Credit Union Loans offer a unique and often advantageous alternative to traditional bank loans. These financial institutions, owned by their members, prioritize community and affordability, often providing lower interest rates and personalized service. Whether you’re seeking a personal loan, auto financing, or a mortgage, understanding the benefits and intricacies of credit union loans can empower you to make informed financial decisions.

Overwhelmed by multiple debts? Debt consolidation can help simplify your finances by combining multiple loans into one, potentially lowering your monthly payments.

From the diverse loan options available to the application process and management strategies, this guide delves into the world of credit union loans, providing insights that can help you navigate the lending landscape and secure the financial resources you need.

Keep an eye on mortgage interest rates today to make informed decisions about your home financing. Rates change constantly, so it’s wise to stay informed.

Contents List

Introduction to Credit Union Loans

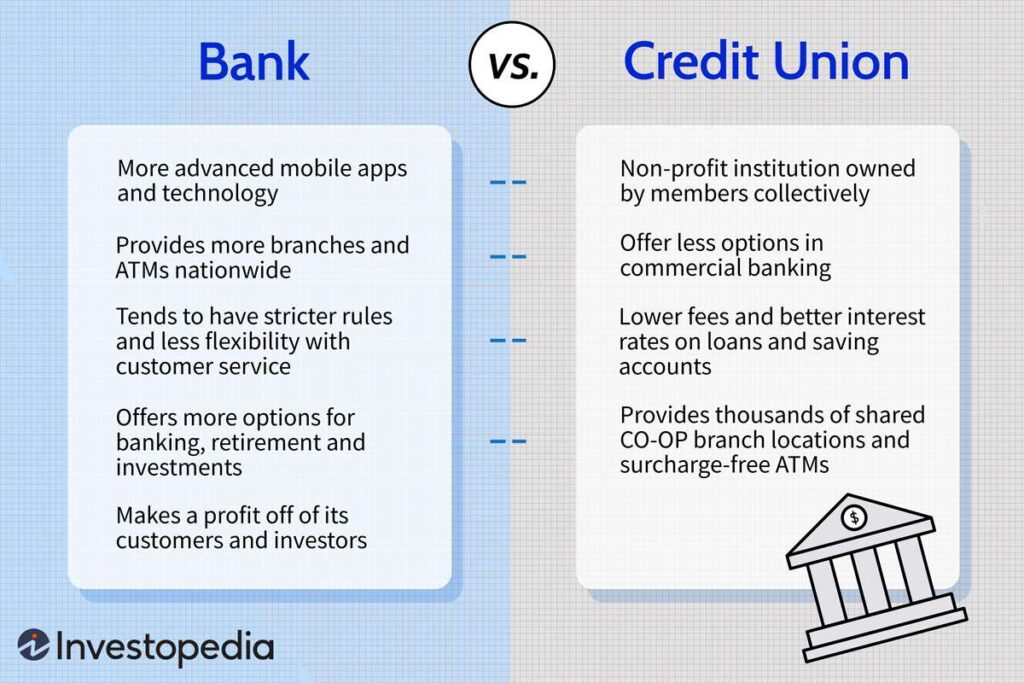

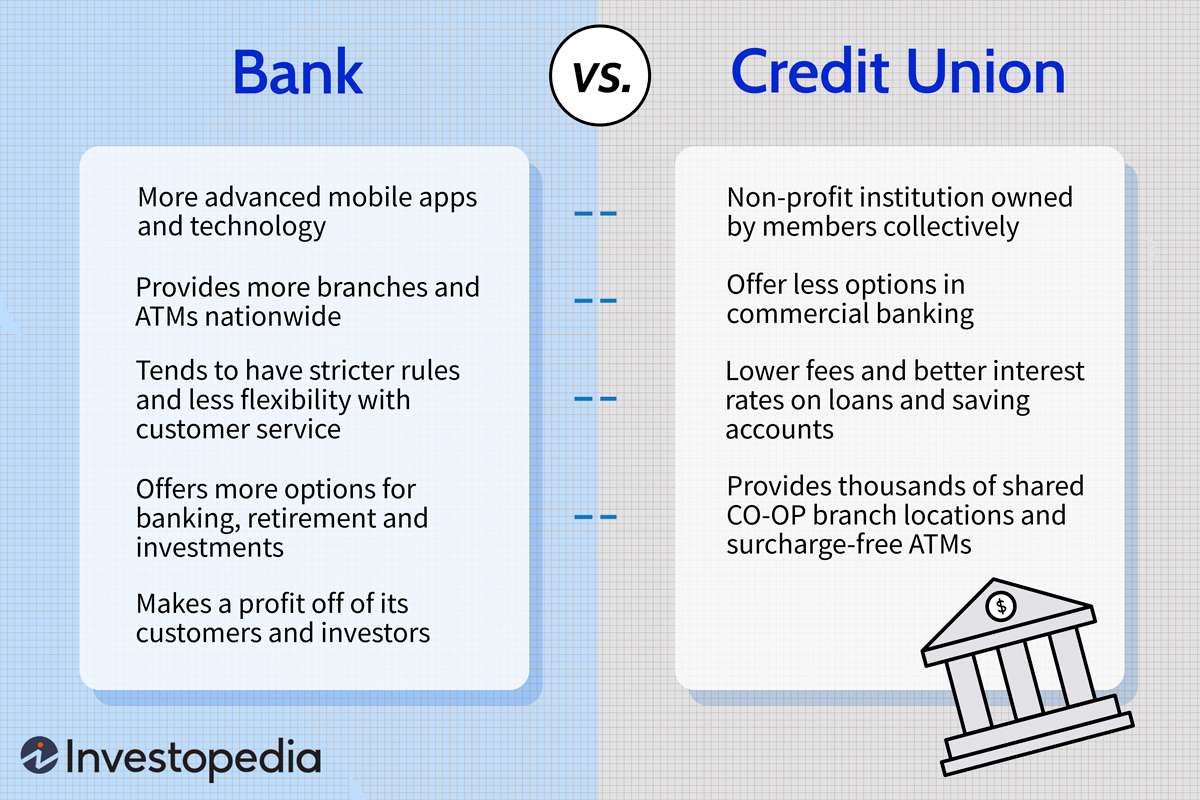

Credit unions are financial institutions that are owned and operated by their members. Unlike banks, which are for-profit businesses, credit unions are not-for-profit organizations. This means that they are focused on providing their members with affordable financial services, including loans.

For borrowers with limited credit history, an Oportun Loan could be an option. These loans cater to individuals who may struggle to qualify for traditional loans.

Credit unions often offer lower interest rates and fees than traditional banks, making them a more attractive option for borrowers.

If you need to tap into your home’s equity, consider a Home Equity Line of Credit (HELOC). HELOCs offer flexible borrowing options and can be a great way to consolidate debt or fund home improvements.

Benefits of Credit Union Loans

Credit union loans offer several advantages over traditional bank loans, including:

- Lower interest rates: Credit unions typically offer lower interest rates on loans than banks. This is because they are not required to generate profits for shareholders.

- Lower fees: Credit unions often charge lower fees on loans than banks. This can save borrowers a significant amount of money over the life of the loan.

- Personalized service: Credit unions are known for providing personalized service to their members. This can be especially helpful for borrowers who need assistance with the loan application process or have questions about their loan.

- Community involvement: Credit unions are often deeply involved in their local communities. They may offer financial education programs or support local charities.

Types of Credit Union Loans

Credit unions offer a wide variety of loan products to meet the needs of their members. Some common types of credit union loans include:

| Loan Type | Eligibility Requirements | Interest Rates | Loan Terms |

|---|---|---|---|

| Personal Loans | Good credit history, stable income | Varying based on creditworthiness | Typically 1 to 5 years |

| Auto Loans | Good credit history, stable income, down payment | Varying based on vehicle type, loan term, and creditworthiness | Typically 3 to 7 years |

| Mortgage Loans | Good credit history, stable income, down payment | Varying based on loan type, loan term, and creditworthiness | Typically 15 to 30 years |

| Business Loans | Good credit history, strong business plan, collateral | Varying based on loan amount, loan term, and creditworthiness | Typically 1 to 10 years |

Applying for a Credit Union Loan

Applying for a credit union loan is generally a straightforward process. Here are the steps involved:

- Choose a credit union: Research different credit unions in your area and compare their loan offerings.

- Gather your documents: You will need to provide the credit union with proof of income, identity, and residence. You may also need to provide information about your credit history and debt-to-income ratio.

- Submit your application: You can apply for a loan online, in person, or over the phone.

- Wait for approval: The credit union will review your application and make a decision within a few days.

- Close on your loan: If your loan is approved, you will need to sign the loan documents and receive the loan funds.

Tips for Improving Loan Application Success

Here are some tips for improving your chances of getting a credit union loan approved:

- Build a good credit score: A good credit score is essential for getting approved for a loan at a competitive interest rate. You can improve your credit score by paying your bills on time, keeping your credit utilization low, and avoiding opening too many new credit accounts.

Rocket Mortgage is a popular online platform for obtaining mortgage loans. They offer a streamlined application process and a variety of loan options to choose from.

- Have a stable income: Credit unions want to ensure that you can afford to repay the loan. This means having a steady income source and a low debt-to-income ratio.

- Shop around for the best rates: Compare loan offers from different credit unions to find the best interest rate and terms.

- Be prepared to provide documentation: Credit unions will require you to provide documentation to verify your income, identity, and residence. Having these documents readily available will speed up the loan application process.

Advantages of Credit Union Loans

Credit union loans offer several advantages over traditional bank loans. These advantages can save borrowers money, provide them with more personalized service, and help them achieve their financial goals.

If you need a loan without collateral, an unsecured personal loan might be a suitable option. However, interest rates are generally higher compared to secured loans.

Lower Interest Rates and Fees

One of the biggest advantages of credit union loans is that they typically offer lower interest rates and fees than bank loans. This is because credit unions are not-for-profit organizations, so they do not have to generate profits for shareholders.

Marcus by Goldman Sachs offers personal loans with competitive rates and transparent terms. They can be a good option for consolidating debt or financing major purchases.

Instead, they can pass on these savings to their members in the form of lower interest rates and fees. This can save borrowers a significant amount of money over the life of the loan.

A conventional loan is a popular choice for homebuyers. These loans are backed by Fannie Mae or Freddie Mac, offering competitive interest rates and flexible terms.

Personalized Service and Member-Focused Lending Practices

Credit unions are known for providing personalized service to their members. This means that borrowers can expect to work with a loan officer who understands their individual needs and financial situation. Credit unions also tend to have more flexible lending practices than banks, which can be helpful for borrowers who may not meet the strict requirements of traditional bank loans.

Struggling with debt? Debt relief programs can help you manage overwhelming debt and potentially reduce your monthly payments.

Community Involvement and Financial Education Resources

Credit unions are often deeply involved in their local communities. They may offer financial education programs or support local charities. This commitment to community involvement can make credit unions a more attractive option for borrowers who want to support local businesses and organizations.

Looking for a loan with flexible repayment options? Upgrade Loans offer a range of personal loan products, including options for debt consolidation and home improvement projects.

Finding the Right Credit Union

Choosing the right credit union for your loan needs is important. Here are some factors to consider when selecting a credit union:

Checklist of Factors to Consider

- Loan offerings: Make sure the credit union offers the type of loan you need at a competitive interest rate.

- Membership requirements: Most credit unions have membership requirements, such as living or working in a specific geographic area or being a member of a particular organization. Make sure you meet the membership requirements before applying for a loan.

- Local presence: Consider the credit union’s local presence. If you prefer to do your banking in person, choose a credit union with branches in your area.

- Financial stability: Look for a credit union with a strong financial history and a good track record of lending.

- Customer service: Read online reviews or talk to other members of the credit union to get a sense of their customer service.

Researching and Comparing Credit Unions, Credit Union Loans

Once you have identified a few credit unions that meet your needs, research their loan offerings and compare them side-by-side. You can use online tools or contact the credit unions directly to get more information.

Finding a loan with no credit check can be challenging, but there are options available. Online loans with no credit check may be an option, but they often come with higher interest rates.

Importance of Membership Requirements and Local Presence

Membership requirements and local presence are important factors to consider when choosing a credit union. If you do not meet the membership requirements, you will not be able to apply for a loan. And if you prefer to do your banking in person, you will need to choose a credit union with branches in your area.

A cash advance loan can provide quick access to funds, but it’s essential to understand the high interest rates and potential fees associated with these loans.

Managing Credit Union Loans

Once you have secured a credit union loan, it is important to manage it responsibly to avoid late fees and maintain a good credit score.

A personal line of credit offers a flexible borrowing option that can be used for various needs. It’s a good choice for those who want access to funds as needed.

Guide for Responsible Loan Management

- Make timely payments: One of the most important things you can do to manage your loan responsibly is to make your payments on time. This will help you avoid late fees and keep your credit score high.

- Create a budget: Creating a budget can help you track your income and expenses, making it easier to manage your loan payments and other financial obligations.

- Consider debt consolidation: If you have multiple loans, consider consolidating them into a single loan with a lower interest rate. This can help you save money on interest and make it easier to manage your debt.

Tips on Making Timely Payments and Avoiding Late Fees

Here are some tips for making timely payments and avoiding late fees:

- Set up automatic payments: Automatic payments can help ensure that your payments are made on time, even if you forget. You can set up automatic payments through your credit union’s website or mobile app.

- Use a calendar or reminder app: Mark your payment due dates on a calendar or use a reminder app to make sure you don’t miss a payment.

- Contact your credit union if you are having trouble making a payment: If you are having trouble making a payment, contact your credit union as soon as possible. They may be able to work with you to create a payment plan or offer other assistance.

Importance of Budgeting and Debt Consolidation Strategies

Budgeting and debt consolidation strategies are important tools for managing your credit union loans responsibly. Budgeting can help you track your income and expenses, making it easier to manage your loan payments and other financial obligations. Debt consolidation can help you save money on interest and make it easier to manage your debt.

Ultimate Conclusion

Navigating the world of credit union loans can be a rewarding experience, offering access to competitive rates, personalized service, and a commitment to community. By carefully researching and selecting the right credit union, understanding the application process, and managing your loan responsibly, you can leverage the benefits of these unique financial institutions to achieve your financial goals.

Need money fast? Instant cash loans can provide quick access to funds, but it’s important to understand the terms and potential costs before borrowing.

Question & Answer Hub

What is the difference between a credit union and a bank?

Credit unions are member-owned financial institutions, while banks are typically for-profit companies. This ownership structure often translates to lower interest rates and fees for credit union members.

Do I need to be a member of a credit union to apply for a loan?

Looking to buy a home? It’s crucial to understand current mortgage rates before you start shopping. These rates fluctuate frequently, so it’s essential to stay informed.

Yes, you generally need to be a member of a credit union to apply for a loan. However, membership requirements are often straightforward, and you can typically join by making a small deposit.

What are the typical interest rates for credit union loans?

Interest rates for credit union loans can vary depending on the loan type, your credit score, and the specific credit union. However, they are often lower than those offered by traditional banks.

How can I improve my chances of getting a credit union loan approved?

Maintaining a good credit score, having a stable income, and providing a solid financial history can significantly improve your chances of loan approval.