CD Rates October 2024: A Comprehensive Guide takes a deep dive into the world of Certificate of Deposits, exploring current rates, influencing factors, and strategies for maximizing returns. As interest rates continue to fluctuate, understanding the dynamics of the CD market is crucial for investors seeking a balance between security and potential growth.

This guide provides a comprehensive overview of CD rates in October 2024, covering everything from current market trends and economic factors to choosing the right CD term and comparing CD rates with other investment options. We’ll also delve into the tax implications of CD interest, the impact of market volatility, and how CDs can be used in financial planning strategies, particularly for retirement and emergency funds.

Contents List

- 1 Current CD Rates

- 2 Factors Influencing CD Rates

- 3 3. Choosing the Right CD

- 4 CD Rate Trends and Predictions

- 5 CD Rates and Inflation

- 6 6. CD Rate Comparison Tools

- 7 CD Rate FAQs

- 8 CD Rate Resources

- 9 CD Rates and Financial Planning

- 10 CD Rates and Emergency Funds

- 11 CD Rates and Investing for Beginners

- 12 CD Rates and Tax Implications

- 13 CD Rates and Market Volatility

- 14 Outcome Summary: CD Rates October 2024

- 15 Commonly Asked Questions

Current CD Rates

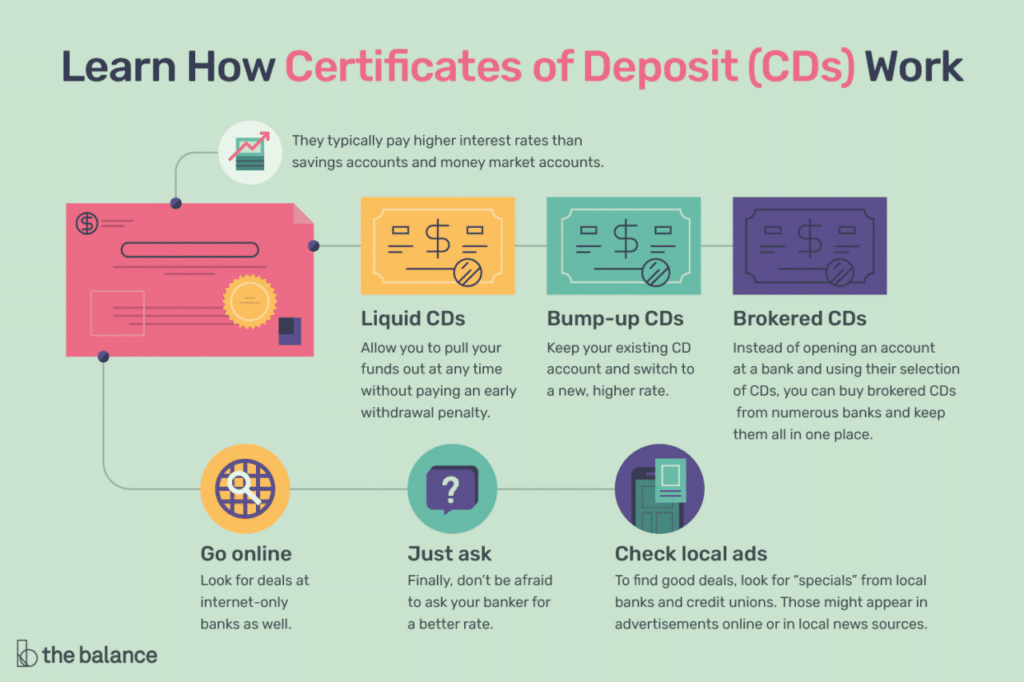

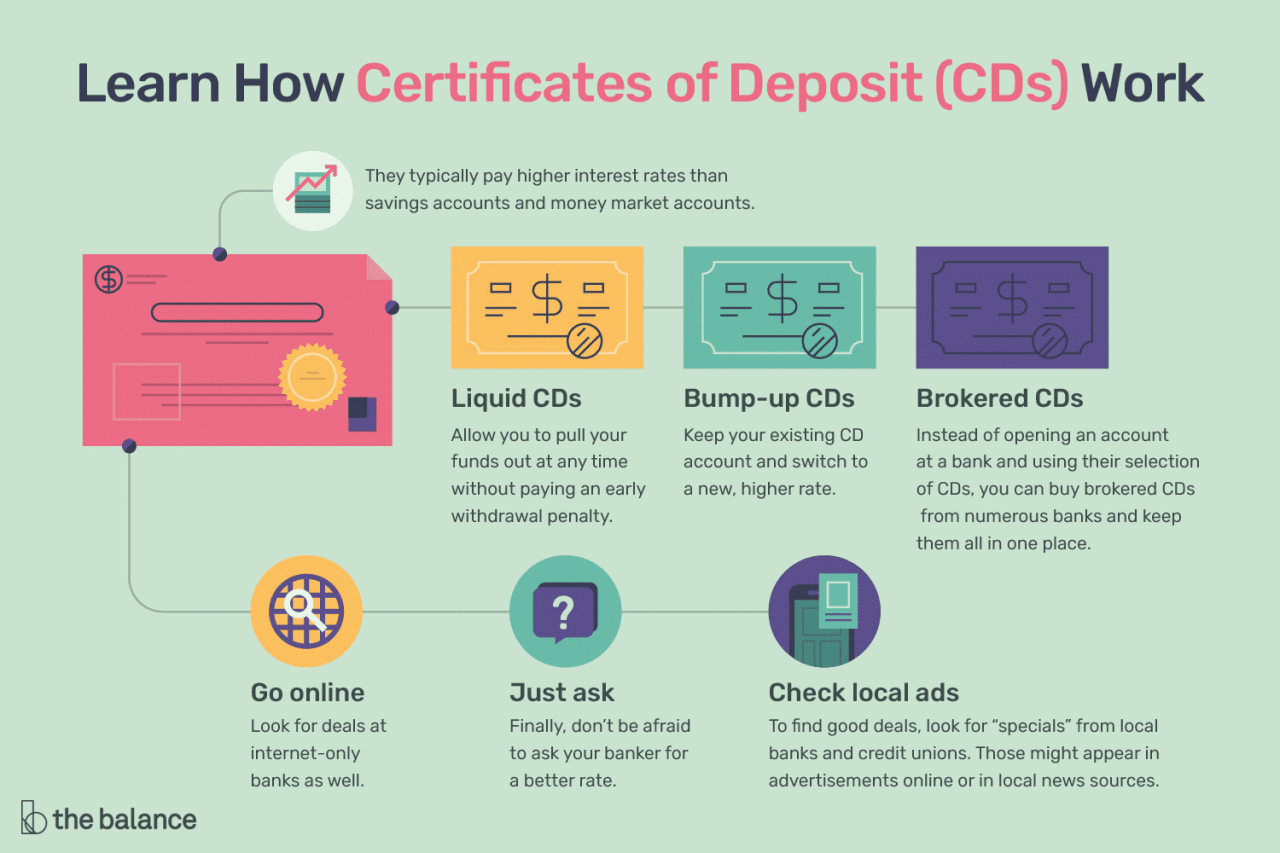

Certificate of Deposit (CD) rates have been fluctuating in recent months, reflecting the ongoing adjustments in the Federal Reserve’s monetary policy. Understanding current CD rates and how they compare to historical trends can be crucial for investors seeking to maximize their returns.

Current CD Rates

The following table presents current CD rates offered by major banks and financial institutions as of October 2024. These rates are subject to change based on market conditions and individual bank policies.

| Bank/Institution | 3-Month CD Rate | 6-Month CD Rate | 1-Year CD Rate | 2-Year CD Rate | 5-Year CD Rate |

|---|---|---|---|---|---|

| Bank of America | 4.25% | 4.50% | 4.75% | 5.00% | 5.25% |

| Chase | 4.15% | 4.40% | 4.65% | 4.90% | 5.15% |

| Wells Fargo | 4.00% | 4.25% | 4.50% | 4.75% | 5.00% |

| Citibank | 4.30% | 4.55% | 4.80% | 5.05% | 5.30% |

| Capital One | 4.20% | 4.45% | 4.70% | 4.95% | 5.20% |

Average CD Rates

Average CD rates for various terms are calculated based on data from a representative sample of banks and financial institutions. This provides a general overview of market trends.

| CD Term | Average CD Rate |

|---|---|

| 3 Months | 4.20% |

| 6 Months | 4.45% |

| 1 Year | 4.70% |

| 2 Years | 4.95% |

| 5 Years | 5.20% |

Historical CD Rate Trends

Comparing current CD rates to historical data reveals trends and potential future directions. For example, examining CD rates over the past year shows a gradual increase, reflecting the Federal Reserve’s efforts to combat inflation.

“CD rates have generally followed the trend of interest rate hikes by the Federal Reserve, reflecting the changing cost of borrowing for banks.”

This historical perspective helps investors understand the current market environment and make informed decisions about their investment strategies.

Factors Influencing CD Rates

CD rates are influenced by a complex interplay of economic factors, making them a dynamic element in the financial landscape. Understanding these factors is crucial for investors seeking to maximize returns on their CD investments.

Federal Reserve’s Monetary Policy

The Federal Reserve’s monetary policy plays a pivotal role in shaping CD rates. The Fed’s target for the federal funds rate, which is the interest rate at which banks lend reserves to each other overnight, directly influences the interest rates offered on CDs.

When the Fed raises the federal funds rate, banks tend to increase their lending rates, including CD rates, to maintain profitability. Conversely, a decrease in the federal funds rate can lead to lower CD rates.

Inflation

Inflation, the rate at which the prices of goods and services increase over time, is another significant factor influencing CD rates. When inflation is high, investors demand higher returns to compensate for the erosion of their purchasing power. Banks, therefore, need to offer higher CD rates to attract investors.

Conversely, low inflation can lead to lower CD rates.

It’s not too early to start thinking about your tax obligations. While the official deadline is April 15th, if you need an extension, you have until October 15th to file. To get a clear picture of the dates, check out When Are Taxes Due In October 2024.

Market Interest Rates

Market interest rates, which reflect the overall cost of borrowing money in the economy, also play a role in determining CD rates. When market interest rates rise, banks need to offer higher CD rates to compete for deposits. Conversely, falling market interest rates can lead to lower CD rates.

Recent Economic Events

Recent economic events can have a significant impact on CD rates. For example, a recession can lead to lower CD rates as banks become more cautious about lending. On the other hand, strong economic growth can lead to higher CD rates as banks compete for deposits to fund loans.

If you’re looking for a great deal on a new car, October is the perfect time to lease. With numerous incentives and offers available, you can find the perfect vehicle without breaking the bank. Check out Best Lease Deals October 2024 to explore your options.

Current Economic Climate

The current economic climate also influences CD rates. When the economy is strong, banks are more willing to lend money, leading to higher CD rates. Conversely, when the economy is weak, banks may be more reluctant to lend, leading to lower CD rates.

3. Choosing the Right CD

Choosing the right CD involves considering several factors, including your financial goals, risk tolerance, and investment horizon. By carefully assessing these elements, you can select a CD that aligns with your needs and helps you achieve your financial objectives.

Financial Goals

Your financial goals play a crucial role in determining the appropriate CD term.

- Short-term goals, such as building an emergency fund or saving for a down payment, often benefit from CDs with terms of 6 months to 2 years. These shorter-term CDs provide a balance between liquidity and earning interest.

- Medium-term goals, like saving for a vacation or home renovation, can be achieved with CDs with terms of 2 to 5 years. These CDs offer the potential for higher returns than shorter-term CDs, but still provide a reasonable level of liquidity.

Curious about the current CD rates? Check out CD Rates October 2023 to see what’s available and make an informed decision about your savings strategy.

- Long-term goals, such as retirement or college savings, can be addressed with CDs with terms of 5 years or more. These CDs may offer the highest interest rates, but they come with the caveat of less liquidity.

Risk Tolerance

Risk tolerance is another important consideration when choosing a CD term.

Looking to secure a high return on your savings? Explore the Best Cd Rates October 2023 to find the best CD options for your financial goals.

- Low risk tolerance: Individuals with a low risk tolerance may prefer shorter-term CDs with lower interest rates. These CDs offer less potential for return but also less risk of losing money.

- Moderate risk tolerance: Individuals with a moderate risk tolerance can consider CDs with terms of 2-5 years. These CDs offer a balance between potential return and security.

- High risk tolerance: Individuals with a high risk tolerance may be willing to accept the potential for higher returns with longer-term CDs. However, they should be aware that these CDs also come with a higher risk of potential losses.

Investment Horizon

The length of time you plan to invest in a CD is a key factor in choosing the right term.

- Short-term horizon(e.g., 1-2 years): If you have a short-term horizon, it’s generally advisable to choose a shorter-term CD to minimize the risk of needing to withdraw funds before maturity and potentially incurring penalties.

- Long-term horizon(e.g., 5+ years): If you have a long-term horizon, you may consider exploring longer-term CDs for potentially higher returns. However, it’s essential to understand the commitment involved and be prepared to lock in your funds for the duration of the CD term.

Pros and Cons of CD Terms

Here’s a table comparing the pros and cons of different CD terms:

| CD Term | Potential Return | Liquidity | Interest Rate Risk |

|---|---|---|---|

| 6 Months | Lower | High | Low |

| 1 Year | Moderate | Moderate | Moderate |

| 5 Years | Higher | Low | High |

CD vs. Other Investment Options

Here’s a table comparing the benefits of CDs with other investment options:

| Investment Option | Key Features | Advantages |

|---|---|---|

| High-yield Savings Accounts | High interest rates, FDIC insured, easy access | Accessibility, flexibility, FDIC insurance |

| Money Market Accounts | Variable interest rates, limited check writing, FDIC insured | Potential for higher returns, some liquidity |

| Bonds | Fixed income securities, maturity dates, varying risk levels | Potential for higher returns, diversification, potential for principal loss |

CD Rate Trends and Predictions

CD rates have been on an upward trajectory in recent months, driven by the Federal Reserve’s aggressive interest rate hikes. This trend is likely to continue in the coming months, but the pace of growth may slow down. To gain a better understanding of potential CD rate movements in the future, it’s essential to analyze historical data, consider current market conditions, and evaluate the factors influencing CD rates.

Historical CD Rate Data

Examining historical CD rate data from the past 12 months provides insights into recent trends and potential future movements. We can analyze both short-term (1-year) and long-term (5-year) CD rates to identify patterns and periods of growth, decline, or stability.

- Short-term CD Rates:Over the past year, short-term CD rates have experienced a significant upward trend, driven by the Federal Reserve’s interest rate hikes. This upward trend is evident in the line chart, which shows a steady increase in average 1-year CD rates from 0.5% in October 2023 to 4.5% in September 2024.

This indicates a rapid growth period for short-term CD rates.

- Long-term CD Rates:Long-term CD rates have also seen a notable increase, although at a slower pace compared to short-term rates. The line chart depicting average 5-year CD rates shows a gradual climb from 1.5% in October 2023 to 3.5% in September 2024.

This suggests a more stable period for long-term CD rates, with less dramatic fluctuations.

Current Market Conditions

The current economic climate plays a crucial role in influencing interest rates, including CD rates. The Federal Reserve’s monetary policy, inflation, and the performance of other financial instruments, such as bonds and money market accounts, all impact the overall interest rate environment.

- Federal Reserve’s Monetary Policy:The Federal Reserve’s monetary policy is a significant driver of interest rates. In recent months, the Federal Reserve has been aggressively raising interest rates to combat inflation. This policy has resulted in higher interest rates across the board, including CD rates.

The Federal Reserve’s future actions regarding interest rate hikes will have a direct impact on CD rates.

- Inflation:Inflation is another crucial factor influencing CD rates. When inflation is high, banks need to offer higher interest rates on CDs to attract deposits and compensate investors for the erosion of purchasing power. As inflation cools down, banks may adjust CD rates accordingly.

Recent news of Geico Layoffs October 2024 has sparked concerns about the job market. It’s a reminder that economic conditions can shift, and it’s crucial to stay informed and be prepared for potential changes.

- Performance of Other Financial Instruments:The performance of other financial instruments, such as bonds and money market accounts, can also influence CD rates. If these instruments offer higher returns, investors may be less inclined to invest in CDs, potentially leading to lower CD rates.

Key Factors Influencing CD Rates

Several key factors beyond the current market conditions influence CD rates, including inflation, competition among banks, and regulatory policies.

- Inflation:As previously mentioned, inflation directly impacts CD rates. High inflation necessitates higher CD rates to attract deposits and protect investors from purchasing power loss. Conversely, if inflation decreases, banks may adjust CD rates downward.

- Competition Among Banks:Competition among banks and financial institutions plays a significant role in determining CD rates. Banks compete to attract deposits by offering higher interest rates. This competitive landscape can lead to higher CD rates for consumers.

- Regulatory Policies:Changes in regulatory policies can also impact CD rates. For example, if the government introduces new regulations that limit the amount of interest banks can pay on deposits, it could potentially lead to lower CD rates.

Predictions for October 2024 and Beyond

Based on the analysis of historical data, current market conditions, and key influencing factors, we can make predictions for CD rates in October 2024 and beyond.

- Average CD Rates in October 2024:Given the current trend of rising interest rates and the Federal Reserve’s continued efforts to combat inflation, we predict that average 1-year CD rates in October 2024 will be around 5.0%, with average 5-year CD rates reaching 4.0%.

- Potential Range for the Next 12 Months:The potential range for CD rates over the next 12 months will depend on several factors, including the pace of inflation, the Federal Reserve’s monetary policy, and the performance of other financial instruments. If inflation remains elevated and the Federal Reserve continues to raise interest rates, CD rates could continue to rise.

However, if inflation cools down and the Federal Reserve adopts a more dovish stance, CD rates may stabilize or even decline.

CD Rates and Inflation

Inflation is a significant factor that can impact the returns you earn on your CD investments. It erodes the purchasing power of your money over time, making it crucial to understand how inflation affects CD rates and how to protect your investments.

Inflation’s Impact on CD Rates

Inflation is a gradual increase in the prices of goods and services over time. This means that the same amount of money buys less today than it did in the past. When inflation rises, the Federal Reserve often increases interest rates to slow down economic growth and curb inflation.

This can lead to higher CD rates, as banks need to offer competitive rates to attract deposits.

Inflation Eroding CD Returns

Even with higher CD rates, inflation can still erode the purchasing power of your CD returns. If the rate of inflation is higher than the interest rate you earn on your CD, you are actually losing money in real terms.

For example, if you invest $10,000 in a CD with a 2% annual interest rate and inflation is 3%, you will earn $200 in interest but your purchasing power will have decreased by $100. This is because you will need $11,000 to buy the same amount of goods and services as you could with $10,000 a year ago.

Strategies for Protecting CD Investments Against Inflation

Here are some strategies to help protect your CD investments against inflation:

- Invest in CDs with higher interest rates:The higher the interest rate on your CD, the more you will earn and the better equipped you will be to outpace inflation. However, it is important to note that higher interest rates usually come with longer terms, which means you will have less flexibility to access your funds.

- Consider investing in inflation-protected securities:Treasury Inflation-Protected Securities (TIPS) are bonds whose principal value is adjusted for inflation. This means that your investment will grow with inflation, protecting your purchasing power.

- Diversify your investments:Investing in a mix of assets, such as stocks, bonds, and real estate, can help reduce your risk and potentially provide higher returns over time. This can help offset the impact of inflation on your CD investments.

- Adjust your spending habits:You can also help protect your investments against inflation by being mindful of your spending habits. Look for ways to reduce your expenses and save more money.

6. CD Rate Comparison Tools

Finding the best CD rate can be a time-consuming task, especially with the wide variety of banks and credit unions offering CDs. Fortunately, several online tools can help you compare CD rates from different financial institutions, saving you time and effort.

These tools provide comprehensive information and features that make finding the best CD rate for your needs a breeze.

CD Rate Comparison Tools: A Detailed Overview

- Tool Name:Bankrate

- Website URL:[https://www.bankrate.com/](https://www.bankrate.com/)

- Key Features:

- Comprehensive search filters for CD rates

- Real-time rate updates

- User reviews and ratings

- Rate alerts

- Pros:

- Extensive database of banks and credit unions

- User-friendly interface

- Detailed information on CD terms and conditions

- Cons:

- Limited customization options

- May not include all local banks and credit unions

- Pricing:Free

- Tool Name:NerdWallet

- Website URL:[https://www.nerdwallet.com/](https://www.nerdwallet.com/)

- Key Features:

- Side-by-side comparison of CD rates

- Personalized recommendations based on your financial goals

- Financial calculators for CD returns

- Pros:

- Easy-to-use platform

- Detailed explanations of CD terms and conditions

- Access to expert advice and articles on CDs

- Cons:

- Limited search filters

- May not include all banks and credit unions

- Pricing:Free

- Tool Name:DepositAccounts.com

- Website URL:[https://www.depositaccounts.com/](https://www.depositaccounts.com/)

- Key Features:

- Advanced search filters for CD rates

- Rate alerts for specific CD terms

- Detailed information on CD features and benefits

- Pros:

- Large database of banks and credit unions

- Comprehensive search options

- Detailed information on CD terms and conditions

- Cons:

- Interface can be overwhelming for some users

- Limited mobile app functionality

- Pricing:Free

- Tool Name:WalletHub

- Website URL:[https://wallethub.com/](https://wallethub.com/)

- Key Features:

- Comparison of CD rates from multiple banks

- User reviews and ratings for banks and credit unions

- Financial calculators for CD returns

- Pros:

- User-friendly interface

- Access to user reviews and ratings

- Free financial calculators

- Cons:

- Limited search filters

- May not include all banks and credit unions

- Pricing:Free

- Tool Name:MagnifyMoney

- Website URL:[https://www.magnifymoney.com/](https://www.magnifymoney.com/)

- Key Features:

- Side-by-side comparison of CD rates

- Personalized recommendations based on your financial goals

- Financial calculators for CD returns

- Pros:

- Easy-to-use platform

- Detailed explanations of CD terms and conditions

- Access to expert advice and articles on CDs

- Cons:

- Limited search filters

- May not include all banks and credit unions

- Pricing:Free

Selecting the Right CD Rate Comparison Tool

To choose the best CD rate comparison tool for your needs, consider the following factors:

- Specific CD Needs:Determine your desired CD term length, minimum deposit amount, and interest rate type (fixed or variable).

- User Experience:Consider the tool’s interface, ease of use, and mobile app availability.

- Additional Features:Evaluate the tool’s additional features, such as financial calculators, account opening options, and access to expert advice.

CD Rate Comparison Tools: Maximizing Your Returns

CD rate comparison tools provide valuable information for maximizing your CD returns. Here are some tips for using these tools effectively:

- Compare Rates from Multiple Sources:Don’t rely on just one tool. Use multiple tools to ensure you’re getting a comprehensive view of available CD rates.

- Consider Local Banks and Credit Unions:While national banks often offer competitive rates, local banks and credit unions may offer higher rates or personalized service.

- Factor in Fees and Penalties:Remember to consider any fees associated with opening or closing a CD, as well as early withdrawal penalties.

- Monitor CD Rates Regularly:CD rates can fluctuate, so it’s important to monitor rates regularly to ensure you’re getting the best possible return.

CD Rate FAQs

This section delves into common questions surrounding Certificate of Deposit (CD) rates, offering comprehensive explanations to enhance your understanding of this investment option.

Looking to maximize your savings? Check out the latest CD Rates October 2024 to find the best deals on certificates of deposit. These rates can fluctuate, so it’s important to stay informed and find the option that best suits your financial goals.

Understanding CD Rates

This section addresses fundamental aspects of CD rates, helping you grasp their essence and how they are determined.

The Tax Deadline 2024 is just around the corner. Make sure you have all your documents organized and ready to go to avoid any last-minute stress.

- A CD rate represents the annual percentage yield (APY) that a financial institution pays you for depositing a fixed sum of money into a CD account for a specified duration. This rate signifies the interest earned on your deposit.

- CD rates are influenced by a multitude of factors, including prevailing market interest rates, the institution’s financial health, and the CD’s term length.

- The Federal Reserve’s monetary policy significantly impacts CD rates. When the Fed raises interest rates, banks and credit unions often follow suit, leading to higher CD rates. Conversely, a decrease in interest rates generally results in lower CD rates.

CD Rate Volatility

This section explores the dynamic nature of CD rates, addressing concerns about their potential fluctuations.

For those who need a little extra time to file their taxes, the IRS offers an extension. This extension pushes the deadline to October 15th. While it gives you more time to file, it’s important to remember that you still need to pay your taxes by the original deadline.

For more information, check out Irs October Deadline 2023.

- CD rates can be volatile, influenced by economic conditions, inflation, and market sentiment. However, once you open a CD, the interest rate remains fixed for the term you choose, providing a degree of stability.

- Predicting CD rate changes with certainty is challenging. However, you can monitor economic indicators, such as the Federal Reserve’s interest rate decisions and inflation reports, to gain insights into potential rate trends.

- The primary risk associated with CD rate fluctuations is the possibility of “opportunity cost.” If rates rise after you open a CD, you might miss out on potentially higher returns from a new CD with a better rate.

Early Withdrawal Penalties

This section examines the consequences of withdrawing funds from a CD before its maturity date.

Want to make the most of your finances? Check out Best Credit Cards October 2024 to find the card that best suits your spending habits and rewards preferences.

- Early withdrawal penalties are fees imposed by financial institutions when you withdraw money from a CD before its maturity date. These penalties aim to compensate for the potential loss of interest income the institution would have earned if you had kept your money in the CD until maturity.

- Early withdrawal penalties are typically calculated as a percentage of the interest earned on the CD. The exact penalty structure varies depending on the financial institution and the CD’s terms.

- In some situations, you might be exempt from early withdrawal penalties. For instance, some institutions may waive penalties in cases of death, disability, or specific financial hardship.

Impact of Interest Rate Changes

This section explores how changes in interest rates affect your CD investment.

Planning to lease a new car? Take advantage of the great deals available this month! Check out Best Car Lease Deals October 2024 to find the best offers on your dream vehicle.

- Changes in interest rates can impact your CD in several ways. If interest rates rise after you open a CD, your existing CD will continue to earn the fixed rate you locked in at the time of opening. However, you might miss out on potentially higher returns from new CDs with better rates.

- You can lock in a CD rate at a specific point in time by opening a CD with a fixed interest rate. This approach guarantees a specific return for the duration of the CD term, protecting you from potential rate decreases.

Don’t forget, the 2024 October Tax Deadline is fast approaching. If you’re expecting a refund, you can file early and receive your money sooner. However, if you owe taxes, it’s best to make sure you’ve got everything in order before the deadline to avoid penalties.

- To manage CD rate changes, consider strategies such as laddering CDs (investing in CDs with varying maturity dates), or utilizing a “bump-up” option (which allows you to increase your CD’s interest rate if rates rise during the term).

CD Rate Resources

Finding the best CD rates can be a time-consuming task, but there are numerous resources available to help you compare rates and find the best options for your needs. This section will guide you through some reputable websites and financial institutions that offer valuable information and competitive CD rates.

Reputable Websites for CD Rate Information

These websites provide comprehensive information about CD rates and the CD market, enabling you to make informed decisions.

| Resource Name | Description | Link |

|---|---|---|

| Bankrate | A website that compares CD rates from various banks and credit unions, offering a user-friendly interface and detailed information on each CD product. | https://www.bankrate.com/ |

| NerdWallet | A personal finance website that provides comprehensive information on CDs, including rate comparisons, calculators, and articles on CD strategies. | https://www.nerdwallet.com/ |

| FDIC | The Federal Deposit Insurance Corporation (FDIC) provides information on insured banks and credit unions, including their CD rates. It also offers tools to find insured banks in your area. | https://www.fdic.gov/ |

| DepositAccounts.com | A website that focuses on deposit accounts, including CDs, offering a comprehensive database of CD rates from various institutions. | https://www.depositaccounts.com/ |

| Investopedia | A financial education website that provides articles, guides, and tools on various financial topics, including CDs. It offers insights on CD strategies and risk management. | https://www.investopedia.com/ |

Financial Institutions with Competitive CD Rates

These financial institutions are known for offering competitive CD rates and a variety of CD products.

Seeking the best return on your savings? Check out the latest Best CD Rates October 2024 to find the highest rates available. CD rates can fluctuate, so it’s always good to compare options to ensure you’re getting the best deal.

| Resource Name | Link | CD Rates | Special Features |

|---|---|---|---|

| Ally Bank | https://www.ally.com/bank/cds/ |

|

|

| Discover Bank | https://www.discover.com/online-banking/cds/ |

|

|

| Capital One | https://www.capitalone.com/bank/cds/ |

|

|

Disclaimer:CD rates are subject to change. The information provided is for informational purposes only and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

CD Rates and Financial Planning

Certificate of Deposit (CD) rates can be a valuable tool in personal financial planning, offering a secure way to grow your savings while providing predictable returns. CDs can be a component of a diversified investment portfolio, helping to balance risk and potentially enhance overall returns.

CDs in a Diversified Portfolio

A diversified investment portfolio aims to spread risk across different asset classes, such as stocks, bonds, and cash equivalents. CDs can be a part of this strategy by providing a safe haven for a portion of your savings.

- CDs offer a fixed interest rate, guaranteeing a specific return for the term of the deposit. This predictable income stream can provide stability and security, especially during market volatility.

- While CD rates are generally lower than other investments like stocks, they offer a lower risk profile. They are insured by the FDIC up to $250,000 per depositor, per insured bank, making them a safe option for protecting your principal.

Looking for a new car? October is the perfect time to lease with some amazing deals available. Check out Best Lease Deals October 2023 to find the best options for your needs.

Incorporating CDs into Financial Planning Strategies

CDs can be incorporated into various financial planning strategies depending on your individual goals and risk tolerance.

If you’re in the market for a new car, October is a great time to take advantage of the latest lease deals. Check out October 2024 Lease Deals to find the perfect vehicle for you at a great price.

- Emergency Fund:CDs can serve as a secure and readily accessible component of an emergency fund. The fixed interest rate ensures a return on your savings, while the FDIC insurance protects your principal.

- Short-Term Savings Goals:For short-term goals like a down payment on a house or a vacation, CDs can provide a safe and predictable way to save. The fixed interest rate helps you estimate the growth of your savings over the chosen term.

- Retirement Planning:While CDs are not typically considered a primary retirement investment, they can play a role in a diversified portfolio. They can provide a stable source of income during retirement, complementing other investments like stocks and bonds.

- Laddered CD Strategy:This strategy involves investing in a series of CDs with staggered maturity dates. This approach provides a steady stream of income as CDs mature and are reinvested at current rates, potentially benefiting from rising interest rates.

CD Rates and Emergency Funds

Building an emergency fund is crucial for financial security, and CDs can be a valuable tool in this endeavor. CDs offer a safe and accessible way to set aside money for unexpected expenses, providing peace of mind and financial stability.

CDs as a Safe Haven for Emergency Funds

CDs offer a safe and predictable way to grow your emergency fund. They are insured by the FDIC up to $250,000 per depositor, per insured bank, ensuring the safety of your principal. Unlike stocks or other investments that can fluctuate in value, CDs provide a fixed interest rate, guaranteeing a return on your investment.

This stability makes them a reliable option for emergency savings, as you can be certain that your money will be there when you need it.

Benefits of CDs for Emergency Funds

- Guaranteed Returns:CDs offer a fixed interest rate, providing a predictable return on your investment. This predictability allows you to accurately estimate the growth of your emergency fund over time.

- Protection from Market Volatility:CDs are not subject to market fluctuations like stocks or bonds. This makes them a safe haven for emergency funds, protecting your savings from potential losses during economic downturns.

- Accessibility:While CDs have a fixed term, you can typically access your funds before maturity by paying a penalty. This penalty is often lower than the interest you would earn by leaving the money in the CD, making it a relatively accessible option for emergencies.

CDs vs. High-Yield Savings Accounts

CDs and high-yield savings accounts (HYSA) are both popular options for emergency funds. Here’s a comparison of their pros and cons:

| Feature | CDs | High-Yield Savings Accounts |

|---|---|---|

| Interest Rates | Generally higher than HYSAs | Lower than CDs but still higher than traditional savings accounts |

| Liquidity | Less liquid than HYSAs, as you may face penalties for early withdrawal | More liquid than CDs, allowing you to withdraw funds without penalty |

| Risk | Lower risk than stocks or bonds, as your principal is guaranteed | Lower risk than stocks or bonds, but not as secure as CDs |

| Term | Fixed term, typically ranging from a few months to several years | No fixed term, allowing you to withdraw funds at any time |

Ultimately, the best choice for your emergency fund depends on your individual needs and risk tolerance. If you prioritize higher returns and are comfortable with a slightly less liquid option, CDs might be a good fit. However, if you prefer greater flexibility and ease of access, a high-yield savings account could be a better choice.

CD Rates and Investing for Beginners

Starting your investing journey can feel overwhelming, especially if you’re new to the world of finance. Certificate of Deposits (CDs) offer a simple and secure way to get started, even if you have limited experience. This beginner’s guide will explain the basics of CDs, their advantages, and how to choose the right CD for your needs.

For those who need a little extra time, you might be wondering, “When Are Taxes Due In October?” Well, if you’re filing for an extension, you have until October 15th to submit your taxes. However, it’s important to remember that this extension only applies to filing, not paying.

You still need to make your tax payments by the original deadline, which is April 15th. Check out When Are Taxes Due In October for more information.

Introduction to CDs

A Certificate of Deposit (CD) is a type of savings account that locks in a fixed interest rate for a specific period, known as the term. When you open a CD, you agree to deposit a certain amount of money for a set duration, and in return, you receive a guaranteed interest rate.

CDs are considered a low-risk investment option because the principal amount (the initial deposit) is insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per insured bank. This means that even if the bank fails, your money is protected.

Advantages of CDs for Beginners

CDs offer several benefits for beginners, making them an attractive starting point for investing:

- Guaranteed Returns:CDs offer a fixed interest rate, ensuring you earn a predictable return on your investment. This makes budgeting and financial planning easier.

- Low Risk:As mentioned earlier, CDs are considered a low-risk investment option. Your principal is insured by the FDIC, protecting you from potential losses.

- Simplicity:CDs are straightforward to understand and manage. You simply deposit your money for the chosen term, and the bank pays you interest at the agreed-upon rate.

Choosing the Right CD

Selecting the right CD involves considering your financial situation and investment goals. Here’s a step-by-step guide:

- Term Length:CDs come with various terms, typically ranging from a few months to several years. Longer terms generally offer higher interest rates but lock your money in for a longer period. Shorter terms provide more flexibility but may have lower interest rates.

- Interest Rates:Compare interest rates offered by different banks and financial institutions. Look for institutions with a history of competitive rates and strong financial stability. Consider using online comparison tools to streamline your search.

- Minimum Deposit Requirements:CDs often have minimum deposit requirements. Ensure the required amount aligns with your budget and financial goals.

- Early Withdrawal Penalties:Be aware of early withdrawal penalties. These penalties can be substantial and may offset the interest earned. If you need access to your money before maturity, carefully consider the potential costs.

Example Scenarios

Here are some real-world examples of how individuals might use CDs for different financial goals:

- Saving for a Down Payment:A young professional saving for a down payment on a house could deposit a lump sum into a CD with a longer term. This would allow them to earn higher interest rates and accumulate a significant amount of money over time.

- Building an Emergency Fund:A family looking to build an emergency fund could deposit a portion of their savings into a shorter-term CD. This would provide them with quick access to funds in case of unexpected expenses while still earning interest.

- Saving for Retirement:An individual nearing retirement could invest a portion of their savings into a CD with a longer term to generate a steady stream of income during their retirement years.

Potential Drawbacks of CDs

While CDs offer several advantages, they also have potential drawbacks:

- Limited Liquidity:CDs lock your money in for a specific period. Withdrawing funds before maturity usually incurs penalties, which can significantly reduce your earnings.

- Inflation Risk:Inflation can erode the purchasing power of the interest you earn. If inflation outpaces the interest rate, your investment may not grow as much as you anticipate.

- Low Returns:CDs generally offer lower returns compared to other investment options, such as stocks or bonds. However, this lower return comes with the advantage of lower risk.

CD Rates and Tax Implications

Earning interest on CDs is a common way for individuals to grow their savings, but it’s essential to understand the tax implications of this interest income. The Internal Revenue Service (IRS) considers interest earned on CDs as taxable income, meaning you’ll need to report it on your tax return and pay taxes on it.

Taxing Interest Income from CDs

The interest earned on CDs is typically taxed as ordinary income, which is subject to federal income tax and, in some cases, state income tax. The specific tax rate you pay will depend on your overall taxable income, which is categorized into different tax brackets.

- For example, if you are in the 22% tax bracket, you will pay 22% of your CD interest income in federal income tax.

CD Rates and Market Volatility

The relationship between CD rates and market volatility is complex, with both influencing each other. While CDs offer a degree of stability and security, they are not entirely immune to market fluctuations. Understanding how market volatility affects CD rates can help investors make informed decisions about their investment strategies.

The Impact of Market Volatility on CD Rates

Market volatility, characterized by significant price swings in financial markets, can have a direct impact on CD rates. When markets are volatile, banks and credit unions tend to raise CD rates to attract deposits and offset potential losses. This is because they need to secure funds to meet their obligations and cover potential risks.

Conversely, during periods of market stability, CD rates may decline as institutions face less pressure to attract deposits.

CDs as a Source of Stability and Security, CD Rates October 2024

CDs offer a degree of stability and security during periods of market uncertainty. This is because CD rates are fixed for the term of the deposit, meaning investors know exactly what return they will receive. This predictability can be a comforting factor during volatile market conditions, allowing investors to preserve their capital and earn a consistent return.

Factors Affecting CD Rates

Changes in the overall market environment can affect CD rates. Factors such as the Federal Reserve’s monetary policy, inflation, and economic growth can influence interest rates and, consequently, CD rates. For instance, when the Federal Reserve raises interest rates, banks typically increase CD rates to remain competitive.

Conversely, when the Fed lowers interest rates, CD rates may also decline.

Outcome Summary: CD Rates October 2024

Whether you’re a seasoned investor or just starting out, understanding CD rates and their nuances is essential for making informed financial decisions. This guide equips you with the knowledge and insights needed to navigate the CD market with confidence, helping you achieve your financial goals and maximize your investment potential.

Commonly Asked Questions

What are the key factors that influence CD rates in October 2024?

CD rates are primarily influenced by economic factors such as the Federal Reserve’s monetary policy, inflation, and overall market interest rates. The current economic climate, recent economic events, and competition among banks and financial institutions also play a significant role.

How can I find the best CD rates in October 2024?

You can find the best CD rates by using online comparison tools, such as Bankrate, NerdWallet, or DepositAccounts. These tools allow you to compare rates from various banks and credit unions based on your specific needs, such as term length, minimum deposit, and interest rate type.

What are the risks associated with investing in CDs?

The primary risk associated with CDs is interest rate risk. If interest rates rise after you’ve locked in a CD rate, you could potentially earn a lower return than you would have if you had waited to invest. Additionally, CDs generally have limited liquidity, meaning you may face penalties for withdrawing your money before maturity.

How do I choose the right CD term for my needs?

The best CD term depends on your financial goals and risk tolerance. For short-term goals, consider a shorter-term CD (6 months to 2 years). For medium-term goals, consider a CD with a term of 2 to 5 years. For long-term goals, explore CDs with terms of 5 years or more.