Financial Calculator Annuity 2024 takes center stage, guiding you through the intricacies of annuities and their role in financial planning. Annuities, a financial instrument that provides a stream of regular payments, have become increasingly popular as individuals seek secure and predictable income streams, particularly during retirement.

Annuity King is a company that specializes in annuities and offers a range of products and services. If you’re interested in learning more about their services in Sarasota, you can check out this article: Annuity King Sarasota 2024. This article provides information about their services, including their contact details and other relevant information.

This guide delves into the world of annuities, exploring their various types, benefits, risks, and the essential role financial calculators play in their analysis. We’ll examine how market conditions and factors like inflation and investment returns impact annuity calculations in 2024, providing practical insights for making informed financial decisions.

While annuities can be a valuable tool for retirement planning, they’re not always the best choice for everyone. To understand the potential drawbacks and risks associated with annuities, you can read this article: Annuity Is Bad 2024. This article provides a balanced perspective on the pros and cons of annuities, helping you make an informed decision.

Understanding annuities is crucial for anyone seeking to plan for their future. Whether you’re approaching retirement, looking to supplement your income, or seeking long-term care protection, annuities offer a range of options to meet your specific needs. This guide will equip you with the knowledge to navigate the complexities of annuity calculations and explore the various tools available, including financial calculators and online resources, to make informed choices about your financial future.

For those living in the UK, it’s important to understand the tax implications of annuities. You can find information about whether annuity income is taxable in the UK in this article: Is Annuity Income Taxable In Uk 2024. This article explains the relevant tax rules and provides guidance on managing your tax obligations.

Contents List

Understanding Annuities: Financial Calculator Annuity 2024

An annuity is a financial product that provides a stream of regular payments over a specified period of time. Annuities are commonly used in financial planning to ensure a steady income stream during retirement or to protect against financial risks.

They can be a valuable tool for individuals seeking to secure their financial future.

One of the key considerations when choosing an annuity is its flexibility. To understand if annuities offer flexibility in terms of payment options and other aspects, you can refer to this article: Is Annuity Flexible 2024. This article explores the different types of annuities and their respective flexibility levels.

Types of Annuities

Annuities come in various forms, each with its unique features and benefits. The most common types include:

- Fixed Annuities:These annuities offer guaranteed interest rates, providing a predictable income stream. They are suitable for individuals seeking stability and a known return on their investment.

- Variable Annuities:These annuities offer the potential for higher returns but also carry greater risk. The interest rate and payout are linked to the performance of underlying investments, such as stocks or bonds.

- Immediate Annuities:These annuities start making payments immediately after the purchase. They are ideal for individuals seeking immediate income, such as retirees.

- Deferred Annuities:These annuities start making payments at a later date, often during retirement. They allow individuals to accumulate funds over time and receive a steady income stream during their golden years.

Key Features and Benefits of Annuities

Annuities offer several key features and benefits that make them an attractive option for financial planning:

- Guaranteed Income:Fixed annuities provide a guaranteed income stream, eliminating the uncertainty of market fluctuations.

- Tax Advantages:Depending on the type of annuity, the income generated can be tax-deferred or tax-free.

- Protection Against Longevity Risk:Annuities can provide a lifetime income stream, ensuring financial security even if you live longer than expected.

- Flexibility:Annuities offer various options for customization, allowing individuals to tailor their payments and investment strategies to their specific needs.

Risks Associated with Annuities

While annuities offer numerous benefits, it’s crucial to understand the associated risks:

- Limited Liquidity:Accessing funds from an annuity before the payout period can result in penalties.

- Interest Rate Risk:Fixed annuities may not keep pace with inflation, leading to a decrease in purchasing power over time.

- Market Risk:Variable annuities are subject to market fluctuations, which can affect the value of your investment and your future payments.

- Fees and Charges:Annuities often involve various fees, such as surrender charges, administrative fees, and mortality and expense charges.

Financial Calculators for Annuities

Financial calculators are invaluable tools for analyzing and understanding annuities. They provide a comprehensive framework for calculating various annuity parameters, helping individuals make informed financial decisions.

If you’re considering an annuity with a specific amount, such as $75,000, this article: Annuity 75000 2024 can provide insights into the potential payouts and other aspects of this type of annuity. Understanding the specifics of an annuity with a specific amount can help you make informed financial decisions.

Popular Financial Calculator Models

Several popular financial calculator models support annuity calculations, including:

- Texas Instruments BA II Plus Professional:This is a widely used financial calculator that offers a comprehensive range of functions for annuity analysis, including present value, future value, and payment calculations.

- HP 12C:Another popular financial calculator known for its user-friendly interface and powerful capabilities for annuity calculations.

- Casio FC-200V:This calculator is specifically designed for financial applications and provides dedicated functions for annuity calculations.

Key Functions and Features, Financial Calculator Annuity 2024

These financial calculators typically offer the following key functions and features for annuity analysis:

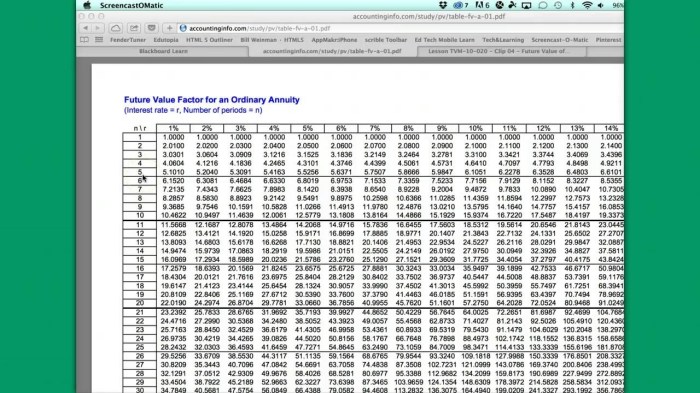

- Present Value (PV):Calculates the present value of an annuity, which represents the lump sum amount needed today to generate a future stream of payments.

- Future Value (FV):Calculates the future value of an annuity, representing the total amount accumulated at the end of the payout period.

- Payment (PMT):Calculates the regular payment amount for an annuity, based on the present value, future value, interest rate, and time period.

- Interest Rate (I/Y):Represents the annual interest rate applied to the annuity.

- Number of Periods (N):Represents the total number of payment periods for the annuity.

Step-by-Step Guide

Here’s a step-by-step guide on using a financial calculator to calculate annuity payments:

- Input the known values:Enter the present value (PV), future value (FV), interest rate (I/Y), and number of periods (N) into the calculator.

- Select the appropriate mode:Ensure that the calculator is set to the correct mode for annuity calculations, such as “END” for payments at the end of each period or “BEGIN” for payments at the beginning of each period.

- Calculate the payment:Press the “PMT” button to calculate the regular payment amount.

Limitations and Considerations

While financial calculators are powerful tools, they have limitations:

- Simplicity:Calculators may not account for all the complexities of real-world annuity scenarios, such as taxes, fees, and investment performance.

- Limited Customization:Calculators may not offer the flexibility to customize calculations based on specific individual needs or market conditions.

- Learning Curve:Using a financial calculator effectively requires understanding its functions and features, which can be challenging for beginners.

Annuity Calculations in 2024

The current economic landscape, including interest rates and market conditions, significantly influences annuity calculations. Understanding these factors is crucial for making informed decisions about annuity investments in 2024.

Rolling over your 401k into an annuity can be a strategic move for retirement planning. To learn more about this process and its potential benefits, you can read this article: Annuity 401k Rollover 2024. This article provides insights into the mechanics of a 401k rollover and its implications for your retirement income.

Interest Rates and Market Conditions

Interest rates are a key factor determining annuity payouts. In 2024, interest rates are expected to remain at a relatively low level due to ongoing economic uncertainties and inflation. This means that annuity payouts may be lower compared to previous years when interest rates were higher.

Understanding the concept of an annuity can be easier with a practical example. This article: Annuity Meaning With Example 2024 provides a clear and concise explanation of annuities, along with a real-world example to illustrate how they work.

Factors Influencing Annuity Payouts

Several factors influence annuity payouts in 2024:

- Inflation:Rising inflation can erode the purchasing power of annuity payments, reducing their real value over time.

- Taxes:Taxes on annuity income can significantly impact the net payout. Understanding tax implications is essential for accurate calculations.

- Investment Returns:For variable annuities, investment returns on underlying assets directly impact the annuity payouts.

Real-World Examples

Here are some real-world examples of annuity calculations using current market data:

- Example 1:A 65-year-old retiree invests $100,000 in a fixed annuity with a guaranteed interest rate of 3% per year. The annuity pays out monthly for 20 years. Using a financial calculator, we can determine the monthly payment to be approximately $576.

Choosing the right financial product can be challenging, and determining if an annuity is suitable for your individual needs is crucial. This article: Is Annuity Right For Me 2024 provides guidance on evaluating your financial goals and determining if an annuity aligns with your overall financial strategy.

This example illustrates the impact of low interest rates on annuity payouts.

- Example 2:A 55-year-old individual invests $50,000 in a variable annuity linked to a stock market index. Assuming an average annual return of 7%, the annuity could generate a monthly payment of approximately $350 after 10 years. This example highlights the potential for higher returns with variable annuities but also carries greater risk.

BMO, a well-known financial institution, offers a variety of financial products, including annuities. If you’re considering an annuity with BMO, you can use their online Annuity Calculator Bmo 2024 to estimate your potential payouts and explore different scenarios. This tool can help you make informed decisions about your financial future.

Hypothetical Scenario

Imagine a 50-year-old individual with a retirement goal of receiving $3,000 per month for 20 years. They have $200,000 to invest and are considering a fixed annuity with a guaranteed interest rate of 2.5%. Using a financial calculator, we can determine that the individual needs to invest an additional $100,000 to reach their retirement income goal.

Annuity is a financial product that provides regular payments over a set period of time. If you’re unsure about the definition of an annuity, you can find a clear explanation in this article: Annuity What Is It Definition 2024.

Understanding the basics of annuities can help you determine if they align with your financial needs.

This scenario demonstrates how a financial calculator can be used to determine the necessary investment amount based on specific financial goals and risk tolerance.

Deciding between an annuity or a lump sum payment can be a tough choice, especially when it comes to large sums like lottery winnings. To help you make the right decision, you can check out this article on Annuity Or Lump Sum Lottery 2024.

This article provides insights into the pros and cons of each option, helping you understand the potential benefits and risks involved.

Alternatives to Financial Calculators

While financial calculators are valuable tools, online annuity calculators offer a convenient and accessible alternative. These calculators provide a user-friendly interface and often offer more comprehensive features compared to traditional calculators.

The discount factor is an important concept in annuity calculations, and understanding how to calculate it can be helpful for financial planning. This article: Calculate Annuity Discount Factor 2024 provides a step-by-step guide on calculating the discount factor and its significance in annuity calculations.

Online Annuity Calculators

Online annuity calculators offer several benefits:

- Convenience:They are readily available online and can be accessed from any device with an internet connection.

- User-Friendliness:Online calculators often have intuitive interfaces and provide step-by-step guidance, making them easy to use.

- Customization:Many online calculators offer various customization options, allowing users to adjust calculations based on their specific needs and circumstances.

Comparison of Online Calculators

Different online annuity calculators offer varying features and functionalities. When choosing an online calculator, consider factors such as:

- Accuracy:Ensure that the calculator uses reliable data and algorithms for accurate calculations.

- Features:Look for calculators that offer a comprehensive range of features, such as present value, future value, payment calculations, and tax considerations.

- User Interface:Choose a calculator with a user-friendly interface that is easy to navigate and understand.

Reputable Websites

Several reputable websites offer free annuity calculators:

- Bankrate:Provides a comprehensive annuity calculator that allows users to compare different annuity types and features.

- NerdWallet:Offers a user-friendly annuity calculator that helps users estimate their potential annuity payments.

- Investopedia:Provides a variety of financial calculators, including an annuity calculator that can be used to estimate future value and payments.

Tips for Choosing the Right Calculator

Here are some tips for choosing the right online calculator for your needs:

- Define your needs:Determine the specific calculations you need to perform and choose a calculator that offers those features.

- Read reviews:Check reviews and ratings from other users to get an idea of the calculator’s accuracy and user experience.

- Compare features:Compare the features and functionalities of different calculators before making a decision.

Practical Applications of Annuities

Annuities have diverse practical applications in financial planning, helping individuals achieve their financial goals and secure their future.

An X Share Annuity is a type of annuity that offers a guaranteed return on your investment. You can learn more about this type of annuity and its potential benefits in this article: X Share Annuity 2024. Understanding the specifics of this annuity can help you determine if it’s a suitable option for your financial goals.

Scenarios for Annuity Use

| Scenario | Annuity Application |

|---|---|

| Retirement Planning | Provide a guaranteed income stream during retirement, ensuring financial stability and supplementing other retirement savings. |

| Estate Planning | Transfer wealth to beneficiaries over time, providing a steady income stream for heirs and minimizing estate taxes. |

| Income Generation | Generate a regular income stream from a lump sum investment, providing financial flexibility and income diversification. |

| Long-Term Care Planning | Provide financial protection against the high costs of long-term care, ensuring access to quality care without depleting savings. |

Supplementing Retirement Income

Annuities can be a valuable tool for supplementing retirement income. They provide a predictable income stream, reducing reliance on other sources of income and mitigating the risk of outliving savings.

Annuity payments are often subject to taxes, and understanding how these taxes work is crucial for financial planning. This article: Annuity Is Taxable 2024 provides detailed information about the tax implications of annuities, including the types of taxes that may apply and how to manage them.

Long-Term Care Planning

Annuities can be incorporated into long-term care planning to provide financial protection against the potentially high costs of care. Some annuities offer specific benefits for long-term care, such as accelerated death benefits or long-term care riders.

Comprehensive Financial Planning

Annuities can be integrated into a comprehensive financial plan to address various financial needs and goals. They can be used in conjunction with other investment strategies, such as stocks, bonds, and real estate, to create a diversified portfolio that aligns with individual risk tolerance and financial objectives.

Closing Notes

As we conclude our exploration of Financial Calculator Annuity 2024, we’ve unveiled the power of this financial tool in navigating the world of annuities. By understanding the intricacies of annuity calculations, you gain the ability to make informed decisions about your financial future.

Whether you choose to utilize financial calculators, online resources, or a combination of both, the knowledge gained from this guide empowers you to take control of your financial well-being and plan for a secure and prosperous future.

Commonly Asked Questions

What is the difference between a fixed and a variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s returns are tied to the performance of underlying investments, making them subject to market fluctuations.

How do I choose the right online annuity calculator?

Consider factors such as ease of use, features offered, reputation of the website, and whether the calculator provides personalized recommendations.

Are there any tax implications associated with annuities?

Yes, annuity payments are typically subject to taxation, but the specific tax treatment varies depending on the type of annuity and its distribution terms.

Can I withdraw money from an annuity before retirement?

It depends on the specific terms of the annuity contract. Some annuities may allow for early withdrawals, but penalties may apply.