Faye Travel Insurance October 2024 Coverage Details provides comprehensive protection for your next adventure. This guide delves into the specifics of Faye’s travel insurance plan for October 2024, highlighting key benefits, coverage details, and important considerations. We’ll explore the various policy types, premium costs, and the claims process, ensuring you have the information needed to make an informed decision about your travel insurance needs.

Transamerica offers a variety of financial products, including variable annuities. If you’re interested in learning more, you can check out Transamerica B Share Variable Annuity 2024 to see if it’s a good fit for your needs.

Whether you’re planning a solo backpacking trip, a family vacation, or a business excursion, Faye Travel Insurance offers peace of mind with its robust coverage options. From medical emergencies to trip cancellations, Faye has you covered. We’ll also compare Faye’s offerings with other leading travel insurance providers, giving you a comprehensive overview of the market.

It’s important to understand the limitations of variable annuities before investing. A Variable Annuity Does Not Provide 2024 can help you clarify what you can and cannot expect from this type of investment.

Contents List

- 1 Faye Travel Insurance Overview

- 2 October 2024 Coverage Details

- 3 Policy Types and Premiums

- 4 Claims Process and Customer Support

- 5 Comparison with Other Travel Insurance Providers: Faye Travel Insurance October 2024 Coverage Details

- 6 Travel Insurance Tips and Best Practices

- 7 FAQs and Common Concerns

- 8 Concluding Remarks

- 9 Question & Answer Hub

Faye Travel Insurance Overview

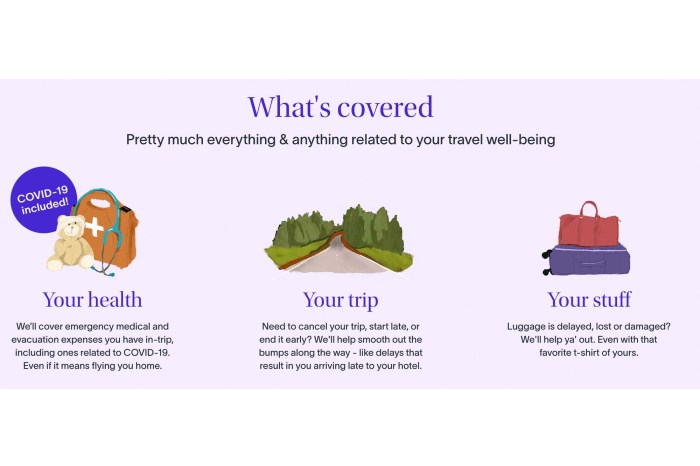

Faye Travel Insurance is designed to provide peace of mind to travelers by offering comprehensive coverage against unexpected events that may occur during their trips. Whether you’re embarking on a short getaway or a long-term adventure, Faye Travel Insurance aims to protect you financially and ensure you can enjoy your journey without worry.

If you’re wondering how much annuity you can get for $100,000, you can find out by checking out How Much Annuity For 100 000 2024. This can help you plan for your retirement income.

Key Benefits and Selling Points

Faye Travel Insurance offers a range of benefits that cater to various travel needs. Some key features include:

- Medical Expenses Coverage:Faye Travel Insurance covers medical expenses incurred due to illness or injury during your trip, including hospitalization, emergency medical evacuation, and repatriation.

- Trip Cancellation and Interruption Coverage:If unforeseen circumstances force you to cancel or interrupt your trip, Faye Travel Insurance can reimburse you for non-refundable travel expenses.

- Baggage Loss and Damage Coverage:Faye Travel Insurance protects your belongings against loss, theft, or damage during your travels.

- Personal Liability Coverage:Faye Travel Insurance provides protection against legal liability for accidental injury or damage to third parties.

- 24/7 Emergency Assistance:Faye Travel Insurance offers round-the-clock emergency assistance services, providing support and guidance during unexpected situations.

Target Audience

Faye Travel Insurance is designed for individuals and families planning to travel abroad or domestically. It’s particularly suitable for:

- Frequent travelers who seek comprehensive coverage for their trips.

- Individuals traveling to destinations with high medical costs.

- Families with children or seniors who require additional protection.

- Travelers engaging in adventurous activities or sports.

October 2024 Coverage Details

Faye Travel Insurance offers tailored coverage plans to meet the specific needs of travelers. Here’s a breakdown of the coverage details for October 2024:

Key Inclusions

- Medical Expenses:Up to [insert amount] for medical expenses incurred due to illness or injury, including hospitalization, surgery, and emergency medical evacuation.

- Trip Cancellation and Interruption:Up to [insert amount] for non-refundable travel expenses incurred due to covered reasons, such as illness, injury, or natural disasters.

- Baggage Loss and Damage:Up to [insert amount] for lost or damaged baggage, including personal belongings and electronics.

- Personal Liability:Up to [insert amount] for legal liability for accidental injury or damage to third parties.

- Emergency Assistance:24/7 emergency assistance services, including medical referrals, translation services, and emergency travel arrangements.

Key Exclusions, Faye Travel Insurance October 2024 Coverage Details

It’s important to note that Faye Travel Insurance does not cover all travel-related risks. Some common exclusions include:

- Pre-existing medical conditions unless specifically covered under a separate rider.

- Travel-related activities deemed high-risk, such as extreme sports or dangerous activities.

- Losses due to war, terrorism, or political unrest.

- Losses resulting from negligence or intentional acts.

Coverage Limitations and Restrictions

- Age Limits:There may be age limits for certain coverage options, especially for seniors or children.

- Trip Duration:The maximum trip duration covered by Faye Travel Insurance may vary depending on the policy type.

- Destination Restrictions:Some destinations may have specific coverage limitations or exclusions.

Policy Types and Premiums

Faye Travel Insurance offers a range of policy types to cater to different travel needs and budgets. Here’s a comparison of the available options, their coverage details, and premium costs:

| Policy Type | Coverage Details | Premium (USD) |

|---|---|---|

| Basic | Medical Expenses, Trip Cancellation, Baggage Loss | [insert premium amount] |

| Standard | Basic Coverage + Personal Liability, Emergency Assistance | [insert premium amount] |

| Premium | Standard Coverage + Enhanced Medical Expenses, Trip Interruption | [insert premium amount] |

Claims Process and Customer Support

Filing a claim with Faye Travel Insurance is straightforward. Here’s a step-by-step guide:

Steps Involved in Filing a Claim

- Notify Faye Travel Insurance:Contact Faye Travel Insurance immediately upon the occurrence of a covered event.

- Gather Necessary Documentation:Collect relevant documentation, such as medical bills, receipts, and police reports, as proof of loss.

- Submit Claim Form:Complete and submit the claim form along with supporting documentation to Faye Travel Insurance.

- Claim Processing:Faye Travel Insurance will review your claim and process it within a reasonable timeframe.

- Claim Payment:Once approved, Faye Travel Insurance will issue payment for covered expenses directly to you or the relevant service provider.

Claim Processing Timeframe

The claim processing timeframe may vary depending on the complexity of the claim and the availability of required documentation. However, Faye Travel Insurance strives to process claims efficiently and promptly.

When traveling, it’s important to have the right insurance to protect yourself. Essential travel insurance for October 2024 can help you understand what coverage is necessary for your trip.

Customer Support Channels

Faye Travel Insurance offers various customer support channels to assist travelers with their insurance needs:

- Phone:[insert phone number]

- Email:[insert email address]

- Website:[insert website address]

- Live Chat:[insert live chat availability information]

Comparison with Other Travel Insurance Providers: Faye Travel Insurance October 2024 Coverage Details

Faye Travel Insurance competes with several other prominent travel insurance providers in the market. Here’s a comparison of Faye Travel Insurance with some key competitors, highlighting their similarities and differences in coverage, pricing, and customer service:

| Provider | Coverage Features | Pricing | Customer Service |

|---|---|---|---|

| Faye Travel Insurance | [Insert key coverage features] | [Insert pricing information] | [Insert customer service details] |

| [Competitor 1] | [Insert key coverage features] | [Insert pricing information] | [Insert customer service details] |

| [Competitor 2] | [Insert key coverage features] | [Insert pricing information] | [Insert customer service details] |

Travel Insurance Tips and Best Practices

Travel insurance can be a valuable investment for travelers, but choosing the right plan and understanding its coverage is crucial. Here are some tips and best practices for maximizing your travel insurance benefits:

Choosing the Right Insurance Plan

- Assess Your Travel Needs:Consider your destination, trip duration, activities, and medical history when choosing a plan.

- Compare Coverage Options:Review different insurance providers and compare their coverage details, premiums, and customer service.

- Read the Policy Carefully:Pay close attention to the policy’s terms and conditions, including exclusions, limitations, and claim procedures.

Maximizing Coverage and Minimizing Risks

- Purchase Insurance Early:It’s generally advisable to purchase travel insurance as soon as you book your trip to ensure coverage for cancellations or interruptions.

- Keep Important Documents Safe:Store your insurance policy details, emergency contact information, and passport safely.

- Be Aware of Your Destination:Research your destination and familiarize yourself with local customs, laws, and potential risks.

FAQs and Common Concerns

Here are some frequently asked questions and common concerns regarding Faye Travel Insurance:

Q: What happens if I need to cancel my trip due to a medical emergency?

A: Faye Travel Insurance covers trip cancellation due to covered medical emergencies, such as illness or injury. You’ll need to provide supporting documentation from a medical professional to support your claim.

Allianz is a well-known provider of travel insurance. If you’re planning international travel, you might want to check out Allianz Travel Insurance October 2024 for International Travel to learn about their coverage options.

Q: Does Faye Travel Insurance cover pre-existing medical conditions?

A: Faye Travel Insurance may cover pre-existing medical conditions if they are declared during the application process and approved by the insurer. You may need to purchase a separate rider for pre-existing condition coverage.

Traveling with pre-existing conditions can be stressful, but you can find peace of mind with the right insurance. Check out Medical travel insurance for pre-existing conditions in October 2024 to learn about coverage options that can protect you.

Q: What if my luggage is lost or damaged during my trip?

A: Faye Travel Insurance offers baggage loss and damage coverage. You’ll need to report the loss or damage to the airline or transportation provider and file a claim with Faye Travel Insurance, providing supporting documentation.

Excel can be a valuable tool for managing your finances, including calculating annuity present values. Learn more about Calculating Annuity Present Value In Excel 2024 to get a better understanding of your potential retirement income.

Q: How do I contact Faye Travel Insurance in case of an emergency?

A: Faye Travel Insurance provides 24/7 emergency assistance services. You can contact them via phone, email, or website for immediate support and guidance.

Seniors have unique travel insurance needs. Travel health insurance for seniors in October 2024 can provide coverage for medical emergencies, trip cancellations, and other unforeseen events.

Concluding Remarks

With Faye Travel Insurance October 2024 Coverage Details, you can embark on your journey with confidence, knowing you have a reliable safety net in place. By understanding the coverage specifics, policy options, and claims process, you can make the most of your travel insurance and ensure a worry-free experience.

If you’re looking for variable annuity life insurance in Amarillo, TX, you can find a company that can help. Variable Annuity Life Insurance Company Amarillo Tx 2024 can provide you with the information you need to make an informed decision.

Remember, travel insurance is an investment in your peace of mind, and Faye Travel Insurance offers a comprehensive solution to protect your travels.

Question & Answer Hub

What is the maximum coverage amount for medical expenses?

If you’re considering a variable annuity, you might want to check out a Variable Annuity Jackson National Review 2024. This review can help you understand the potential benefits and risks of variable annuities, as well as how they compare to other retirement savings options.

The maximum coverage amount for medical expenses varies depending on the policy type and plan chosen. It’s essential to review the policy details to determine the specific coverage limits.

Does Faye Travel Insurance cover pre-existing conditions?

Coverage for pre-existing conditions may be limited or excluded. It’s crucial to disclose any pre-existing medical conditions during the application process to ensure proper coverage.

If you’re planning an adventure trip, you’ll want to make sure you’re protected. Medical travel insurance for adventure travelers in October 2024 can provide coverage for a wide range of activities, from hiking and skiing to scuba diving and white-water rafting.

What happens if my trip is interrupted due to unforeseen circumstances?

Faye Travel Insurance provides coverage for trip interruption due to unforeseen circumstances, such as medical emergencies, natural disasters, or family emergencies. The policy details Artikel the specific circumstances covered and the reimbursement process.

How do I file a claim with Faye Travel Insurance?

You can file a claim online, by phone, or by mail. The policy details provide specific instructions on the claim filing process, including the required documentation.

Variable annuities can be complex, and it’s important to understand how they work before investing. You might find it helpful to learn How To Calculate A Growing Annuity 2024. This can help you make informed decisions about your retirement savings.

The variable annuity market has been evolving. If you’re interested in understanding the trends, you can check out Variable Annuity Sales 2019 2024 to see how sales have changed over the past few years.

Aditya Birla is another provider of travel insurance. You can learn more about their coverage options by visiting Aditya Birla Travel Insurance October 2024 Policy Details.

It’s always a good idea to have travel insurance that covers medical emergencies. Travel insurance for medical emergencies in October 2024 can provide you with peace of mind while you’re traveling.