Cash Net: It’s not just a buzzword; it’s the lifeblood of your financial well-being. Whether you’re a business owner meticulously tracking every dollar or an individual striving for financial freedom, understanding your cash flow is essential. Cash Net, the difference between your cash inflows and outflows, reveals the true picture of your financial health.

If you’re looking to tap into your home’s equity for a major project or a financial boost, an Equity Loan might be a good option. These loans allow you to borrow against the value of your home, offering flexibility and potentially lower interest rates compared to other types of loans.

This comprehensive guide explores the multifaceted world of Cash Net, unraveling its core concepts and practical applications. From defining cash net in various contexts to analyzing its impact on business decisions and personal financial planning, we’ll delve into the intricacies of managing your financial flow effectively.

Shopping around for a loan? Loan Companies offer a wide range of loan products, from mortgages to personal loans. It’s essential to compare different lenders and their terms to find the best fit for your needs. Don’t hesitate to ask questions and explore all your options.

Epilogue: Cash Net

By mastering the principles of Cash Net, you gain a powerful tool for navigating the complexities of financial management. Whether you’re seeking to optimize business operations, achieve personal financial goals, or make informed investment decisions, a clear understanding of Cash Net provides a solid foundation for success.

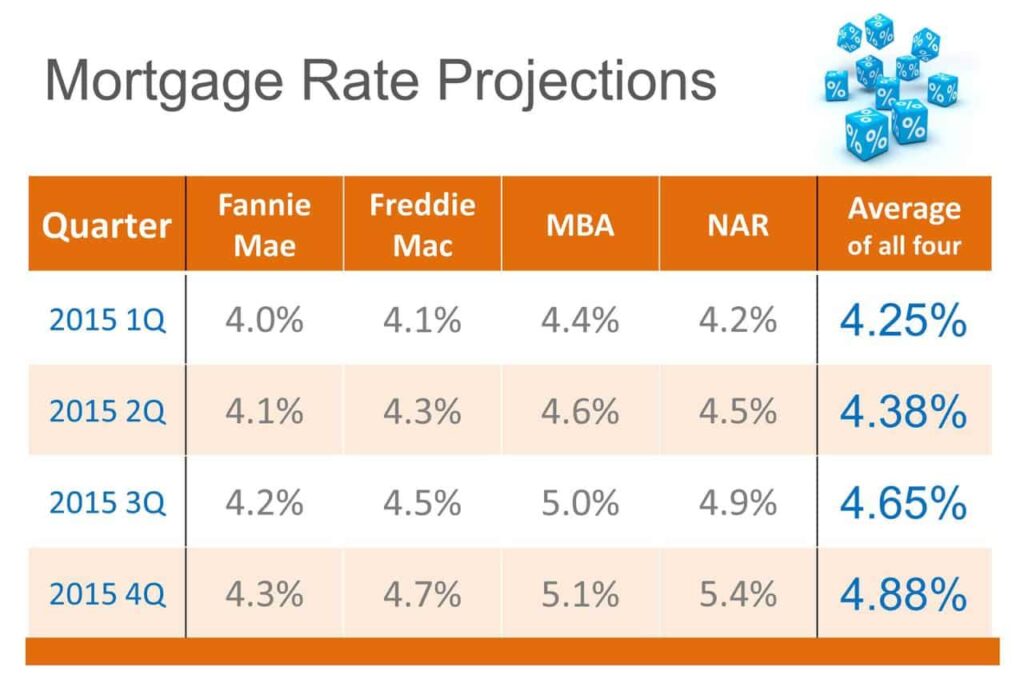

Interested in securing a mortgage? It’s always smart to check Mortgage Interest Rates Today. Rates fluctuate regularly, so staying informed can help you lock in the best possible deal. Keep in mind that rates vary based on factors like your credit score, loan amount, and loan type.

So, embark on this journey of financial clarity and empower yourself with the knowledge to manage your cash flow effectively.

Understanding the current market is key when applying for a mortgage. Average Mortgage Rate data provides a valuable benchmark, allowing you to see how your potential rate compares to the broader market. This information can empower you to negotiate better terms and potentially save money.

Questions Often Asked

What are some common examples of cash inflows and outflows?

Considering a 15-year mortgage? 15 Year Mortgage Rates can offer lower interest rates than 30-year mortgages, leading to significant savings on interest payments over the life of the loan. However, you’ll also have a higher monthly payment, so it’s crucial to carefully weigh your financial situation before making a decision.

Cash inflows include income from salaries, investments, and sales. Cash outflows include expenses like rent, utilities, and debt payments.

How can I improve my personal cash net?

Strategies include increasing income through additional work or side hustles, reducing unnecessary expenses, and negotiating better rates on loans or utilities.

Is a positive cash net always a good sign?

While a positive cash net is generally desirable, it’s crucial to consider the context. A business with a large cash net might be investing in growth, while an individual with a small cash net might be saving for a major purchase.

Looking for a personal loan with favorable terms? Best Personal Loan Rates can vary significantly depending on your credit score and the lender. Compare offers from different lenders to find the most competitive interest rate and repayment terms for your individual situation.

Sometimes, traditional lenders aren’t the best fit for your needs. Private Lenders can offer alternative financing options, especially for unique projects or borrowers with less-than-perfect credit. Researching and understanding their offerings can open doors to new possibilities.

Navigating the mortgage process can feel overwhelming, but a Mortgage Broker can be a valuable asset. They act as your advocate, helping you compare loan options from multiple lenders and guiding you through the entire process, potentially saving you time and money.

Building your dream home? Construction Loan Rates can fluctuate, so it’s essential to shop around and compare options. These loans are specifically designed to finance the construction of a new home, and understanding the terms and interest rates is crucial for budgeting effectively.

Need a quick cash infusion? A 1000 Loan can provide short-term financial relief. These small loans are often available through online lenders and can be a convenient solution for unexpected expenses. However, it’s important to consider the interest rates and repayment terms carefully.

Adding a pool to your backyard? Pool Financing options are available to help make your dream a reality. From traditional loans to home equity lines of credit, exploring different financing options can help you create the perfect oasis without breaking the bank.

Bank of America is a well-known lender, and their Bank Of America Mortgage Rates are worth considering. Compare their rates to other lenders and see if they offer competitive terms that align with your needs.

Wells Fargo is another major lender, and their Wells Fargo Heloc can be a useful option for homeowners seeking flexible financing. A HELOC allows you to borrow against your home’s equity as needed, providing a revolving line of credit for various expenses.

Purchasing your first home is an exciting milestone! First Time Home Buyer Loans are designed to make the process more accessible. These programs often come with lower down payment requirements and other benefits to help you achieve your homeownership dreams.

Before you start house hunting, consider getting a Home Loan Pre Approval. This process allows lenders to assess your financial situation and provide an estimated loan amount you’re likely to qualify for. A pre-approval gives you a clear picture of your buying power and makes you a more attractive buyer in a competitive market.