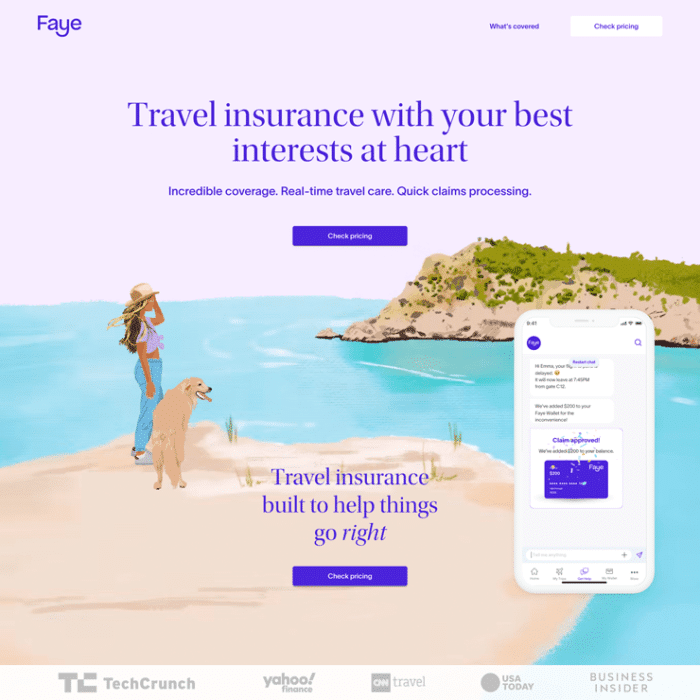

Faye Travel Insurance October 2024 for Solo Travelers offers a comprehensive solution for those seeking peace of mind while exploring the world independently. As a solo traveler, you crave freedom and adventure, but you also want the security of knowing you’re protected in case of unexpected events.

The International Financial Reporting Standards (IFRS) 17 has brought significant changes to the insurance industry. Learn how this standard impacts variable annuities by visiting Variable Annuity Ifrs 17 2024.

Faye Travel Insurance understands this need and provides a range of coverage options designed specifically for the independent explorer.

Traveling to Europe in October 2024? Allianz Travel Insurance offers comprehensive coverage for various situations. Learn more about the specific details of their coverage by visiting Allianz Travel Insurance October 2024 Coverage Details.

Whether you’re planning a backpacking trip through Southeast Asia, a city break in Europe, or a road trip across the American Southwest, Faye Travel Insurance can help you navigate the complexities of solo travel with confidence. This guide will delve into the key features and benefits of Faye Travel Insurance, addressing the unique challenges and risks faced by solo travelers in October 2024.

An immediate annuity is a type of insurance product that provides a guaranteed stream of income for life. It’s a great option for those looking for financial security in retirement. Learn more about the details and benefits of immediate annuities by visiting What Is Immediate Annuities.

Contents List

- 1 Faye Travel Insurance Overview

- 2 Solo Travel Considerations in October 2024

- 3 Faye Travel Insurance Benefits for Solo Travelers

- 4 Comparison with Other Travel Insurance Options

- 5 Tips for Choosing the Right Travel Insurance

- 6 Closing Notes: Faye Travel Insurance October 2024 For Solo Travelers

- 7 Helpful Answers

Faye Travel Insurance Overview

Faye Travel Insurance is a comprehensive travel insurance plan designed to provide peace of mind and financial protection for travelers, particularly solo adventurers. Faye Travel Insurance is designed to cater to the specific needs of solo travelers, offering a range of coverage options that address the unique challenges and risks they may encounter on their journeys.

Retirement planning involves making informed decisions about your investments. Discover potential annuity returns for 2024 by visiting 7 Annuity Return 2024.

Key Features and Benefits

Faye Travel Insurance offers a comprehensive suite of features and benefits, including:

- Medical Expenses Coverage:Faye Travel Insurance provides coverage for medical expenses incurred during your trip, including emergency medical evacuation, hospitalization, and doctor’s visits.

- Trip Cancellation and Interruption Coverage:Faye Travel Insurance can reimburse you for non-refundable trip expenses if you have to cancel or interrupt your trip due to unforeseen circumstances, such as illness, injury, or family emergencies.

- Baggage Loss and Damage Coverage:Faye Travel Insurance provides protection against loss or damage to your baggage during your trip, offering reimbursement for the value of your belongings.

- Emergency Assistance Services:Faye Travel Insurance provides 24/7 emergency assistance services, including translation assistance, legal advice, and medical referral services.

Target Audience and Solo Traveler Focus

Faye Travel Insurance is specifically designed for solo travelers, recognizing their unique needs and potential risks. The plan’s coverage options are tailored to address the specific challenges faced by individuals traveling alone, such as:

- Increased Vulnerability:Solo travelers may be more susceptible to certain risks, such as theft or scams. Faye Travel Insurance provides coverage that can help mitigate these risks.

- Limited Support:Solo travelers may not have the same level of support as those traveling in groups. Faye Travel Insurance’s emergency assistance services provide a safety net for solo travelers.

- Financial Concerns:Solo travelers may be more concerned about the financial implications of unforeseen events. Faye Travel Insurance offers comprehensive coverage to protect against financial losses.

Solo Travel Considerations in October 2024

Solo travel in October 2024 presents both exciting opportunities and potential challenges. It is crucial to be aware of the unique considerations and risks associated with solo travel during this time.

Looking for a variable annuity with a solid reputation? The American Legacy Signature 1 Variable Annuity might be worth exploring. Check out American Legacy Signature 1 Variable Annuity 2024 for more information on this product.

Travel Disruptions and Safety Concerns, Faye Travel Insurance October 2024 for Solo Travelers

October 2024 could witness potential travel disruptions due to factors such as:

- Hurricane Season:Many popular travel destinations are located in hurricane-prone regions. It’s essential to be aware of weather forecasts and potential disruptions.

- Peak Travel Season:October is a popular month for travel, which can lead to crowded destinations, higher prices, and potential delays.

- Political Unrest:Political instability in certain regions could impact travel plans. It’s important to stay informed about current events and travel advisories.

Solo travelers should be particularly mindful of safety concerns, including:

- Increased Risk of Theft:Solo travelers may be more vulnerable to theft, especially in crowded tourist areas. It’s important to take precautions to protect your belongings.

- Scams and Fraud:Solo travelers may be more susceptible to scams and fraud. Be cautious about who you trust and avoid sharing personal information with strangers.

- Language Barriers:Solo travelers may encounter language barriers, making it difficult to communicate with locals or seek assistance in emergencies.

Travel Trends and Popular Destinations

October 2024 is expected to see continued popularity for solo travel destinations such as:

- Southeast Asia:Countries like Thailand, Vietnam, and Indonesia offer a rich cultural experience and affordable travel options.

- Europe:Popular destinations like Italy, Spain, and France offer stunning scenery, historical sites, and vibrant cities.

- Latin America:Countries like Peru, Colombia, and Mexico offer unique experiences and affordable travel options.

Faye Travel Insurance Benefits for Solo Travelers

Faye Travel Insurance provides significant benefits for solo travelers, offering peace of mind and financial protection during their journeys. The plan’s coverage options can mitigate risks and provide support in unexpected situations.

Traveling solo in October 2024? Don’t forget to secure your peace of mind with travel health insurance. Travel health insurance for last minute trips in October 2024 can provide coverage for medical emergencies, evacuation, and other unexpected events, ensuring you can focus on enjoying your trip.

Mitigating Risks and Providing Peace of Mind

Faye Travel Insurance offers a range of coverage options that can help solo travelers mitigate risks and travel with confidence. These include:

- Medical Expenses Coverage:In case of medical emergencies, Faye Travel Insurance covers medical expenses, ensuring that solo travelers don’t face significant financial burdens.

- Trip Cancellation and Interruption Coverage:Faye Travel Insurance provides reimbursement for non-refundable trip expenses if a solo traveler has to cancel or interrupt their trip due to unforeseen circumstances.

- Emergency Assistance Services:Faye Travel Insurance’s 24/7 emergency assistance services offer a safety net for solo travelers, providing support and guidance in challenging situations.

Real-Life Examples and Case Studies

Consider the case of Sarah, a solo traveler who experienced a medical emergency while hiking in the Andes Mountains. Faye Travel Insurance covered her medical expenses, including emergency evacuation and hospitalization, ensuring that she received the necessary care without facing significant financial hardship.

Annuity payouts can be a significant source of income, especially if you’re aiming for a comfortable retirement. Find out how an annuity can potentially help you reach your financial goals by exploring Annuity 2 Million 2024.

Another example is John, a solo traveler who had to cancel his trip to Europe due to a family emergency. Faye Travel Insurance reimbursed him for his non-refundable flight and accommodation expenses, minimizing his financial losses.

Variable annuities can offer growth potential while providing income in retirement. Learn more about the potential benefits and risks of variable annuities by visiting Variable Annuity Blocks 2024.

Comparison with Other Travel Insurance Options

Faye Travel Insurance stands out among other travel insurance providers catering to solo travelers. It offers a competitive combination of comprehensive coverage, competitive pricing, and excellent customer service.

Immediate annuities can be a valuable tool for retirement planning. If you’re interested in learning more about them in Hindi, visit Immediate Annuity Ka Hindi.

Strengths and Weaknesses of Faye Travel Insurance

Faye Travel Insurance’s strengths include:

- Comprehensive Coverage:Faye Travel Insurance offers a wide range of coverage options, including medical expenses, trip cancellation, baggage loss, and emergency assistance.

- Competitive Pricing:Faye Travel Insurance offers competitive pricing compared to other travel insurance providers.

- Excellent Customer Service:Faye Travel Insurance is known for its responsive and helpful customer service, providing support to travelers throughout their journeys.

While Faye Travel Insurance offers many benefits, it’s important to consider potential weaknesses:

- Limited Coverage for Certain Activities:Some travel insurance plans offer more extensive coverage for specific activities, such as adventure sports or extreme travel. Solo travelers engaging in these activities should carefully review the coverage details.

- Exclusions and Limitations:Like all travel insurance plans, Faye Travel Insurance has certain exclusions and limitations. It’s crucial to review the policy details carefully to understand what is and is not covered.

Comparison Table

| Feature | Faye Travel Insurance | Competitor A | Competitor B |

|---|---|---|---|

| Medical Expenses Coverage | Up to $1,000,000 | Up to $500,000 | Up to $750,000 |

| Trip Cancellation Coverage | 100% of non-refundable expenses | 75% of non-refundable expenses | 90% of non-refundable expenses |

| Baggage Loss Coverage | $1,000 per item | $500 per item | $750 per item |

| Emergency Assistance Services | 24/7 support | 24/7 support | Limited hours |

| Pricing (Example) | $50 per trip | $40 per trip | $60 per trip |

Tips for Choosing the Right Travel Insurance

Choosing the right travel insurance plan is crucial for solo travelers, ensuring that they have the necessary protection during their journeys. Consider the following factors when selecting a plan:

Factors to Consider

- Budget:Travel insurance plans vary in price, so it’s important to choose a plan that fits your budget. Consider the level of coverage you need and compare prices from different providers.

- Destination:The destination you’re traveling to can influence the type of coverage you need. Some destinations may have higher risks of medical emergencies or political instability, requiring more comprehensive coverage.

- Travel Activities:If you plan to engage in adventure sports or other high-risk activities, ensure that your travel insurance plan covers those activities. Some plans may have exclusions or limitations for certain activities.

- Pre-existing Conditions:If you have pre-existing medical conditions, it’s crucial to disclose them to the travel insurance provider. Some plans may have exclusions or limitations for pre-existing conditions.

Decision Tree

Use the following decision tree to guide your selection of the right travel insurance plan:

- Determine your budget:How much are you willing to spend on travel insurance?

- Identify your destination:Where are you traveling to?

- Assess your travel activities:Are you engaging in any high-risk activities?

- Disclose pre-existing conditions:Do you have any pre-existing medical conditions?

- Compare plans:Compare different travel insurance plans based on your needs and budget.

- Choose the best plan:Select the travel insurance plan that provides the most comprehensive coverage at a price you can afford.

Closing Notes: Faye Travel Insurance October 2024 For Solo Travelers

Choosing the right travel insurance is an essential step in planning any solo trip, and Faye Travel Insurance stands out as a reliable and comprehensive option. By understanding your individual needs and comparing coverage options, you can find the perfect plan to ensure a safe and worry-free adventure.

Whether you’re seeking medical protection, trip cancellation coverage, or emergency assistance, Faye Travel Insurance offers the peace of mind you need to embrace the freedom of solo travel.

Medical emergencies can happen anywhere, even on vacation. John Hancock offers travel insurance that can provide peace of mind during your trip. Discover their specific coverage for medical emergencies by visiting John Hancock Travel Insurance October 2024 for Medical Emergencies.

Helpful Answers

What are the key benefits of Faye Travel Insurance for solo travelers in October 2024?

If you’ve recently purchased an immediate annuity, congratulations! This decision can provide a steady income stream for your future. You can find more information on An Immediate Annuity Has Been Purchased to understand the implications and benefits of your purchase.

Faye Travel Insurance offers comprehensive coverage for solo travelers, including medical expenses, trip cancellation, baggage loss, and emergency assistance. Their plans are designed to address the specific needs of solo travelers, providing peace of mind and financial protection in case of unforeseen events.

What are the most common travel disruptions and safety concerns for solo travelers in October 2024?

Planning for retirement? Annuity calculations can be complex, but spreadsheets like Excel can make the process easier. Check out Pv Annuity Excel 2024 for helpful insights and resources on using Excel for annuity calculations.

Solo travelers in October 2024 may face challenges related to weather, natural disasters, political instability, and travel disruptions. It’s important to stay informed about potential risks and to have a plan in place to address any unexpected situations.

How does Faye Travel Insurance compare to other travel insurance providers for solo travelers?

Faye Travel Insurance stands out for its comprehensive coverage, competitive pricing, and excellent customer service. When comparing Faye Travel Insurance to other providers, consider factors such as coverage options, pricing, and customer reviews to find the best fit for your individual needs.

Traveling in October 2024 and worried about lost luggage? Travel insurance can provide coverage for such unexpected events. Find out more about travel insurance for lost luggage by visiting Travel insurance for lost luggage in October 2024.

ABSLI offers a range of financial products, including immediate annuities. Learn more about their immediate annuity offerings by visiting Immediate Annuity Absli.

Traveling solo can be an amazing experience, but it’s essential to be prepared for any medical emergencies. Medical travel insurance can provide peace of mind during your trip. Explore options for solo travelers in October 2024 by visiting Medical travel insurance for solo travelers in October 2024.