Credit Score For Home Loan 2024 is a crucial factor in securing the financing you need to purchase your dream home. Your credit score, a numerical representation of your financial history, plays a significant role in determining your loan eligibility, interest rates, and overall loan terms.

A strong credit score can unlock favorable loan options, while a lower score may limit your choices and increase your borrowing costs.

Looking for a mortgage with lower documentation requirements? Low doc home loans might be the answer. You can also compare rates from ME Bank to see if they offer competitive rates.

Understanding how credit scores impact home loans is essential for navigating the mortgage process effectively. This guide will delve into the intricacies of credit scores, their influence on loan approval, and practical strategies for improving your score to achieve your homeownership goals.

Contents List

- 1 Understanding Credit Scores and Home Loans

- 2 Credit Score Requirements for Home Loans in 2024

- 3 Impact of Credit Score on Loan Eligibility and Interest Rates

- 4 Strategies for Improving Credit Score for Home Loan Approval

- 5 Understanding Credit Reports and Their Role in Loan Approval: Credit Score For Home Loan 2024

- 6 Additional Factors Affecting Home Loan Approval Beyond Credit Score

- 7 Wrap-Up

- 8 Expert Answers

Understanding Credit Scores and Home Loans

A credit score is a numerical representation of your creditworthiness, reflecting your ability to manage and repay debt. It plays a crucial role in securing a home loan, influencing your loan eligibility, interest rates, and overall loan terms. Lenders use credit scores to assess the risk associated with lending you money.

A higher credit score generally indicates a lower risk, which can lead to more favorable loan terms, including lower interest rates and potentially larger loan amounts.

Factors Contributing to a Credit Score

Your credit score is calculated based on several factors, including:

- Payment history:This is the most significant factor, accounting for approximately 35% of your credit score. It reflects your track record of making timely payments on credit cards, loans, and other bills.

- Amounts owed:This factor represents the amount of debt you currently have relative to your available credit. It includes credit card balances, loan balances, and other outstanding debts. A higher credit utilization ratio (the percentage of available credit you’re using) can negatively impact your credit score.

- Length of credit history:The longer your credit history, the more positive impact it has on your credit score. This demonstrates your ability to manage credit over an extended period.

- Credit mix:Having a mix of different credit accounts, such as credit cards, installment loans, and mortgages, shows lenders that you can manage various types of credit responsibly.

- New credit:Applying for new credit accounts can temporarily lower your credit score, as it signals increased credit risk to lenders. It’s generally advisable to avoid opening new credit accounts too close to applying for a home loan.

Tips for Improving Your Credit Score

Here are some practical steps to improve your credit score before applying for a home loan:

- Pay your bills on time:Make all your payments, including credit card bills, loan payments, and utility bills, on or before the due date. Setting up automatic payments can help ensure timely payments.

- Reduce credit card balances:Aim to keep your credit utilization ratio below 30%. Paying down credit card balances can significantly boost your credit score.

- Avoid opening new credit accounts:Opening new credit accounts can temporarily lower your credit score. Focus on managing your existing credit accounts responsibly.

- Dispute errors on your credit report:Check your credit report for any inaccuracies and dispute them with the credit reporting agencies. Errors can negatively impact your credit score.

- Become an authorized user on a responsible credit account:If you have a limited credit history, becoming an authorized user on a credit account with a good payment history can help improve your credit score.

Credit Score Requirements for Home Loans in 2024

The minimum credit score required for a home loan varies depending on the loan type and lender. Generally, lenders prefer borrowers with higher credit scores, as they pose a lower risk. Here’s a general overview of credit score requirements for different loan types in 2024:

Minimum Credit Score Requirements for Different Loan Types

| Loan Type | Minimum Credit Score |

|---|---|

| Conventional Loan | 620-640 |

| FHA Loan | 580 |

| VA Loan | No Minimum Credit Score Requirement (but credit history is reviewed) |

| USDA Loan | 640 |

Keep in mind that these are just general guidelines, and individual lenders may have their own specific credit score requirements. It’s essential to check with multiple lenders to compare their terms and requirements before applying for a home loan.

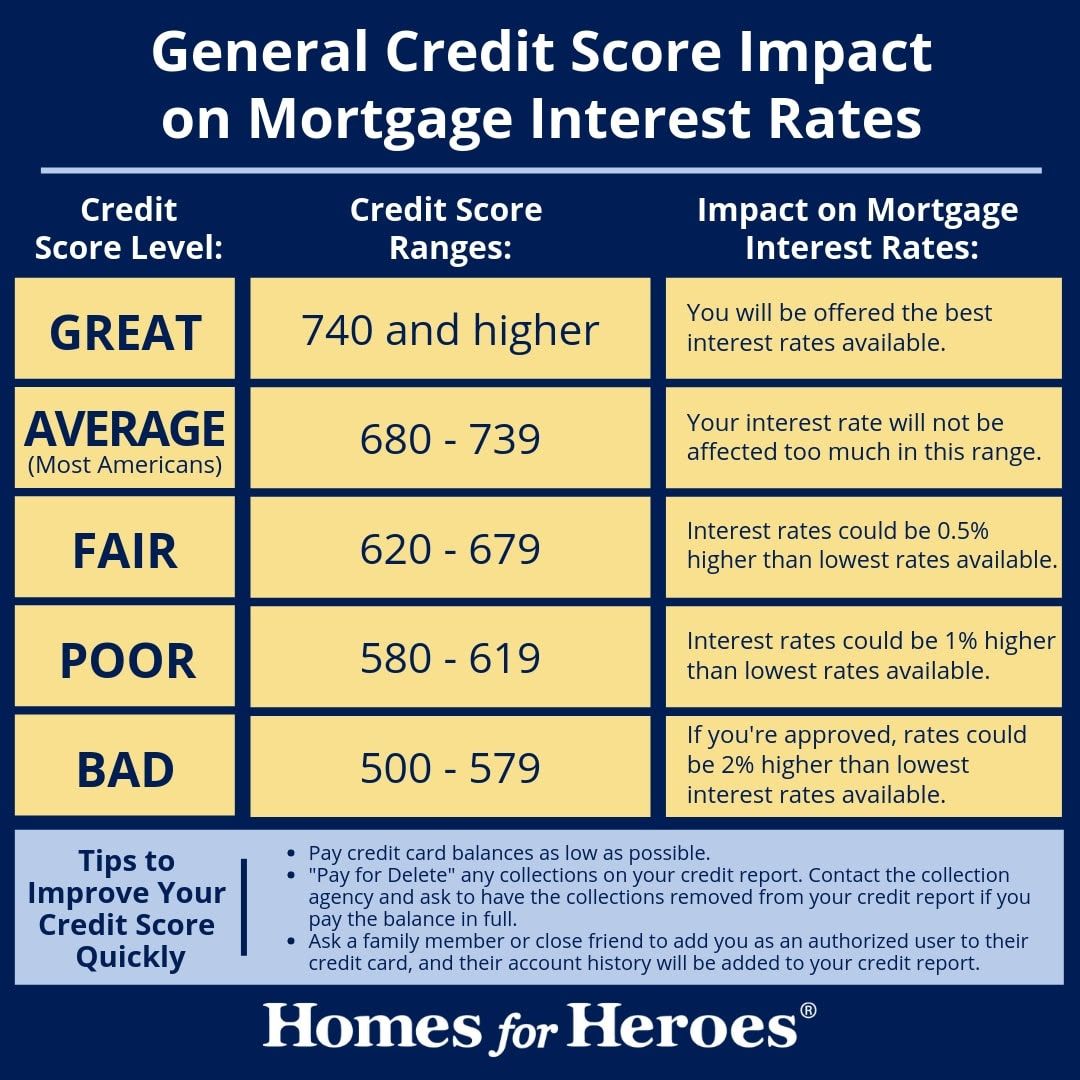

Impact of a Higher Credit Score on Loan Terms and Interest Rates

A higher credit score typically translates into more favorable loan terms, including lower interest rates. Lenders view borrowers with higher credit scores as less risky, which allows them to offer lower interest rates. A lower interest rate can save you thousands of dollars in interest payments over the life of your mortgage.

The average mortgage interest rate fluctuates regularly, so it’s important to stay up-to-date on current rates. If you’re a first-time buyer, you’ll want to research the best mortgages for first-time buyers.

For example, a borrower with a credit score of 740 might qualify for an interest rate of 4.5%, while a borrower with a credit score of 620 might receive an interest rate of 5.5%. This seemingly small difference in interest rates can result in a significant difference in overall loan costs.

Impact of Credit Score on Loan Eligibility and Interest Rates

Your credit score significantly influences your loan eligibility and the interest rate you’ll receive. Lenders use credit scores to assess your risk as a borrower, and a higher credit score generally indicates a lower risk, leading to better loan terms.

Looking for a mortgage in 2024? Servion Mortgage is a great place to start. They offer a wide range of loan options, including conventional, FHA, and VA loans. You can also learn about Fannie Mae mortgages to see if they’re a good fit for you.

Relationship Between Credit Score and Loan Eligibility

A good credit score is often a prerequisite for loan approval. Lenders may have minimum credit score requirements for different loan types, and failing to meet those requirements could result in loan denial. Even if you meet the minimum credit score requirements, a higher score can increase your chances of approval, especially if you’re applying for a larger loan amount.

If you’re considering Chase Home Lending , make sure you compare their rates and fees to other lenders. Rural home loans offer unique benefits for those looking to buy in less populated areas.

Impact of Credit Score on Interest Rates and Loan Costs

Your credit score directly impacts the interest rate you’ll be offered on a home loan. A higher credit score typically results in a lower interest rate, which can save you a substantial amount of money in interest payments over the life of the loan.

If you’re interested in an interest-only home loan , it’s important to understand the pros and cons. These loans can help you lower your monthly payments, but you’ll have to pay back the principal at the end of the loan term.

A home mortgage loan might be a better fit if you prefer a more traditional loan structure.

Lenders offer lower interest rates to borrowers with higher credit scores because they are considered less risky.

Interest Rate Comparison Table, Credit Score For Home Loan 2024

| Credit Score Range | Estimated Interest Rate (Example) |

|---|---|

| 620-640 | 5.5%

|

| 660-680 | 5.0%

|

| 700-720 | 4.5%

|

| 740+ | 4.0%

|

Note: These are just estimated interest rates and can vary based on several factors, including lender, loan type, and market conditions. It’s essential to get pre-approval from multiple lenders to compare interest rates and find the best offer.

Strategies for Improving Credit Score for Home Loan Approval

Improving your credit score takes time and effort, but it’s a worthwhile investment. By taking proactive steps to build a strong credit history, you can increase your chances of loan approval and secure a favorable interest rate. Here are some strategies to improve your credit score within a specific timeframe:

Practical Steps to Improve Your Credit Score

- Pay down your credit card balances:Aim to reduce your credit card balances as much as possible, ideally to below 30% of your credit limit. This will significantly improve your credit utilization ratio, a crucial factor in your credit score.

- Make all payments on time:This is the most important factor in your credit score. Set up automatic payments for your bills to ensure timely payments and avoid late fees.

- Avoid opening new credit accounts:Opening new credit accounts can temporarily lower your credit score, as it signals increased credit risk. Focus on managing your existing accounts responsibly.

- Dispute errors on your credit report:Review your credit report for any inaccuracies and dispute them with the credit reporting agencies. Errors can negatively impact your credit score.

- Consider becoming an authorized user on a responsible account:If you have a limited credit history, becoming an authorized user on a credit account with a good payment history can help improve your credit score.

Resources and Tools for Monitoring Your Credit Score

Several resources and tools can help you monitor your credit score and identify areas for improvement. Consider using these resources to stay on top of your credit health:

- Credit reporting agencies:You can obtain a free credit report from each of the three major credit reporting agencies (Experian, Equifax, and TransUnion) once a year through AnnualCreditReport.com.

- Credit monitoring services:Credit monitoring services provide real-time alerts for changes to your credit report, allowing you to detect potential errors or fraud quickly.

- Credit score tracking apps:Many financial apps allow you to track your credit score and provide insights into your credit health.

Tips for Building a Positive Credit History

Here are some tips for building a positive credit history and improving your credit score over time:

- Use credit responsibly:Don’t overspend on your credit cards, and pay your balances down regularly. Avoid maxing out your credit cards, as this can negatively impact your credit utilization ratio.

- Limit the number of hard inquiries:Hard inquiries occur when lenders check your credit report. Too many hard inquiries can lower your credit score. Try to limit your credit applications to only those that are necessary.

- Be patient:Building a good credit score takes time and effort. Be consistent with your credit management practices, and you’ll see positive results over time.

Understanding Credit Reports and Their Role in Loan Approval: Credit Score For Home Loan 2024

Your credit report is a detailed record of your credit history, providing lenders with valuable information about your creditworthiness. Lenders use credit reports to assess your risk as a borrower and determine your loan eligibility and interest rate.

Components of a Credit Report

A credit report typically includes the following components:

- Personal information:Your name, address, Social Security number, and date of birth.

- Credit accounts:A list of your open and closed credit accounts, including credit cards, loans, and other lines of credit.

- Payment history:A record of your payment history on your credit accounts, including on-time payments, late payments, and missed payments.

- Credit inquiries:A record of inquiries made by lenders to check your credit report. Hard inquiries can temporarily lower your credit score.

- Public records:Information about any public records, such as bankruptcies, foreclosures, or judgments.

Obtaining and Reviewing Your Credit Report

You can obtain a free copy of your credit report from each of the three major credit reporting agencies (Experian, Equifax, and TransUnion) once a year through AnnualCreditReport.com. Review your credit report carefully for any errors or inaccuracies. If you find any errors, dispute them with the credit reporting agency.

There are many different mortgage providers available, so it’s important to shop around and compare rates. You can find information on a variety of lenders and loan options online.

Identifying and Disputing Errors

If you find any errors or inaccuracies in your credit report, it’s crucial to dispute them promptly. Errors can negatively impact your credit score and hinder your ability to obtain a loan. To dispute an error, contact the credit reporting agency directly and provide supporting documentation.

If you’re a member of USAA, you may want to check out their mortgage offerings. They offer competitive rates and excellent customer service. If you’re considering a FHA cash-out refinance , make sure you understand the potential tax implications.

Additional Factors Affecting Home Loan Approval Beyond Credit Score

While your credit score is a significant factor in home loan approval, it’s not the only factor considered by lenders. They also assess other factors, including your income, debt-to-income ratio, and employment history, to determine your ability to repay the loan.

Other Factors Considered by Lenders

- Income:Lenders will review your income to ensure you can afford the monthly mortgage payments. They may consider your gross income, net income, and any other sources of income you have.

- Debt-to-income ratio (DTI):Your DTI is the percentage of your monthly income that goes towards debt payments. Lenders typically prefer borrowers with a DTI below 43%. A lower DTI indicates that you have more disposable income to cover your mortgage payments.

- Employment history:Lenders want to see that you have a stable employment history. They may ask for pay stubs, tax returns, or other documentation to verify your employment status and income.

- Assets:Lenders may consider your assets, such as savings, investments, and other property, to assess your financial stability and ability to repay the loan.

Importance of Pre-Approval

Before you start house hunting, it’s highly recommended to get pre-approved for a home loan. Pre-approval shows sellers that you’re a serious buyer and can afford the purchase. It also gives you a better understanding of how much you can afford to borrow and helps you streamline the loan application process.

If you’re considering US Bank mortgage rates , you’ll want to compare them to other lenders. Current ARM rates are often lower than fixed rates, but they can fluctuate over time.

Tips for Preparing for the Home Loan Application Process

Here are some tips for preparing for the home loan application process:

- Gather your financial documents:This includes pay stubs, tax returns, bank statements, credit card statements, and other relevant documents.

- Check your credit report:Review your credit report for any errors and dispute them with the credit reporting agency.

- Shop around for lenders:Get pre-approval from multiple lenders to compare interest rates and loan terms.

- Understand the loan process:Familiarize yourself with the different types of home loans and the requirements for each type.

- Ask questions:Don’t hesitate to ask your lender any questions you have about the loan process or your eligibility.

Wrap-Up

In conclusion, understanding your credit score and its impact on home loans is essential for achieving your homeownership aspirations. By taking proactive steps to improve your credit score, you can position yourself for a smoother and more favorable mortgage experience.

Remember, a strong credit score is a valuable asset in the home buying journey, opening doors to better loan terms and lower interest rates.

Expert Answers

How often should I check my credit score?

It’s recommended to check your credit score at least once a year, but more frequent checks can be beneficial, especially if you’re planning to apply for a loan.

What is a good credit score for a home loan?

A credit score of 740 or higher is generally considered good for a home loan. However, lenders may have different requirements, so it’s always best to check with them directly.

Can I get a home loan with a low credit score?

While it may be more challenging, you may still be able to qualify for a home loan with a lower credit score. You may need to consider a higher interest rate or a smaller loan amount.

What are some ways to improve my credit score quickly?

Pay your bills on time, keep your credit utilization low, and avoid opening new credit accounts. You can also consider disputing any errors on your credit report.