Claims Handler: a crucial role in the insurance industry, navigating complex situations with a blend of empathy and expertise. They act as the bridge between policyholders and insurance companies, ensuring smooth and efficient resolution of claims.

Subrogation insurance is a type of coverage that allows your insurance company to recover money from a third party who caused the damage. This can be helpful if you’re involved in an accident with an uninsured or underinsured motorist. You can find more information about subrogation insurance on your insurance company’s website.

This comprehensive guide delves into the multifaceted world of claims handling, exploring the responsibilities, processes, skills, and challenges faced by these professionals. From understanding the different types of claims and the investigation process to navigating legal complexities and fostering positive customer experiences, this exploration provides a detailed understanding of the vital role claims handlers play in the insurance ecosystem.

Universal Credit is a benefit that can help you with your living costs if you’re on a low income or out of work. To apply for Universal Credit, you’ll need to create an account on the GOV.UK website and provide information about your income and expenses.

You can find more information about applying for Universal Credit on the GOV.UK website.

Contents List

The Role of a Claims Handler

A claims handler plays a crucial role in the insurance industry, acting as the bridge between insurance companies and policyholders during the claims process. They are responsible for handling and resolving claims efficiently and fairly, ensuring that policyholders receive the benefits they are entitled to.

A tort claim is a legal claim that arises from a civil wrong. This could include negligence, intentional torts, or strict liability. If you’re considering filing a tort claim, it’s important to speak with an attorney to understand your rights and options.

You can find more information about tort claims online.

Primary Responsibilities

Claims handlers have a wide range of responsibilities, including:

- Receiving and acknowledging claims

- Gathering and verifying claim information

- Investigating claims and assessing damages

- Negotiating settlements with policyholders

- Processing claim payments

- Communicating with policyholders throughout the claims process

- Maintaining accurate records and documentation

- Handling claim disputes and appeals

- Staying informed about industry regulations and best practices

Types of Claims

Claims handlers handle a variety of claims, including:

- Property claims: These involve damage to property, such as homes, vehicles, or businesses, due to events like fire, theft, or natural disasters.

- Liability claims: These involve claims for bodily injury or property damage caused by the insured party’s negligence.

- Health claims: These involve claims for medical expenses incurred by policyholders.

- Life insurance claims: These involve claims for death benefits payable to beneficiaries.

- Disability claims: These involve claims for income replacement benefits due to disability.

Communication and Customer Service Skills

Excellent communication and customer service skills are essential for claims handlers. They must be able to:

- Communicate effectively with policyholders, both verbally and in writing

- Listen attentively to policyholders’ concerns and provide empathetic support

- Explain complex insurance policies and procedures in a clear and concise manner

- Handle difficult conversations and complaints professionally

- Build trust and rapport with policyholders

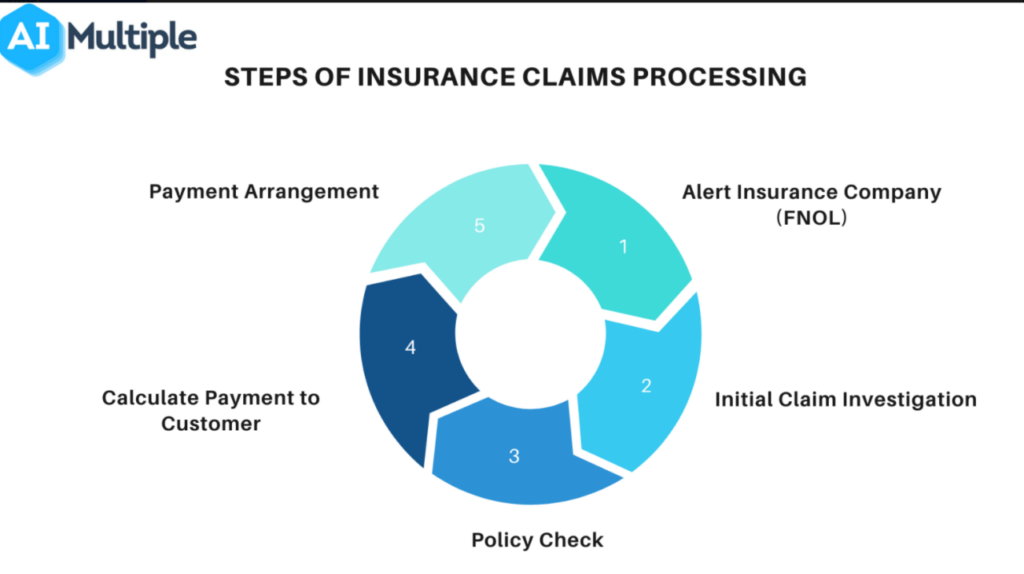

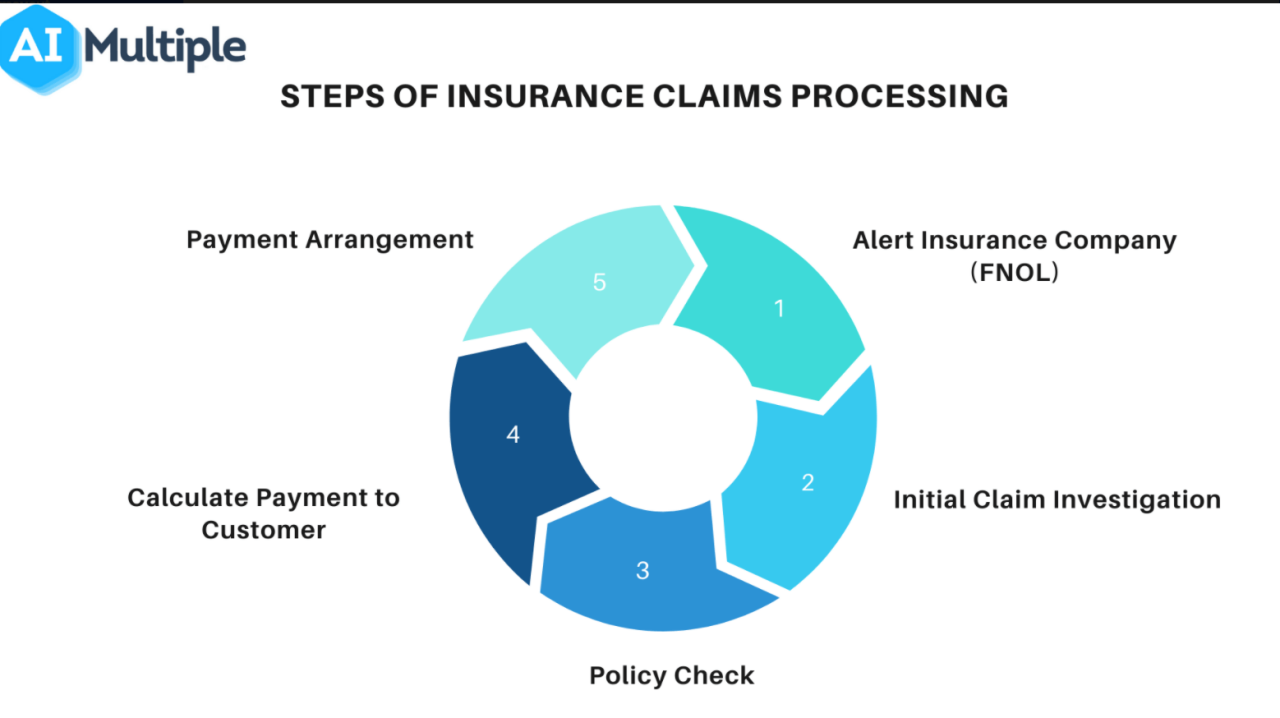

The Claims Handling Process

The claims handling process involves a series of steps designed to ensure a fair and efficient resolution for policyholders. The process typically includes:

Steps in the Claims Handling Process

- Claim Reporting: The process begins when a policyholder reports a claim to the insurance company. This can be done by phone, email, or online.

- Claim Acknowledgement: The claims handler acknowledges receipt of the claim and provides the policyholder with a claim number.

- Claim Investigation: The claims handler gathers information and evidence related to the claim, such as police reports, medical records, or repair estimates.

- Claim Assessment: The claims handler assesses the claim and determines the amount of coverage provided by the policy.

- Claim Negotiation: The claims handler negotiates a settlement with the policyholder, taking into account the amount of coverage, the severity of the loss, and any applicable deductibles.

- Claim Payment: Once a settlement is reached, the claims handler processes the payment to the policyholder or to a third party, such as a repair shop.

- Claim Closure: The claim is closed once all payments have been made and the policyholder has acknowledged satisfaction.

Documentation and Evidence

Claims handlers rely on various documentation and evidence to process claims accurately. Some common examples include:

- Claim forms: These forms collect basic information about the claim, such as the date of the loss, the nature of the loss, and the policyholder’s contact information.

- Police reports: These reports document the circumstances surrounding an accident or incident, providing valuable information for claim investigation.

- Medical records: These records document the nature and extent of injuries sustained by the policyholder, providing evidence for medical expense claims.

- Repair estimates: These estimates provide a detailed breakdown of the costs associated with repairing or replacing damaged property.

- Photographs: Photographs of the damaged property or the scene of the accident can provide visual evidence to support the claim.

Technology and Software

Technology and software play a significant role in streamlining the claims handling process. These tools help claims handlers to:

- Automate tasks: Software can automate repetitive tasks, such as data entry and claim processing, freeing up claims handlers to focus on more complex issues.

- Improve communication: Claims handling software can facilitate communication between claims handlers, policyholders, and other stakeholders.

- Enhance data analysis: Software can analyze claim data to identify trends and patterns, helping insurance companies to improve risk management and pricing.

- Reduce fraud: Claims handling software can help to detect and prevent fraudulent claims.

Claims Investigation and Assessment

Thorough investigation and assessment are crucial steps in the claims handling process. Claims handlers use a variety of methods to gather information, verify claim details, and identify potential fraud.

Celsius Network, a cryptocurrency lending platform, has been facing legal challenges in recent months. If you’re a Celsius customer and are considering filing a lawsuit, it’s important to understand your rights and options. You can find more information about Celsius lawsuit claims online.

Investigation Methods, Claims Handler

Claims handlers employ various methods to investigate claims, including:

- Reviewing claim documentation: This involves carefully examining claim forms, police reports, medical records, and other relevant documents.

- Conducting interviews: Claims handlers may interview the policyholder, witnesses, or other parties involved in the claim to gather firsthand accounts.

- Visiting the scene of the loss: This allows claims handlers to assess the damage firsthand and gather visual evidence.

- Consulting with experts: Claims handlers may consult with specialists, such as engineers, doctors, or appraisers, to obtain expert opinions on the cause and extent of the loss.

Claim Verification and Fraud Detection

Claims handlers must verify the accuracy of claim information to prevent fraudulent claims. This involves:

- Cross-referencing information: Comparing information from different sources, such as police reports and medical records, to identify inconsistencies.

- Checking for red flags: Identifying suspicious patterns or behaviors that may indicate fraud, such as multiple claims from the same policyholder or inconsistencies in claim narratives.

- Utilizing fraud detection software: Employing specialized software to analyze claim data and identify potential red flags.

Common Claim Scenarios and Challenges

Claims handlers encounter a variety of claim scenarios, each presenting unique challenges. Some common examples include:

- Claims involving multiple parties: These claims can be complex to investigate and resolve, requiring coordination between different stakeholders.

- Claims with disputed liability: When there is disagreement about who is responsible for the loss, claims handlers must carefully assess the evidence and negotiate a fair settlement.

- Claims involving catastrophic events: These claims often involve significant losses and require extensive investigation and coordination with government agencies and other stakeholders.

Claims Resolution and Payment

The goal of the claims handling process is to reach a fair and timely resolution for policyholders. This involves determining the appropriate claim payment amount and handling any disputes or appeals.

Progressive is a leading auto insurance company that offers a variety of coverage options, including liability, collision, and comprehensive coverage. If you need to file an auto claim with Progressive, you can do so online, over the phone, or by visiting your local agent.

You can find more information about Progressive auto claims on their website.

Methods of Claim Resolution

Claims handlers use different methods to resolve claims, depending on the specific circumstances:

- Settlements: This involves reaching an agreement between the claims handler and the policyholder on the amount of payment for the claim.

- Denials: If the claims handler determines that the claim is not covered under the policy, the claim may be denied.

- Appeals: Policyholders have the right to appeal a claim denial or a settlement they believe is unfair.

Factors Influencing Claim Payment

Several factors influence the amount and timing of claim payments, including:

- Policy coverage: The amount of coverage provided by the insurance policy limits the maximum payment for the claim.

- Deductible: The policyholder is typically responsible for paying a deductible before the insurance company covers the remaining costs.

- Severity of the loss: The extent of the damage or injury determines the amount of payment needed to cover the loss.

- Claim investigation findings: The investigation may uncover additional information that affects the amount of payment.

- Negotiation process: The claims handler may negotiate with the policyholder to reach a mutually acceptable settlement amount.

Handling Complex or Disputed Claims

Claims handlers may encounter complex or disputed claims that require additional investigation, legal expertise, or mediation. These claims may involve:

- Multiple parties with conflicting interests: This can create challenges in coordinating the claims process and reaching a mutually acceptable resolution.

- Substantial financial implications: These claims may involve significant financial losses, requiring careful analysis and negotiation.

- Legal issues: Some claims may involve legal disputes, requiring the involvement of lawyers and potentially litigation.

Claims Handler Skills and Qualifications

To excel as a claims handler, individuals need a combination of skills and qualifications. These include:

Essential Skills and Qualifications

- Strong communication skills: Effective communication is essential for interacting with policyholders, gathering information, and explaining complex procedures.

- Problem-solving abilities: Claims handlers must be able to analyze situations, identify solutions, and resolve disputes effectively.

- Attention to detail: Accurate record-keeping and meticulous attention to detail are crucial for ensuring claim accuracy and compliance.

- Negotiation skills: Claims handlers must be able to negotiate fair settlements with policyholders, balancing the interests of both parties.

- Customer service skills: Empathy, patience, and a commitment to providing excellent customer service are essential for building trust and rapport with policyholders.

Industry Knowledge and Legal Understanding

Claims handlers must possess a thorough understanding of insurance policies, regulations, and legal principles. This includes:

- Insurance contracts: Familiarity with the terms and conditions of various insurance policies.

- Insurance regulations: Knowledge of state and federal laws governing insurance practices.

- Legal principles: Understanding of legal concepts such as negligence, liability, and contract law.

Professional Certifications and Continuing Education

Professional certifications and continuing education can enhance the skills and knowledge of claims handlers. Some common certifications include:

- Certified Insurance Adjuster (CIA): This certification demonstrates proficiency in claims handling principles and practices.

- Associate in Claims (AIC): This designation recognizes expertise in claims handling and insurance principles.

- Continuing education courses: These courses provide updates on industry regulations, best practices, and emerging technologies.

The Claims Handling Environment

The claims handling environment is constantly evolving, driven by technological advancements, regulatory changes, and evolving customer expectations.

Property damage can be a stressful situation, but it’s important to take steps to document the damage and file a claim with your insurance company. You’ll need to provide information about the damage, including photographs and estimates. If you’re dealing with property damage, it’s helpful to understand the different types of property damage and how to file a claim.

Challenges and Opportunities

Claims handlers face a number of challenges in today’s insurance landscape, including:

- Increased claim complexity: Claims are becoming more complex due to factors such as technological advancements, changing lifestyles, and emerging risks.

- Rising claim costs: Increasing medical costs, repair costs, and litigation expenses are putting pressure on insurance companies to manage claims effectively.

- Increased regulatory scrutiny: Insurance companies are facing greater scrutiny from regulators, requiring them to adhere to strict compliance standards.

- Customer expectations: Policyholders expect faster, more convenient, and more personalized claim experiences.

However, these challenges also present opportunities for claims handlers to innovate and improve their practices. This includes:

- Embracing technology: Utilizing software and digital tools to streamline claim processing, improve communication, and enhance data analysis.

- Focusing on customer experience: Providing personalized and efficient service to meet the evolving needs of policyholders.

- Promoting collaboration: Working closely with other stakeholders, such as adjusters, experts, and legal professionals, to resolve complex claims effectively.

- Developing specialized skills: Acquiring expertise in specific areas, such as fraud detection, catastrophic event management, or technology-related claims.

Best Practices and Innovative Approaches

Claims handlers can adopt best practices and innovative approaches to improve their efficiency and effectiveness. This includes:

- Early intervention: Addressing claims promptly and efficiently to prevent delays and reduce costs.

- Data-driven decision-making: Using data analytics to identify trends, predict claim outcomes, and improve risk management.

- Continuous improvement: Regularly reviewing processes and procedures to identify areas for improvement and implement best practices.

- Employee training and development: Investing in training programs to enhance the skills and knowledge of claims handlers.

Last Point

The world of claims handling is a dynamic and evolving field, demanding a unique blend of technical proficiency, interpersonal skills, and a commitment to fairness. As the insurance landscape continues to transform, claims handlers will play an increasingly important role in shaping the future of the industry, ensuring that policyholders receive the support and compensation they need in times of need.

Q&A

What are the most common types of claims handled by claims handlers?

Claims handlers typically handle a variety of claims, including property damage, liability claims, medical claims, and life insurance claims.

If you’re a State Farm customer and need to file a glass claim, you can do so online, over the phone, or by visiting your local agent. Just make sure to have your policy information handy. You can find more information about filing a State Farm glass claim on their website.

What are the essential skills required for a successful claims handler?

Essential skills include strong communication and interpersonal skills, analytical and problem-solving abilities, attention to detail, and knowledge of insurance policies and procedures.

USAA is a well-respected insurance company that offers a variety of coverage options, including auto, home, and life insurance. If you need to file a claim with USAA, you can do so online, over the phone, or by visiting your local agent.

You can find more information about USAA insurance claims on their website.

What are the challenges faced by claims handlers in today’s insurance landscape?

Claims handlers face challenges such as increasing claim complexity, evolving regulatory environments, and rising customer expectations.

What are some of the best practices for effective claims handling?

Best practices include prompt communication, thorough investigation, fair and impartial assessment, and efficient resolution.

T-Mobile offers a variety of claims services, including coverage for lost or stolen phones, device damage, and more. To file a claim, you can contact their customer service department or visit their website. You’ll need to provide information about your device and the nature of the damage or loss.

You can find more information about Tmobile Claims on their website.

Many insurance policies offer benefits for a variety of situations, such as medical expenses, lost wages, and property damage. To claim these benefits, you’ll need to contact your insurance company and provide documentation of your claim. You can find more information about claiming benefits on your insurance company’s website.

An auto claim is a claim filed with your insurance company after an accident involving your vehicle. This could include damage to your car, injuries to yourself or others, or property damage. You can find more information about auto claims on your insurance company’s website.

Verizon offers a variety of warranty options for its products, including phones, tablets, and other devices. If you need to file a warranty claim with Verizon, you can do so online, over the phone, or by visiting a Verizon store.

You can find more information about Verizon warranty claims on their website.

Once you’ve filed a claim, you can often track its progress online or by contacting your insurance company. This can help you stay informed about the status of your claim and ensure that it’s being processed in a timely manner.

You can find more information about tracking your claim on your insurance company’s website.

Tail coverage is a type of insurance that provides coverage for claims that occur after your policy has expired. This can be helpful if you’re involved in an accident after your policy has ended, but before you’ve had a chance to renew it.

You can find more information about tail coverage on your insurance company’s website.

If you’re involved in an accident with an uninsured motorist, your own insurance policy may cover the damages to your vehicle. This type of coverage is known as uninsured motorist property damage. You can find more information about uninsured motorist property damage on your insurance company’s website.