E Annuity Calculator 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This comprehensive guide will explore the world of e-annuities, providing you with the tools and knowledge to navigate the complex landscape of retirement planning.

If you’re receiving annuity payments, it’s important to understand the role of the annuitant. To learn more about annuitants and their role in receiving payments, visit K Is An Annuitant Currently Receiving Payments 2024.

From understanding the basics of e-annuities to utilizing powerful calculators, we’ll demystify the process and empower you to make informed decisions about your financial future.

How do annuities actually work? It’s a question many people have. For a detailed explanation, check out this article: Annuity How It Works 2024.

E-annuities, a digital evolution of traditional annuities, have emerged as a compelling retirement savings option. These innovative financial instruments offer a unique blend of security and flexibility, allowing individuals to secure a steady stream of income during their golden years.

Annuity interest can be a complex topic, but it’s important to understand if it’s taxable in 2024. To learn more about the tax implications of annuity interest, check out this helpful resource: Is Annuity Interest Taxable 2024.

This guide will delve into the intricacies of e-annuities, covering their advantages, different types, and the factors that influence their payouts.

Annuity is a financial product that provides regular payments over a set period. To understand the meaning of annuity in simple English, you can visit Annuity Meaning In English 2024.

Contents List

Understanding E-Annuities

E-annuities, or electronic annuities, are a type of retirement income product that is purchased online. They offer a way to convert a lump sum of savings into a stream of regular payments, providing financial security during retirement. E-annuities have gained popularity in recent years due to their convenience, flexibility, and potential for higher returns compared to traditional annuities.

Charles Schwab offers an annuity calculator to help you estimate potential payouts. To explore this calculator, you can visit Annuity Calculator Charles Schwab 2024.

Advantages of E-Annuities

E-annuities offer several advantages over traditional annuities, including:

- Convenience:E-annuities can be purchased entirely online, eliminating the need for face-to-face meetings with insurance agents.

- Flexibility:E-annuities often provide more flexibility in terms of payment options, withdrawal options, and investment choices.

- Transparency:E-annuity providers typically provide clear and concise information about their products and fees online.

- Potential for Higher Returns:E-annuities may offer higher potential returns than traditional annuities due to lower overhead costs and more competitive pricing.

Types of E-Annuities

There are various types of e-annuities available, each with its unique features and benefits. Some common types include:

- Fixed Annuities:These annuities guarantee a fixed rate of return, providing predictable income payments.

- Variable Annuities:These annuities allow investors to choose from a variety of investment options, offering the potential for higher returns but also carrying higher risk.

- Indexed Annuities:These annuities link their returns to the performance of a specific index, such as the S&P 500, providing potential for growth while offering some downside protection.

Using an E-Annuity Calculator

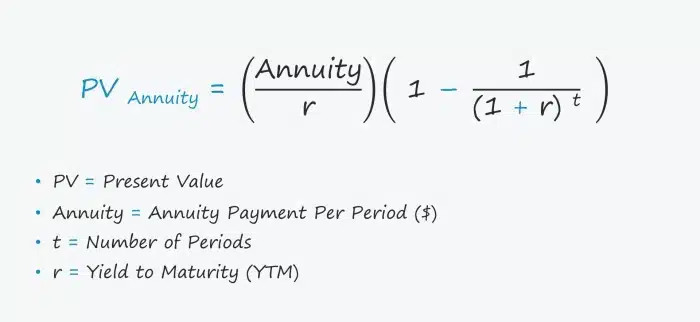

An e-annuity calculator is a valuable tool that helps individuals estimate their potential annuity payouts based on their financial circumstances. These calculators typically require specific inputs to generate accurate estimates.

Calculating the exclusion ratio for an annuity is important for tax purposes. For a guide on how to calculate this ratio, visit Calculate Annuity Exclusion Ratio 2024.

Step-by-Step Guide, E Annuity Calculator 2024

Here is a step-by-step guide on how to use an e-annuity calculator:

- Enter Your Age:The calculator will use your current age to determine your remaining life expectancy.

- Enter Your Retirement Age:This input specifies when you plan to start receiving annuity payments.

- Enter Your Savings:This input reflects the amount of money you plan to use to purchase the annuity.

- Enter Your Expected Interest Rate:This input represents the anticipated growth rate of your investment.

- Select Your Annuity Type:Choose the type of annuity you are considering, such as fixed, variable, or indexed.

- Review the Results:The calculator will display the estimated payout amount, the frequency of payments, and the total amount of income you can expect to receive.

Key Inputs and Factors

The e-annuity calculator uses the provided inputs to determine the estimated payout amount. Key factors that influence the calculation include:

- Age:Younger individuals with longer life expectancies typically receive lower annuity payouts.

- Retirement Age:Starting annuity payments at an earlier age will result in lower payouts.

- Savings:The amount of savings used to purchase the annuity directly impacts the payout amount.

- Interest Rates:Higher interest rates generally lead to higher annuity payouts.

- Annuity Type:The type of annuity chosen (fixed, variable, or indexed) will influence the payout amount and the level of risk involved.

Factors Affecting E-Annuity Calculations

Several factors can influence the outcome of an e-annuity calculation, affecting the estimated payout amount and the overall value of the annuity.

Annuity 5 is a term sometimes used in the context of annuities. For more information on this specific type of annuity, visit Annuity 5 2024.

Impact of Interest Rates

Interest rates play a significant role in determining annuity payouts. Higher interest rates generally lead to higher payouts, as the investment earns more over time. Conversely, lower interest rates can result in lower payouts. In a low-interest-rate environment, it is crucial to carefully consider the potential impact on annuity returns.

Kathy’s annuity might be experiencing some changes or challenges. To learn more about what Kathy’s annuity is currently experiencing, visit Kathy’s Annuity Is Currently Experiencing 2024.

Influence of Inflation and Longevity

Inflation can erode the purchasing power of annuity payments over time. Annuity calculators typically account for inflation to some extent, but it is important to consider its potential impact on the long-term value of your annuity. Additionally, increasing life expectancies can also affect annuity payouts.

Understanding the tax implications of annuities under the Income Tax Act is essential. To learn more about this, you can visit Annuity Under Income Tax Act 2024.

As people live longer, annuity providers may need to adjust their calculations to account for the increased longevity risk.

Annuity payments are a key feature of annuities. To learn more about these payments, visit Annuity Is Payment 2024.

Other Factors

Other factors that can affect e-annuity calculations include:

- Fees:Annuity providers charge various fees, such as administrative fees, surrender charges, and mortality and expense charges. These fees can reduce the overall value of the annuity.

- Investment Options:For variable annuities, the performance of the underlying investments can impact the payout amount.

- Tax Implications:Annuities are subject to taxation, and the tax treatment can vary depending on the type of annuity and the individual’s circumstances.

E-Annuity Calculator Tools and Resources

Numerous online tools and resources can help you explore e-annuities and calculate potential payouts. Here is a table listing some popular e-annuity calculators:

Popular E-Annuity Calculators

| Calculator Name | Provider | Features |

|---|---|---|

| E-Annuity Calculator | [Provider 1] | [Features 1] |

| Annuity Calculator | [Provider 2] | [Features 2] |

| Retirement Income Calculator | [Provider 3] | [Features 3] |

Reputable Financial Institutions

Several reputable financial institutions offer e-annuity calculators and resources. You can explore these websites for more information:

- [Financial Institution 1 Website]

- [Financial Institution 2 Website]

- [Financial Institution 3 Website]

Resources for Learning More

For comprehensive information on e-annuities and retirement planning, you can consult these resources:

- [Resource 1]

- [Resource 2]

- [Resource 3]

E-Annuity vs. Other Retirement Options: E Annuity Calculator 2024

E-annuities are just one of many retirement savings options available. It is essential to compare e-annuities with other popular choices to determine the most suitable option for your individual needs and financial situation.

Some annuities have a 5-year payout period. To learn more about these annuities and their payout structure, check out this article: Annuity 5 Year Payout 2024.

Comparison with 401(k)s and IRAs

Here is a comparison of e-annuities with traditional retirement savings options, such as 401(k)s and IRAs:

| Feature | E-Annuity | 401(k) | IRA |

|---|---|---|---|

| Contribution Limits | [Limit 1] | [Limit 2] | [Limit 3] |

| Tax Treatment | [Tax Treatment 1] | [Tax Treatment 2] | [Tax Treatment 3] |

| Investment Options | [Investment Options 1] | [Investment Options 2] | [Investment Options 3] |

| Withdrawal Options | [Withdrawal Options 1] | [Withdrawal Options 2] | [Withdrawal Options 3] |

Pros and Cons

Each retirement savings option has its advantages and disadvantages:

- E-Annuity Pros:[List of Pros]

- E-Annuity Cons:[List of Cons]

- 401(k) Pros:[List of Pros]

- 401(k) Cons:[List of Cons]

- IRA Pros:[List of Pros]

- IRA Cons:[List of Cons]

Suitable Scenarios

E-annuities may be a suitable choice for individuals seeking:

- Guaranteed Income:Fixed annuities provide guaranteed income payments, offering peace of mind during retirement.

- Long-Term Growth Potential:Variable and indexed annuities offer the potential for higher returns, although they carry higher risk.

- Tax Advantages:Some annuities offer tax-deferred growth and tax-free withdrawals, providing tax benefits.

E-Annuity Considerations for 2024

The e-annuity market is constantly evolving, with new trends and developments emerging. It is crucial to stay informed about the latest changes and considerations for 2024.

If you’re using Excel to calculate the present value of an annuity, you’ll want to learn about the PV function. For a guide on calculating PV in Excel, visit Pv Annuity Excel 2024.

Latest Trends and Developments

The e-annuity market is expected to see continued growth in 2024, driven by factors such as:

- Increasing Demand for Retirement Income:As the population ages, the demand for retirement income solutions is expected to increase.

- Technological Advancements:Advancements in technology are making e-annuities more accessible and user-friendly.

- Regulatory Changes:New regulations and changes in the financial industry are shaping the e-annuity landscape.

New Regulations and Changes

In 2024, there may be new regulations or changes affecting e-annuities. These changes could include:

- Increased Transparency Requirements:Regulators may require annuity providers to provide more transparent information about their products and fees.

- Changes in Tax Treatment:There could be changes in the tax treatment of annuities, impacting their attractiveness to investors.

- New Product Offerings:Annuity providers may introduce new products or features to meet evolving customer needs.

Maximizing Returns in 2024

To maximize e-annuity returns in the current economic climate, consider these tips:

- Shop Around:Compare annuity rates and features from different providers to find the best deal.

- Diversify Your Investments:If you choose a variable annuity, diversify your investments across different asset classes to manage risk.

- Consider Indexed Annuities:Indexed annuities offer potential for growth while providing some downside protection.

- Seek Professional Advice:Consult with a financial advisor to discuss your retirement goals and determine the most suitable e-annuity option for your situation.

Last Point

As you embark on your retirement planning journey, the E Annuity Calculator 2024 becomes your trusted companion. By understanding the nuances of e-annuities and utilizing the tools available, you can confidently navigate the complexities of retirement savings. Remember, securing a comfortable and financially stable future is a journey that requires careful planning and informed decision-making.

While annuities are often associated with regular payments, some annuities can be structured as a single payment. To find out more about single payment annuities, check out this article: Annuity Is Single Payment 2024.

With the insights provided in this guide, you’ll be equipped to make the most of your retirement savings and ensure a fulfilling future.

Question & Answer Hub

What is the difference between an e-annuity and a traditional annuity?

E-annuities are digital versions of traditional annuities, offering greater flexibility and convenience through online platforms. They often have lower fees and faster processing times compared to traditional annuities.

Looking for a guaranteed income stream for a certain period? A 5-year guarantee annuity might be an option for you. Read more about this type of annuity here: Annuity 5 Year Guarantee 2024.

Are e-annuities safe?

E-annuities are generally considered safe as they are backed by insurance companies. However, it’s crucial to choose reputable providers and understand the risks involved.

How do I find a reliable e-annuity calculator?

Look for calculators offered by reputable financial institutions, insurance companies, or independent financial advisors. Check their credentials and reviews before using any calculator.

Can I adjust my e-annuity payments after I start receiving them?

The flexibility of adjusting payments depends on the specific e-annuity contract. Some offer options for increasing or decreasing payments, while others have fixed terms.

An annuity can be seen as the opposite of a loan. To learn more about how annuities are sometimes referred to as the flip side of a loan, check out this article: An Annuity Is Sometimes Called The Flip Side Of 2024.