Find A Mortgage 2024: Your Guide to Homeownership, is your comprehensive guide to navigating the complex world of mortgages in the year ahead. The mortgage market is constantly evolving, and staying informed about the latest trends, options, and strategies is crucial for achieving your homeownership goals.

Choosing the right mortgage company is a crucial step in the home buying process. To learn more about the best mortgage companies in 2024, visit Mortgage Company 2024.

This guide will equip you with the knowledge and tools you need to make informed decisions, from understanding current interest rates and loan terms to comparing different mortgage types and navigating the application process. We’ll also explore essential factors to consider when choosing a mortgage, including loan length, closing costs, and other fees.

Contents List

Understanding the Mortgage Landscape in 2024

The mortgage market is a dynamic landscape that’s constantly evolving, and 2024 is no exception. Understanding the current state of the market, including interest rates, loan terms, and lending policies, is crucial for homebuyers seeking to navigate this complex process.

This section will delve into the key factors influencing mortgage availability and affordability in 2024, providing insights into potential trends and predictions for the year ahead.

Current State of the Mortgage Market, Find A Mortgage 2024

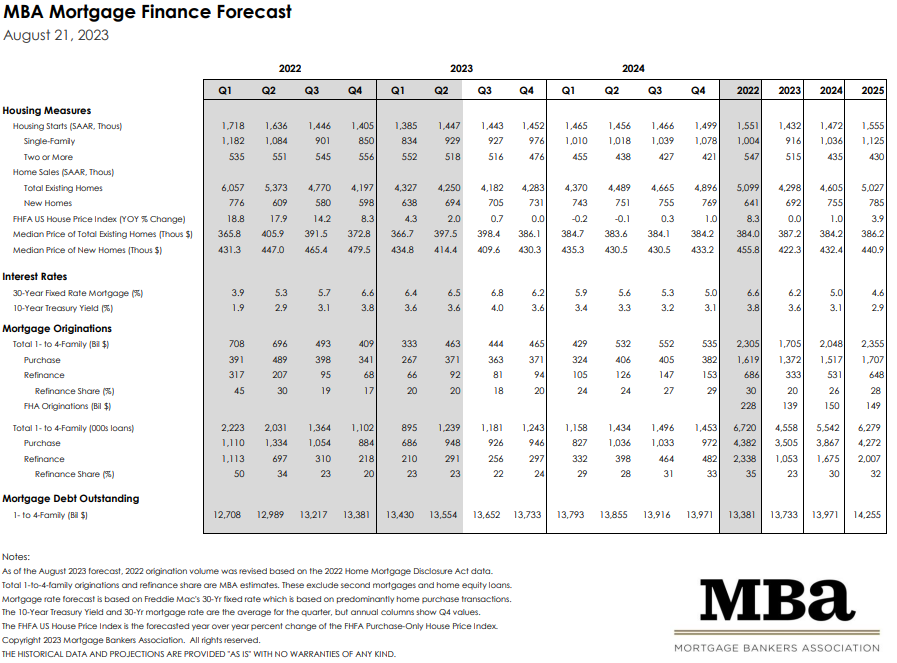

The mortgage market in 2024 is characterized by a combination of factors that are shaping both opportunities and challenges for borrowers. Interest rates, a key driver of mortgage affordability, have been fluctuating in recent months. While rates have shown signs of stabilization, they remain higher than they were in 2022, impacting monthly mortgage payments.

A commercial mortgage broker can help you navigate the complex world of commercial real estate financing. You can find more information on Commercial Mortgage Broker 2024.

Lending policies have also tightened, with banks becoming more cautious about approving loans due to economic uncertainties. This shift has led to a more stringent evaluation process, with stricter credit score requirements and debt-to-income ratios. These factors have contributed to a more competitive market, making it essential for borrowers to carefully research and compare different mortgage options to find the best fit for their individual circumstances.

5/1 ARM mortgages offer a fixed rate for the first five years and then adjust annually. If you’re interested in learning more about these rates, check out 5 1 Arm Rates Today 2024.

Factors Influencing Mortgage Availability and Affordability

Several factors are influencing mortgage availability and affordability in 2024, creating a complex landscape for homebuyers. The Federal Reserve’s monetary policy, aimed at controlling inflation, has a significant impact on interest rates. As the Fed adjusts its policies, interest rates can fluctuate, impacting mortgage costs.

FHA loans are a great option for borrowers with lower credit scores or smaller down payments. To learn more about FHA refinance options, visit Fha Refinance 2024.

Economic conditions, including inflation, unemployment, and consumer confidence, also play a role. A strong economy generally supports lower interest rates, while economic uncertainty can lead to higher rates. Government regulations and policies, such as changes in loan terms or eligibility requirements, can also influence mortgage availability and affordability.

Getting pre-approved for a mortgage in 2024 can be a great way to start your home buying journey. Check out this resource on Mortgage Pre Approval 2024 to learn more about the process and what to expect.

It’s crucial for homebuyers to stay informed about these factors to make informed decisions.

Potential Trends and Predictions for 2024

While predicting the future of the mortgage market with certainty is impossible, several trends and predictions are emerging based on current conditions. Interest rates are expected to remain volatile throughout 2024, influenced by economic factors and the Fed’s policy decisions.

Commercial real estate requires a different type of financing. If you’re looking for information on commercial mortgages, you can find a helpful guide on Commercial Mortgage 2024.

Some experts predict a gradual decline in rates later in the year, while others anticipate a more prolonged period of higher rates. The demand for housing is expected to remain strong, driven by factors such as population growth and a limited supply of available homes.

This demand could contribute to continued price appreciation in some markets. However, affordability concerns may lead to a slowdown in housing sales in areas where prices have risen significantly. The mortgage market is expected to continue evolving, with new loan products and technologies emerging to meet the changing needs of borrowers.

It’s always a good idea to shop around for the best mortgage rates. You can find a helpful guide to current rates on Best Mortgage Rates Today 2024.

Mortgage Options for Homebuyers in 2024

Navigating the diverse world of mortgage options can be overwhelming for homebuyers. This section will provide a comprehensive overview of the different types of mortgages available in 2024, including conventional, FHA, VA, and USDA loans. By understanding the eligibility requirements, interest rates, and closing costs associated with each type, homebuyers can make informed decisions that align with their financial goals and circumstances.

Types of Mortgages Available

The mortgage market offers a variety of loan options, each designed to cater to different borrower profiles and needs. Understanding the key differences between these options is crucial for making an informed decision.

| Mortgage Type | Eligibility Requirements | Interest Rates | Closing Costs |

|---|---|---|---|

| Conventional Loan | Strong credit score, low debt-to-income ratio, sufficient down payment | Typically lower than other types of mortgages | Can vary depending on lender and loan terms |

| FHA Loan | Lower credit score requirements, lower down payment (3.5%), for first-time homebuyers or those with limited credit history | May have slightly higher interest rates than conventional loans | Includes mortgage insurance premiums (MIP) |

| VA Loan | For eligible veterans, active-duty military personnel, and surviving spouses | Often offer competitive interest rates and no down payment requirement | Funding fee may apply |

| USDA Loan | For eligible borrowers in rural areas, with income limits | Typically offer low interest rates and no down payment requirement | Includes a guarantee fee |

The mortgage application process can seem daunting, but understanding the steps involved and preparing adequately can make it smoother. This section will guide you through the process, from pre-approval to closing, highlighting the importance of credit score and debt-to-income ratio in securing a favorable mortgage.

VA loans are a great option for eligible veterans. To find current VA loan rates, visit Va Loan Rates 2024.

Steps Involved in Applying for a Mortgage

- Pre-Approval:Getting pre-approved before you start house hunting gives you a clear idea of how much you can afford to borrow and makes you a more competitive buyer. It also demonstrates your financial readiness to lenders.

- Loan Application:Once you’ve found a home, you’ll need to complete a formal loan application, providing details about your finances, income, and assets.

- Credit and Background Check:Lenders will review your credit history, employment history, and income to assess your ability to repay the loan.

- Property Appraisal:An appraiser will determine the fair market value of the property to ensure it aligns with the loan amount.

- Loan Underwriting:Lenders will review your application, credit score, and property appraisal to make a final decision on your loan.

- Closing:The final step involves signing the mortgage documents and transferring ownership of the property to you.

Importance of Credit Score and Debt-to-Income Ratio

Your credit score and debt-to-income ratio (DTI) are crucial factors that lenders consider when evaluating your mortgage application. A higher credit score indicates good financial responsibility and can lead to lower interest rates and better loan terms.

DTI measures the percentage of your monthly income that goes towards debt payments. A lower DTI generally improves your chances of loan approval and can help you qualify for better rates.

Veterans United Mortgage offers a variety of loan programs specifically for veterans and their families. To learn more about their rates and options, you can visit Veterans United Mortgage Rates 2024.

Tips for Maximizing Your Chances of Mortgage Approval

- Improve Your Credit Score:Pay bills on time, reduce debt, and avoid opening new credit accounts.

- Lower Your DTI:Reduce your debt load by paying down existing loans or consolidating debt.

- Shop Around for Rates:Compare rates from multiple lenders to secure the best terms.

- Get Pre-Approved:Pre-approval shows sellers you’re a serious buyer and can help you negotiate a better price.

- Be Transparent:Provide accurate and complete information on your loan application.

Essential Factors to Consider When Choosing a Mortgage

Selecting the right mortgage is a critical decision that can impact your finances for years to come. This section will guide you through the essential factors to consider, including loan terms, closing costs, and comparing different mortgage offers to find the best fit for your needs.

Ally Home Loans is a well-known lender that offers a variety of mortgage options. If you’re interested in learning more about their offerings, check out Ally Home Loans 2024 to explore their rates and programs.

Loan Terms: Interest Rate, Loan Length, and Amortization Schedule

Understanding the key loan terms is essential for making an informed decision. The interest rate determines the cost of borrowing money, while the loan length dictates the duration of your repayment period. The amortization schedule Artikels the breakdown of your monthly payments, showing how much goes towards principal and interest over the life of the loan.

A lower interest rate can result in significant savings over the long term. A shorter loan term may mean higher monthly payments but can help you pay off your mortgage faster. It’s important to consider your financial goals and budget when choosing loan terms.

If you’re planning to build a new home, you’ll need a construction loan. You can find helpful information on Home Construction Loans 2024.

Closing Costs and Other Fees

Closing costs are expenses incurred during the mortgage process, including appraisal fees, title insurance, and loan origination fees. These costs can vary depending on the lender and loan terms. It’s crucial to factor in these costs when budgeting for your home purchase.

Home equity lines of credit (HELOCs) can be a useful source of financing. To learn more about HELOC interest rates in 2024, visit Home Equity Line Of Credit Interest Rates 2024.

Other fees may also apply, such as prepayment penalties, late payment fees, and property taxes.

A VA cash-out refinance can allow you to access equity in your home. To learn more about this option, visit Va Cash Out Refinance 2024.

Comparing Mortgage Offers

Once you have multiple mortgage offers, it’s essential to compare them side-by-side to find the best deal. Consider factors such as interest rate, loan term, closing costs, and any additional fees. It’s also important to assess the reputation and track record of the lender.

A mortgage calculator can help you estimate your monthly payments and total loan cost based on different loan terms and interest rates.

15-year fixed-rate mortgages offer lower monthly payments than 30-year mortgages. You can find current rates and information on 15 Year Fixed Mortgage Rates 2024.

Resources and Tools for Finding the Right Mortgage

In today’s digital age, there are numerous online resources and tools available to help homebuyers find the best mortgage deals. This section will provide a comprehensive guide to these resources, including reputable mortgage lenders and brokers, along with tips for using them effectively to secure a favorable mortgage.

Online Resources and Tools

- Mortgage Comparison Websites:These websites allow you to compare rates and terms from multiple lenders in one place. Some popular options include Bankrate, NerdWallet, and LendingTree.

- Mortgage Calculators:These tools can help you estimate your monthly payments, total loan cost, and affordability based on different loan terms and interest rates.

- Credit Monitoring Services:Monitoring your credit score regularly can help you identify any errors or potential issues that could impact your loan application.

- Financial Planning Websites:Websites like Investopedia and The Balance provide educational resources and guidance on managing your finances and planning for homeownership.

Reputable Mortgage Lenders and Brokers

Choosing a reputable lender or broker is crucial for ensuring a smooth and successful mortgage experience. Look for lenders with a strong track record, competitive rates, and excellent customer service. Consider factors such as the lender’s fees, loan options, and availability of online tools and resources.

Navigating the mortgage process can be overwhelming, but it doesn’t have to be. Get A Mortgage 2024 offers a great overview of the process and can help you find the right mortgage for your needs.

Here are some examples of reputable mortgage lenders and brokers:

- Bank of America:One of the largest banks in the US, offering a range of mortgage products and services.

- Wells Fargo:Another major bank with a comprehensive mortgage portfolio and online tools.

- Quicken Loans:A leading online mortgage lender known for its user-friendly platform and innovative loan products.

- Rocket Mortgage:A digital mortgage lender with a streamlined application process and competitive rates.

Tips for Using Resources Effectively

- Compare Multiple Options:Don’t settle for the first mortgage offer you receive. Compare rates, terms, and fees from multiple lenders to find the best deal.

- Read Reviews:Check online reviews and ratings to gauge the reputation and customer satisfaction of different lenders.

- Ask Questions:Don’t hesitate to ask questions and clarify any aspects of the mortgage process that you don’t understand.

- Get Pre-Approved:Pre-approval shows sellers you’re a serious buyer and can help you negotiate a better price.

- Stay Organized:Keep track of your loan documents, communication with lenders, and any important deadlines.

Final Thoughts

Armed with the information and resources provided in this guide, you’ll be well-prepared to embark on your homeownership journey with confidence. Remember, finding the right mortgage is a crucial step towards achieving your dream of owning a home. By understanding the mortgage landscape, exploring your options, and taking a proactive approach, you can secure a loan that meets your individual needs and financial goals.

FAQ Section: Find A Mortgage 2024

What are the current interest rates for mortgages?

Mortgage interest rates fluctuate daily, so it’s best to check with lenders for the most up-to-date information. However, you can find general trends and estimates online from reputable sources like Bankrate or NerdWallet.

How much of a down payment do I need for a mortgage?

Down payment requirements vary depending on the type of mortgage. Conventional loans typically require a 20% down payment, while FHA loans can be obtained with as little as 3.5% down.

What is a good credit score for getting a mortgage?

A credit score of 740 or above is generally considered good for obtaining a mortgage with favorable interest rates.

How long does it take to get approved for a mortgage?

The mortgage approval process can take anywhere from a few weeks to a few months, depending on factors such as your credit score, debt-to-income ratio, and the complexity of the loan.