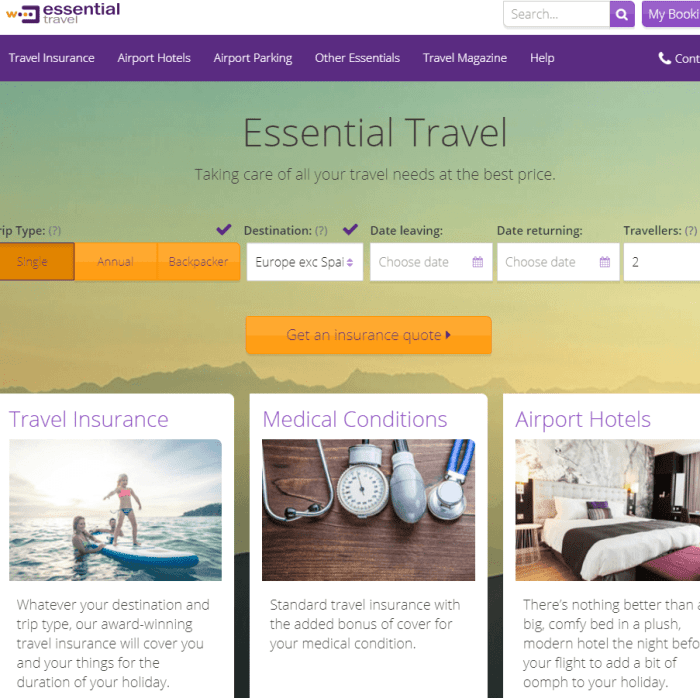

Essential travel insurance for October 2024 is more than just a safety net; it’s a passport to peace of mind. As you plan your autumn adventures, understanding the nuances of travel insurance can make all the difference in ensuring a smooth and enjoyable journey.

From medical emergencies to unexpected trip disruptions, having the right coverage can protect you from financial burdens and unforeseen circumstances.

For those seeking information in Hindi, this resource on Immediate Annuity Meaning In Hindi provides a comprehensive explanation of this financial product.

This guide will delve into the essential aspects of travel insurance, focusing on key considerations for October 2024 travel. We’ll explore the different types of coverage available, discuss potential travel risks specific to this time of year, and provide tips for choosing the right policy to meet your individual needs and budget.

An immediate deferred annuity offers flexibility in your retirement planning. Explore the details of Immediate Deferred Annuity to understand how it can provide income later in life while allowing you to access your funds earlier if needed.

By understanding the intricacies of travel insurance, you can confidently embark on your October adventures, knowing that you have the necessary protection in place.

Variable annuities often involve separate accounts for investment purposes. Understand the intricacies of Variable Annuity Separate Account 2024 to make informed decisions about your investment strategy.

Contents List

Essential Travel Insurance for October 2024

Traveling is an exciting experience, but it’s also important to be prepared for the unexpected. Travel insurance can provide you with peace of mind and financial protection in case of unforeseen events. This article will guide you through the essential aspects of travel insurance, focusing on what to consider for trips in October 2024.

Finding the best variable annuity can be challenging. Explore this guide on Best Variable Annuity 2020 2024 to compare different options and make an informed investment decision.

Essential Travel Insurance Coverage, Essential travel insurance for October 2024

Travel insurance offers various coverage options to safeguard your trip and protect your finances. Understanding the different types of coverage is crucial to choosing the right policy for your needs.

- Medical Coverage:This covers medical expenses incurred during your trip, including emergency hospitalization, doctor visits, and prescription medications. It’s especially important for travelers visiting countries with high healthcare costs or those with pre-existing medical conditions.

- Baggage Coverage:This protects your belongings against loss, damage, or theft during your travels. It covers the cost of replacing or repairing your luggage and its contents. This coverage can be crucial for travelers carrying expensive electronics, jewelry, or other valuable items.

If you’re planning a long-term trip, consider purchasing Medical travel insurance for comprehensive coverage in case of unexpected medical emergencies while abroad.

- Trip Cancellation Coverage:This reimburses you for non-refundable travel expenses if you need to cancel your trip due to unforeseen circumstances, such as illness, injury, or a family emergency. This coverage is essential for travelers who have invested significant funds in their trip.

Immediate annuities offer a guaranteed stream of income. Check out the current Immediate Annuity Yields to understand the potential returns and how they can impact your retirement planning.

- Emergency Evacuation Coverage:This covers the costs of transporting you back home in case of a medical emergency or natural disaster. This coverage is particularly important for travelers venturing to remote or high-risk destinations.

When choosing travel insurance coverage, it’s crucial to consider your individual travel needs and circumstances. For example, travelers with pre-existing medical conditions may require more extensive medical coverage, while those traveling to remote destinations may need more comprehensive emergency evacuation coverage.

While both annuities and life insurance provide financial security, they are distinct products. Read this article on Is Annuity The Same As Life Insurance 2024 to clarify their differences and choose the right solution for your needs.

Key Considerations for October 2024 Travel

October 2024 presents unique travel considerations that can impact your trip. Understanding these potential risks is crucial for planning your trip and choosing the right insurance coverage.

The variable annuity market is dynamic and offers various career opportunities. Learn more about Variable Annuity Jobs 2024 if you’re interested in a rewarding career in this field.

- Hurricane Season:October falls within hurricane season in many parts of the world, including the Caribbean, the Gulf Coast of the United States, and parts of Southeast Asia. If you’re traveling to these regions, consider travel insurance that covers hurricane-related disruptions, such as flight cancellations, hotel closures, and emergency evacuation.

American Legacy 3 Variable Annuity is a popular choice. Learn more about American Legacy 3 Variable Annuity 2024 to understand its features, benefits, and potential risks before making an investment.

- Seasonal Illnesses:October can bring about seasonal illnesses, particularly in the Northern Hemisphere. Travel insurance can provide coverage for medical expenses related to these illnesses, including doctor visits, medication, and hospital stays.

- Political Instability:Political instability can occur anywhere in the world, and it’s important to be aware of potential risks before traveling. Travel insurance can offer protection against disruptions caused by political unrest, such as flight cancellations, evacuations, and property damage.

It’s essential to stay informed about travel advisories and recommendations issued by government agencies and travel organizations. These advisories can provide valuable insights into potential risks and help you make informed decisions about your travel plans.

Annuity rates can vary significantly. Explore the possibilities of Annuity 8 Percent 2024 to see if it aligns with your financial goals and risk tolerance.

Choosing the Right Travel Insurance Policy

Choosing the right travel insurance policy requires careful consideration of your needs, budget, and the specific details of your trip. Here are some factors to keep in mind:

- Coverage Limits:This refers to the maximum amount your insurer will pay for covered expenses. Ensure the coverage limits are sufficient for your needs, especially if you’re traveling to expensive destinations or have valuable belongings.

- Deductibles:This is the amount you’ll need to pay out-of-pocket before your insurance coverage kicks in. Consider your budget and choose a deductible you can comfortably afford.

- Exclusions:These are activities or situations that are not covered by your insurance policy. Read the policy terms carefully to understand what’s covered and what’s not. For example, some policies may exclude coverage for certain adventure activities or pre-existing medical conditions.

Calculating annuities can be complex. This resource on Calculating Annuities 2024 provides a step-by-step guide to help you understand the calculations involved and make informed decisions about your retirement planning.

Comparing different insurance providers and their policy offerings is essential. Look for policies that offer comprehensive coverage, reasonable premiums, and a user-friendly claims process. Consider factors such as the insurer’s reputation, customer service, and financial stability.

Variable annuities come with various charges. Learn more about Variable Annuity Charges 2024 to understand how they impact your returns and make informed investment decisions.

Travel Insurance Claims and Procedures

Understanding the claims process is crucial to ensure a smooth experience if you need to file a claim. Here’s what you should know:

- Required Documentation:Keep all relevant documentation, including receipts, medical bills, and travel itineraries, safe and readily accessible. These documents will be required to support your claim.

- Timelines:Be aware of the timeframes for filing claims and providing supporting documentation. Late submissions can result in delays or claim denials.

- Policy Terms and Conditions:Thoroughly review your policy terms and conditions to understand the requirements for filing a claim, including the timeframes, documentation, and process. This will help you navigate the claims process efficiently.

Contact your insurer immediately if you experience an event that may be covered by your policy. They can guide you through the claims process and provide support throughout the process.

If you’re planning a domestic flight in October 2024, consider purchasing Chase Trip Delay Insurance for peace of mind. It can help cover unexpected expenses if your flight is delayed or canceled.

Tips for Staying Safe and Insured While Traveling

While travel insurance provides a safety net, it’s also important to take proactive measures to stay safe and minimize risks while traveling. Here are some tips:

- Be Aware of Your Surroundings:Pay attention to your surroundings and be cautious of potential threats. Avoid displaying large amounts of cash or expensive jewelry.

- Practice Good Hygiene:Wash your hands frequently, avoid contact with sick individuals, and stay hydrated to minimize your risk of illness.

- Take Necessary Precautions:Research local customs and laws, follow safety guidelines, and avoid risky activities.

Remember, travel insurance is a valuable safety net that can protect you from unexpected events. By understanding the different coverage options, choosing the right policy, and taking proactive safety measures, you can enjoy your trip with peace of mind.

Summary

Navigating the world of travel insurance can seem daunting, but by taking the time to understand your needs and explore the available options, you can make informed decisions that safeguard your well-being and financial security. Remember, travel insurance is not just about covering unexpected events; it’s about empowering you to travel with confidence and enjoy your adventures to the fullest.

If you’re looking for a shorter payout period, explore the options of Annuity 5 Year Payout 2024 to understand how it can provide a steady stream of income for a specific timeframe.

As you plan your October 2024 travels, remember that having the right travel insurance policy can be your greatest ally in ensuring a memorable and worry-free experience.

FAQ Resource: Essential Travel Insurance For October 2024

What are the most common travel insurance claims?

Deciding between an annuity and a pension can be tough. Check out this guide on Annuity Vs Pension 2024 to understand the pros and cons of each option and make the best choice for your retirement planning.

The most common travel insurance claims are for medical expenses, trip cancellation or interruption, and lost or stolen baggage.

How do I know if I need travel insurance?

If you are traveling internationally, or if your trip involves any high-risk activities, it is highly recommended to have travel insurance. Even if you are traveling domestically, travel insurance can provide valuable protection in case of unforeseen events.

What are some tips for staying safe while traveling?

Some tips for staying safe while traveling include being aware of your surroundings, practicing good hygiene, keeping your valuables secure, and avoiding risky situations. It’s also essential to research your destination and understand local customs and laws.