Fixed Immediate Annuities set the stage for a secure retirement income, providing a guaranteed stream of payments for life. These annuities offer a unique way to transform a lump sum of savings into a predictable income source, shielding you from market volatility and providing peace of mind during your golden years.

To accurately calculate your annuity payments, you need to understand Calculating An Annuity Factor 2024. This factor helps determine the present value of future payments, providing a more precise picture of your potential income.

When you purchase a fixed immediate annuity, you essentially exchange a lump sum of money for a series of regular payments, often monthly, that begin immediately. The payment amount is fixed and guaranteed, regardless of how the market performs, ensuring a consistent income stream.

Annuity payments are a crucial part of many retirement plans. Annuity Is Payment 2024 can provide a steady stream of income, helping you maintain your desired lifestyle during retirement.

The key to understanding fixed immediate annuities lies in the concept of annuitization. This process involves converting your savings into a stream of income payments that cannot be outlived. This means you will receive payments for the rest of your life, regardless of how long you live.

If you’re new to annuities, you might be wondering, Annuity Kya Hai 2024 ? Simply put, an annuity is a financial product that provides regular payments for a specified period.

Contents List

- 1 Fixed Immediate Annuities: A Comprehensive Guide

- 1.1 What are Fixed Immediate Annuities?

- 1.2 How Fixed Immediate Annuities Work

- 1.3 Benefits of Fixed Immediate Annuities

- 1.4 Drawbacks of Fixed Immediate Annuities

- 1.5 Types of Fixed Immediate Annuities

- 1.6 Factors to Consider Before Purchasing

- 1.7 Alternatives to Fixed Immediate Annuities

- 1.8 Tax Implications of Fixed Immediate Annuities

- 2 Last Word: Fixed Immediate Annuities

- 3 Commonly Asked Questions

Fixed Immediate Annuities: A Comprehensive Guide

Fixed immediate annuities are a popular retirement income option that provides a guaranteed stream of income for life. They offer a predictable and secure source of funds, making them an attractive choice for those seeking financial stability during their golden years.

It’s important to understand the tax implications of annuities. Annuity Under Income Tax Act 2024 outlines the tax treatment of annuity payments, helping you plan your financial strategy.

This comprehensive guide will delve into the intricacies of fixed immediate annuities, exploring their workings, benefits, drawbacks, and key considerations before purchasing.

What are Fixed Immediate Annuities?

Fixed immediate annuities are contracts that provide a guaranteed stream of income payments for life. Once you purchase an annuity, you transfer a lump sum of money to the insurance company, which then agrees to make regular payments to you, starting immediately.

Understanding the Formula Annuity Certain 2024 is essential for anyone considering an annuity. This formula helps calculate the present value of a series of future payments, providing a clear picture of your potential income stream.

These payments are fixed and cannot be altered, regardless of market fluctuations.

Deciding between Variable Annuity Vs Variable Life Insurance 2024 requires careful consideration. Both options have unique features and potential benefits, so understanding the differences is essential for making the right choice.

In simple terms, you’re essentially exchanging a lump sum of money for a guaranteed lifetime income. This can provide peace of mind and financial security during retirement, knowing that you’ll receive regular payments, regardless of how long you live.

A Annuity Is Deferred 2024 means that payments begin at a later date. This option can be beneficial if you’re aiming for a larger payout or if you’re still working and don’t need immediate income.

How Fixed Immediate Annuities Work

The process of purchasing a fixed immediate annuity is straightforward. You simply choose an annuity provider, select the type of annuity that best suits your needs, and provide them with a lump sum payment. The insurance company then calculates your monthly payment based on your age, the amount of your investment, and the current interest rates.

Imagine receiving Annuity 2000 Per Month 2024. This could significantly enhance your financial security, providing a consistent source of income to cover your expenses.

Annuity payments are typically distributed monthly, but some providers may offer quarterly or annual payments. The payment amount is fixed and remains the same for the rest of your life. This ensures a predictable and reliable income stream, regardless of market volatility or changes in interest rates.

Benefits of Fixed Immediate Annuities

Fixed immediate annuities offer several advantages for retirement income planning. These include:

- Guaranteed Income Stream:One of the primary benefits of fixed immediate annuities is the guaranteed income stream. Once you purchase an annuity, you can be sure that you’ll receive regular payments for life, regardless of market fluctuations. This provides financial security and peace of mind, knowing that you’ll have a consistent source of income during retirement.

- Protection Against Market Volatility:Unlike investments in stocks or bonds, which can fluctuate in value, fixed immediate annuities offer protection against market volatility. Your annuity payments are fixed and will not be affected by market downturns. This can be especially valuable during retirement, when you may be less tolerant of investment risk.

An annuity is a valuable tool for retirement planning. An Annuity Is A Life Insurance Product That 2024 can provide a secure and consistent income stream, helping you enjoy your retirement years with financial peace of mind.

Drawbacks of Fixed Immediate Annuities

While fixed immediate annuities offer several advantages, they also have some potential drawbacks. These include:

- Impact of Interest Rate Changes:Fixed immediate annuities are sensitive to interest rate changes. If interest rates rise after you purchase an annuity, your payments may be lower than they would have been if you had purchased the annuity at a later date. However, if interest rates fall, your payments will remain fixed, providing some protection against declining rates.

For those seeking potential growth with their annuity, Variable Annuity Funds 2024 might be an option. These funds invest in a variety of assets, offering the potential for higher returns.

- Possibility of Outliving the Annuity Payments:If you live longer than expected, you may outlive the annuity payments. While fixed immediate annuities provide a guaranteed income stream for life, they do not offer a guarantee that you’ll receive a specific amount of total income. If you live a very long time, your total annuity payments may be less than your initial investment.

To determine the potential return on your investment, you might want to Calculate Annuity Bond 2024. This process helps you assess the potential growth of your annuity and make informed investment decisions.

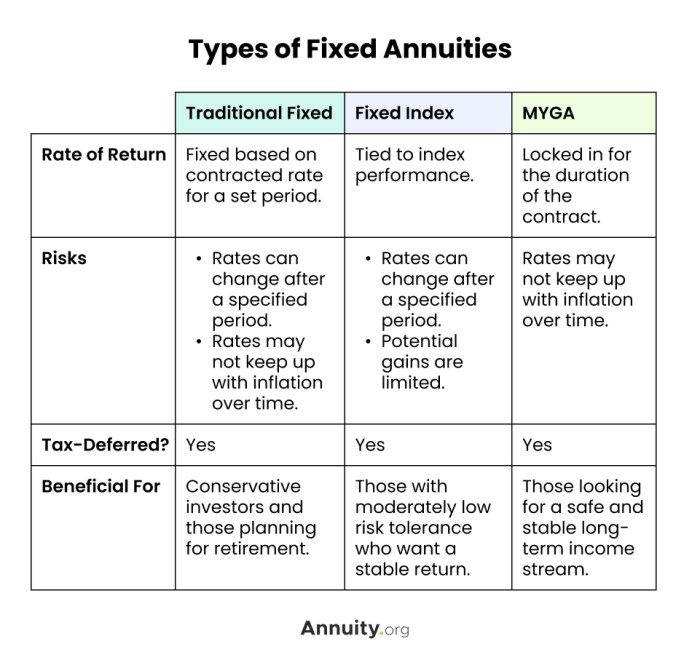

Types of Fixed Immediate Annuities

There are several types of fixed immediate annuities, each with its own features and benefits. Here’s a table summarizing some common types:

| Type | Description | Pros | Cons |

|---|---|---|---|

| Single Premium Immediate Annuity (SPIA) | A lump sum payment is made to the insurance company, which then provides a guaranteed income stream for life. | Guaranteed income stream for life, protection against market volatility. | Limited flexibility, payments may be lower than if interest rates rise. |

| Deferred Income Annuity (DIA) | Payments are deferred for a specific period, allowing the annuity to grow tax-deferred. | Tax-deferred growth, higher potential income payments. | Limited flexibility, payments may be lower than if interest rates rise. |

| Joint and Survivor Annuity | Payments continue to the surviving spouse after the death of the primary annuitant. | Provides income for both spouses during their lifetimes. | Lower payments than a single life annuity. |

Factors to Consider Before Purchasing

Before purchasing a fixed immediate annuity, it’s crucial to consider several factors, including:

- Financial Goals:What are your retirement income needs and how much income do you require to maintain your desired lifestyle?

- Risk Tolerance:How comfortable are you with the potential for interest rate changes to affect your annuity payments? Fixed immediate annuities offer guaranteed income but are sensitive to interest rate fluctuations.

- Health and Life Expectancy:Your health and life expectancy can impact your annuity payments. If you have a shorter life expectancy, your annuity payments may be lower than if you have a longer life expectancy.

- Annuity Provider:It’s essential to compare different annuity providers and their products. Consider factors such as the financial strength of the provider, the interest rates offered, and the flexibility of the annuity contract.

Alternatives to Fixed Immediate Annuities

Fixed immediate annuities are just one retirement income option. Other alternatives include:

- Traditional IRAs and 401(k)s:These retirement accounts allow you to save for retirement on a tax-deferred basis. You can withdraw funds from these accounts during retirement, but you will be subject to taxes on your withdrawals.

- Roth IRAs:These retirement accounts allow you to save for retirement with after-tax contributions. Your withdrawals during retirement are tax-free, making them a popular option for those who anticipate being in a higher tax bracket in retirement.

- Annuities:Annuities offer a variety of income options, including variable annuities, which allow for investment growth, and indexed annuities, which provide some protection against inflation.

Tax Implications of Fixed Immediate Annuities

The tax treatment of annuity payments and distributions depends on the type of annuity and the terms of the contract. In general, the portion of annuity payments that represents a return of your original investment is not taxable. However, the portion of your payments that represents interest or earnings is taxable as ordinary income.

If you’re seeking immediate income, you might be interested in Immediate Annuity Earnings. These annuities provide regular payments right from the start, offering a reliable source of income for retirement or other financial needs.

Fixed immediate annuities can offer tax advantages, such as tax-deferred growth and the ability to defer taxes on a portion of your annuity payments. However, it’s essential to consult with a tax advisor to understand the specific tax implications of your annuity contract.

The Annuity Is The Value Of 2024 depends on several factors, including the amount invested, the interest rate, and the duration of the annuity. Understanding these factors can help you maximize your potential returns.

Last Word: Fixed Immediate Annuities

Fixed Immediate Annuities can be a powerful tool for securing your retirement income. By understanding the benefits and drawbacks, carefully considering your financial goals, and exploring the different types available, you can make an informed decision about whether this option is right for you.

Remember, seeking guidance from a qualified financial advisor can provide valuable insights and help you navigate the complexities of retirement planning.

Commonly Asked Questions

How much money do I need to purchase a fixed immediate annuity?

The amount you need to purchase a fixed immediate annuity varies depending on your desired payment amount, your age, and current interest rates. It’s essential to consult with a financial advisor to determine the appropriate investment amount based on your individual circumstances.

Can I withdraw money from a fixed immediate annuity before I start receiving payments?

LIC, a leading insurance provider, offers Immediate Annuity Plan Of Lic , which can provide a stable income stream. Understanding the details of this plan can help you make informed decisions about your financial future.

Generally, you cannot withdraw money from a fixed immediate annuity before you start receiving payments. However, some annuities may offer limited withdrawal options, but these typically come with penalties or restrictions.

Annuity contracts often offer Immediate Annuity Guaranteed payments, providing peace of mind that your income stream will remain consistent. This guarantee can be especially valuable in uncertain economic times.

What happens to my annuity payments if I die before I receive all the payments?

Most fixed immediate annuities offer a death benefit feature. If you die before receiving all the payments, your beneficiary will receive a lump sum payment, typically the remaining value of the annuity. The specifics of the death benefit vary depending on the annuity contract.

Are there any tax implications associated with fixed immediate annuities?

Yes, there are tax implications associated with fixed immediate annuities. The annuity payments you receive are generally taxed as ordinary income. However, there may be tax-advantaged options available depending on the type of annuity and your individual tax situation. It’s crucial to consult with a tax advisor to understand the specific tax implications of your annuity.