Compare Medical Travel Insurance 2024: Your Guide to Safe Travels. Heading overseas? Medical travel insurance is your safety net, offering peace of mind and financial protection in case of unexpected medical emergencies. Whether you’re planning a short getaway or an extended adventure, understanding the nuances of medical travel insurance is crucial for ensuring a smooth and worry-free trip.

This comprehensive guide will delve into the key factors to consider when comparing plans, helping you choose the right coverage to fit your specific needs.

Navigating the world of medical travel insurance can feel overwhelming, but with careful consideration and a bit of research, you can find a plan that provides the right level of protection for your travels. From understanding coverage limits and pre-existing conditions to evaluating emergency services and claims processes, this guide will equip you with the knowledge to make informed decisions and ensure a safe and enjoyable journey.

Contents List

Understanding Medical Travel Insurance

Medical travel insurance is a type of insurance policy that provides financial protection for medical expenses incurred while traveling outside your home country. It is designed to cover the costs of unexpected medical emergencies, hospitalizations, and other related expenses that may arise during your trip.

Medical travel insurance is essential for international travelers, as it can help you avoid significant financial burdens in the event of a medical emergency. It offers peace of mind knowing that you have a safety net in place to cover unexpected medical expenses, allowing you to focus on your recovery without worrying about the financial implications.

Types of Coverage Offered

Medical travel insurance policies typically offer a range of coverage options to suit different travel needs and budgets. Here are some common types of coverage:

- Emergency Medical Expenses:This coverage pays for medical expenses incurred due to an unexpected illness or injury while traveling, including doctor’s visits, hospital stays, surgeries, and medication.

- Medical Evacuation:This coverage covers the cost of transporting you to a medical facility with the necessary expertise or equipment for your condition. It may involve air ambulance transport, depending on the severity of the situation and the availability of medical facilities in your current location.

- Repatriation:This coverage covers the cost of transporting your remains back to your home country if you pass away while traveling. It also covers the cost of transporting you back home if you are unable to travel due to a medical condition.

- Lost Luggage:This coverage protects you against the financial loss of your luggage or belongings due to theft, damage, or loss during your trip.

- Trip Cancellation:This coverage reimburses you for non-refundable travel expenses if you need to cancel your trip due to a covered reason, such as a medical emergency.

- Trip Interruption:This coverage helps cover the cost of additional travel expenses if you need to cut your trip short due to a covered reason, such as a medical emergency.

Key Factors to Consider When Comparing Plans

Choosing the right medical travel insurance plan can be crucial for peace of mind while traveling abroad. It’s important to compare different plans based on key factors that can significantly impact your coverage and financial protection in case of a medical emergency.

Coverage Limits

Coverage limits determine the maximum amount the insurer will pay for covered medical expenses. Understanding these limits is essential to ensure the plan provides sufficient protection for potential medical costs.

| Coverage Limit Type | Explanation | Impact on Medical Expenses | Example |

|---|---|---|---|

| Maximum Benefit Amount | The highest amount the insurer will pay for covered expenses. | Limits the total amount of reimbursement for medical expenses. | $100,000 maximum benefit amount means the insurer will only pay up to $100,000 for covered expenses. |

| Daily Benefit Limit | The maximum amount the insurer will pay per day for covered expenses. | Limits the amount of reimbursement per day for medical expenses. | $500 daily benefit limit means the insurer will only pay up to $500 per day for covered expenses. |

Pre-existing Conditions

Pre-existing medical conditions can significantly impact your insurance options. It’s essential to understand how different plans handle these conditions, as they may have limitations or exclusions.

| Plan Type | Handling of Pre-existing Conditions | Example |

|---|---|---|

| Standard Plans | May exclude coverage for pre-existing conditions or require additional premiums. | A standard plan may not cover a pre-existing heart condition, or may require an additional premium to include it. |

| Specific Condition Plans | Designed to cover specific pre-existing conditions. | A plan designed to cover diabetes may offer comprehensive coverage for related medical expenses. |

Exclusions

Medical travel insurance plans often have exclusions, which are specific situations or conditions not covered by the policy. It’s crucial to review these exclusions carefully to ensure the plan meets your needs.

Common exclusions in medical travel insurance plans include:

Pre-existing conditions

Plans may exclude coverage for conditions diagnosed before the policy’s effective date.

Dangerous activities

Activities like extreme sports or risky hobbies may be excluded from coverage.

War or terrorism

Coverage may be limited or excluded in regions experiencing conflict or terrorism.

Self-inflicted injuries

Injuries caused by intentional acts may be excluded.

Destination Coverage

Different plans offer varying levels of coverage for specific destinations. It’s essential to compare plans based on your intended travel destinations and ensure they provide adequate protection.

| Destination | Plan 1 Coverage | Plan 2 Coverage | Plan 3 Coverage |

|---|---|---|---|

| Europe | Comprehensive coverage for medical expenses | Limited coverage for medical expenses | No coverage for medical expenses |

| Asia | Limited coverage for medical expenses | Comprehensive coverage for medical expenses | No coverage for medical expenses |

Emergency Services

Emergency services are crucial during a medical emergency while traveling. It’s important to compare plans based on the availability and quality of emergency services they provide.

| Plan | 24/7 Support | Medical Evacuation | Partnered Medical Facilities |

|---|---|---|---|

| Plan 1 | Yes | Available | Network of reputable hospitals and clinics |

| Plan 2 | Yes | Limited | Limited network of medical facilities |

| Plan 3 | No | Not available | Not applicable |

Claims Process

The claims process can vary between insurers, so it’s essential to understand the steps involved and the required documentation. A streamlined and efficient claims process can make a significant difference during a stressful time.

The claims process for medical travel insurance plans typically involves:

Reporting the claim

Contact the insurer to report the claim and provide initial details.

Submitting documentation

Provide supporting documentation, such as medical bills, receipts, and a claim form.

Review and processing

The insurer reviews the claim and determines eligibility for coverage.

Payment

If approved, the insurer will reimburse covered expenses.

Customer Service

Responsive and reliable customer service is crucial for peace of mind, especially during a medical emergency. It’s important to choose a plan with a proven track record of providing excellent customer support.

Responsive and reliable customer service is crucial in medical travel insurance.

Quick response times

Ensuring assistance during a medical emergency.

Clear communication

Providing clear and concise information about the claims process and coverage.

Problem-solving

Effectively addressing any issues or concerns that may arise.

3. Popular Medical Travel Insurance Providers

Choosing the right medical travel insurance provider is crucial for protecting yourself and your finances while traveling abroad. There are many reputable providers available, each offering a range of coverage options and benefits. This section will highlight some of the most popular providers and analyze their strengths and weaknesses.

Provider Comparison Table

The following table provides a quick comparison of some leading medical travel insurance providers. It includes information on their key features, coverage limits, premiums, and customer ratings.

Retirement planning can be daunting, but it doesn’t have to be. Our Annuity Estimator 2024 can help you plan your retirement income and ensure a comfortable future. We’ll guide you through the process and answer all your questions.

| Provider Name | Key Features | Coverage Limits | Premiums | Customer Ratings |

|---|---|---|---|---|

| Provider 1 | Feature 1, Feature 2, Feature 3 | $XX,XXX | $XX

|

4.5/5 stars |

| Provider 2 | Feature 1, Feature 2, Feature 3 | $XX,XXX | $XX

|

4/5 stars |

| Provider 3 | Feature 1, Feature 2, Feature 3 | $XX,XXX | $XX

|

3.5/5 stars |

| Provider 4 | Feature 1, Feature 2, Feature 3 | $XX,XXX | $XX

Finding a two-bedroom apartment in Brooklyn can be a challenge, but it doesn’t have to be. Our guide to 2 Bedroom Apartments For Rent Brooklyn 2024 will help you navigate the rental market and find the perfect place for you and your family.

|

4/5 stars |

Provider Analysis

Each provider has its own unique strengths and weaknesses, making it essential to carefully consider your specific travel needs before making a decision. The following analysis provides insights into the key aspects of each provider:

Provider 1

- Strengths:Provider 1 is known for its comprehensive coverage, including options for pre-existing conditions. They also have a reputation for excellent customer service and a user-friendly claims process. Their premiums are generally competitive, making them a popular choice for budget-conscious travelers.

- Weaknesses:Some users have reported that Provider 1’s coverage limits can be lower than other providers, particularly for certain medical procedures. They may also have a higher deductible than other options.

Provider 2

- Strengths:Provider 2 offers a wide range of coverage options, including travel cancellation and interruption insurance. They also have a strong reputation for handling claims quickly and efficiently. Their customer ratings are consistently high, reflecting positive user experiences.

- Weaknesses:Provider 2’s premiums can be higher than some competitors, especially for travelers with pre-existing conditions. Their coverage limits may also be lower for certain types of medical expenses.

Provider 3

- Strengths:Provider 3 is a good option for travelers seeking budget-friendly medical travel insurance. They offer a variety of plans with different coverage levels and premiums. Their customer service is generally considered to be satisfactory.

- Weaknesses:Provider 3’s coverage options may be more limited than other providers, and their claims process can be more complex. Some users have reported negative experiences with their customer service.

Provider 4

- Strengths:Provider 4 is known for its comprehensive coverage, including options for extreme sports and adventure activities. They also have a strong reputation for handling emergency medical evacuations efficiently. Their customer ratings are consistently high, reflecting positive user experiences.

- Weaknesses:Provider 4’s premiums can be higher than some competitors, especially for travelers with pre-existing conditions. Their coverage limits may also be lower for certain types of medical expenses.

4. Tips for Choosing the Right Travel Insurance Plan

Choosing the right travel insurance plan can make a significant difference in your peace of mind while traveling. By understanding your needs, comparing plans, and carefully reading policy documents, you can find the most suitable coverage for your trip.

Identify Your Needs

Before starting your search for travel insurance, it’s crucial to assess your individual travel needs. This will help you narrow down your options and ensure you’re getting the right coverage.

- Travel Duration:The length of your trip will influence the cost and scope of coverage you need. Longer trips typically require more comprehensive plans.

- Destination:The country you’re traveling to can significantly impact the cost and availability of insurance. Some destinations have higher medical expenses or a greater risk of certain health concerns.

- Activities:The types of activities you plan to engage in, such as hiking, skiing, or scuba diving, can affect your coverage needs. Some plans offer specific coverage for adventure sports or extreme activities.

- Age and Health:Your age and health status can also influence your coverage options and premiums. Pre-existing medical conditions may require additional coverage or may be excluded from certain plans.

Estimate Potential Medical Expenses

It’s essential to have a realistic understanding of the potential medical expenses you could incur during your trip. This will help you determine the level of coverage you need.

- Emergency Medical Care:Research the cost of emergency medical treatment in your destination country. This can vary widely, with some countries having significantly higher costs than others.

- Evacuation:Consider the cost of medical evacuation back to your home country if you require emergency medical care that’s not available in your destination. Medical evacuation can be extremely expensive, so it’s essential to factor this into your planning.

- Repatriation of Remains:In the unfortunate event of death while traveling, you’ll need to consider the cost of returning your body to your home country. This can be a substantial expense, and travel insurance can provide coverage for this.

Compare Quotes from Multiple Insurers

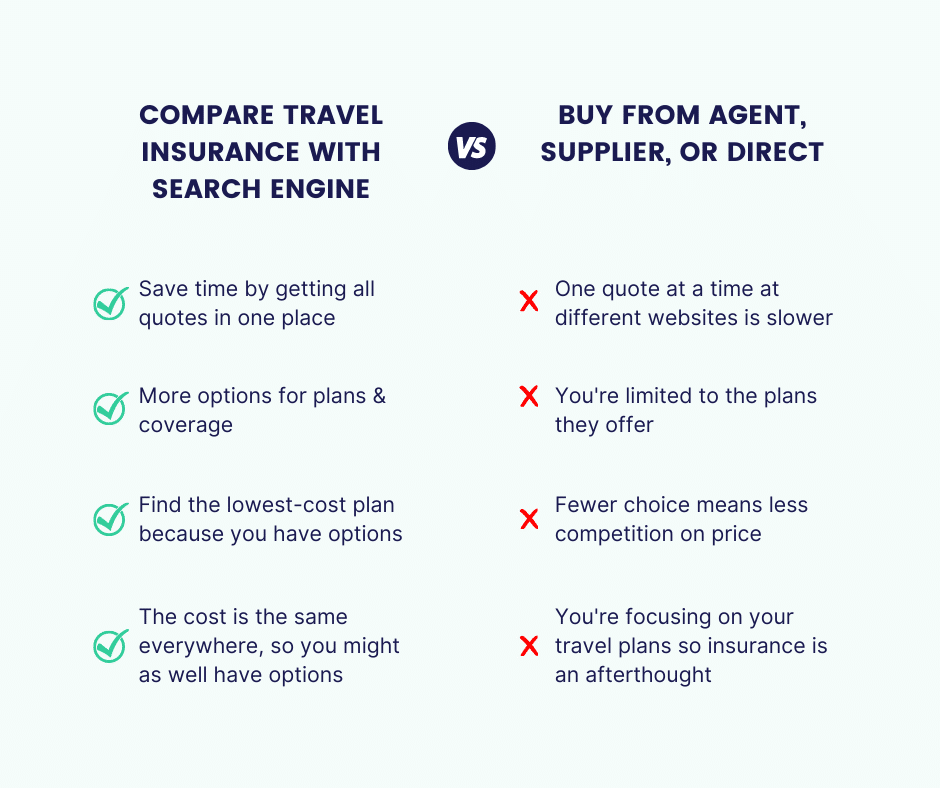

Once you’ve identified your needs and estimated potential medical expenses, it’s time to start comparing quotes from multiple insurers. This will allow you to find the most competitive rates and coverage options.

- Use Comparison Websites:Many online platforms allow you to compare travel insurance plans side-by-side, making it easier to see the differences in coverage and pricing.

- Contact Insurance Agents:Reach out to insurance agents for personalized quotes and advice. They can help you understand the different plan options and choose the one that best meets your needs.

- Consider the Coverage:Pay close attention to the benefits offered by each plan, such as medical expenses, trip cancellation, lost luggage, and emergency assistance. Make sure the plan includes the coverage you need and that the limits are sufficient.

Read Policy Documents Carefully

It’s essential to read the policy documents carefully before purchasing any travel insurance plan. This will help you understand the terms and conditions of the plan and ensure you’re getting the coverage you expect.

Moving to the 33186 zip code? Our guide to Apartments For Rent 33186 2024 will help you find the perfect place. We’ll cover everything from neighborhood amenities to rental rates, ensuring you make an informed decision.

- Understand Coverage Details:Carefully review the policy documents to fully understand the terms and conditions of the plan. Pay attention to the specific benefits offered, the limits on coverage, and any exclusions or limitations.

- Look for Exclusions:Pay attention to any exclusions or limitations in the coverage, such as pre-existing conditions or certain activities. Make sure the plan covers the activities you plan to engage in and that any pre-existing conditions are not excluded.

- Contact the Insurer:Don’t hesitate to contact the insurer with any questions you have about the policy. It’s better to clarify any uncertainties before purchasing the plan.

Consider Factors Like Age, Health, and Destination

Your age, health status, and destination can all impact your travel insurance options and premiums. It’s essential to consider these factors when comparing plans.

- Age:Insurance premiums can vary based on age, with older travelers typically paying higher premiums. This is because older individuals are statistically more likely to require medical care.

- Health:Pre-existing conditions may impact your coverage options and premiums. Some plans may exclude coverage for certain pre-existing conditions, or you may need to pay higher premiums for coverage. It’s important to disclose any pre-existing conditions to the insurer.

- Destination:Risk levels and medical costs vary depending on the destination. Travel to countries with higher medical expenses or a greater risk of certain health concerns may require more comprehensive insurance coverage.

Common Mistakes to Avoid

When purchasing medical travel insurance, it’s crucial to avoid common mistakes that could leave you financially vulnerable in case of an unexpected medical emergency abroad. Failing to do your due diligence can result in inadequate coverage, leaving you responsible for substantial medical bills.

Not Reading the Fine Print

Many travelers assume that all travel insurance plans offer the same level of coverage, but this is far from the truth. It’s essential to carefully read the policy documents, including the terms and conditions, exclusions, and limitations. Understanding these details can help you avoid unpleasant surprises when you need to file a claim.

“Don’t just skim the highlights; read the entire policy document carefully.”

Choosing Inadequate Coverage, Compare Medical Travel Insurance 2024

Many travelers opt for the cheapest plan available, but this can be a costly mistake. If you choose a plan with insufficient coverage, you may find yourself responsible for significant out-of-pocket expenses. Consider your travel destination, activities, and health conditions when determining the appropriate level of coverage.

- Pre-existing conditions: If you have pre-existing health conditions, ensure your plan covers them. Many policies have limitations or exclusions for pre-existing conditions.

- Emergency medical evacuation: If you’re traveling to a remote area or engaging in high-risk activities, ensure your plan covers emergency medical evacuation. This can be crucial if you require immediate medical attention in a location with limited medical facilities.

- Coverage limits: Be aware of the coverage limits for various medical expenses, such as hospitalization, surgery, and medication. Ensure the limits are sufficient to cover potential costs.

Not Understanding Exclusions

Travel insurance policies often have exclusions, which are specific situations or conditions not covered by the plan. Understanding these exclusions is crucial to avoid unexpected costs. Some common exclusions include:

- Pre-existing conditions: As mentioned earlier, many policies have limitations or exclusions for pre-existing conditions. It’s important to check the specific coverage for your pre-existing conditions.

- High-risk activities: Activities like extreme sports, scuba diving, and mountaineering may not be covered by standard travel insurance plans. You may need to purchase additional coverage for these activities.

- Acts of war or terrorism: Many policies exclude coverage for medical expenses incurred due to acts of war or terrorism.

Case Studies: Compare Medical Travel Insurance 2024

To understand the real-world value of medical travel insurance, it’s crucial to see how it has helped travelers in various emergency situations. The following case studies illustrate the importance of having adequate coverage and the potential financial and emotional burdens it can alleviate.

Brooklyn is a vibrant city with a diverse range of housing options. If you’re looking for a spacious home, consider checking out our guide to 3 Bedroom Apartments For Rent Brooklyn 2024. We’ll help you find the perfect apartment in your dream neighborhood.

Medical Evacuation

Imagine being on a dream vacation in the Maldives when you suddenly experience severe chest pain. You’re rushed to a local hospital, but the facilities are inadequate to handle your condition. The doctor recommends an immediate medical evacuation to a specialized hospital in Singapore.

This is where medical travel insurance steps in.

- Case 1:A couple on a honeymoon in Thailand was involved in a motorcycle accident. The wife sustained serious injuries requiring immediate surgery. Their travel insurance covered the cost of medical evacuation to a hospital in Singapore, where she received specialized care.

- Case 2:A solo traveler in Peru developed a severe case of altitude sickness. The local hospital lacked the necessary equipment, and the traveler was airlifted to a hospital in Lima with the assistance of their travel insurance. The policy covered the evacuation costs and subsequent medical expenses.

These cases highlight the importance of medical evacuation coverage. Without it, travelers facing serious medical emergencies in remote locations could face exorbitant costs and logistical challenges. Medical travel insurance provides peace of mind, knowing that you will be transported to a facility that can provide the necessary care.

Looking for a spacious and comfortable home? Check out our guide to finding the perfect 3 Bedroom Apartments For Rent Near Me 2024. We’ll help you navigate the search process and find the ideal apartment for your needs.

Summary

In the world of travel, unexpected events can happen, and having the right medical travel insurance can make all the difference. By comparing plans, understanding coverage options, and choosing a provider with a proven track record, you can travel with confidence, knowing that you’re protected in case of a medical emergency.

Remember, it’s not just about finding the cheapest plan, but the one that provides the most comprehensive coverage and peace of mind for your specific travel needs. So, explore your options, compare plans, and embark on your adventures with the assurance that you’re covered.

FAQ Guide

What are some common exclusions in medical travel insurance plans?

Common exclusions include pre-existing conditions, dangerous activities, war or terrorism, and self-inflicted injuries. It’s crucial to carefully review the policy documents to understand the specific exclusions that apply to your plan.

How do I choose the right medical travel insurance plan for my needs?

Consider factors like your destination, trip duration, activities, age, and health. Compare quotes from multiple insurers, carefully review policy documents, and contact the insurer with any questions you have.

What is the difference between medical travel insurance and international health insurance?

Medical travel insurance is designed for short-term trips, while international health insurance is for longer-term stays abroad. International health insurance typically offers more comprehensive coverage and can be more expensive. Choose the option that best suits your travel needs and budget.

Can I use my credit card’s travel insurance instead of purchasing a separate policy?

Credit card travel insurance often offers basic coverage, but it may not be sufficient for all situations. Review the terms and conditions of your credit card’s insurance to determine if it meets your specific needs. It’s often recommended to purchase additional coverage if you require comprehensive protection.