Capital One must comply with regulatory requirements regarding capital adequacy and dividend payouts. These regulations ensure financial stability and protect investors’ interests.

- Market Conditions:Economic conditions, interest rates, and market volatility can influence Capital One’s dividend decisions. In periods of economic uncertainty or market volatility, the company may prioritize capital conservation over dividend payouts.

- Strategic Priorities:Capital One’s investment plans and growth strategies also play a role in its dividend policy. When the company identifies attractive investment opportunities, it may prioritize reinvesting earnings for growth rather than distributing them as dividends.

Consistency and Predictability

Capital One’s dividend payouts have historically been consistent and predictable. The company has a track record of paying dividends regularly and increasing them over time, demonstrating its commitment to shareholder returns. However, investors should be aware that future dividend decisions are subject to various factors and uncertainties.

Factors Affecting Payout Distribution

Capital One’s future dividend payouts are influenced by a range of factors, including economic conditions, industry trends, and regulatory changes. Understanding these factors can help investors anticipate potential changes in dividend distributions.

Economic Conditions

Economic conditions play a significant role in Capital One’s dividend decisions. A strong economy typically leads to higher loan demand, increased profitability, and greater capacity for dividend payouts. Conversely, economic downturns or recessions can impact loan growth, profitability, and potentially lead to reduced dividend payments.

Discover how Capital One Settlement Payout FAQs has transformed methods in this topic.

Industry Trends

Trends within the banking and financial services industry also influence Capital One’s dividend payouts. Factors such as competition, regulatory changes, and technological advancements can impact the company’s profitability and its ability to distribute dividends.

Regulatory Changes

Regulatory changes can have a significant impact on Capital One’s dividend policy. New regulations or changes to existing regulations can affect capital adequacy requirements, lending practices, and ultimately, dividend payouts.

Examine how How the Payouts Are Distributed can boost performance in your area.

Potential Risks and Uncertainties

Several risks and uncertainties could affect Capital One’s dividend payout plans, including:

- Economic Recession:A significant economic downturn could lead to reduced loan demand, lower profitability, and potentially reduced dividend payments.

- Increased Competition:Increased competition from other financial institutions could put pressure on Capital One’s profitability and its ability to maintain dividend payouts.

- Regulatory Changes:New or stricter regulations could increase Capital One’s capital requirements, potentially limiting its capacity for dividend distributions.

Analyst Expectations

Analysts closely follow Capital One’s dividend policy and financial performance to provide insights into future dividend expectations. Their forecasts and projections can help investors understand the potential trajectory of dividend payouts.

Consensus Expectations

The current consensus among analysts is that Capital One is likely to maintain its dividend policy and continue to increase its dividend payments in the future, assuming favorable financial performance and market conditions. Analysts generally view Capital One as a company with a strong track record of dividend payouts and a commitment to shareholder returns.

Forecasts and Projections, Capital One’s Payout Distribution: What to Expect

Analysts typically provide forecasts and projections for future dividend payouts based on their analysis of Capital One’s financial performance, growth prospects, and industry trends. These forecasts can provide investors with a sense of the potential range of dividend payouts in the coming years.

Differences in Opinions

Analyst opinions on Capital One’s dividend expectations can vary based on their assessment of the company’s financial performance, growth prospects, and the overall economic environment. Some analysts may be more optimistic about the company’s future prospects and anticipate higher dividend payouts, while others may be more cautious and project lower dividend growth.

Obtain a comprehensive document about the application of What to Do If Your Payout Is Delayed that is effective.

Investor Considerations

Capital One’s dividend payouts have significant implications for investors, influencing potential returns and risks. Understanding these implications can help investors make informed investment decisions.

Expand your understanding about How Will I Receive My Capital One Payout? with the sources we offer.

Potential Returns

Capital One’s dividend payouts provide investors with regular income streams, contributing to their overall investment returns. The company’s dividend yield, which measures the annual dividend payout as a percentage of the stock price, can be an attractive feature for income-oriented investors.

Discover more by delving into Where to Get Official Capital One Settlement Information further.

Dividend Yield

Capital One’s dividend yield typically compares favorably to its peers in the banking and financial services industry. The company’s consistent dividend payouts and strong financial performance have contributed to its attractive dividend yield, making it a potentially appealing investment for investors seeking income.

Discover more by delving into Can I Still Claim If I Didn’t Receive a Notification? further.

Investment Decisions

Investors can use dividend information to make informed investment decisions. By considering factors such as the company’s dividend policy, financial performance, and analyst expectations, investors can assess the potential for future dividend payouts and their implications for their investment returns.

Investors should also consider their own investment goals and risk tolerance when evaluating Capital One’s dividend payouts.

Further details about Capital One Payout and Tax Implications is accessible to provide you additional insights.

Closure

By considering Capital One’s dividend history, financial performance, policy, and the various factors that influence its payouts, investors can gain valuable insights into the company’s dividend prospects. While future payouts are never guaranteed, understanding these elements can help investors make more informed decisions and navigate the complexities of the investment landscape.

General Inquiries

What is Capital One’s current dividend yield?

Capital One’s current dividend yield is [Insert Current Dividend Yield]. This can fluctuate based on the share price and the dividend amount.

How often does Capital One pay dividends?

Capital One typically pays dividends [Insert Frequency – Quarterly, Semi-Annually, etc.].

What is the ex-dividend date for the next dividend payment?

The ex-dividend date for the next dividend payment is [Insert Ex-Dividend Date]. This is the date after which you must own the stock to receive the dividend.