Capitalized Interest, a complex financial concept, refers to the inclusion of interest expenses incurred during the development or construction of an asset as part of the asset’s cost. This practice, often encountered in industries like construction, real estate, and manufacturing, significantly impacts a company’s financial statements and can have far-reaching implications for investors, creditors, and stakeholders.

A reverse mortgage is a unique type of loan that allows homeowners aged 62 and older to access their home equity. It’s a good option to consider if you need extra income.

The concept of capitalized interest is rooted in accounting standards that dictate when and how interest expenses can be treated as part of an asset’s cost. This practice allows companies to spread the cost of financing over the asset’s useful life, reflecting a more accurate representation of the asset’s true value.

A home equity line of credit (HELOC) can be a good way to access funds using your home’s equity. Understanding the rates is important before you decide if this option is right for you.

Contents List

- 1 Capitalized Interest

- 1.1 Definition of Capitalized Interest

- 1.2 Accounting Treatment of Capitalized Interest

- 1.3 Impact of Capitalized Interest on Financial Statements

- 1.4 Examples of Capitalized Interest

- 1.5 Ethical Considerations of Capitalized Interest

- 1.6 Capitalized Interest in Different Legal Jurisdictions

- 1.7 Future Trends in Capitalized Interest

- 2 Last Recap

- 3 FAQs: Capitalized Interest

Capitalized Interest

Capitalized interest, also known as interest capitalization, is a financial accounting practice where interest expense incurred during the construction or development of a long-term asset is added to the cost of the asset rather than being expensed immediately. This means that the interest expense is not recognized on the income statement in the period it is incurred but is instead capitalized and included in the asset’s carrying value on the balance sheet.

Securing an auto loan can be a crucial step in buying your dream car. Make sure to compare rates and terms from different lenders to find the best deal.

Definition of Capitalized Interest

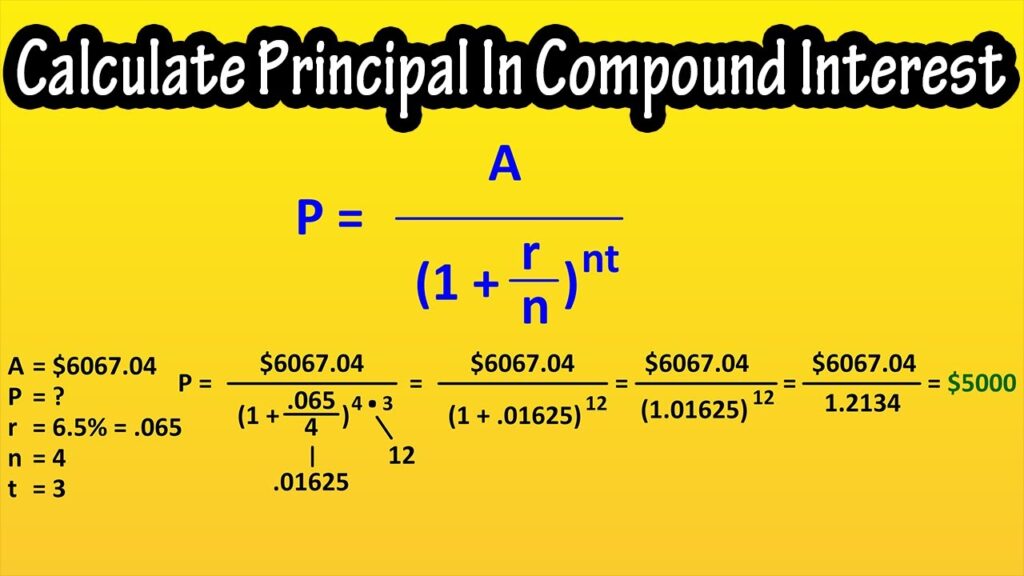

Capitalized interest refers to the interest expense incurred on debt financing that is directly attributable to the acquisition, construction, or development of a qualifying asset. This interest expense is not recognized as an expense in the current period but is added to the cost of the asset, increasing its carrying value on the balance sheet.

Need a loan but not sure where to start? Possible Loan can help you get the financing you need. They offer a variety of loan products, and they have a simple application process.

Accounting Treatment of Capitalized Interest

The capitalization of interest is governed by accounting standards, such as the International Financial Reporting Standards (IFRS) and the US Generally Accepted Accounting Principles (GAAP). These standards provide specific criteria for determining when interest can be capitalized.

A 15-year mortgage can help you pay off your home loan faster and save on interest. If you’re looking for this option, you can check out 15-year mortgage rates from different lenders.

- Qualifying Assets: Capitalized interest is only applicable to qualifying assets, which are typically long-term assets that are under construction or development. These assets must be intended for use in the business and must be expected to generate future economic benefits.

Ascend Loans is a credit union that offers a variety of loan products, including personal loans, auto loans, and mortgages. You can check their website for more information.

- Capitalization Period: The capitalization period begins when the asset is acquired or construction starts and ends when the asset is ready for its intended use. This period can include the time it takes to acquire the asset, prepare the site, and construct the asset.

When you’re looking for a property loan, understanding the property loan interest rate is crucial. It can significantly impact your monthly payments and overall cost.

- Capitalization Rate: The capitalization rate is the weighted-average interest rate on the company’s outstanding debt during the capitalization period. This rate is used to calculate the amount of interest expense that can be capitalized.

Impact of Capitalized Interest on Financial Statements

Capitalized interest has a significant impact on a company’s financial statements, particularly the balance sheet, income statement, and cash flow statement.

Third Federal is a well-known mortgage lender, and their mortgage rates are competitive. You can compare them to other lenders to find the best deal for you.

- Balance Sheet: Capitalized interest increases the carrying value of the asset on the balance sheet, leading to a higher asset value and a higher equity balance.

- Income Statement: Capitalized interest reduces the amount of interest expense recognized on the income statement in the current period, leading to a higher net income.

- Cash Flow Statement: Capitalized interest does not affect the cash flow statement in the current period. However, it can impact future cash flows by reducing the amount of depreciation expense recognized on the asset in future periods.

Examples of Capitalized Interest

Capitalized interest is commonly applied in various industries and projects. Here are some examples:

- Construction Projects: Interest expense incurred during the construction of buildings, factories, and infrastructure projects is typically capitalized.

- Asset Acquisitions: When a company acquires a long-term asset, such as a piece of machinery or a software license, interest expense incurred during the acquisition period may be capitalized.

- Research and Development: In some cases, interest expense incurred during the research and development phase of a new product or process may be capitalized.

Ethical Considerations of Capitalized Interest

While capitalized interest is a legitimate accounting practice, there are potential ethical considerations. One concern is the potential for manipulation or misrepresentation. Companies may capitalize interest on assets that do not meet the qualifying criteria, leading to an inflated asset value and an overstated net income.

If you’re considering a home equity loan, it’s essential to research home equity loan rates from different lenders. This can help you secure the best deal possible.

Transparency and disclosure are crucial to ensure ethical accounting practices.

Looking for a mortgage lender in your area? You can find a list of mortgage companies near me online. This can help you compare local options and find the right lender for your needs.

Capitalized Interest in Different Legal Jurisdictions

The treatment of capitalized interest can vary across different legal jurisdictions. Accounting standards, tax regulations, and legal interpretations may differ, leading to variations in the capitalization rules and the impact on financial reporting.

Getting car finance can be a big decision. There are many options available, so it’s important to shop around and compare rates.

Future Trends in Capitalized Interest

The treatment of capitalized interest is constantly evolving as accounting standards and regulations are updated. Future trends may include changes in the definition of qualifying assets, the capitalization period, and the capitalization rate. Technological advancements, such as automation and artificial intelligence, may also impact the accounting and reporting of capitalized interest.

Figure Lending is known for its online platform and transparent lending process. It’s a good option if you’re looking for a modern and convenient way to get a loan.

Last Recap

Understanding the intricacies of capitalized interest is crucial for making informed financial decisions. While it can enhance the accuracy of financial reporting, it also presents potential challenges related to transparency, ethical considerations, and legal interpretations. As businesses navigate the complexities of this concept, staying abreast of evolving accounting standards and regulatory changes is essential for ensuring financial integrity and stakeholder confidence.

FAQs: Capitalized Interest

What are the benefits of capitalizing interest?

Capitalizing interest can provide a more accurate representation of an asset’s true cost, allowing for a more realistic depreciation schedule and a clearer picture of the company’s financial performance.

What are the risks associated with capitalizing interest?

If you’re looking to buy a foreclosed home, Fannie Mae Homepath is a program that offers incentives for buyers. It’s worth checking out if you’re in the market for a property.

Capitalizing interest can be subject to manipulation and misrepresentation, leading to potential ethical concerns and legal issues. It’s crucial to ensure transparency and proper disclosure regarding capitalized interest.

How does capitalized interest impact a company’s financial ratios?

If you’re looking for a new car, Capital One Auto might be a good option for you. They offer a variety of financing options, and they can help you find the right loan for your needs.

Capitalized interest can affect key financial ratios such as return on assets, debt-to-equity ratio, and profitability ratios. Understanding these impacts is essential for analyzing a company’s financial health.

Finding the right mortgage lender is important for a smooth and successful home buying experience. Compare rates, terms, and services from different lenders to find the best fit for your needs.