Collision Insurance 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Collision insurance, a vital component of safeguarding your financial well-being in the event of an accident, has evolved significantly in recent years.

Get a quick and easy quote from Geico with Geico Car Insurance Quote 2024. Their user-friendly platform makes it easy to compare rates and find the best coverage for your needs. Get your quote today and see how much you can save.

This exploration delves into the intricacies of collision insurance, analyzing the current trends, benefits, and considerations that shape this crucial aspect of car ownership in 2024.

Finding the right Term Life Insurance Quotes 2024 can be a daunting task, but it’s essential for providing financial security for your loved ones. Compare quotes and features to find the best term life insurance policy for your circumstances.

From the impact of technological advancements on premiums to the influence of driving habits on costs, this comprehensive guide aims to provide a clear understanding of collision insurance in the modern era. We will examine the advantages of having collision insurance, delve into factors that influence premiums, and explore alternative options available to drivers.

Your home is your sanctuary, and House Insurance 2024 provides the peace of mind you need. Find the right coverage to protect your property and belongings from natural disasters, theft, and other unforeseen circumstances.

Additionally, we will shed light on the potential future of collision insurance, considering the rise of autonomous vehicles and other emerging trends.

Securing your family’s future is a top priority, and finding the Best Life Insurance 2024 can provide peace of mind. Compare quotes and features to find the right policy that fits your budget and provides the financial security your loved ones deserve.

Contents List

Collision Insurance: A Comprehensive Guide for 2024

Collision insurance is a vital part of protecting your vehicle and your finances in the event of an accident. This comprehensive guide delves into the intricacies of collision insurance, exploring its definition, purpose, benefits, and considerations for 2024. We’ll also examine the impact of driving habits and technological advancements on collision insurance, along with exploring alternative options and future trends.

Dental health is essential as we age, and Dental Insurance For Seniors 2024 can provide affordable coverage. Compare plans and find the right dental insurance to maintain your oral health and well-being.

What is Collision Insurance?, Collision Insurance 2024

Collision insurance is a type of car insurance that covers damage to your vehicle resulting from a collision with another vehicle or object, regardless of who is at fault. This means that even if you are responsible for the accident, your collision insurance will help pay for repairs or replacement costs.

For comprehensive insurance solutions, consider Universal Insurance 2024. They offer a wide range of insurance products, from life insurance to property insurance, providing a one-stop shop for all your insurance needs.

Collision Insurance in 2024

The collision insurance landscape is constantly evolving, influenced by factors like technological advancements, economic conditions, and changing driving habits. In 2024, we are witnessing a confluence of trends that are shaping the way collision insurance is priced and accessed.

Your modified car deserves specialized insurance, and Modified Car Insurance 2024 can provide the right coverage. Ensure your unique vehicle is protected with comprehensive policies designed for modified cars.

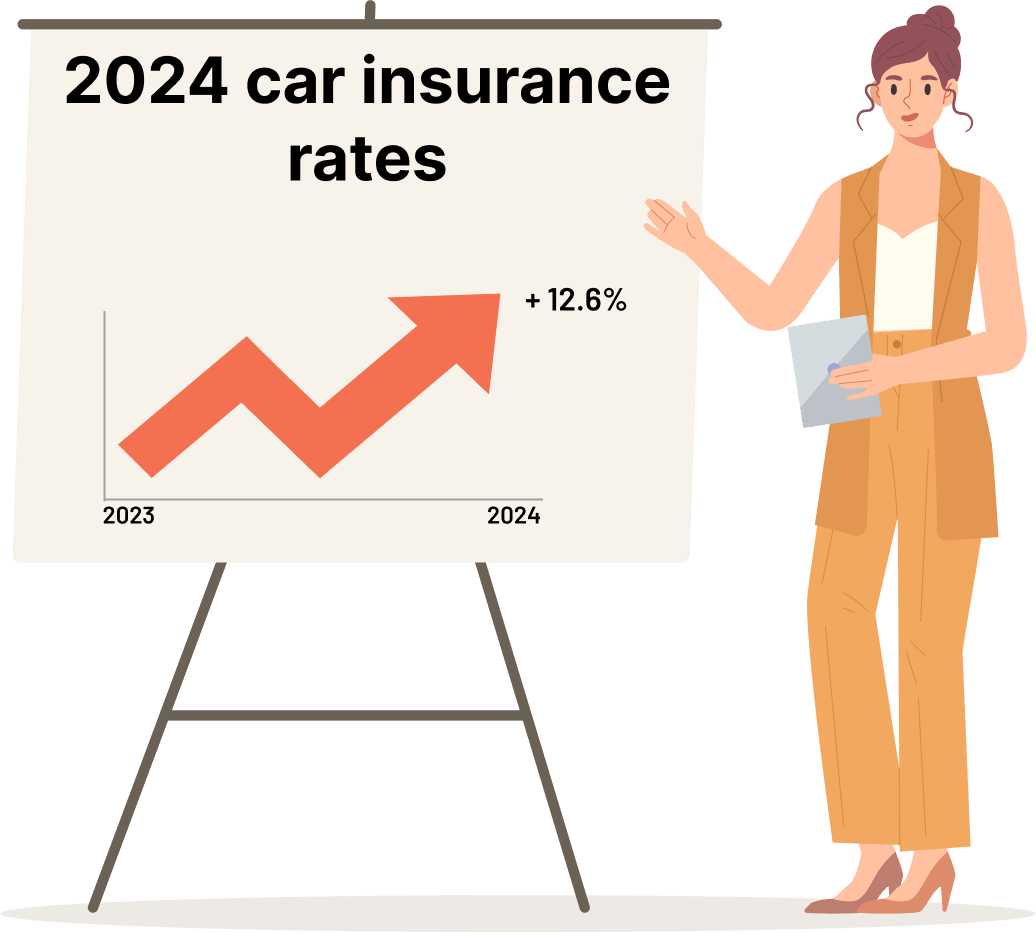

Trends in Collision Insurance Premiums

Collision insurance premiums are influenced by various factors, including the make and model of your car, your driving history, your location, and the amount of coverage you choose. In 2024, several trends are impacting premium costs:

- Rising Repair Costs:The cost of vehicle repairs has been steadily increasing due to the use of advanced technology and complex components in modern cars. This directly impacts collision insurance premiums, as insurers need to cover higher repair expenses.

- Inflation:Inflation is impacting the cost of everything, including car insurance. Insurers must factor in rising costs for parts, labor, and administrative expenses, which can lead to higher premiums.

- Increased Claims:While the number of accidents may fluctuate, the severity of accidents and the associated repair costs have been rising. This can lead to higher claims payouts for insurers, potentially influencing premium rates.

Impact of Technological Advancements

Technological advancements are revolutionizing the automotive industry and influencing collision insurance in significant ways:

- Advanced Driver-Assistance Systems (ADAS):Cars equipped with ADAS features like lane departure warning, automatic emergency braking, and adaptive cruise control are becoming more common. These systems can help prevent accidents, potentially reducing the number of collision claims and influencing premium rates.

- Telematics:Telematics devices track driving behavior, providing valuable data to insurers. This data can help insurers assess risk more accurately, potentially leading to personalized premium rates based on individual driving habits.

- Autonomous Vehicles:The development of autonomous vehicles is expected to have a profound impact on collision insurance. As self-driving cars become more prevalent, the role of human error in accidents is expected to diminish, potentially leading to lower collision rates and insurance premiums.

Prepare for the unexpected with Critical Illness Insurance 2024. This type of insurance provides financial support if you are diagnosed with a serious illness, helping you focus on your recovery without worrying about medical expenses.

Key Factors Influencing Collision Insurance Costs

In 2024, several key factors will continue to influence collision insurance costs:

- Vehicle Value:The value of your vehicle is a primary factor in determining your collision insurance premium. Newer, more expensive cars typically have higher premiums because the cost of repair or replacement is greater.

- Driving History:Your driving record plays a significant role in determining your premium. Drivers with a history of accidents or traffic violations are considered higher risk and may face higher premiums.

- Location:The geographic location where you live can influence your collision insurance premium. Areas with higher rates of accidents or traffic congestion may have higher premiums.

- Coverage Limits:The amount of coverage you choose for your collision insurance will affect your premium. Higher coverage limits typically result in higher premiums, but also provide greater financial protection in the event of an accident.

- Deductible:Your deductible is the amount you agree to pay out-of-pocket before your collision insurance kicks in. A higher deductible typically results in a lower premium, but you will have to pay more in the event of an accident.

Conclusive Thoughts

As we navigate the ever-changing landscape of collision insurance, understanding the nuances of this critical coverage becomes paramount. By carefully evaluating your needs, considering various factors that influence premiums, and exploring alternative options, you can make informed decisions that ensure adequate protection for your vehicle and your finances.

Ultimately, the goal is to find a collision insurance solution that aligns with your individual circumstances and provides peace of mind on the road ahead.

Q&A: Collision Insurance 2024

What is the average cost of collision insurance in 2024?

The average cost of collision insurance varies significantly based on factors such as your location, driving history, vehicle type, and chosen coverage limits. It’s best to obtain quotes from multiple insurance providers to compare prices and find the best value for your needs.

Looking for the best Workmans Comp coverage in 2024? Workmans Comp 2024 can help you find the right plan for your needs. They provide comprehensive coverage for work-related injuries and illnesses, ensuring you have the support you need during a difficult time.

Is collision insurance mandatory?

Protecting your valuable trailers is important, and Trailer Insurance 2024 offers comprehensive coverage. From liability to collision, ensure your trailers are protected from unexpected events.

Collision insurance is not mandatory in most states. However, lenders often require it if you have a car loan. If you lease a vehicle, the leasing company may also require collision insurance.

Protecting your business is crucial, and Company Insurance 2024 can help you find the right coverage. From liability insurance to property insurance, find the policies that safeguard your assets and ensure your company’s continued success.

How can I reduce my collision insurance premium?

Finding Cheap Car Insurance Quotes 2024 can be a challenge, but it’s essential to find the right balance between cost and coverage. Compare quotes from different providers to secure affordable protection for your vehicle.

There are several ways to potentially lower your collision insurance premium, including maintaining a good driving record, increasing your deductible, choosing a vehicle with safety features, and bundling your insurance policies.

What are the benefits of having collision insurance?

Collision insurance provides financial protection in case of an accident that damages your vehicle. It covers repairs or replacement costs, even if you are at fault. This can help you avoid significant out-of-pocket expenses and keep your vehicle on the road.

Finding Auto Insurance Near Me 2024 is easy with online resources. Enter your location and get personalized quotes from local insurance providers, ensuring you find the best coverage at the right price.

State Farm is a trusted name in homeowners insurance, and State Farm Homeowners Insurance 2024 offers comprehensive coverage. Explore their policies and find the right protection for your home and belongings.

For military members and their families, Usaa Insurance 2024 provides exceptional insurance services. They offer competitive rates and personalized coverage designed to meet the unique needs of the military community.