Compound Value Annuity Factor Table 2024 offers a powerful tool for understanding the future value of your investments. This table helps you calculate the growth of a series of regular payments over time, considering the impact of compounding interest.

Imagine you’re saving for retirement, planning a big purchase, or managing a loan. Understanding the concept of compound value annuity factor (CVAF) can help you make informed financial decisions. This table provides a comprehensive overview of CVAF values for various interest rates and time periods, making it an invaluable resource for financial planning.

Annuity is often used as a way to supplement retirement income, but it can also be used for other purposes. You can find real-life examples of how annuities are used in Annuity Examples In Real Life 2024.

Contents List

Understanding Compound Value Annuity Factor (CVAF)

The Compound Value Annuity Factor (CVAF) is a crucial concept in finance that helps calculate the future value of a series of equal payments made over a specific period. It’s essentially a multiplier that considers the effect of compounding interest on the annuity payments, allowing you to project their growth over time.

Annuity payments can vary depending on factors like the amount of your initial investment, the interest rate, and the length of the payout period. If you’re looking to calculate your annual annuity payment, you can find a helpful guide on Calculating Annuity Annual Payment 2024.

Concept and Role of CVAF

CVAF represents the accumulated value of a series of equal payments at the end of a specific time period, assuming a constant interest rate. It’s a factor that simplifies the calculation of future value by incorporating the compounding effect of interest.

In essence, CVAF helps you determine how much your annuity will be worth in the future, considering the power of compounding.

Annuity is a type of financial product that can provide you with a steady stream of income for life. It’s often seen as a way to secure your retirement, but it’s important to understand how annuities work before making any decisions.

To learn more about the intricacies of annuities, you can check out An Annuity Is A Life Insurance Product That 2024.

Relationship Between CVAF, Interest Rates, and Time Periods

The value of CVAF is directly influenced by interest rates and the length of the time period. Higher interest rates lead to a larger CVAF, reflecting the greater growth potential of the annuity. Similarly, a longer time period allows for more compounding cycles, resulting in a higher CVAF.

The relationship between CVAF, interest rates, and time periods can be summarized as follows:

- Higher interest rateslead to higher CVAFvalues.

- Longer time periodslead to higher CVAFvalues.

Examples of CVAF in Real-World Scenarios

CVAF finds application in various real-world financial scenarios, such as:

- Retirement Planning:Calculating the future value of regular retirement contributions to determine the potential savings at retirement.

- Loan Repayment:Estimating the total amount to be repaid on a loan, including interest, over the loan term.

- Investment Analysis:Assessing the future value of periodic investments to evaluate their potential returns.

CVAF Table 2024: Key Features

The CVAF table for 2024 provides a comprehensive overview of CVAF values for various interest rates and time periods. It serves as a valuable tool for financial professionals and individuals alike, simplifying the calculation of future values for annuities.

Structure of the CVAF Table

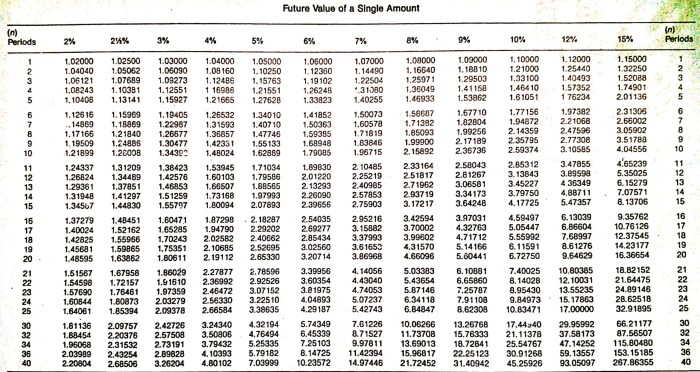

The CVAF table is typically structured with:

- Rows:Representing different time periods (e.g., 1 year, 2 years, 5 years, 10 years, etc.).

- Columns:Representing different interest rates (e.g., 2%, 3%, 4%, 5%, etc.).

- Cells:Containing the corresponding CVAF values for each combination of time period and interest rate.

Interest Rates and Time Periods Covered

The CVAF table for 2024 typically covers a range of interest rates and time periods relevant to financial planning and investment decisions. The specific interest rates and time periods included may vary depending on the source of the table, but generally encompass a wide spectrum to accommodate diverse financial scenarios.

Accuracy and Reliability of the CVAF Table

The accuracy and reliability of the CVAF table are crucial for making informed financial decisions. It’s important to use tables from reputable sources that employ robust mathematical formulas and up-to-date market data. The accuracy of the table ensures that the calculated future values are realistic and reliable for financial planning purposes.

Applications of CVAF Table 2024

The CVAF table for 2024 provides a straightforward method for calculating the future value of an annuity. It simplifies the complex mathematical calculations involved, making it accessible for individuals with varying levels of financial expertise.

Annuity formulas can be complex, but there are resources available to help you understand them. For example, you can find information about the “R Annuity Formula” on R Annuity Formula 2024.

Calculating the Future Value of an Annuity

To use the CVAF table to calculate the future value of an annuity, follow these steps:

- Identify the annuity payment amount.This is the regular payment made over the annuity period.

- Determine the interest rate.This is the annual interest rate applied to the annuity.

- Find the time period.This is the length of time over which the annuity payments are made.

- Locate the corresponding CVAF value in the table.This value represents the future value of a $1 annuity at the given interest rate and time period.

- Multiply the annuity payment amount by the CVAF value.This gives you the total future value of the annuity.

Applying the CVAF Table to Investment Scenarios

The CVAF table can be applied to various investment scenarios, such as:

- Retirement Planning:By using the CVAF table, you can calculate the future value of your retirement savings based on your contributions and expected interest rates.

- Loan Repayment:The table can be used to estimate the total amount you will repay on a loan, considering the interest rate and loan term.

- Investment Analysis:The CVAF table helps you assess the future value of different investment options, allowing you to compare their potential returns.

Hypothetical Scenario

Let’s consider a hypothetical scenario where you are planning to invest $1,000 per year for the next 10 years, expecting an average annual return of 5%. Using the CVAF table for 2024, you can find the CVAF value for a 10-year period at a 5% interest rate.

Annuity and life insurance are both financial products that can help you secure your future, but they serve different purposes. If you’re wondering if they’re the same, you can find the answer in Is Annuity The Same As Life Insurance 2024.

Multiplying this CVAF value by $1,000 will give you the future value of your investment after 10 years.

Factors Influencing CVAF Values

Several factors influence the value of CVAF, impacting the future value of an annuity. Understanding these factors is crucial for making informed financial decisions.

Annuity is a financial product that provides regular payments over a set period of time. If you’re curious about the definition of annuity, you can find it explained in detail on Annuity Is Defined As 2024.

Impact of Interest Rate Changes

Interest rate changes directly affect CVAF values. Higher interest rates lead to a larger CVAF, reflecting the greater growth potential of the annuity. Conversely, lower interest rates result in a smaller CVAF, as the compounding effect is reduced. This relationship highlights the importance of considering interest rate fluctuations when making financial plans.

Relationship Between Inflation and CVAF Calculations

Inflation can erode the purchasing power of money over time. When calculating future values using CVAF, it’s essential to consider the impact of inflation. A higher inflation rate reduces the real value of the future value calculated using CVAF. To account for inflation, you can adjust the interest rate used in the calculation by subtracting the inflation rate.

Annuity calculators are a helpful tool for estimating future payments. If you’re curious about how annuity calculators work for lottery winnings, you can find more information on Annuity Calculator Lottery 2024.

Changes in Time Periods

The length of the time period over which the annuity payments are made significantly impacts CVAF values. Longer time periods allow for more compounding cycles, resulting in higher CVAF values. This reflects the power of time and compounding in financial growth.

For example, a 20-year annuity will have a higher CVAF than a 10-year annuity, assuming the same interest rate.

While annuity and pension might sound similar, they’re not exactly the same. To better understand the differences, you can check out Is Annuity The Same As Pension 2024.

Comparing CVAF Tables Across Years

Comparing CVAF tables across different years provides insights into how interest rate trends and economic conditions affect the future value of annuities. It helps to understand the historical context of CVAF values and their implications for financial planning.

If you’re looking for a guaranteed income stream, an annuity can be a good option. You can find more information about annuities with specific amounts, like Annuity 250k 2024 , to see if it aligns with your financial needs.

Comparison of CVAF Values

CVAF values can fluctuate from year to year due to changes in interest rates and economic factors. Comparing CVAF tables across years allows you to identify these fluctuations and assess their impact on financial planning. For example, if interest rates have been consistently increasing over time, you might expect to see higher CVAF values in more recent years compared to previous years.

Annuity payments are generally considered a form of fixed income, providing a predictable stream of payments. If you’re unsure about the nature of annuity payments, you can learn more about it on Is Annuity Fixed Income 2024.

Trends in CVAF Values

Analyzing CVAF values across years can reveal trends that might indicate future financial opportunities or risks. For instance, if CVAF values have been trending upward, it might suggest a favorable investment environment with potential for higher returns. Conversely, a downward trend in CVAF values might indicate a more challenging investment environment with lower potential returns.

Annuity can be a good option if you’re looking for a guaranteed income stream. You can even find information on annuities for a specific amount, like Annuity $400 000 2024 , which can help you determine if it’s right for your financial goals.

Implications for Financial Planning

Understanding the historical context of CVAF values can inform your financial planning strategies. If you anticipate a period of low interest rates, you might consider making larger contributions to your annuity to compensate for the reduced compounding effect. Conversely, if you expect higher interest rates, you might consider taking advantage of the potential for higher returns.

Annuity calculations can be done on a financial calculator, but you might find it easier to use a spreadsheet program like Excel. If you’re unsure how to calculate a growing annuity, you can find a guide on Calculate Growing Annuity In Excel 2024.

Limitations of CVAF Tables: Compound Value Annuity Factor Table 2024

While CVAF tables provide a valuable tool for financial calculations, they have limitations that should be considered when making financial decisions.

Limitations for Complex Calculations, Compound Value Annuity Factor Table 2024

CVAF tables are designed for calculating the future value of annuities with constant payments and interest rates. They might not be suitable for complex financial calculations involving variable payments, changing interest rates, or other factors that affect the growth of an annuity.

In such cases, more sophisticated financial models or software might be necessary.

Scenarios Where CVAF Tables Might Not Provide Accurate Results

CVAF tables assume a constant interest rate over the entire annuity period. In reality, interest rates fluctuate over time, making the results based on CVAF tables potentially inaccurate, especially for longer time periods. Additionally, CVAF tables do not account for factors like inflation, taxes, or fees, which can significantly impact the actual future value of an annuity.

Importance of Considering Other Factors

When making financial decisions, it’s crucial to consider factors beyond CVAF values, such as your individual financial goals, risk tolerance, and investment horizon. CVAF tables should be used as a tool for initial analysis and planning, but they should not be relied upon solely for making financial decisions.

Consulting with a financial advisor can help you make informed decisions based on your specific circumstances.

Conclusive Thoughts

The Compound Value Annuity Factor Table 2024 is a valuable resource for anyone seeking to understand the growth potential of their investments. By understanding the relationship between interest rates, time periods, and compound interest, you can gain insights into how your financial decisions impact your future wealth.

Whether you’re a seasoned investor or just starting your financial journey, this table can be a powerful tool for making informed decisions and achieving your financial goals.

Clarifying Questions

What is the difference between CVAF and the future value of a single sum?

CVAF calculates the future value of a series of equal payments, while the future value of a single sum calculates the future value of a single lump sum investment.

How do I use the CVAF table to calculate the future value of an annuity?

Locate the interest rate and time period corresponding to your investment scenario in the table. Multiply the annuity payment amount by the corresponding CVAF value to find the future value.

Are there any online tools or calculators that can help me use the CVAF table?

Yes, several online tools and calculators can help you calculate future values using the CVAF table. Simply search for “compound value annuity factor calculator” to find these resources.