FHA Interest Rates 2024 are a crucial factor for anyone considering purchasing a home with government-backed financing. Understanding the current rates and how they are influenced by market conditions is essential for making informed financial decisions. This guide delves into the intricacies of FHA interest rates, exploring the factors that drive them, historical trends, and a comparison with conventional mortgage rates.

Taking advantage of the VA home loan benefits 2024 can help you achieve homeownership. From low interest rates to no down payment options, VA loans can be a great choice for eligible veterans.

Navigating the world of FHA loans can be complex, but this comprehensive overview aims to simplify the process by providing insights into eligibility requirements, loan limits, and the step-by-step application procedure.

Looking for stability and predictability in your mortgage payments? A fixed interest rate 2024 mortgage can offer you peace of mind by locking in your interest rate for the life of the loan.

Contents List

FHA Loan Basics: Fha Interest Rates 2024

The Federal Housing Administration (FHA) offers government-backed loans designed to make homeownership more accessible for individuals with lower credit scores or a smaller down payment. FHA loans are popular choices for first-time homebuyers and those seeking to refinance their existing mortgage.

USAA offers a variety of financial products and services for its members, including home equity lines of credit (HELOCs). If you’re looking for a USAA HELOC 2024 , you can learn more about the terms and rates offered by USAA.

This article will delve into the intricacies of FHA loans, covering their purpose, benefits, eligibility requirements, current loan limits, interest rates, and the loan process.

Understanding the current house mortgage rates 2024 is crucial for making informed decisions about your home purchase. We’ve compiled the latest information on rates, so you can find the best fit for your financial situation.

Purpose and Benefits of FHA Loans

FHA loans are designed to assist individuals who may not qualify for conventional mortgages due to lower credit scores or limited down payments. These loans provide a pathway to homeownership for those who might otherwise struggle to secure financing. The primary benefits of FHA loans include:

- Lower Down Payment Requirements: FHA loans typically require a down payment of as low as 3.5% of the purchase price, compared to the 20% down payment often required for conventional loans. This lower barrier to entry makes homeownership more attainable for many borrowers.

Are you a veteran looking to buy a home? The current VA loan rates 2024 offer competitive interest rates and other benefits to eligible veterans. Learn more about how a VA loan can help you achieve your homeownership goals.

- More Lenient Credit Score Requirements: FHA loans have more flexible credit score requirements than conventional loans, making them a suitable option for borrowers with less-than-perfect credit history. While the minimum credit score for FHA loans varies by lender, it generally falls below the requirements for conventional loans.

If you’re looking to tap into your home’s equity, a home equity line of credit (HELOC) might be a good option. Learn about the current home equity line of credit interest rates 2024 to see if this is a good fit for your financial goals.

- Government-Backed Security: FHA loans are insured by the Federal Housing Administration, which provides lenders with additional security in case of default. This insurance can make lenders more willing to approve loans for borrowers with lower credit scores or a smaller down payment.

In today’s digital age, many lenders offer their services online. Check out our list of online mortgage lenders 2024 to find the best option for your needs.

- Flexible Housing Options: FHA loans can be used to purchase a variety of housing types, including single-family homes, townhouses, condominiums, and manufactured homes. This versatility allows borrowers to find a home that meets their specific needs and budget.

FHA Loan Eligibility Requirements

To qualify for an FHA loan, borrowers must meet certain eligibility requirements, including:

- Credit Score: Borrowers must have a minimum credit score, which can vary by lender. However, a score of at least 580 is generally required to qualify for the lowest down payment of 3.5%.

- Debt-to-Income Ratio (DTI): The DTI, which represents the percentage of monthly income used to pay debts, must be below a certain threshold. Lenders typically prefer a DTI of 43% or less for FHA loans.

- Income Documentation: Borrowers must provide documentation of their income, including pay stubs, tax returns, and other relevant financial records.

- Employment History: Lenders typically require a stable employment history, with a minimum of two years of consistent employment.

- Down Payment: The minimum down payment for FHA loans is 3.5% of the purchase price. Borrowers with credit scores below 580 may be required to make a larger down payment.

- Property Requirements: The property being purchased must meet certain FHA guidelines, including structural soundness, safety, and habitability.

Current FHA Loan Limits for Various Regions, Fha Interest Rates 2024

FHA loan limits are set by the Federal Housing Administration and vary based on the geographic location of the property. These limits represent the maximum loan amount that can be provided for an FHA-insured mortgage. Here are the current FHA loan limits for various regions:

| Region | Single-Family Home Limit |

|---|---|

| Low-Cost Areas | $364,200 |

| High-Cost Areas | $822,375 |

Note: These limits are subject to change and may vary depending on the specific county or metropolitan statistical area (MSA). It is essential to consult with a lender or mortgage broker for the most up-to-date FHA loan limits in your area.

FHA Interest Rates in 2024

FHA interest rates, like other mortgage rates, fluctuate based on a variety of economic factors. Understanding the factors that influence FHA interest rates is crucial for borrowers seeking to secure a favorable mortgage rate in 2024.

Factors Influencing FHA Interest Rates in 2024

Several factors play a significant role in shaping FHA interest rates in 2024. These include:

- Federal Reserve Monetary Policy: The Federal Reserve’s decisions on interest rates and bond purchases directly impact mortgage rates, including FHA rates. When the Fed raises interest rates, mortgage rates tend to rise, and vice versa.

- Inflation: High inflation erodes purchasing power and can lead to increased interest rates as lenders seek to protect their returns from the impact of inflation.

- Economic Growth: Strong economic growth can lead to increased demand for mortgages, potentially driving up interest rates. Conversely, a slowing economy can lead to lower interest rates as lenders become more competitive.

- Housing Market Conditions: The supply and demand dynamics in the housing market can also influence FHA interest rates. A strong housing market with limited inventory can push rates higher, while a slower market with more available properties can lead to lower rates.

Getting mortgage approval 2024 can be a complex process. We’ve compiled tips and resources to help you navigate the process and increase your chances of approval.

- Lender Competition: The level of competition among mortgage lenders can impact interest rates. Increased competition can drive down rates as lenders strive to attract borrowers with more favorable terms.

Historical Trends of FHA Interest Rates

Historically, FHA interest rates have fluctuated in line with broader economic trends. For example, FHA rates reached record lows during the 2008 financial crisis as the Federal Reserve lowered interest rates to stimulate the economy. However, rates have gradually increased in recent years, reflecting the Fed’s efforts to combat inflation.

The Veteran Home Loan 2024 program offers unique benefits to veterans, active-duty military personnel, and surviving spouses. These benefits include no down payment, no mortgage insurance, and competitive interest rates.

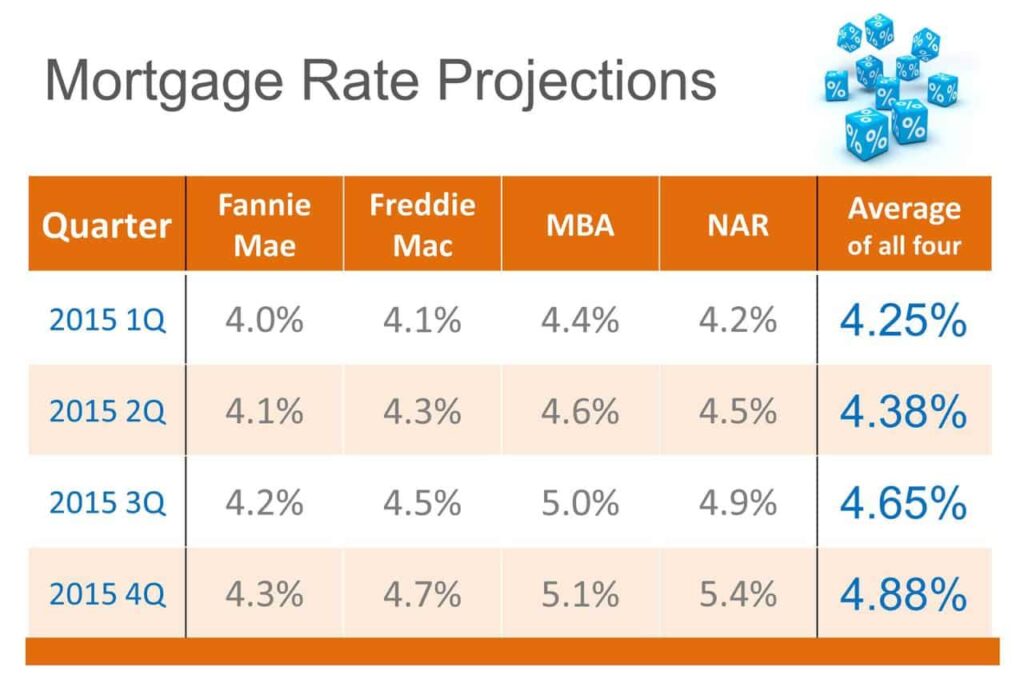

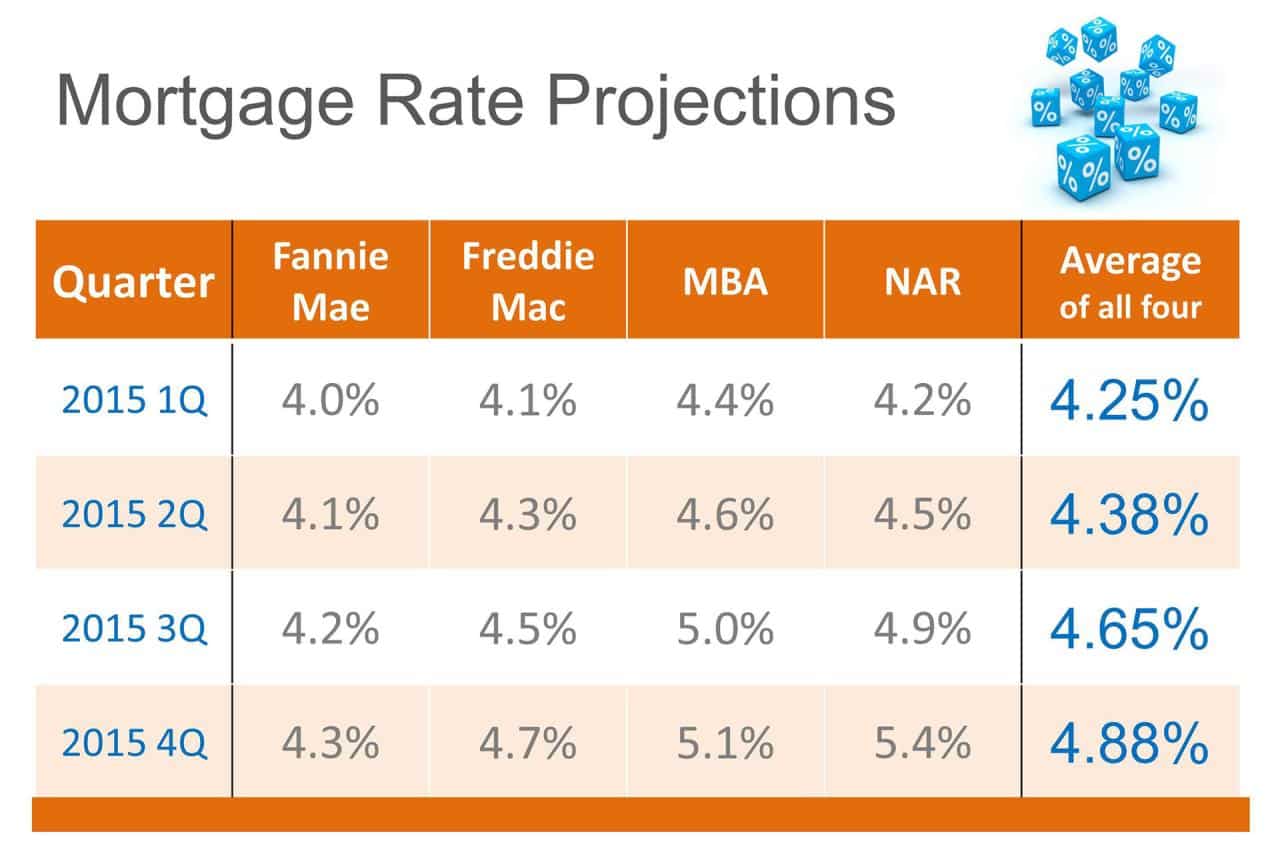

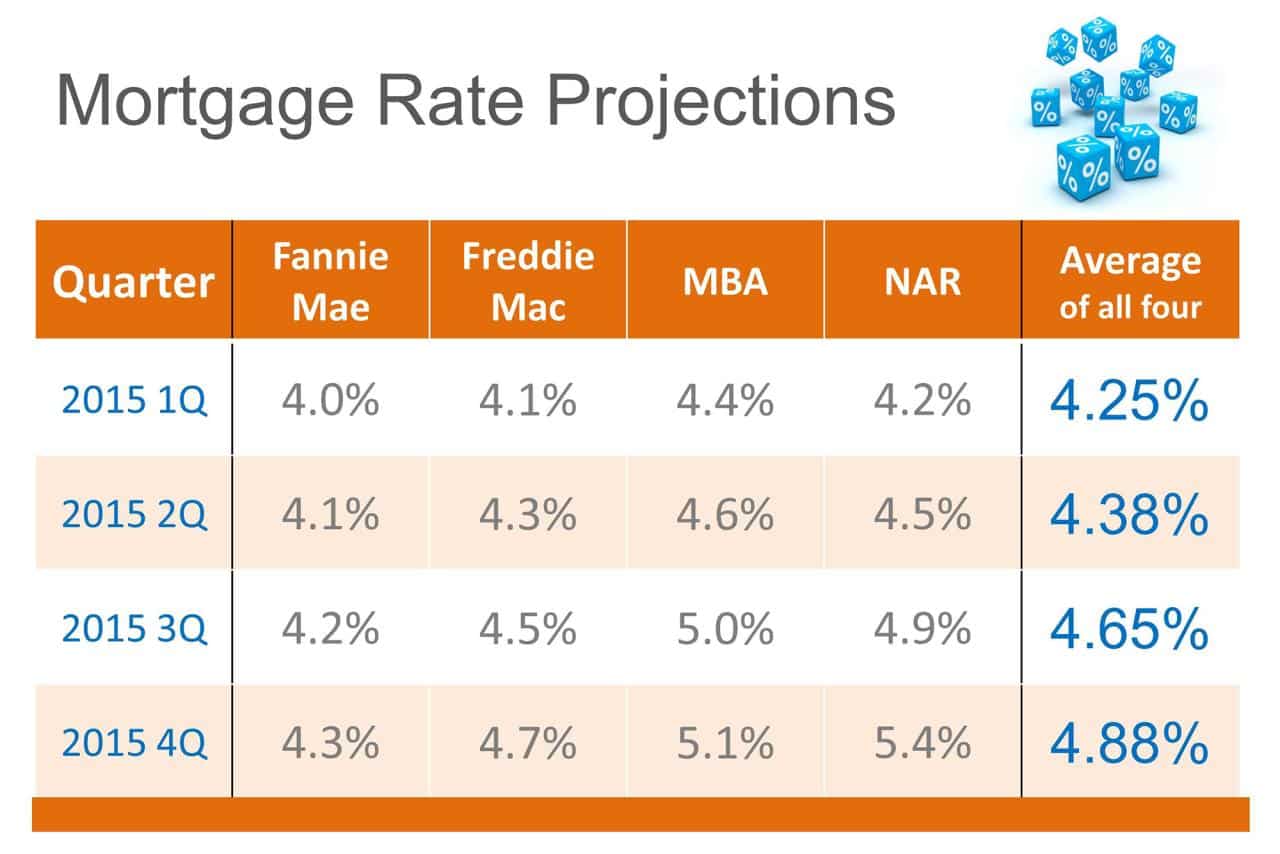

Comparison of Current FHA Interest Rates with Conventional Mortgage Rates

FHA interest rates are typically slightly higher than conventional mortgage rates due to the government insurance backing these loans. However, the difference in rates can vary depending on the borrower’s credit score, loan amount, and other factors. It is essential to compare rates from multiple lenders to find the most competitive offer.

Bank of America is a well-known lender that offers a variety of mortgage products. Check out the current BOA mortgage rates 2024 to see if they’re a good fit for you.

FHA Loan Process

The process of applying for and securing an FHA loan involves several steps, from pre-approval to closing. Understanding the key stages of the FHA loan process can help borrowers navigate the process smoothly.

Ready to start your home buying journey? Our guide to find a mortgage 2024 will help you compare lenders, rates, and options to find the best fit for your situation.

Steps Involved in Applying for an FHA Loan

The FHA loan application process typically involves the following steps:

- Pre-Approval: Getting pre-approved for an FHA loan is a crucial first step. It demonstrates to sellers that you are a serious buyer and provides an estimate of the loan amount you qualify for. Pre-approval also helps you shop for homes within your budget.

- Finding a Home: Once pre-approved, you can start searching for a home that meets your needs and fits within your budget. You should work with a real estate agent to assist in the home search process.

- Making an Offer: When you find a suitable property, you will make an offer to the seller. The offer should include your proposed purchase price, closing date, and any contingencies, such as a home inspection.

- Home Inspection: A home inspection is conducted to assess the property’s condition and identify any potential issues. The inspection report can help you negotiate repairs with the seller or decide to withdraw your offer.

- Loan Application: Once the offer is accepted, you will submit a formal loan application to your chosen lender. The lender will review your financial information, credit history, and other relevant documents.

- Loan Approval: If your application is approved, the lender will issue a loan commitment, outlining the terms of the loan, including the interest rate, loan amount, and closing costs.

- Closing: The closing process involves signing all necessary documents, transferring ownership of the property, and disbursing funds. This is typically the final step in the FHA loan process.

Documentation Required for FHA Loan Approval

To ensure a smooth and efficient loan approval process, borrowers must provide the following documentation to their lender:

- Proof of Income: This includes pay stubs, W-2 forms, tax returns, and other documents that verify your income.

- Credit Report: Lenders will obtain a copy of your credit report to assess your credit history and score.

- Bank Statements: You will need to provide recent bank statements to demonstrate your financial stability and ability to make mortgage payments.

- Employment History: You will need to provide documentation of your employment history, such as employment verification letters or pay stubs.

- Property Information: This includes the purchase agreement, property appraisal, and any other documents related to the property being purchased.

Key Differences Between FHA and Conventional Loan Processes

While the overall process for FHA and conventional loans is similar, there are some key differences:

- Eligibility Requirements: FHA loans have more lenient eligibility requirements, including lower credit score and down payment requirements.

- Mortgage Insurance: FHA loans require mortgage insurance premiums (MIP), both upfront and ongoing, to protect lenders against default. Conventional loans may require mortgage insurance if the down payment is less than 20%.

- Loan Limits: FHA loan limits are set by the Federal Housing Administration and vary by geographic location. Conventional loans have higher loan limits.

- Closing Costs: FHA loans typically have higher closing costs than conventional loans due to the upfront MIP and other fees.

Final Thoughts

As you embark on your homeownership journey, it’s vital to have a thorough understanding of FHA interest rates in 2024. This guide has equipped you with the knowledge to navigate the complexities of FHA financing, allowing you to make informed decisions about your mortgage options.

By carefully considering the factors influencing rates, exploring the application process, and understanding the associated costs and fees, you can confidently pursue your dream of homeownership.

If you’re looking to avoid closing costs, a no closing cost mortgage 2024 might be a good option for you. These mortgages can save you thousands of dollars in upfront costs, making homeownership more affordable.

FAQ Section

What are the current FHA interest rates?

Looking for a way to buy a home with no money down? A 0 down mortgage 2024 might be the answer. While these mortgages come with certain requirements, they can be a great way to get into a home sooner.

FHA interest rates fluctuate daily. To get the most up-to-date information, consult with a reputable mortgage lender.

Looking for the best deal on a mortgage in 2024? You’re in the right place! We’ve compiled a list of the cheapest mortgage rates 2024 to help you find the best option for your needs. From fixed-rate mortgages to adjustable-rate mortgages, we’ve got you covered.

How do FHA interest rates compare to conventional loans?

FHA loans typically have lower interest rates than conventional loans, but they also come with mortgage insurance premiums.

Getting the cheapest home loan rates 2024 is a top priority for most homebuyers. We can help you compare rates from different lenders to find the best deal for you.

What is the maximum loan amount for an FHA loan?

FHA loan limits vary by region and are adjusted annually. You can find the current limits on the FHA website.

What are the benefits of an FHA loan?

FHA loans offer lower down payment requirements, more lenient credit score guidelines, and flexible debt-to-income ratios, making homeownership more accessible for a wider range of borrowers.