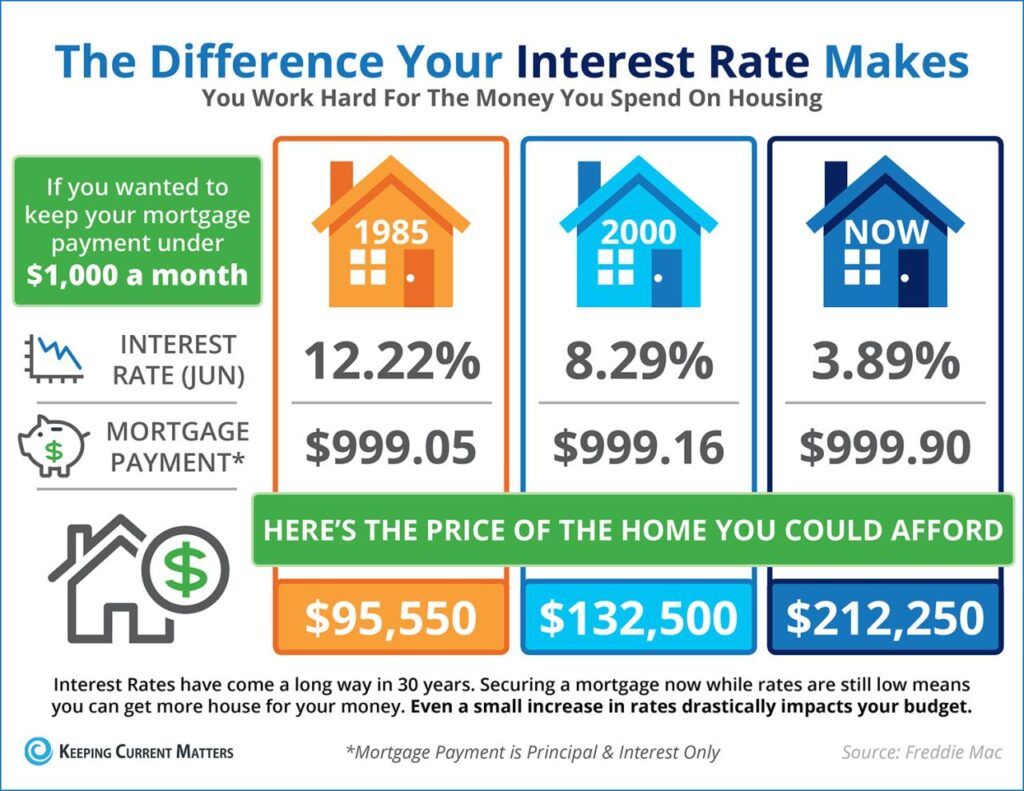

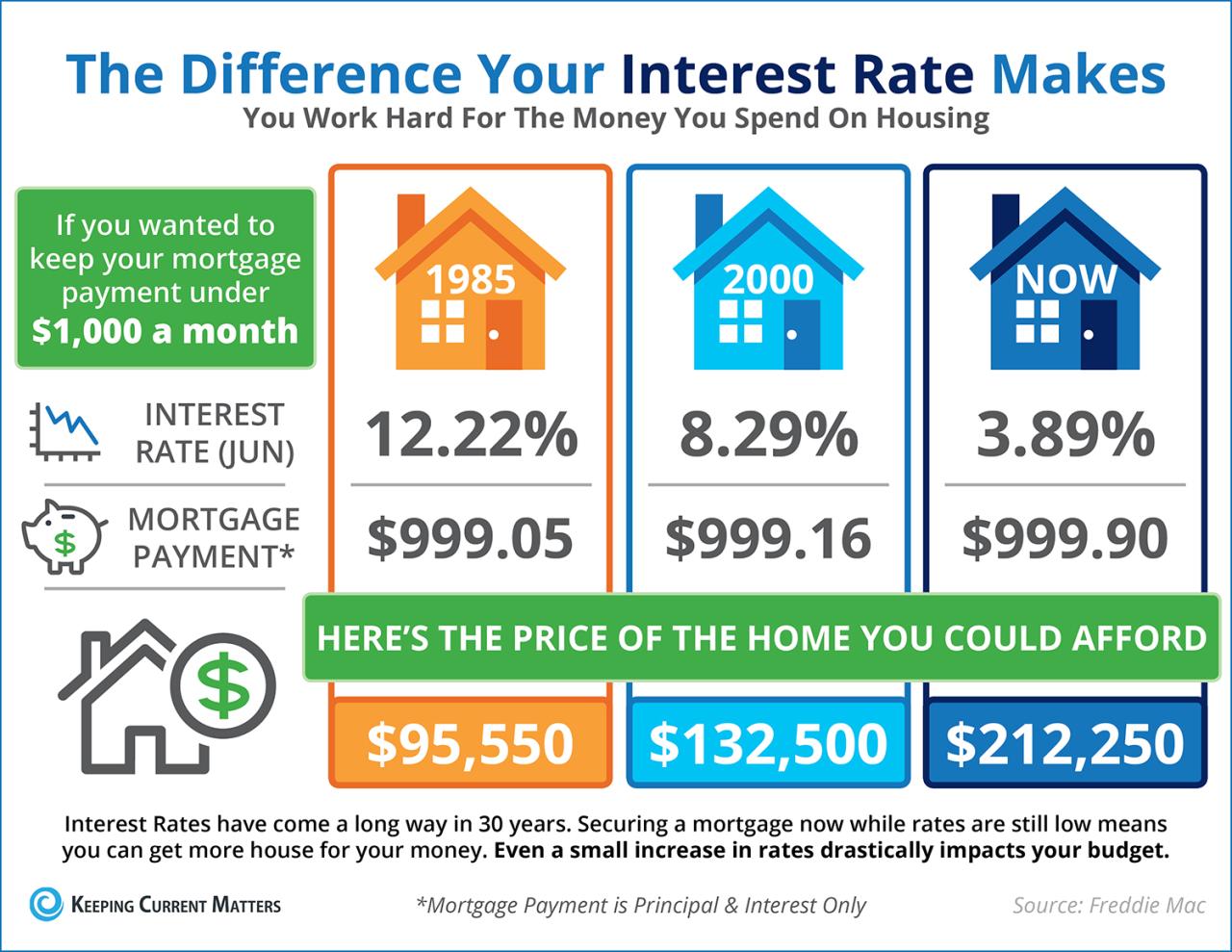

Current Home Interest Rates are a crucial factor for anyone considering buying a home. The current rate environment is a dynamic landscape shaped by economic forces, such as the Federal Reserve’s monetary policy and inflation. Understanding these influences is essential for navigating the challenges and opportunities presented by today’s housing market.

An Equity Loan can be a great way to tap into the equity you’ve built up in your home. You can use the money for a variety of purposes, such as home improvements, debt consolidation, or even a vacation. However, it’s important to make sure you understand the terms of the loan before you take one out.

This exploration delves into the current state of home interest rates, examining their impact on homebuyers and providing strategies for navigating the market. We’ll also look at historical trends and discuss predictions for the future, offering insights on how to prepare for potential fluctuations.

A Mortgage Broker can help you shop around for the best mortgage rates and terms. They can also help you navigate the complex process of getting a mortgage. If you’re not sure where to start, a mortgage broker can be a valuable resource.

Final Conclusion

Navigating the current home interest rate landscape requires a combination of knowledge, strategy, and a willingness to adapt. By understanding the factors driving rates, exploring different mortgage options, and staying informed about market trends, homebuyers can position themselves for success in this dynamic environment.

A Heloc , or Home Equity Line of Credit, is a revolving line of credit that you can use for a variety of purposes. It’s secured by your home, so you’ll typically get a lower interest rate than you would with an unsecured loan.

However, it’s important to be careful not to borrow more than you can afford to repay.

Remember, seeking guidance from a qualified financial advisor can provide valuable support in making informed decisions.

A Paycheck Advance can be a quick and easy way to get some extra cash before your next payday. However, these loans often come with high interest rates and fees, so it’s important to use them sparingly.

Query Resolution: Current Home Interest Rates

What are the main factors influencing home interest rates?

If you’re a veteran, you may be eligible for a VA Loan , which is a government-backed loan that often comes with a lower interest rate than conventional loans. You can find out more about VA loan interest rates by visiting the website.

Home interest rates are primarily influenced by the Federal Reserve’s monetary policy, inflation, and overall economic conditions. The Fed’s actions, such as adjusting interest rates, directly impact borrowing costs, while inflation and economic growth affect investor confidence and demand for mortgages.

What is the difference between a fixed-rate and an adjustable-rate mortgage?

A fixed-rate mortgage offers a consistent interest rate throughout the loan term, providing predictable monthly payments. An adjustable-rate mortgage (ARM) starts with a lower initial interest rate but can fluctuate over time, potentially leading to higher payments later on.

How can I find the best mortgage rates?

To find the best mortgage rates, compare offers from multiple lenders. Utilize online tools, consult with mortgage brokers, and consider your individual financial situation and credit score. Remember, the best rate may not always be the lowest, as other factors like loan terms and fees can impact the overall cost.

If you’re looking for a mortgage, you might want to check out Chase Mortgage Rates. They offer a variety of loan options, including fixed-rate and adjustable-rate mortgages. You can also use their online tools to get pre-approved for a loan, which can help you get a better interest rate.

If you’re struggling with debt, you may want to consider consolidating your debt with a Debt Consolidation Loan. This can help you lower your monthly payments and make it easier to manage your debt. However, it’s important to make sure you understand the terms of the loan before you take one out.

Current Home Mortgage Rates can fluctuate daily, so it’s important to shop around and compare rates from different lenders. You can also use online tools to get an estimate of what your monthly payments would be.

A Line of Credit Loan can be a convenient way to access funds when you need them. You can use it for a variety of purposes, such as home improvements, debt consolidation, or even a vacation. However, it’s important to make sure you understand the terms of the loan before you take one out.

If you’re looking for a great deal on a mortgage, you may want to check out Mortgage Deals. There are a variety of deals available, such as low interest rates, closing cost credits, and even cash back offers. It’s important to compare different deals to find the one that’s right for you.

A 30-Year Mortgage is a popular choice for homeowners because it offers lower monthly payments than a shorter-term loan. However, you’ll end up paying more in interest over the life of the loan. If you’re looking for a lower interest rate, you may want to consider a shorter-term loan.

If you’re looking for a mortgage from TD Bank, you can check out their TD Mortgage Rates. They offer a variety of loan options, including fixed-rate and adjustable-rate mortgages. You can also use their online tools to get pre-approved for a loan.

If you’re looking for a home equity loan, you may want to check out Best Home Equity Loan Rates. There are a variety of lenders offering competitive rates, so it’s important to shop around and compare offers.

If you’re a veteran, you may be eligible for a VA home loan, which often comes with a lower interest rate than conventional loans. You can find out more about VA Home Loan Rates by visiting the website.

A Credit Builder Loan can be a great way to improve your credit score. You make regular payments on the loan, and the lender reports your payments to the credit bureaus. This can help you build a positive credit history and qualify for better loan terms in the future.