Coast Capital Mortgage Rates 2024: Navigating the Canadian housing market in 2024 requires a keen understanding of mortgage rates, and Coast Capital Savings Credit Union offers a range of options for homebuyers. As a major player in the Canadian financial landscape, Coast Capital provides competitive rates, a variety of mortgage products, and a commitment to customer service.

Choosing the Best Bank For Mortgage 2024 depends on your individual needs and circumstances. Consider factors like interest rates, fees, and customer service when making your decision. To learn more about the different Mortgage Financing 2024 options available, it’s helpful to speak with a qualified mortgage advisor.

This guide explores the current state of mortgage rates in Canada, analyzing factors influencing these rates, and comparing Coast Capital’s offerings to other lenders. We’ll delve into the different mortgage products available, including fixed-rate, variable-rate, and open mortgages, and provide a detailed comparison of their features and benefits.

Understanding the eligibility criteria, application process, and factors that affect your individual rate is crucial for making informed decisions. We’ll also examine Coast Capital’s mortgage calculator and other tools, providing a step-by-step guide to help you estimate monthly payments and compare options.

Contents List

- 1 Coast Capital Overview: Coast Capital Mortgage Rates 2024

- 2 Mortgage Rates in 2024

- 3 Coast Capital Mortgage Products

- 4 Mortgage Eligibility and Application

- 5 Factors Affecting Mortgage Rates

- 6 Mortgage Calculator and Tools

- 7 Customer Reviews and Experiences

- 8 Tips for Securing a Favorable Mortgage Rate

- 9 Final Conclusion

- 10 FAQ Guide

Coast Capital Overview: Coast Capital Mortgage Rates 2024

Coast Capital Savings Credit Union is a prominent financial institution in Canada, serving members across British Columbia and Ontario. Founded in 1955 as the Greater Vancouver Savings Credit Union, Coast Capital has a rich history of providing financial services to individuals and businesses.

A Mortgage Adviser 2024 can help you navigate the complexities of the mortgage process. They can provide expert advice and help you find the best loan for your needs. A Mortgage Loan 2024 can be a significant financial commitment, so it’s important to be well-informed before making any decisions.

The credit union has grown significantly over the years, becoming one of the largest credit unions in Canada, with a strong focus on member satisfaction and community engagement.

Services and Mortgage Offerings

Coast Capital offers a comprehensive range of financial services, including:

- Checking and savings accounts

- Mortgages

- Loans

- Credit cards

- Investment products

- Insurance

Coast Capital’s mortgage offerings are particularly noteworthy, known for their competitive rates, flexible terms, and personalized service. The credit union provides a variety of mortgage products to suit different needs and financial situations, including fixed-rate, variable-rate, and open mortgages.

Role in the Canadian Financial Market

Coast Capital plays a vital role in the Canadian financial market by providing alternative banking options to traditional banks. As a credit union, Coast Capital is owned by its members, who benefit from its member-centric approach and commitment to community development.

Coast Capital’s presence in the market promotes competition and innovation, ensuring that consumers have access to a wider range of financial products and services.

Mortgage Rates in 2024

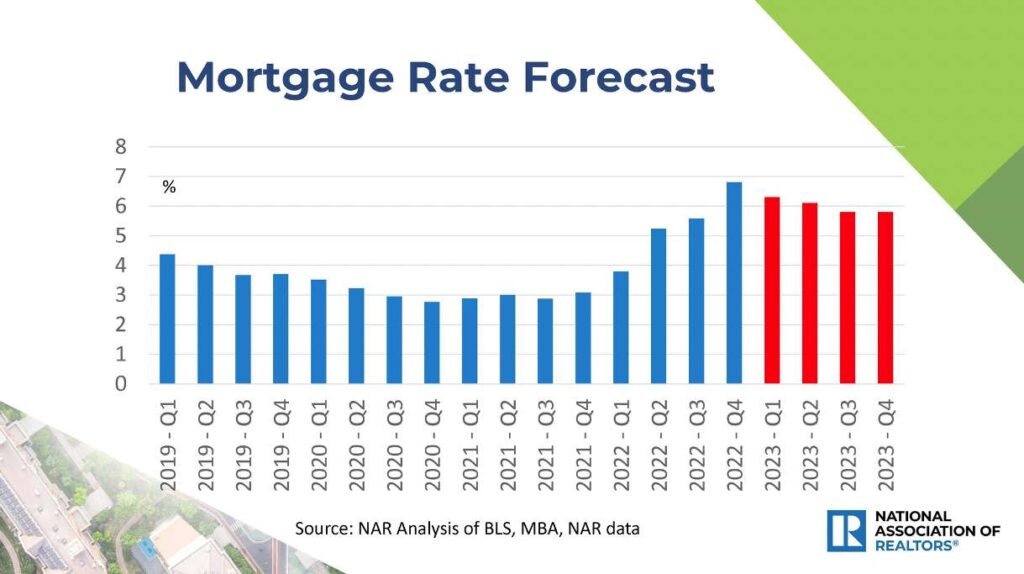

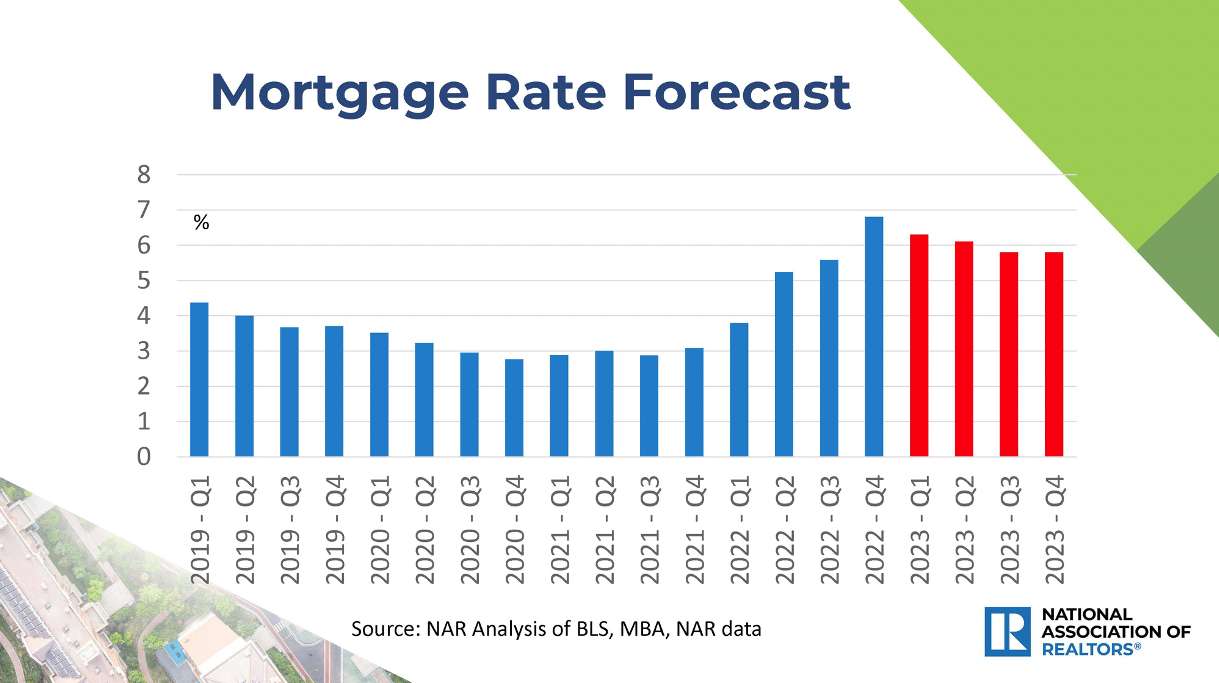

Mortgage rates in Canada are influenced by various factors, including economic indicators, Bank of Canada policies, and market conditions. In 2024, mortgage rates are expected to remain relatively stable, although some fluctuations are possible. The Bank of Canada’s stance on interest rates will play a crucial role in shaping the mortgage rate environment.

Factors Influencing Mortgage Rates

Several factors can influence mortgage rates, including:

- Economic Growth:A strong economy generally leads to lower mortgage rates, as lenders are more willing to lend money at lower interest rates.

- Inflation:High inflation can push interest rates higher, as lenders seek to protect their returns against rising prices.

- Bank of Canada Policy:The Bank of Canada’s monetary policy, particularly its target for the overnight lending rate, directly impacts mortgage rates.

- Global Economic Conditions:Global economic events can also influence Canadian mortgage rates, particularly if they affect investor confidence or global interest rates.

Comparison with Other Lenders

Coast Capital’s mortgage rates are generally competitive with other major Canadian lenders, such as the big banks and other credit unions. However, it’s essential to compare rates and terms from multiple lenders to find the best option for your specific needs.

Factors like your credit score, down payment, and loan-to-value ratio can also influence the rates you qualify for.

Coast Capital Mortgage Products

Coast Capital offers a range of mortgage products to cater to different borrowing needs and financial goals. These products include:

Fixed-Rate Mortgages

Fixed-rate mortgages provide stability and predictability, as the interest rate remains constant for the duration of the term. This can be beneficial for borrowers who prefer to know their monthly payments in advance and avoid the risk of rising interest rates.

Variable-Rate Mortgages

Variable-rate mortgages have an interest rate that fluctuates based on market conditions. This can lead to lower initial payments, but also carries the risk of higher payments if interest rates rise. Variable-rate mortgages can be advantageous for borrowers who anticipate lower interest rates in the future or are comfortable with some level of uncertainty.

Open Mortgages

Open mortgages offer greater flexibility, allowing borrowers to make prepayments or pay off the mortgage in full without penalty. However, open mortgages typically have higher interest rates than closed mortgages.

Comparison Table

| Mortgage Type | Interest Rate | Term | Fees |

|---|---|---|---|

| Fixed-Rate Mortgage | [Insert current fixed-rate information] | [Insert available terms] | [Insert typical fees] |

| Variable-Rate Mortgage | [Insert current variable-rate information] | [Insert available terms] | [Insert typical fees] |

| Open Mortgage | [Insert current open mortgage information] | [Insert available terms] | [Insert typical fees] |

Mortgage Eligibility and Application

To qualify for a mortgage from Coast Capital, you must meet certain eligibility criteria. These criteria include:

Eligibility Criteria

- Credit Score:A good credit score is essential for mortgage approval. Coast Capital will review your credit history to assess your creditworthiness.

- Income:You must have a stable income that can support your mortgage payments.

- Down Payment:Coast Capital requires a minimum down payment, which varies depending on the purchase price of the property.

- Debt-to-Income Ratio:Your debt-to-income ratio, which measures your total debt payments relative to your income, will be considered.

Required Documentation

To apply for a mortgage, you will need to provide Coast Capital with certain documentation, including:

- Proof of income (e.g., pay stubs, tax returns)

- Credit report

- Down payment funds

- Property purchase agreement

Application Process

The mortgage application process typically involves the following steps:

- Pre-Approval:You can get pre-approved for a mortgage before you start looking for a property. This can help you determine how much you can afford to borrow and streamline the buying process.

- Application Submission:Once you have found a property, you will need to submit a formal mortgage application to Coast Capital.

- Documentation Review:Coast Capital will review your application and required documentation.

- Mortgage Approval:If your application is approved, Coast Capital will provide you with a mortgage offer.

- Closing:Once you have accepted the mortgage offer, you will need to sign closing documents and complete the mortgage process.

Mortgage Pre-Approval Options

Coast Capital offers different pre-approval options to suit your needs, including:

- Conditional Pre-Approval:This type of pre-approval is subject to certain conditions, such as the appraisal of the property.

- Firm Pre-Approval:This pre-approval is more secure, as it is not subject to any conditions. It provides greater certainty and can strengthen your offer when purchasing a property.

Factors Affecting Mortgage Rates

Several factors can influence your individual mortgage rate, including:

Credit Score

Your credit score is a significant factor that lenders consider when determining your mortgage rate. A higher credit score generally leads to lower interest rates, as it indicates a lower risk to the lender.

Down Payment

The amount of your down payment also impacts your mortgage rate. A larger down payment typically results in a lower interest rate, as it reduces the lender’s risk.

Loan-to-Value Ratio

The loan-to-value ratio (LTV) is the amount of the mortgage loan divided by the value of the property. A lower LTV, which means a larger down payment, can also lead to a lower mortgage rate.

A 5 Mortgages 2024 comparison can help you understand the different options available. You might also consider refinancing your existing mortgage if you qualify for a lower rate. See the Refinance Rates 30 Year Fixed 2024 to see if refinancing is right for you.

Property Type, Location, and Mortgage Term

Factors like the type of property (e.g., detached house, condo), its location, and the mortgage term can also affect your mortgage rate. For example, properties in high-demand areas or with unique features may command higher interest rates.

For those seeking a home in a rural area, exploring Rural Home Loans 2024 could be beneficial. These programs often offer special incentives and lower interest rates to encourage homeownership in less populated areas. Keeping an eye on the Current Home Interest Rates 2024 can help you make informed decisions about when to buy.

Mortgage Calculator and Tools

Coast Capital provides various online tools and resources to help potential borrowers estimate their monthly payments, compare different mortgage options, and make informed financial decisions. These tools include:

Mortgage Calculator

Coast Capital’s mortgage calculator is a user-friendly tool that allows you to estimate your monthly mortgage payments based on your loan amount, interest rate, and mortgage term. You can also use the calculator to explore different scenarios and see how changes in these factors affect your payments.

For eligible veterans, VA loans offer unique benefits. You can find the Current Va Loan Rates 2024 online. These rates can vary depending on the lender, so it’s important to shop around. You can also check out the Current Va Home Loan Rates 2024 to see if this type of financing is right for you.

Using the Mortgage Calculator

Here’s a step-by-step guide on using Coast Capital’s mortgage calculator:

- Visit Coast Capital’s website and navigate to the mortgage calculator section.

- Enter the desired loan amount, interest rate, and mortgage term.

- Click on “Calculate” to view your estimated monthly payments.

- You can adjust the input values to explore different scenarios and see how they impact your payments.

Other Online Tools

In addition to the mortgage calculator, Coast Capital offers other online tools that can be helpful for mortgage planning, such as:

- Amortization Schedule:This tool shows you a detailed breakdown of your mortgage payments over the life of the loan, including the principal and interest portions.

- Prepayment Calculator:This tool helps you calculate the impact of making extra payments on your mortgage term and total interest paid.

- Debt Consolidation Calculator:This tool can help you estimate the potential savings from consolidating your debts into a single mortgage loan.

Customer Reviews and Experiences

Customer reviews and testimonials can provide valuable insights into Coast Capital’s mortgage services. Based on online reviews and customer feedback, Coast Capital generally receives positive feedback for its competitive rates, personalized service, and commitment to member satisfaction.

Pros and Cons

Here are some of the pros and cons of choosing Coast Capital for a mortgage:

Pros

- Competitive mortgage rates

- Personalized service

- Flexible mortgage options

- Commitment to member satisfaction

Cons

- Limited branch network compared to some banks

- May have longer processing times than some lenders

Customer Satisfaction

Overall, customer satisfaction with Coast Capital’s mortgage offerings appears to be high. Many customers praise the credit union’s competitive rates, friendly staff, and personalized approach. However, some customers have noted that Coast Capital’s processing times can be longer than other lenders.

Large lenders like Rocket Mortgage offer competitive rates. You can check out the Rocket Mortgage Interest Rates 2024 online. For those interested in Chase, you can find the Chase Mortgage Rates Today 2024 on their website. Understanding the New Mortgage Rates 2024 across the market can help you find the best deal.

Tips for Securing a Favorable Mortgage Rate

Here are some tips for securing a competitive mortgage rate from Coast Capital:

Improve Your Credit Score

A higher credit score can significantly improve your chances of getting a lower mortgage rate. You can improve your credit score by:

- Paying your bills on time

- Keeping your credit card balances low

- Avoiding opening too many new credit accounts

Increase Your Down Payment

A larger down payment can also lead to a lower mortgage rate. If possible, try to save up for a substantial down payment.

Shop Around for Rates, Coast Capital Mortgage Rates 2024

Compare mortgage rates from multiple lenders, including Coast Capital, to find the best deal. Don’t just focus on the lowest interest rate; consider the overall terms and fees as well.

Negotiate Interest Rates and Fees

Don’t be afraid to negotiate with Coast Capital about interest rates and fees. You may be able to secure a lower rate or reduced fees by demonstrating your financial strength and negotiating skills.

Consider a Fixed-Rate Mortgage

Fixed-rate mortgages provide stability and predictability, as the interest rate remains constant for the duration of the term. This can be beneficial for borrowers who prefer to know their monthly payments in advance and avoid the risk of rising interest rates.

Explore Mortgage Options

Coast Capital offers a range of mortgage products, including fixed-rate, variable-rate, and open mortgages. Explore the different options to find the one that best suits your needs and financial goals.

Final Conclusion

Whether you’re a first-time homebuyer or looking to refinance, understanding Coast Capital’s mortgage rates in 2024 is essential. By exploring the information provided in this guide, you can gain insights into the current market, compare different mortgage options, and make informed decisions about your financing needs.

Remember, seeking advice from a qualified mortgage professional can help you navigate the complexities of the mortgage process and secure the best possible rate for your individual circumstances.

FAQ Guide

What are the current mortgage rates offered by Coast Capital?

If you’re looking to secure a fixed-rate mortgage with a longer term, checking out 5 Year Arm Rates 2024 could be a good place to start. It’s important to compare rates from different lenders to find the best deal, and you can find a list of reputable Mortgage Providers 2024 online.

Mortgage rates vary depending on the type of mortgage, term, and individual borrower’s circumstances. It’s best to visit Coast Capital’s website or contact a mortgage advisor for the most up-to-date rates.

What are the eligibility requirements for a Coast Capital mortgage?

Eligibility requirements include factors like credit score, income, debt-to-income ratio, and down payment. You can find detailed information on Coast Capital’s website or speak with a mortgage advisor.

How do I apply for a mortgage with Coast Capital?

You can apply online, by phone, or in person at a Coast Capital branch. The application process involves providing documentation like income verification, credit history, and property information.

What are the benefits of choosing Coast Capital for a mortgage?

Benefits include competitive rates, a variety of mortgage products, personalized service, and access to online tools and resources.